The Houthis just struck a storage area in Jeddah, Saudi Arabia, which services local consumption and operations. Exports won’t be impacted but it shows another increase in tensions between the GCC nations (Saudi Arabia and UAE) against Yemen and the Houthis. It will also throw another wrinkle in a potential “Iranian Deal” after another missile attack this time against the GCC. The market is rife with possible disruptions with the Iran/ Houthi connection underappreciated. Several weeks ago we broke down WHY this was going to be an issue given the Houthis control a key port in Yemen. This allows for additional equipment deliveries of advanced missiles and drones. Things will remain very tense in this part of the world.

Russia has been increasing the amount of crude on the water with ural exports reaching the highest in 3 years. Russia only has 8 days of storage and needs to push in AS MUCH crude as possible to ensure normal operations and sending discounts down to almost $40 below dated brent.

Urals crude loadings from Russia’s three western ports are set to jump to 9.255m tons in April, according to a loading program seen by Bloomberg News.

- Equates to 2.26m b/d, the highest since June 2019

- Compared with revised 7.38m tons, or 1.75m b/d for March

- Primorsk loadings will be 4.2m tons in April, vs 3.2m tons in March

- Ust-Luga loadings planned at 2.7m tons in April, vs 2.6m tons in March

- Total Urals exports from Baltic ports will be 6.9m tons, or 1.69m b/d, highest since June 2019, compared with 1.37m b/d for March

- Urals loadings from Black Sea port of Novorossiysk will be 2.355m tons in April, compared with 1.58m tons in March

- April program comprises 12 cargoes of 80k tons each, nine of 140k tons each and one of 135k tons

- Four cargoes totaling 320k tons of Siberian Light will also be exported from Novorossiysk in April, compared with revised 480k tons in March

We are also seeing discounts grow out of West Africa:

- Vitol offered 1m bbl of Usan for April 15-20 arrival on CFR Rotterdam/Augusta basis at $3.25/bbl more than Dated Brent; vessel is Ridgebury Mary Selena: trader monitoring Platts window

- Drops from +$3.65 on March 24, $3.9 on March 23, $3.95 on March 22

- Chevron offered 950k bbl of Dalia for May 4-8 arrival on CFR Rotterdam/Augusta basis at $2.90/bbl more than Dated Brent

- Drops from +$3.55 on March 18

We expect to see discounts grow out of West Africa as they have to compete against discounted Iran and Russian cargoes leaving them a bit stranded. The shifting market between gasoline and diesel (More on that below) will also cause more competition for crude qualities… a lot of fun things to discuss!

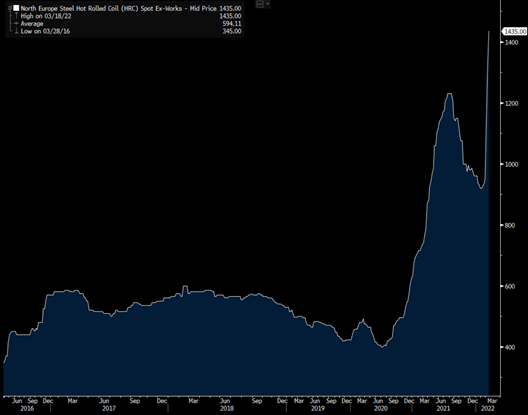

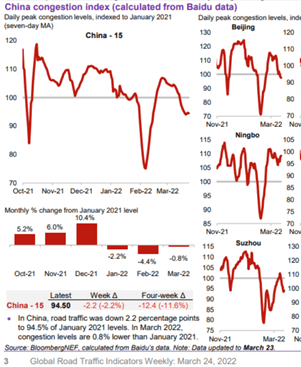

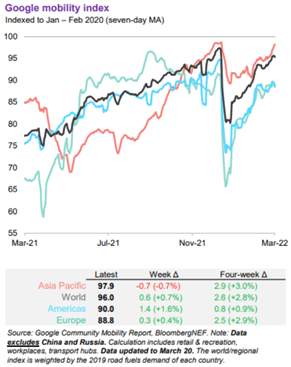

U.S. completion activity is going to start picking back up this week and continue to climb into the 1st week of April. The move higher will be measured, but steady as work increases along seasonal lines. The strength in pricing will keep crews busy as they tackle to pervasive logistical and supply chain problems. We don’t see the supply chain improving in the near or medium term given the issues around the world from steel to aluminum and everything in between. Steel prices have surged higher in Europe, and with scrap prices at record prices- there is little the U.S. can do to bring prices lower. The increase in costs is being passed through the supply chain keeping all prices around the world elevated. The supply chain had yet to recover from COVID, and now it is hit by other issues of broad Chinese lockdowns and the war in Ukraine. The war in Ukraine will be supportive of U.S. crude exports across crude, diesel, and liquids. On the flip side, the surge in gasoline prices has already hindered demand in Europe and Emerging markets leaving more in the market. We will see more gasoline move from Europe and get dumped into PADD 1 (East Coast) where we still have a decent amount of storage available.

Refiners are trying to create as much distillate (diesel) as possible, but when you crack crude for diesel you inherently make gasoline. Refiners can try to minimize the disty cut by adjusting blends and crackers, but you can only limit organic chemistry to a point. We are already seeing big builds in gasoline around the world as refiners create more in the hunt for disty and driving demand falls.

Singapore Gasoline Storage

Europe Gasoline Storage

The only time there was more gasoline in European storage was 2021 on a seasonally adjusted basis. We have already seen demand destruction kicking off in the area with more to follow. Driving demand has started to slow in Europe and remains sluggish in China as more lockdowns spread across the country. Europe and Emerging Markets is where we expect to see more slowdowns as costs cause people to shift spending patterns. Some countries have issued curbs to taxes as well as promising to maintain subsidies. Pakistan is risking its $6 billion bailout program from the International Monetary Fund by reducing fuel prices and promising to not increase them until at least June. In the Philippines, the government is resisting a relief on excise tax fearing the impact it will have on revenue.

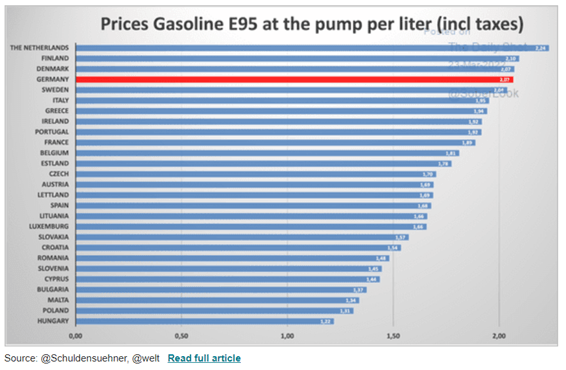

The German government will cut the tax on fuel for three months by 30 euro cents ($0.33) for gasoline and 14 cents for diesel, Finance Minister Christian Lindnertold reporters in Berlin. Taxpayers will also receive a one-off payment of 300 euros, he added. This is to help alleviate some of the pain as Germany has one of the highest prices on the continent. The shift will help bring prices back below 2 Euro a liter, and we should see some other actions from European countries. In Emerging Markets, some of the prices have started to creep higher but so far there hasn’t been a big mark to market, but we should see that change as the stress on budgets get much worse. India government-owned fuel retailers in India took a $2.25 billion hit in revenues by holding back from increasing pump prices in the run-up to local elections, according to a note from Moody’s Investors Service. Retailers increased prices on March 22, but still not a true mark to market to provide some form of relief for local consumers as Indians get hit hard from other areas- such as food (more on that later).

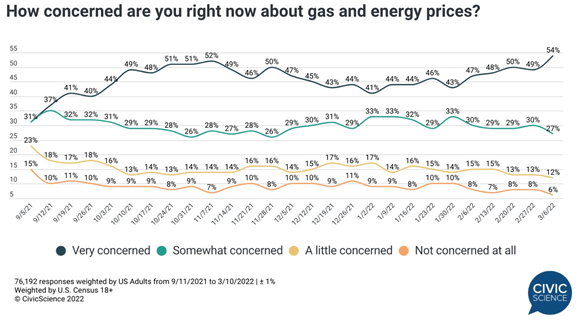

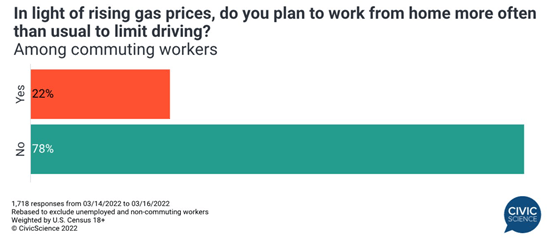

The U.S. is also seeing a shift as people are focusing more on the costs at the pump. People are still working from home, and now instead of COVID being the driver of the WFH- the mantra will be “my cost to go to work is too high.” We don’t believe the U.S. sees a dramatic drop in demand, but rather a muted increase for the spring/summer driving season. It is becoming a much bigger focal point and is already causing people to rethink their vacation plans.

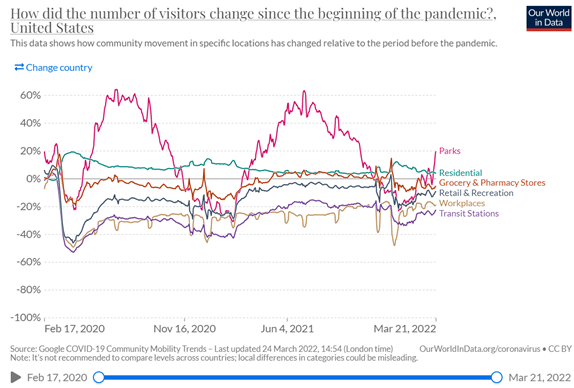

We are still seeing people not adjusting their normal movements, but many are already working from home. But- we are seeing a bigger push in Europe (especially the UK) to work more from home as gasoline prices surge.

We still have workplace travel down 20% vs pre-COVID and the spike in gasoline prices will just be another reason to have a flexible schedule.

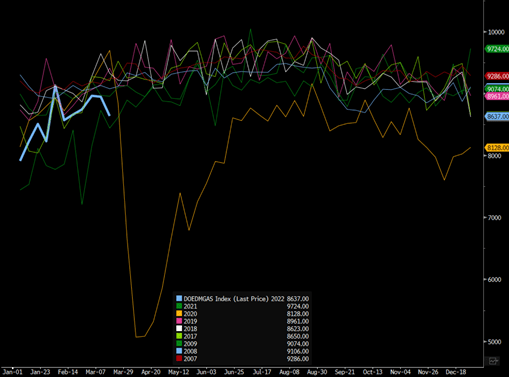

The U.S. remains well off the normal pace when we typically have a seasonal bump driven by spring break. We will likely see a “make-up” number, but it will still be muted on a broad spectrum given the cost to the consumer. Diesel remans the biggest hinderance to growth as it hits every level of the supply chain and is facing a global shortage.

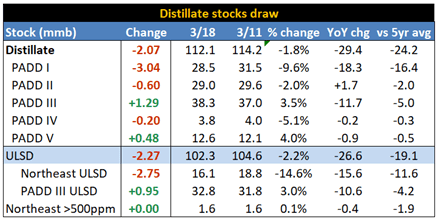

US IMPLIED GASOLINE DEMAND

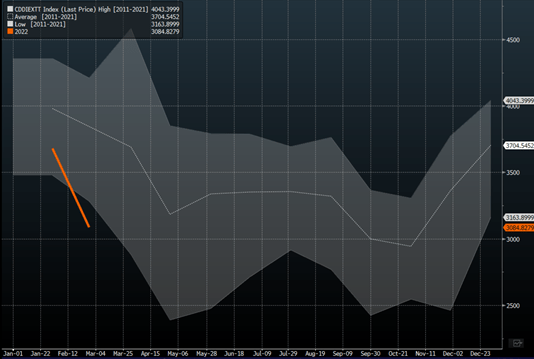

Diesel storage is in a very different predicament vs gasoline. Russia is a big part of the global export market- especially into Europe. We have seen their cargoes slow considerably with some of them sitting outside the ports unable to unload. The shifts are happening around the world, and countries are struggling to replace Russian diesel because they were already sitting near record low levels. The U.S. is just one example where distillate storage has been at record low levels- specifically in PADD 1 (East Coast). We have seen low storage levels around the world, and by shunning Russian diesel a tough (and EXPENSIVE) situation becomes an even bigger problem. Because the disty crack is so strong, we will have refiners targeting it while hoping to get rid of the gasoline (light disty) to anyone who will take it.

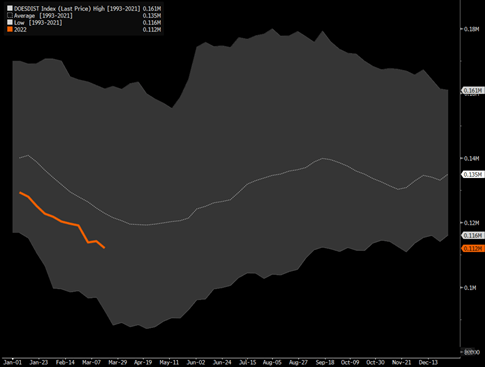

Russia Total Diesel Output for Export

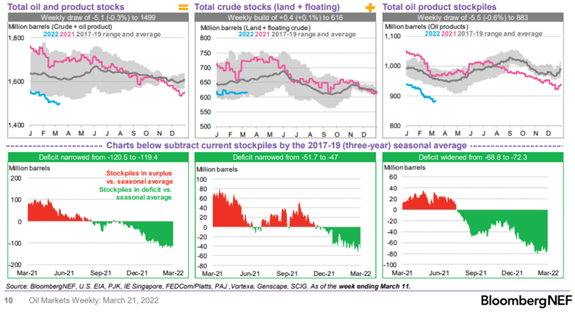

Middle Distillate is the biggest driver of the global drop in refined products that we keep seeing on a global scale. The other products- gasoline/ residual fuel/ fuel oil/ heavy disty are well above the normal range helping to highlight the problems (and underlying costs) the global supply chain faces.

The below chart helps to show exactly where the shortfalls in the U.S. are- PADD1. The limitations created by the Jones Act and Colonial pipeline keep PADD 3 from pushing more product into the East Coast. This means PADD 1 is left to the floating market to try to close the gap, and over the last several quarters have relied on Russian diesel. The U.S. (PADD 3) has started to send a bit more disty to Europe given their shortfalls and healthy pricing/margin that can be earned from taking advantage of the arb.

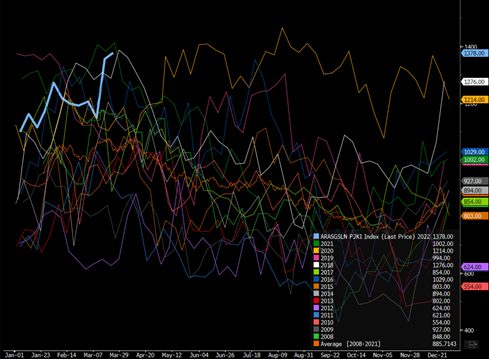

Europe gasoil is just above record lows (only 2008 was lower), and the situation will only get worse as Russia imports slow. We will see some additional shipments from the U.S. and whatever is available from the East of Suez market. The underlying price surge will cause Emerging Markets to avoid gasoil and start running more fuel oil/ HSFO/ heavy distillate to save money. The switch is just starting to happen as pricing is prohibitive and additional cargoes are sourced.

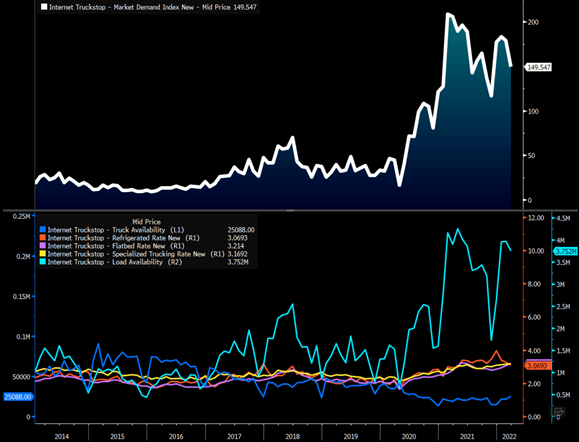

Singapore is sitting in a similar position with Fujairah at RECORD lows. We should get “some” reprieve from the ME market as refiners come back online, but it will take time to see the market repair itself. Instead, we will see more demand destruction as people are priced out of the market. We have already seen that from EM markets, and now trucking demand is slowing again due to the elevated costs of moving goods. Repsol SA will offer a fuel discount for truckers of 10-euro cents per liter in Spain until June 30, the Spanish firm says in e-mailed statement. We expect to see more types of subsidies moving across the system as the market remains constrained.

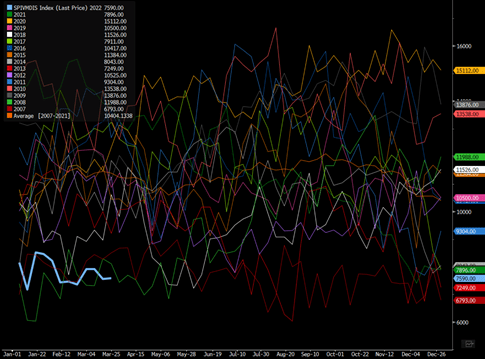

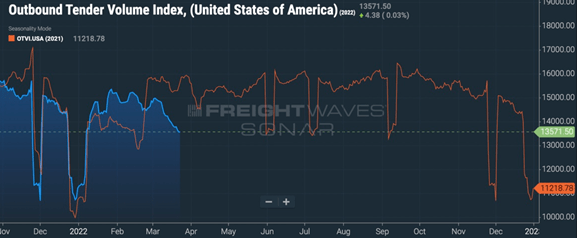

In the U.S., we are seeing some of the trucking demand wane a bit as prices remain prohibitive. Using multiple metrics, the truckload market is showing unusual weakness for March and is softer now than any time in 2021 (other than holidays). Blue = 2022, Orange = 2021. Probably a sign of slowing consumer activity in the economy. We did see “some” shifts in the supply chain increasing inventories, on top of new orders slowing as well as durable goods and retail sales dropping.

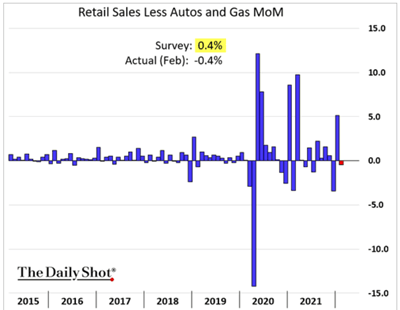

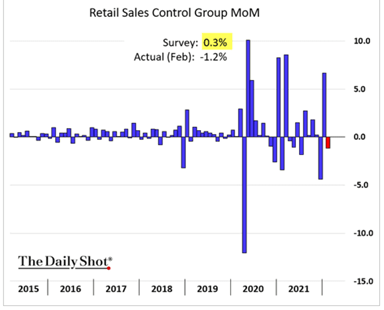

Retail sales have started to slow (again) and we expect it to accelerate as prices skyrocket. The regional Fed data and national numbers are showing more issues in the supply chain as well as a new record in underlying prices. This is also coming at a point when new orders are slowing, which is an important leading indicator.

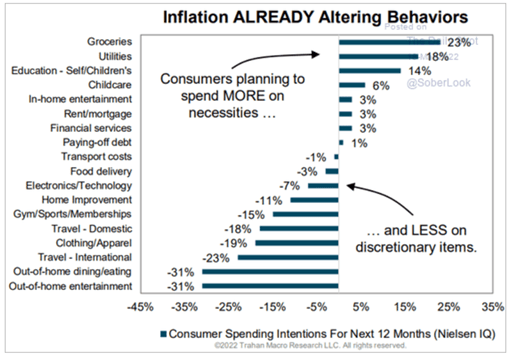

People are already shifting to spend more on necessities and less on discretionary items, which is why the Fed is so concerned about “sticky” inflation. Many of these necessities don’t move quickly in response to prices but are rather a slow shift but once they turn- they can spike rapidly and won’t revert any time soon.

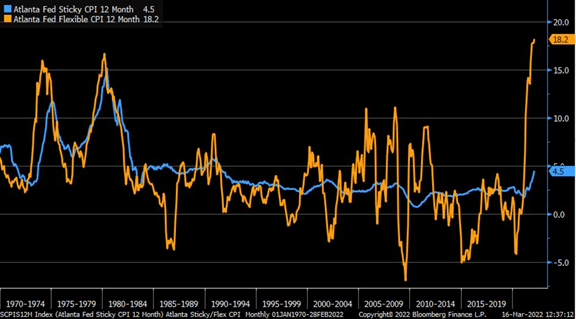

The move in flexible inflation is now off the charts and beyond the 1970’s/1980s rates and we expected it to slow in the first 2 months of the year which proved INCORRECT. Instead, it took another leg higher with crude driving higher mixed with Russia-Ukraine. Given the current dynamics in Eastern Europe, we won’t be seeing any near term adjustments lower- instead we will see the sticky CPI calculation push higher and accelerate.

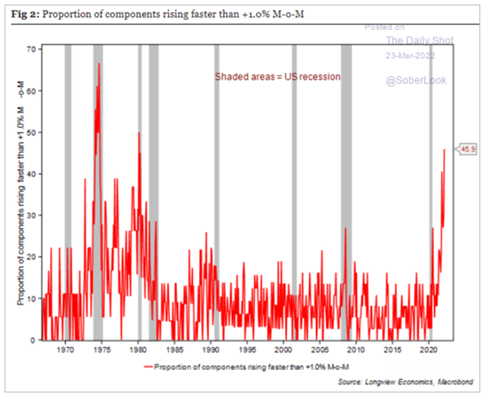

The biggest problem is the proportion of components rising FASTER than 1% month/month. Over 45% of components are spiking and the last time we were at this level of increases was 1980. The problems are becoming more pervasive as they are passed on to the consumer sending prices on an upward spiral. We were expecting another run up in prices from March-June driven by input costs- especially wages as people start new jobs. This is happening but compounded with global issues around basic life necessities.

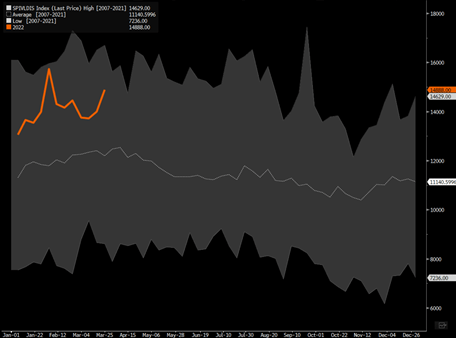

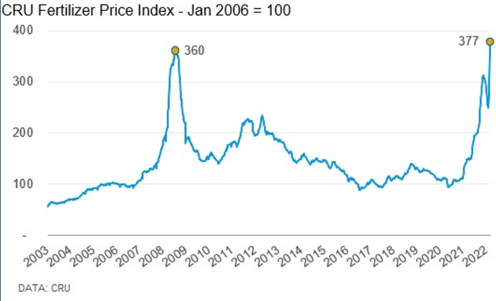

Food prices are going to be pinned to the highs as fertilizer prices surge to a new record. Everything from diesel to fertilizer are hitting new records that will keep farmer costs sky high that have to be passed on to the consumer. The shortage in key fertz will remain as Ukraine/Russia keep exports well below normal and the underlying grain markets remain grossly short. As we have said in the past, Food shortages don’t happen suddenly- it takes time to work through storage and state reserves. It started out slow in the end of ’19 but accelerated in ’20-’21 with droughts/floods/pests/logistics… Ukraine-Russia is just the topper to a situation that started several years ago. The issues have been compounding since the end of 2019, and now we are in a terrible position with ANOTHER projected terrible year of crops BEFORE we even consider the impacts of Russia-Ukraine.

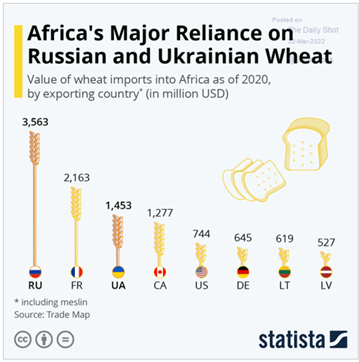

We have already highlighted what the war means for emerging markets, but here is just another reminder for what it means for Africa.

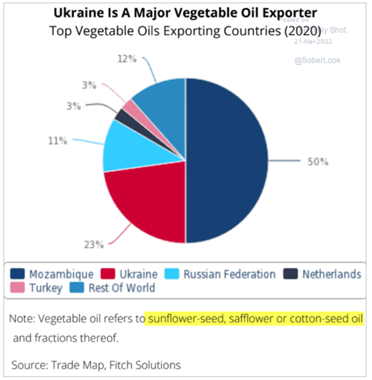

But- another key area of concern is the “vegetable oil” market, which is DOMINATED by Ukraine-Russia. They are about 34% of the global market, and this is another key point of inflationary pressure- especially in India. The below is another example of why India/China will remain neutral with Russia because they can’t risk losing Russian commodities.

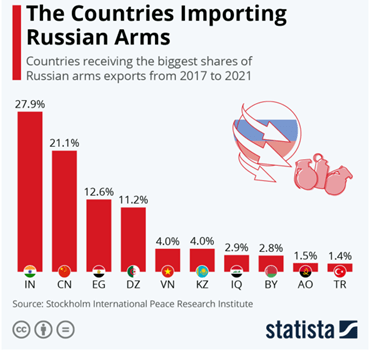

Russia is also a key provider of military equipment to a wide range of countries with India relying significantly on them for equipment and training. After China attacked India in Ladahk, Russia was quick (and the first country) to support India and accelerated the delivery of key equipment including the S-400 and other military equipment. India relies on Russia extensively, and we believe they will remain very neutral in the current conflict. India also has to walk a fine line because they are also part of the QUAD along with the U.S., Australia, and Japan. So they can’t go “too far” towards the Russia camp, but instead remain neutral and purchase cheap crude from the country and maintain a steady flow of food and military equipment.

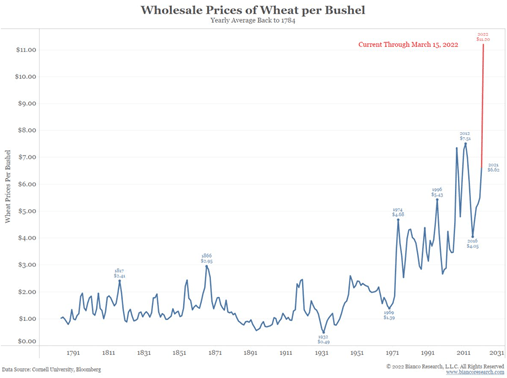

I think this chart puts into perspective the increase in wheat prices. We are seeing an unprecedented surge in prices that will hit people’s wallets hard across the board.

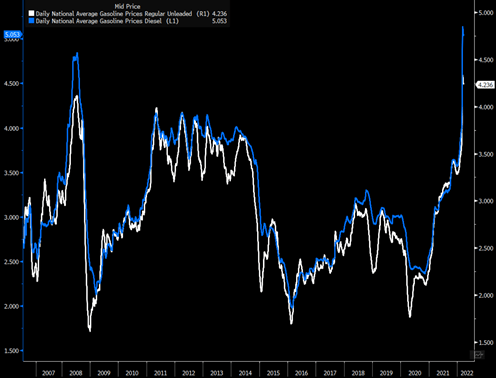

This is all coming as we keep seeing factory prices surge and underlying diesel prices.

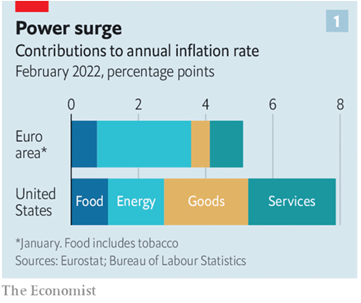

Energy remains a huge driver of inflation- especially for Europe. The U.S. is seeing a much broader impact from foods and services, but in our opinion- Europe is behind the U.S. on the impacts of inflation. The U.S. is the largest importer in the world, so we will feel it quickly and for a prolonged period across goods and services, but Europe is an exporter (depending on the country) and they are just late to the inflation party. They have an outsized impact on energy due to their reliance and connection to Russia, but it will also inherently drive up the prices of everything in their economy.

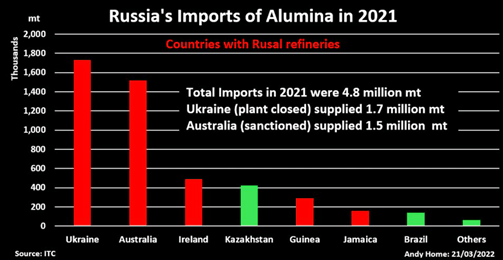

Another hit to the global supply chain is on the aluminum front as Russia hits a lot of problems. Ukraine and Australia provided a significant amount Alumina in 2021, which are now no longer able to operate. At this point, it would be much shorter to describe which commodity is NOT impacted by the Russia-Ukraine war. I just find it fascinating that Russia attacked a country that was so pivotal for their economy since 2014. Prior to 2014, Ukraine provided a significant amount of military components and equipment to Russia… just goes to show you that the famous quote holds true saying that in order to go to war all semblance of economics, finance, and reason have to be thrown out the window.

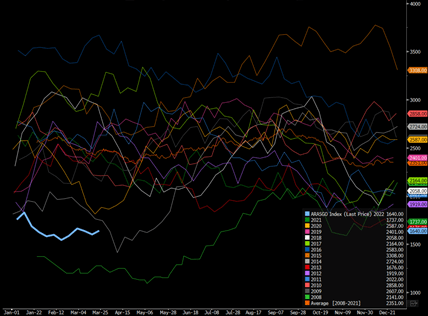

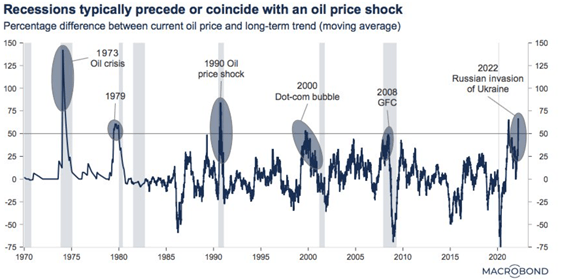

All of the above issues are just compounding on a huge spike in oil prices, and when you look throughout history… it usually either precedes a recession or it is a key reason one is in progress. The below chart helps put it in perspective when you look at broad spikes in crude pricing and what quickly follows. It is really hard to avoid a recession when the cost to all logistics screams higher. The problem we have today- it isn’t just crude that is running to highs- but a broad commodity shift higher with food being the biggest overhang.

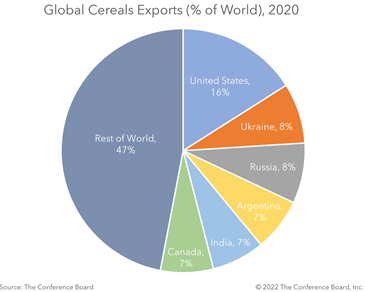

The major disruptions are only growing around the world as we lose about 16% of global export capacity, but we are already seeing broader shortfalls and reduced estimates from other key growing areas such as Latin America. As each area has their yield cut, the excess that can be exported into the global market comes under pressure and total volumes drop. This will be a very important chart when we consider the health of Emerging Markets, and their ability to spend money going forward.

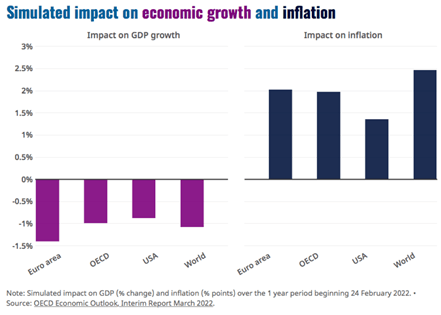

All of the above issues are obviously a huge problem for EMs, but it also hits the developed world and OECD nations hard. The OECD is expecting a broad increase of about 2% inflation but only a decline of about 1% in economic growth. Given the broad impacts on the economy, I think many agencies are underestimating the impacts of inflation on the broader economy.

We haven’t had this level of “pain” in decades- especially with everything being broadly impacted. People are already expected to spend more on necessities vs discretionary items as we broke it down this above. This will keep driving down underlying growth as the consumer keeps getting hit on all fronts. Gasoline storage will be the big one to watch to get a gauge on the consumer, and on the economic/ EM front the split between middle distillate and residual fuel. As the cost rises for VLSD and ULSD (gasoil) it will push more countries to fuel oil/ HSFO in order to compensate. There is a more than enough heavy disty/resid in the market, but it will just be a matter as to when people switch over.

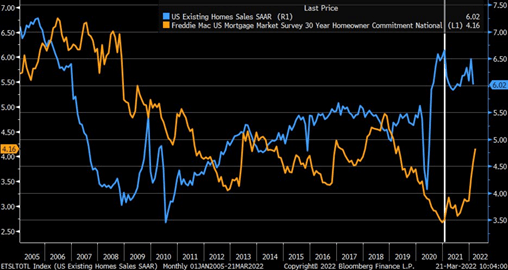

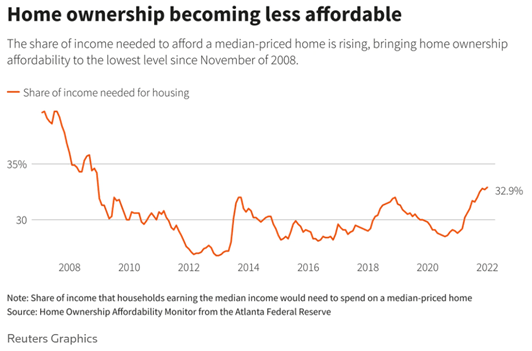

The housing market is also taking a pause from its run higher as rates surge higher, and there remains a limited amount of available capacity. We expect to see housing take a pause as buyers avoid the current market, but sellers (after seeing the prices of other sold homes) are unwilling to drop their asking price. This will create a stalemate, which typically happens near the peak of the market. The 30 year will be the key to watch as rates press higher and the view that the Fed raises rates upwards to 9 times this year. There is now a growing consensus that we will see over 2% by year end, which would cool off the market very quickly.

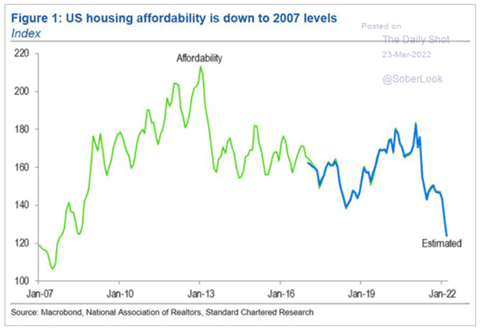

The underlying affordability of the market is also reaching new lows- based on sluggish wages/ rising prices/ spiking rates. All of these components lead to the below chart:

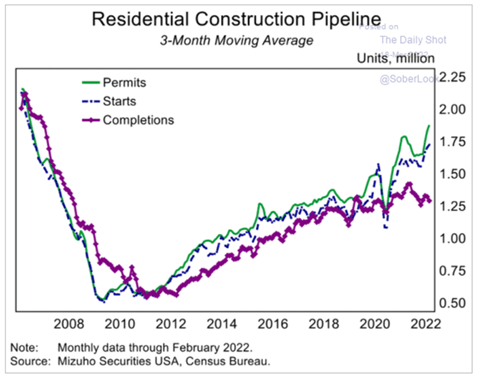

Another problem is the amount of volume waiting to come on market and at what cost those units will come to market. Builders have been facing rising costs, and their breakevens are also driving higher which will either force volume to sit at elevated prices or builders to take a loss. It will be a difficult market for some time as the Fed fights inflation and pushes rates higher. They were buying MBS (mortgage-backed securities) for way too long and have created an unsustainable position. So there is coming volume… the question will be price.

It is all rapidly becoming less affordable.

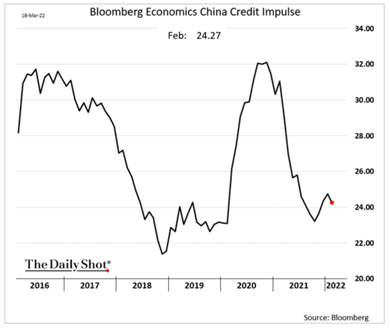

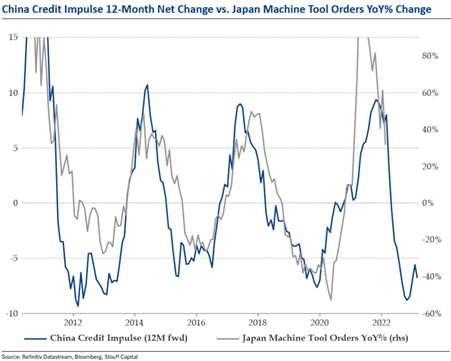

There also remains a consistent theme that China is coming to save us all. I have said consistently that the increase in Chinese Credit Impulses was purely to keep it from falling further. The PBoC is stuck given the amount of leverage in the system and underlying problems in the market. The country is facing rising costs and are issuing MORE tax rebates to help promote more investment and spending amongst businesses and consumers. So as fiscal stimulus remains in play- it limits the amount of liquidity they can push back into the market.

Due to the sheer size of China, their credit metrics have a ton of underlying correlations hitting everything from the U.S. to Asia. I cautioned when EVERYONE got so excited about an increase in credit impulses that it was purely temporary and was going to remain stable at these levels. It was going to be similar to that 2013/ 2016 backdrop. Only this time- China is facing a housing/real estate crisis and an economic slowdown as the global economy shifts lower.

They are also hitting their own issues with food.

On Friday, the National Development and Reform Commission (NDRC) published a notice outlining its plans to ensure food security this year.

ICYMI: Food security matters rank high among Beijing’s priorities this year, as part of broader efforts to deliver macroeconomic stability in the run-up to the 20th Party Congress this fall.

Most of the NDRC’s to-do list was familiar – including supporting grain farmers and pushing to expand soybean and oilseed production.

- Those priorities made an appearance in the 2022 No. 1 Document on agriculture and at the Two Sessions.

But one thing that really stuck out was extensive language on shoring up fertilizer supply.

Here, the NDRC plans to:

- Carefully monitor fertilizer supply and prices, and intervene where necessary

- Ensure chemical fertilizer producers get the raw materials and other production inputs they need

- Get as many fertilizer producers up and running as possible, provided they meet environmental and safety requirements

- Ensure that enterprises managing spring and summer fertilizer reserves have the loans, transportation, and fertilizer stock they need

Get this: Those summer fertilizer reserves are new this year – and it sounds like funding and stocking them is already posing a challenge.

Get smart: Domestic fertilizer producers are reeling from high energy prices, the impacts of environmental regulation, and the Russia-Ukraine conflict’s impact on raw materials supply chains.

Get smarter: It’s pretty much impossible to ensure food security without sufficient fertilizers.

- If the NDRC can’t get a handle on fertilizer supply in the next month or two, expect China to continue quietly curbing fertilizer exports.

While the government issues more tax cuts”

ICYMI: In his government work report released earlier this month, Li Keqiang promised to refund companies RMB 1.5 trillion in VAT in order to (Gov.cn):

- “Promote consumption-driven investment”

- “Improve the cash flow of enterprises”

- “Strongly boost market confidence”

On Monday, the State Council said that RMB 1 trillion of this refund will go to small and micro firms.

- Micro firms will receive the rebate in April.

- Small firms will get theirs in May and June.

The remaining refunds will be dispensed between July and the end of the year and go to companies in:

- Manufacturing

- Scientific research

- Electricity, heat, gas, and water

- Software and information technology services

- Ecological protection and environmental governance

- Transportation, storage, and delivery services

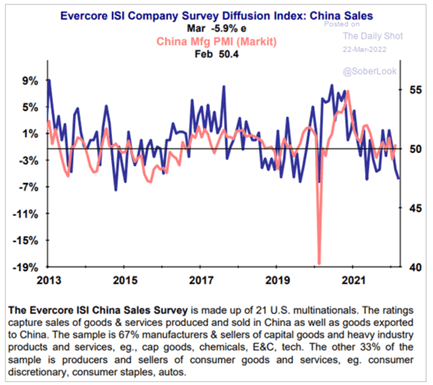

This is all happening as sales drop in the U.S. and China leading to more global pressures.

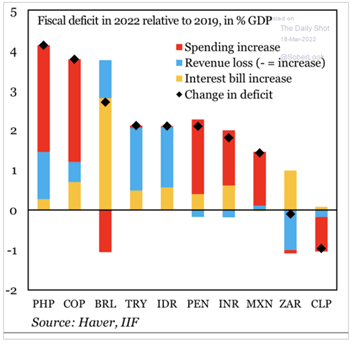

All of these issues are culminating at the WORST time as many governments are already facing budget overruns and a tightening monetary policy.

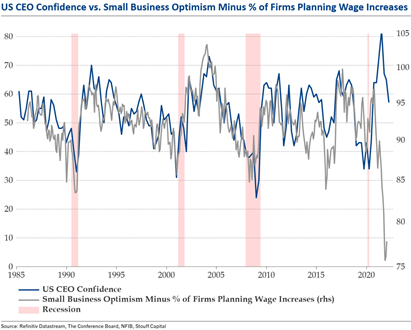

The U.S. is facing its own slow down in new orders/ worsening supply chain/ and record input prices. IT is all resulting in a big drop for CEO confidence. When you consider that wages are running at 40+ year highs and lead indicators suggest top-line growth is peaking, it’s not really a surprise… It’s a double whammy for margins. The regional fed data is mixed but broadly showing a price spike and build in inventories, while being mixed on new orders (some places up and other slowdowns.)

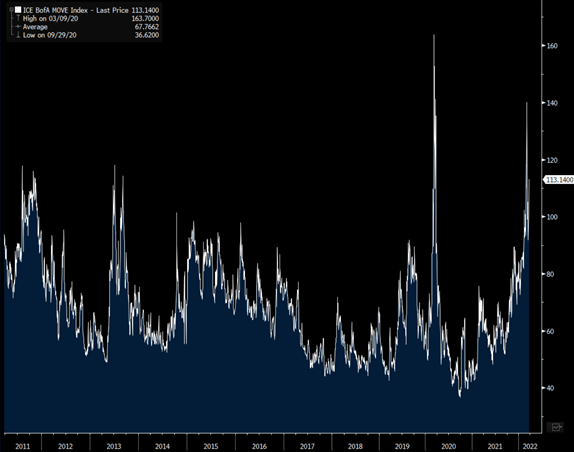

The bond market continues to signal more tightening and additional pressure points… the bond market and underlying rates shouldn’t be ignored. Volatility is spiking again, and this is what will keep Powell up at night as rates shift all around, inflation flies, and wages run unchecked. It is a prime backdrop for a wage spiral and out of control inflation… they will have to get more aggressive.