Market Trends

Market Sentiment Tracker: What If This Is as Good as It Gets?

The data now points to a global economy drifting rather than adjusting. The U.S. is holding on to labor strength,...

Read moreDetailsMonday Macro View: As OPEC+ Raises Output, Is U.S. Shale Prepared to Follow—or Fade?

OPEC+ is in the middle of a fresh output build, adding over 411,000 barrels per day each month between May...

Read moreDetailsNOV’s Perspective in Q1: KEY Takeaways

NOV to benefit from offshore efficiency gains? International market growth: Will it suffice? Tariff hike: What lies ahead?

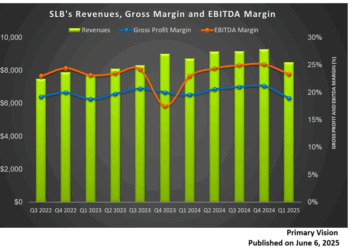

Read moreDetailsSLB’s Perspective in Q1: KEY Takeaways

How will tariffs impact SLB’s performance in 2025? What is its Q2 outlook? New frontiers for SLB: adoption of digital...

Read moreDetailsMarket Sentiment Tracker: Is the U.S. Economy Quietly Rebounding?

🇺🇸 United States: Conflicting Signals, But Momentum Persists Beneath the Surface The latest batch of U.S. macro data has bullish...

Read moreDetailsMonday Macro View: Electric Fleets Keep Expanding, Even as Completions Slow

There’s a noticeable shift underway in how completions are being carried out—and it’s not just about how much is getting...

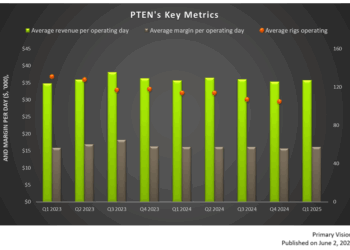

Read moreDetailsPatterson UTI’s Perspective in Q1: KEY Takeaways

Will natural gas-led recovery lead to a higher frac spread count Crude oil market dampens PTEN’s near-term outlook Will cash...

Read moreDetailsMarket Sentiment Tracker: Credit Card Delinquencies Hit 14-Year High

The global economy is moving in different directions, and the cracks are starting to show. In the U.S., signs of...

Read moreDetailsMonday Macro View: Is U.S. Shale Activity About to Slow Down

There’s been a lot of noise in the oil market lately—prices slipping, spreads tightening, operators adjusting guidance. At a glance,...

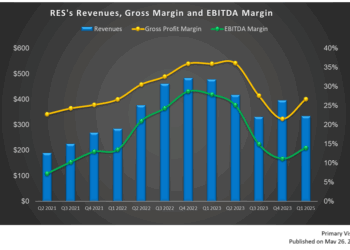

Read moreDetailsRPC’s Perspective in Q1: KEY Takeaways

Will RES’s frac spread count change? How will pricing and utilization be in 2025? Will the acquisition help RES with...

Read moreDetails