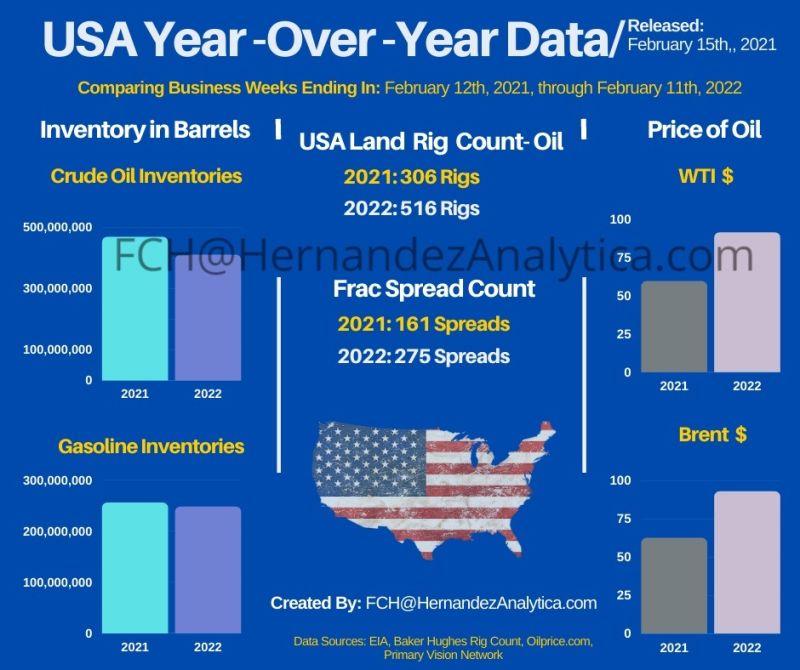

Year-Over-Year Oil Data (USA):

I have captured key industry data, as it relates to the previous business week. The oil rig count has increased 19 by for this week. Moreover, the count has once more reached another high, which has not seen since April 9th, 2020. The count is equally up by 241 rigs compared to the lowest point seen in 2021.

• Also, the price for Brent and WTI crude has increased by over 30.00 USD over the course of a year.

The below information that further complements the #infographic:

(Oil Rig Count: Baker Hughes report)

• February 12th, 2021: 306

• February 11th, 2022: 516

(Primary Vision – Frac Spread Count)

• February 12th, 2021: 161

• February 11th, 2022: 275

(Oilprice site: #WTI price)

• February 12th, 2021: 59.47 USD

• February 11th, 2022: 91.35 USD

(OilPrice site: Brent Crude price)

• February 12th, 2021: 62.43 USD

• February 11th, 2022: 92.84 USD

(EIA Crude Oil Inventories: agency reports with a week delay)

• February 5th, 2021: 469,014,000 Barrels

• February 4th, 2022: 410,387,000 Barrels

(EIA Gasoline Inventories: agency reports with a week delay)

• February 5th, 2021: 256,412,000 Barrels

• February 4th, 2022: 248,393,000 Barrels