- Patterson-UTI Energy plans to add seven more drilling rigs and reactivate a frac spread in Q2

- Average revenue and pricing in contract drilling and pressure pumping are likely to improve due to the tight demand-supply balance

- In March, it invested in Criterion Energy Partner, which makes designs to create energy from subsurface heat

- Although free cash flow stayed negative, a margin hike and improved working capital will ease the pressure on cash flows later in 2022

Focus On Rig Upgrade And Renewable Energy

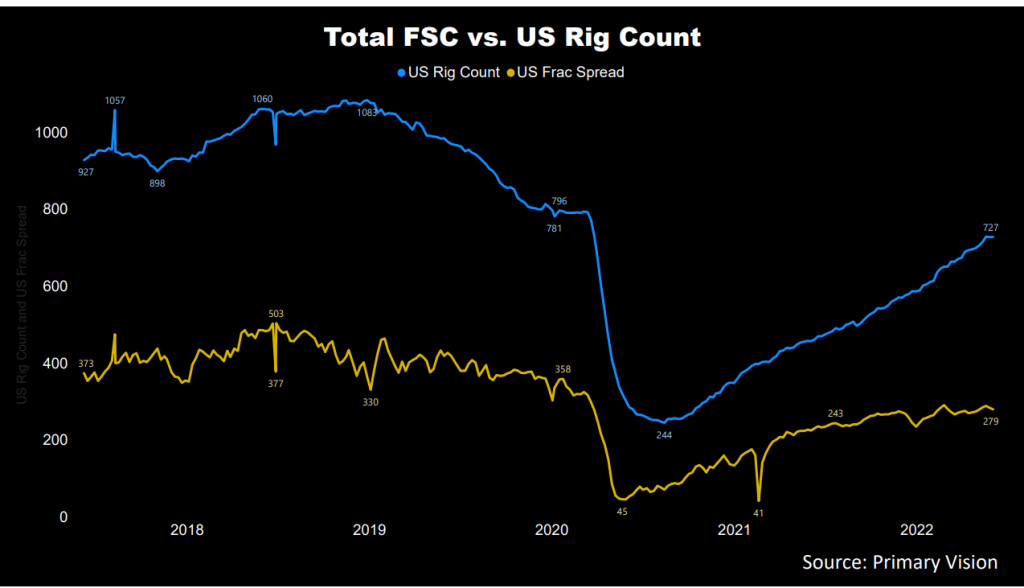

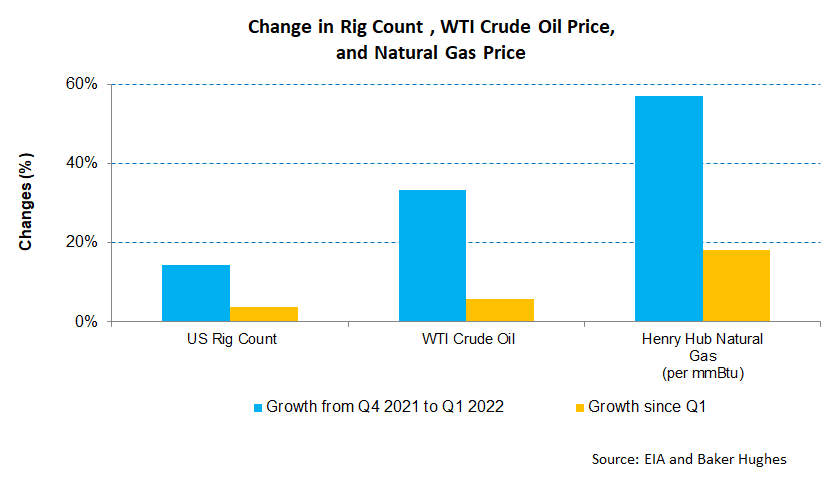

The US rig count has gone up by 21% in 2022, continuing with the momentum gathered in Q4 2021. The crude oil price curve has been steeper, rising by 51% in 2022. As estimated by Primary Vision, the frac spread count has mirrored the rig count’s growth. The reopening of world economies has shifted the energy market sentiment that went bearish in the past two years. As the US drilling and completions markets recovered, the demand for equipment and services soared.

An exciting change of wind blowing in PTEN’s favor has been the accelerated demand for high-quality rigs that typically draw higher leading-edge day rates. The day rate rise was exacerbated by supply chain disruption, which has kept the supply limited. So, there are longer lead times for steel tubular, structural steels, and electrical components. The market conditions for contract drilling will improve, and pricing will continue to increase. PTEN’s management believes that the oilfield service and drilling service providers will have even higher bargaining power in the coming months.

The company plans to convert all its conventional spreads to ESG-compliant dual-fuel-capable pumps in 2022. It will continue to invest in the EcoCell lithium battery hybrid energy management system, among its other initiatives. In March, it made a strategic investment in Criterion Energy Partner. Criterion plans to invest in technologies combining the existing processes from the drilling of oil and gas wells with proprietary designs to create energy from subsurface heat. So, customers looking for sustainability solutions would like to stay invested in PTEN.

How Are The Industry Indicators Doing?

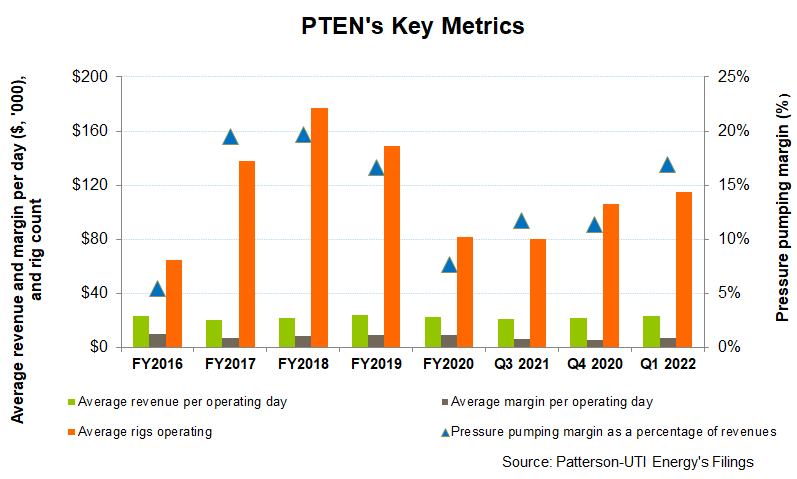

Currently, PTEN expects to operate ~57 rigs under term contract in Q2, while for Q4 2023, it has 43 rigs under a term contract. It also expects its average rig count to grow to 122 in Q2 from 115 in Q1. The average rig margin per day is expected to increase by $1,100. The base leading edge day rates for Tier 1 rigs are ~$20,000, estimated by PTEN’s management. Including ancillary equipment, it may go up to $30,000.

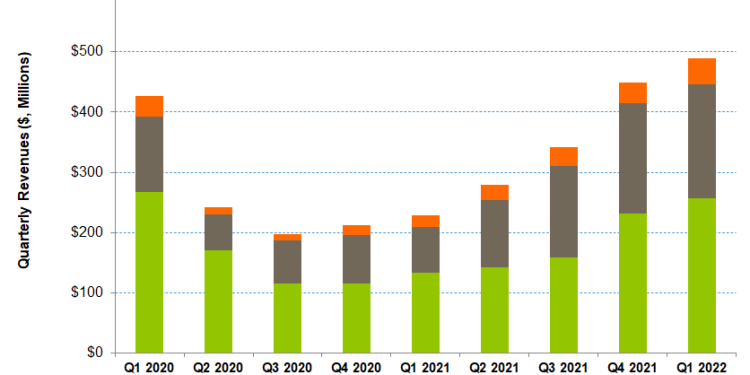

With pricing moving up, the management expects adjusted EBITDA to exceed $500 million in FY2022, a 192% rise compared to FY2021. The margin growth, one of the highest in the past several years, will be backed up by a $1,600 increase in average rig revenue per day.

Contract Drilling Segment: Analyzing Outlook And Performance

In Q1 2022, PTEN’s average revenue per operating day increased (5% up) quarter-over-quarter. On the other hand, operating costs decreased, leading to a 32% rise in the average margin. By March, the company’s term contracts are expected to provide for $400 million of future day rate drilling revenue. This revision is up from $325 million estimated at the end of 2021. We think PTEN’s share of longer-term contracts and contract backlog will increase.

Pressure Pumping Outlook

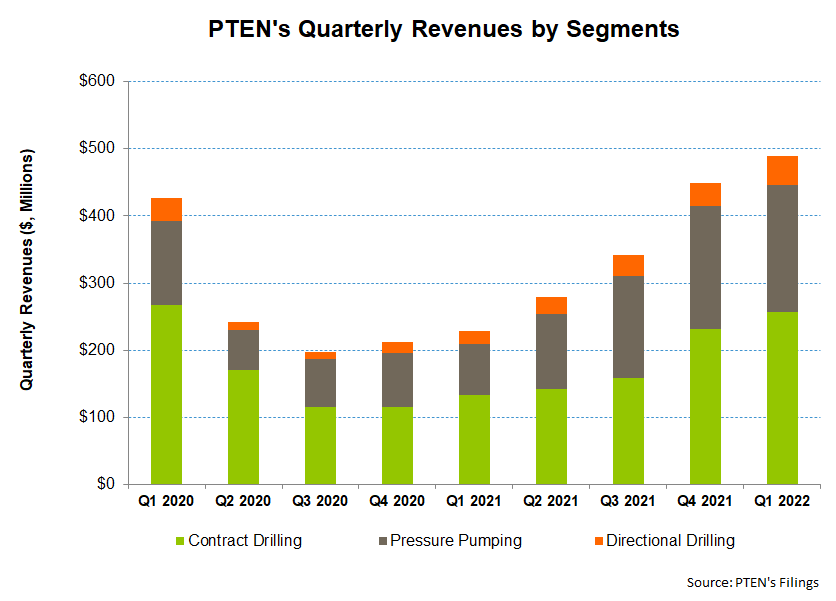

As I discussed in several previous articles about the supply chain issued and the resulting delay of the hardware components in the oilfield services industry, PTEN saw reactivation delays for its 12th frac spread count (or FSC). Now, it expects the 12th frac spread to reactivate in Q2. As the typical winter seasonality recedes, the pressure pumping activity should improve in the US. So, given the additional FSC, the company’s revenues from pressure pumping are expected to increase by 12% in Q2 compared to Q1. Also, the segment gross margin can improve by 3% in Q2.

Also, we notice significant price increases in pressure pumping and directional drilling. As a percentage of revenues, the pressure pumping margin has increased from 11.4% in Q4 2021 to 16.9% in Q1. The tight demand-supply situation has also allowed it to increase the standby rates during customer-related downtime, which will continue to support a higher margin. In the rental technology and E&P businesses, revenues and adjusted gross margin should stay in line with the Q1 results in Q2.

Dividend

In 2022, PTEN has doubled its annual dividend to $0.16 per share. Its forward dividend yield is 0.81%. Helmerich & Payne’s (HP) dividend yield (1.9%) is higher.

Capex And Debt

In FY2021, PTEN’s cash flow from operations (or CFO) increased by 291% compared to Q1 2021, led by 111% higher revenues. However, working capital was a drag as it adjusted its prepaid revenue and made payments of the accrued expenses. Also, Capex increased tremendously in the past year, offsetting all the gains. As a result, free cash flow (or FCF) steeped further into the negative territory in Q1 2022. In FY2022, the working capital requirement can moderate, and free cash flow can increase. It maintained its FY2022 capex guidance at $350 million.

The company had $737 million in liquidity (cash & equivalents plus revolving credit facility available) as of March 31, 2022. Its debt-to-equity (0.54x) is lower than its peers’ (NBR, HP, and LBRT) average of 0.75x. With abundant liquidity, we do not anticipate the near-term financial risks.

Learn about PTEN’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.