by Matthew Johnson

Oil and gas production in North America has huge ramifications across the world economy, and companies in many industries can benefit from keeping track of activity in the oil field. The most common metric is the Baker Hughes rig count, but that only tells you how many drilling rigs are active in a given week. Companies can get a much more complete picture by knowing how many hydraulic fracturing operations, or spreads, are active in a given week.

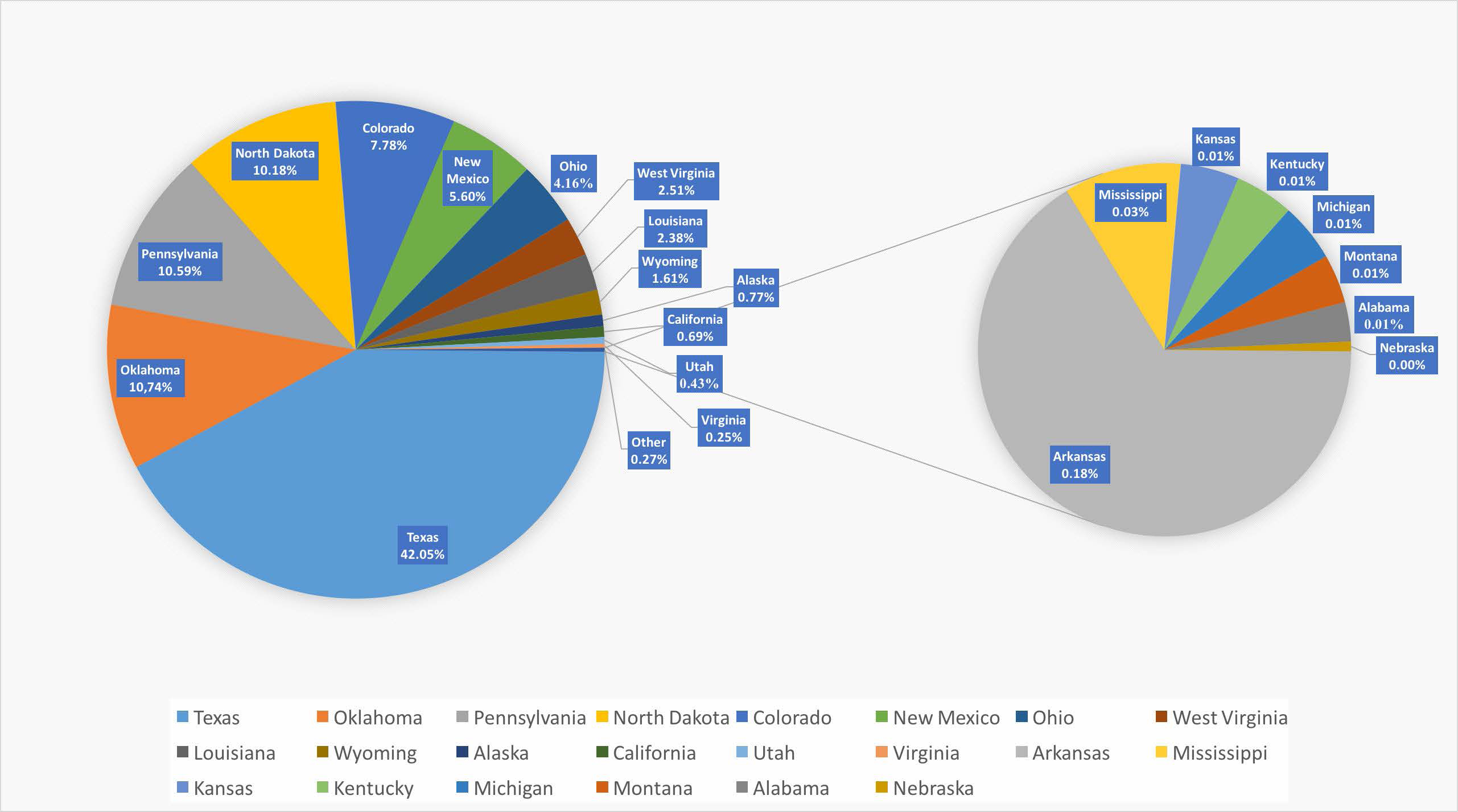

U.S. Regional Analysis

When people think of the frac’ing revolution, they often think of the contentious debates over land use in Pennsylvania or the boomtowns of North Dakota. The real leader in frac’ing has always been Texas, though. The breakthrough in the unconventional revolution came in 1997 in Texas’s Barnett Shale, where Mitchell Energy engineers discovered that they could stop using expensive gels and instead use cheaper, more watery fracking fluid to crack open shale formations to get economic production of oil and gas. Recent data shows Texas has simply continued its domination.

Over 40% of active frac’ing operations, or “spreads,” are in Texas. North Dakota and Pennsylvania come in at 10% each, as does Oklahoma. Colorado has about 7% of active spreads, Ohio has 4%, West Virginia has 2%, and Wyoming has just 1%. Major oil producing states Alaska and California have very little activity on the fracturing side.

Looking at the Eagle Ford region in Texas, the data shows that the number of active frac’ing spreads has held steady this year, even as drilling has fluctuated. The number of drilling rigs continued its plummet caused by low oil prices all the way until the end of spring, and has crept up steadily since. The coming months could be very good for the region, where many openly celebrated OPEC’s recent decision to limit oil production. American frac’ers may benefit more than select OPEC members. The comeback looks to be slow and steady along with the accompanying production bump.

Canada Analysis

Alberta, Canada is not all tar sands. Hundreds of wells have been frac’ed in Alberta in 2016, and the rate has been increasing over the summer and into the fall. The future of frac’ing in Canada is somewhat in flux, as it has both financial and environmental concerns. On the other hand, Canada’s largest driller, Precision Drilling, just announced it will spend 60% more on capex in 2017 than it did in 2016. While Canada’s recovery has been volatile, we look for pressure pumpers to demand more equitable terms while the market continues to stabilize.

Email us at info@pvmic.com for a free output of Frac Spreads in Canada.

Primary Vision Explains Oil Field Activity

Primary Vision has developed a proprietary method for collecting public and private data on frac’ing and then applying sophisticated math models, advanced cross-validation algorithms, and artificial intelligence to fill the gaps caused by industry secrecy and delayed reporting requirements. Our extensive data on hydraulic fracturing in the United States and Alberta, Canada is now available for sale in our new National Frac Spread Count Report. To learn more, visit www.fracspreadcount.com or contact us at info@pvmic.com.

sources: