- The supply chain issues will likely affect the Rig Technologies segment the most, while deferred new orders, delays, and rising costs in shipyards in many international locations are its near-term headwinds

- Although cash flows are negative, it has a robust liquidity base to cover its financial risks

- Broadening the supplier base and recovering escalating costs through higher pricing will lead to NOV’s topline and operating margin improvement in Q2

- In the medium term, it sees huge potential in renewable energy in floating wind turbines

Industry Activity Growth And Challenges

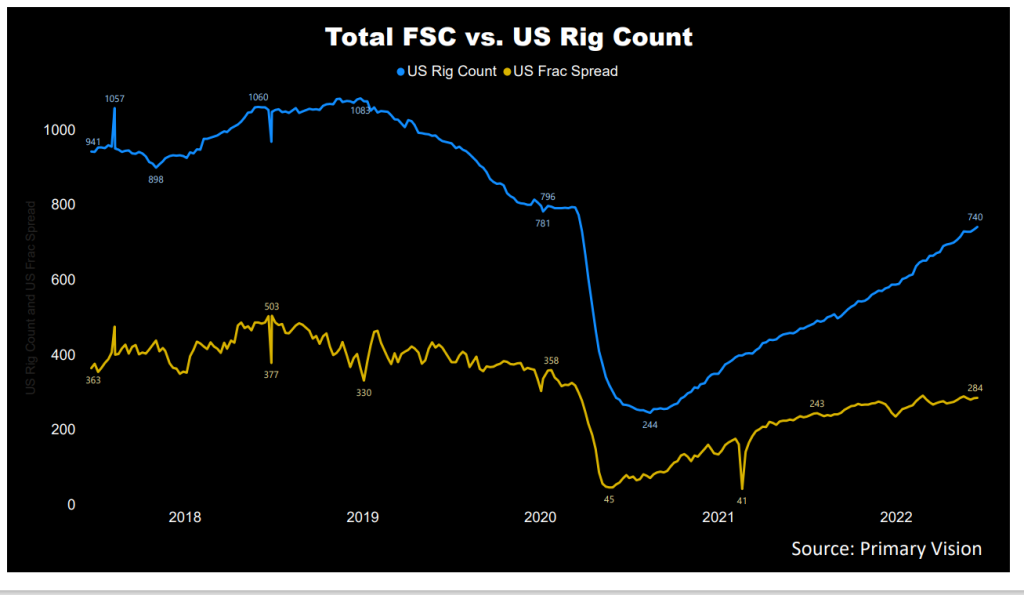

The oilfield services industry is at a cusp of a change. Several years of underinvestment have reduced its capacity and shrunk the workforce, the critical component in this industry. The company estimates that curtailment in FIDs can eventually lead to 10 million barrels of lost production. The OFS companies lost the pricing power as they cannibalized their capital base. In between these, the cost curve has steepened due to the inflation and supply chain disruptions, skilled labor shortage, and ESG measures.

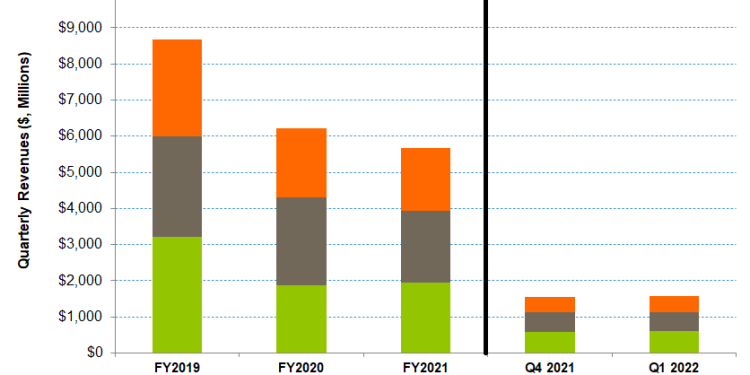

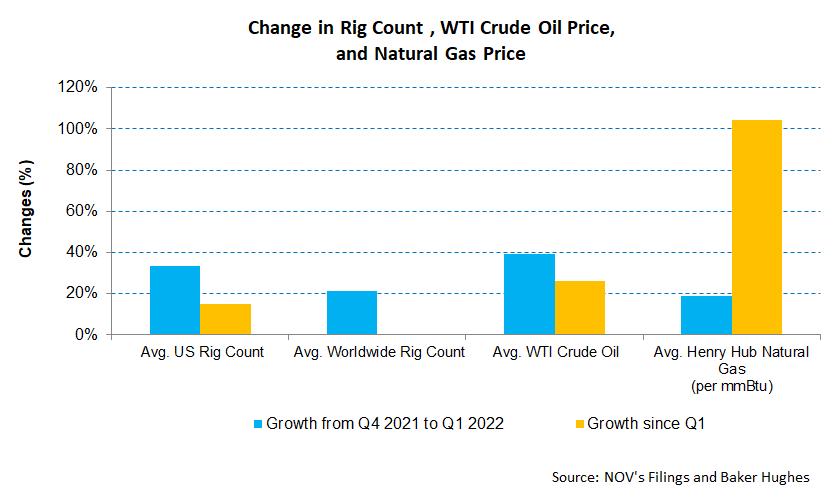

The situation started to change in late 2021. The US rig count has increased by 21% in 2022, continuing with the momentum gathered in Q4 2021. The crude oil price curve has steeped, rising by 51% in 2022. As estimated by Primary Vision, the frac spread count has mirrored the rig count’s growth.

The reopening of world economies has shifted the energy market sentiment that went bearish in the past two years. Pricing has improved and is now keeping pace with the cost hike. NOV has responded to the supply chain issues by broadening its supplier base and recovering escalating costs through higher pricing. However, prices of steel forgings, stainless steel and switchgear, polymers, fiberglass, and electronics kept pushing up in Q1 owing to the conflict in Ukraine and continued COVID impacts. The cost load will likely keep the operating margin under pressure in Q2.

Renewable Is The Long-term Play

NOV’s mid-to longer-term opportunities in wind power are encouraging. The company estimates five to six additional vessels are reaching FID in the next two years. It has invested in developing technologies related to spiral weld tapered wind tower sections. The process has the advantage of infield manufacturing, eliminating the need to transport the larger diameter sections in tall tower developments. In the long term, the company sees massive renewable energy potential in floating wind turbines, especially in large areas of coastal waters.

The Q2 and FY2022 Outlook

The Wellbore Technologies segment will remain in balance in Q2. While the inflationary cost environment will challenge growth, there will be a tailwind of better order outlook and pricing traction. The continued improvements in global oil field activity will drive revenue. In this segment, the ReedHycalog drill bit business is expected to perform well in 2H 2022, while growing backlogs should benefit the downhole business despite the supply chain challenges. The company expects revenue to grow by 1%-5% in Q2 compared to Q1. The EBITDA margin can expand by high teen percentage points by 2022.

In the Completion & Production Solutions segment, the book-to-bill was 110% in Q1, indicating better revenue generation potential in the coming quarters. However, many offshore customers deferred new orders amidst the disruptions, delays, and rising costs in shipyards in many international locations. Still, the improved commodity prices have significantly brightened the demand outlook in this segment. The management expects Q2 revenue to increase by 10% to 15%, while EBITDA margins can increase by 15%-20%.

The supply chain issues will likely affect the Rig Technologies segment the most in Q2. The supply issues include difficulties procuring raw materials, castings, electronic circuits, electric motors, gearboxes, and large bearings. To reduce costs, the company consolidated its operations in the manufacturing facility in Orange, California, which is expected to generate cost savings. Despite its efforts, the associated manufacturing startups took longer than anticipated, and the manufacturing bottlenecks will limit its ability to match demand in Q2. So, the management does not expect the topline and margin to change much from the Q1 level in Q2. However, the situation can change in 2H 2022. It expects to achieve EBITDA margins of 10% by the year-end.

The Q1 2022 Drivers And Segment Performance

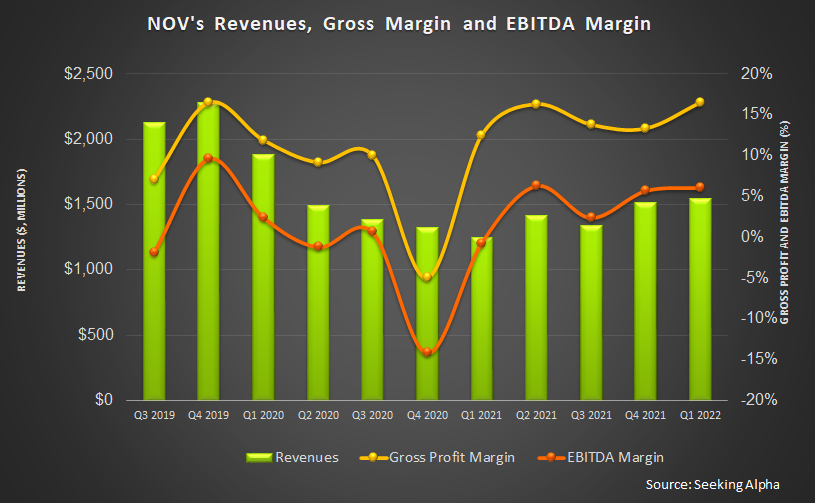

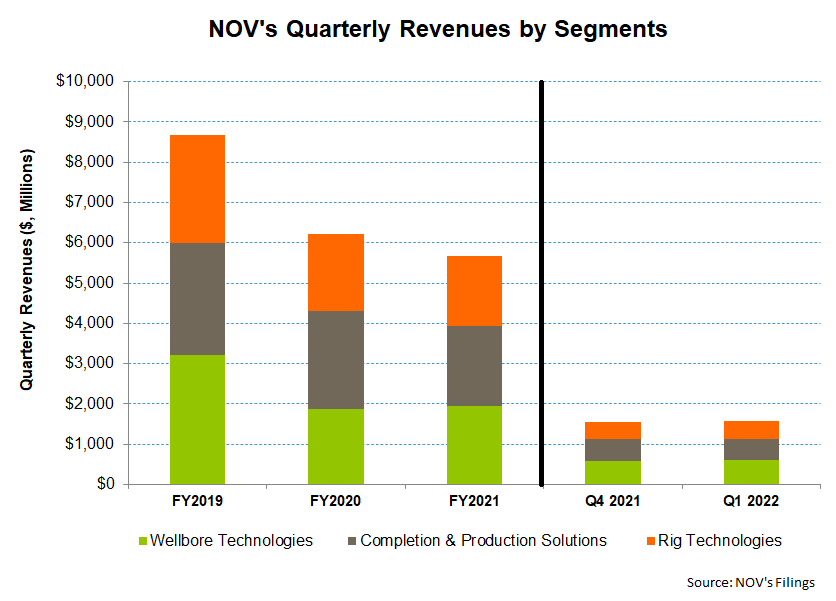

During Q1, NOV’s revenues increased by 2% compared to Q4 2021, following the increase in drilling, completion, and production activities in various geographies. The growing global drilling can n offset seasonal declines and continued supply chain challenges. Its EBITDA margin expanded by 220 basis points during Q1. Investors may also note that it recorded $45 million in impairment charges on assets associated with its operations in Russia, Belarus, and Ukraine.

Segment-wise, revenues in the Wellbore Technologies segment increased the most (6% up) quarter-over-quarter in Q1, although the operating profit declined. The Rig Technologies segment saw only 2% topline growth and a significant recovery in operating profit in Q1. Operating profit in the Completion & Production Solutions, on the other hand, deteriorated in Q1 compared to Q4 2021.

Dividend And Dividend Yield

NOV pays an annual dividend of $0.20 per share at the current rate. It translates to a 0.95% forward dividend yield. Schlumberger (SLB) pays a yearly dividend of $0.70, which equals a forward dividend yield of 1.48%.

Cash Flow Is Negative, And Risks Exist

As of March 31, 2022, NOV’s liquidity (cash and including revolving credit facility) was $2.4 billion. The company’s leverage (debt-to-equity) was 0.34x, in line with its peers’ (CHX, FTI, WHD) average.

NOV’s cash flow from operations (or CFO) remained negative in Q1 2022 and deteriorated compared to a year ago. Although revenues increased in the past year, a significant rise in working capital requirements related to the disproportionate number of shipments and inventory builds to mitigate operational disruptions contributed to the fall in CFO. As a result, free cash flow also remained negative. In Q1, the company faced raw material shortages and growing lead times for subassemblies, castings, forgings, electronics, and motors. So, in Q2, the management expects capex to increase to build additional inventory buffers to increase throughput.

Learn about NOV’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.