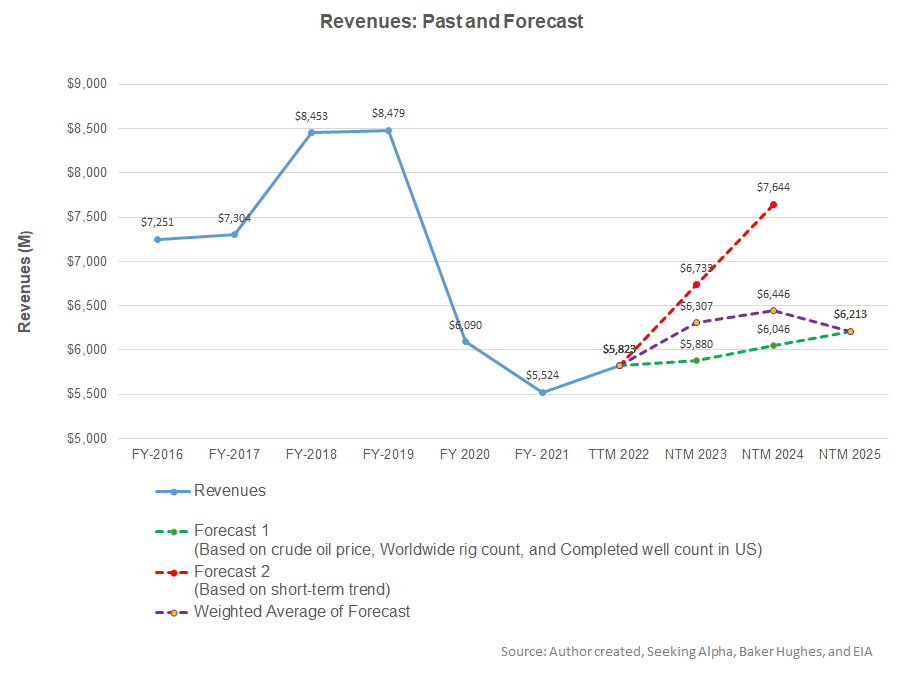

- Estimates suggest strong revenue growth in NTM 2023, but the rate can decelerate sharply over the next couple of years

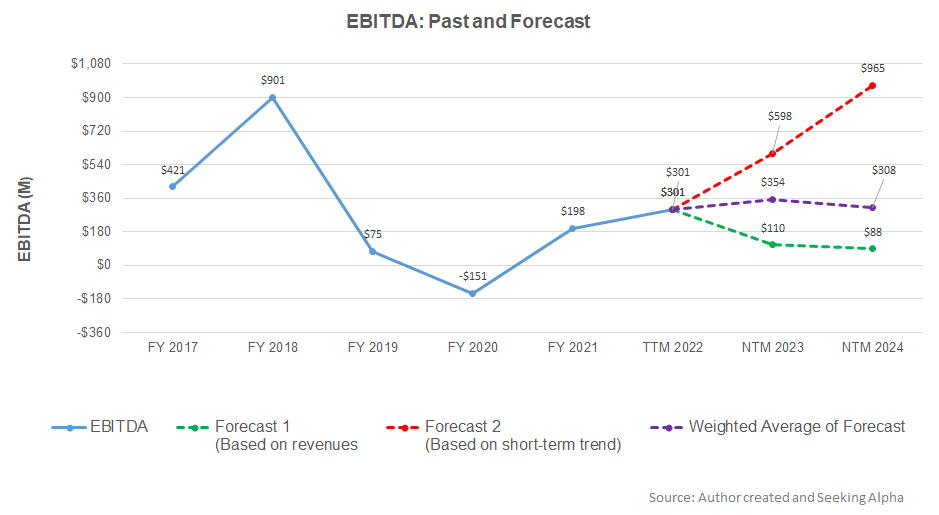

- The EBITDA growth rate is steady in NTM 2023 but may fall in NTM 2024

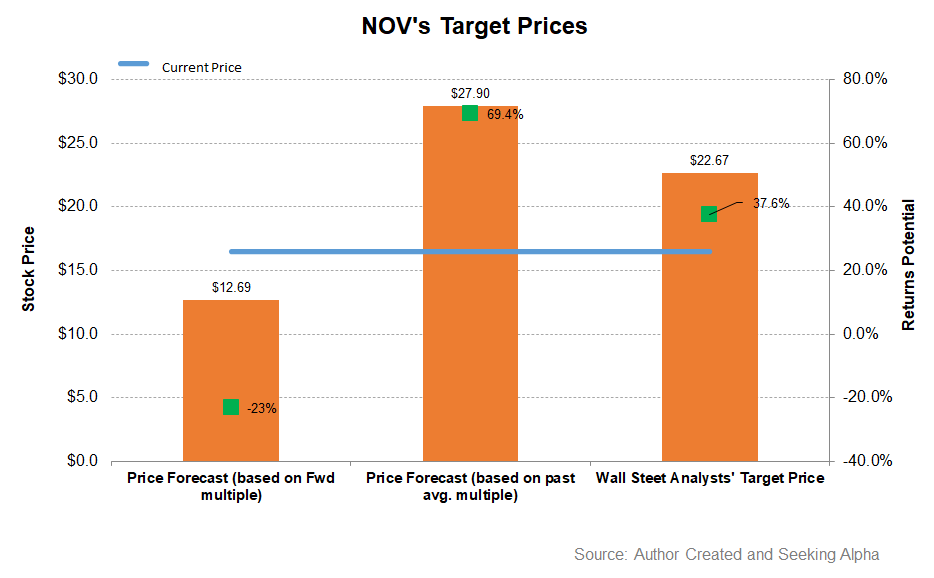

- While the relative valuation suggests the stock is reasonably valued, the model suggests a positive upside bias at this level

Part 1 of this article discussed the NOV’s (NOV) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Revenue Forecast

Based on a regression equation between the key industry indicators (crude oil price, the aggregate rig count in the US and internationally, and the US completed well count) and NOV’s reported revenues for the past seven years and the previous four-quarters, I expect its revenues to increase steadily in the next 12 months (or NTM) in 2023. The growth rate can decelerate in NTM 2024 and decline in NTM 2025.

Based on the same regression models and the forecast revenues, I expect the company’s EBITDA to increase in NTM 2023. However. The EBITDA can decline in NTM 2024.

Target Price

Returns potential using the forward EV/EBITDA multiple (14.7x) is lower (23% downside) than the returns potential (69% upside) using the past average EV/ EBITDA multiple (38x) and the sell-side analysts’ expected returns (37% upside) from the stock.

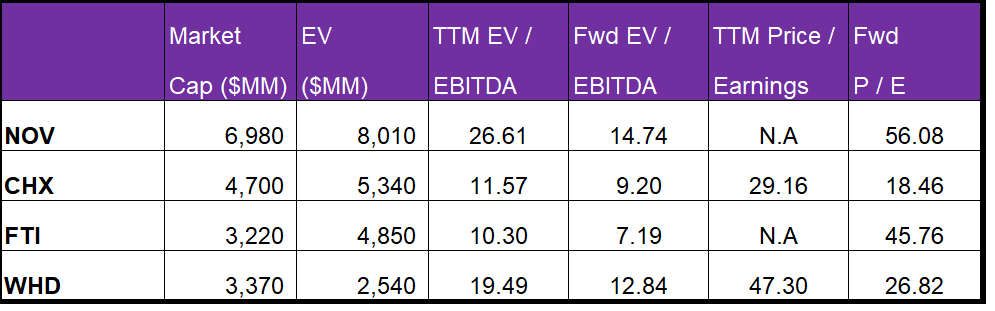

What Does The Relative Valuation Imply?

NOV’s current EV/EBITDA multiple is lower than the past five-year average EV/EBITDA multiple of 38.3x. So, it is currently trading at a discount to its past average.

NOV’s EV/EBITDA multiple is higher than its peers’ (CHX, FTI, and WHD) average of 13.8x. Because NOV’s forward EV/EBITDA multiple contraction is steeper than its peers, it typically reflects in a higher EV/EBITDA multiple than its peers. So, the stock is reasonably valued versus its peers at the current level.

What’s The Take On NOV?

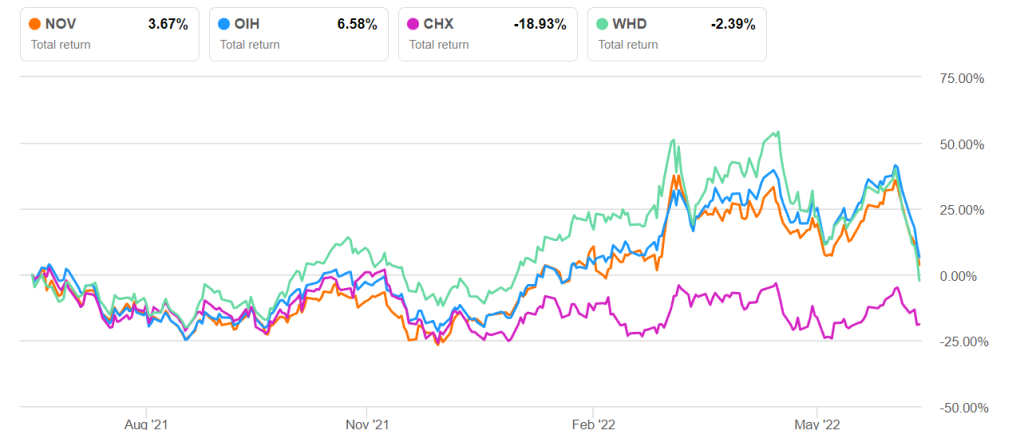

The energy market is in flux. The issues of a long period of underinvestment are being addressed, energy prices shot up, and drilling and completion activities took off in 2022. On the other hand, the cost curve has steepened due to the inflation and supply chain disruptions, skilled labor shortage, and ESG measures. The oilfield services sector often underperformed the operators because of the fragmented nature of the industry and excess equipment availability. In this scenario, NOV’s revenues from Wellbore Technologies are set to grow following growing backlogs in the drill bit business. Its downhole business has also recovered. Improved commodity prices have significantly brightened the demand outlook in the Completion & Production Solutions segment. So, the stock marginally underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

However, increased costs following the supply issue disruption in procuring raw materials, castings, electronic circuits, electric motors, gearboxes, and large bearings will continue to affect the cost. The rise in capex in FY2022 will keep free cash flows negative. A robust liquidity base, however, will protect from any financial risk. The stock is seasonably valued versus its peers at this level. We think it can generate steady returns in the medium-to-long term.