It has been a very upsetting week, to say the least. The events unfolding in Ukraine can lead to unimaginable long term consequences. Given the current state of the world and its economy, we simply cannot afford such triggers.

After a worrisome and aggressive speech where Putin recognized the independence of Donetsk and Luhansk, he ordered his forces to enter these regions for “peacebuilding” which, of course, is a euphemism to take control over them. This has sparked a strong reaction from the international community where U.S., UK and other allies have announced sanctions against Russia with a warning for more if Russia goes ahead with a full-scale invasion. The sanctions include ban on two Russian banks and also affect its soveriegn debt meaning that the country won’t be able to participate in Western, European debt and other markets. UK have sanctioned three Russian banks and few wealthy individuals. However, the main highlight remains the cancellation of Nord Stream 2 by German Chancellor Olaf Scholz.

However, with oil prices soaring to 7 years high will the sanctions make much difference to Russia? Last year Russian oil revenue increased by 41 percent! And per a Bloomberg LP article, if prices stay at where they are, it could add $65 billion to the country’s budget. So far the sanctions haven’t deterred the country to alter its behavior – Russia annexed Crimea in 2014. Another article in Al Jazeera interestingly titled, “When oil prices climb, Putin gets bolder” is certainly true. His intrigues in the past in Georgia (2008), Crimea (2014) and now again Ukraine (2022) saw oil prices elevating to high levels. Brent is about to touch $100 and may breach $100 soon. Global stocks have started to fall.

All in all, it doesn’t bode well as we move forward.

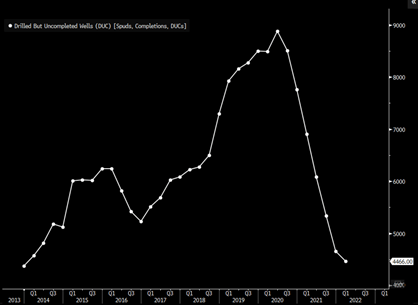

We, at Primary Vision Network, have always highlighted that geopolitical issues will resurface as a result of COVID19. Increase in food prices, rise in protests, et al has been a constant theme in our ECON shows, Mark’s weekly Insights and my articles. This chart is from our recent ECON show’s first segment.

Of course, all of this is rendering global crude markets jittery. Brent prices touched $99.50, only $.50 shy of $100. The risk or fear premium is playing a major role. Other concern, as I noted in a previous article, is an impending supply crunch and falling spare capacity. There are different outlooks on this as well. Personally, I do not expect a supply crunch at all. I still believe that markets will get a major correction, if and when (hopefully soon), the matter regarding Ukraine settles down in a diplomatic, non-confrontational manner. Either of these two possibilities can happen 1) The forces in Donetsk and Luhansk region remain permanent and the status quo, gradually, becomes a norm – just like it has happened in Indian Occupied Kashmir 2) Both parties come to an agreement and a de-escalation entails, highly unlikely scenario. In both the cases, I see the fear premium fading away as the shadow of war retreats. Further escalation can sent markets into a frenzy. Note: Such a development will have opposite impact on global stocks.

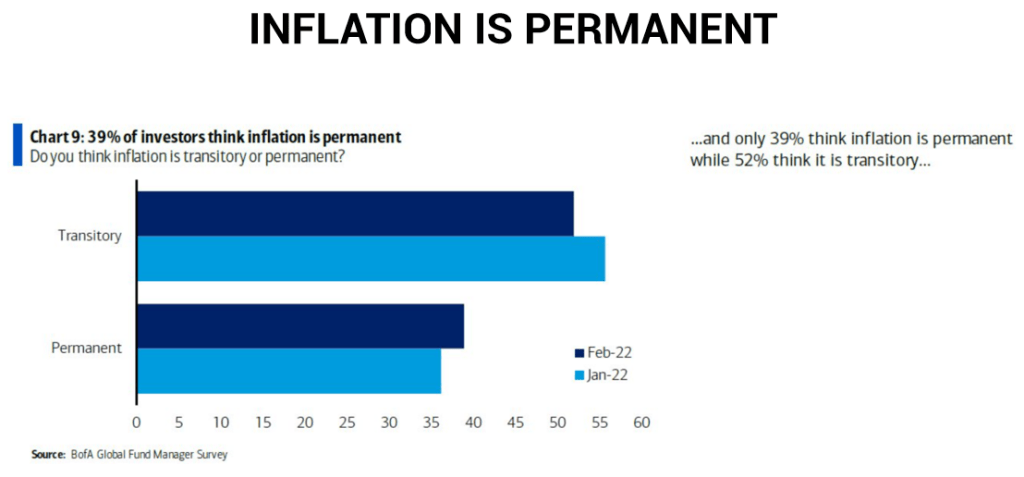

Needless to mention, that all of this can have a serious impact on global economy that is already in a state of recovery and facing headwinds. Inflation continues to rise and many have started to believe that it isn’t transitory but permanent – sticky, in technical terms.

To conclude, we are in the midst of some historical developments. One can only hope that it will get better, it should. The other possibility is very grim. I hope saner heads will prevail and that we will see the current geopolitical conflict moving towards some solution – preferrably, a diplomatic one.