- A multi-year growth cycle will benefit Baker Hughes’s North American market significantly and will also help participate in the Middle East markets’ recovery in 2022

- Strategically, it will transition from a product line-oriented structure to a solutions-focused business

- In recent times, various clean energy-related project awards will help the business transformation

- However, commodity price inflation and supply chain issues can offset some of the profitability gains in the short term

- BKR has strong liquidity, but its free cash flows turned negative in Q1 2022

Oilfield Services Strategy

Over the past few months, the energy world has seen crude oil and natural gas prices increase remarkably and then sustained at a much-elevated level compared to a year ago. Also, underinvestment in energy production over the past few years prompts spending growth due to a need to increase LNG infrastructure investment significantly. At the same time, a challenging supply chain and inflationary environment in the commodity market have compounded the scenario.

So, BKR, in the legacy oilfield services market, will transition from a product line-oriented structure to a solutions-focused business. This means it will augment its well construction, completion, intervention and measurements, and production solutions. On top of organic growth, it may add or acquire businesses like the acquisition of Altus Intervention, which provides well intervention services and downhole technology internationally.

LNG Market Growth

Opportunities in the LNG, offshore production and new energy brighten the company’s medium-to-long-term outlook. In 2021, it booked $7.7 billion of orders, including 22 MTPA of LNG orders. The company estimates that the global LNG capacity may exceed 800 MTPA by 2030 compared to the global installed base of 460 MTPA.

Natural Gas And LNG Market

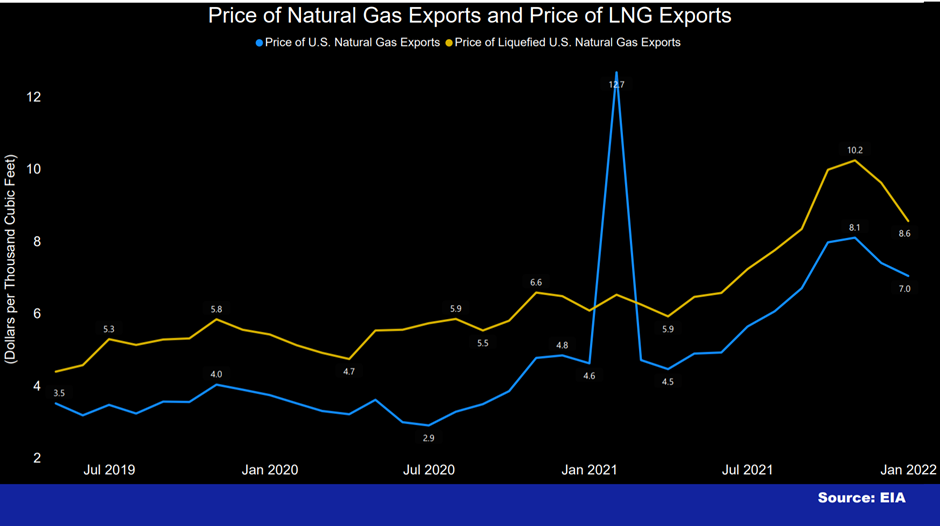

The natural gas export price increased by 52% in the past year until January 2022. During the same period, the LNG export price increased by 41%. The EIA expects natural gas production to increase marginally (1.3% up) in 2022 compared to the current level and increase even more in 2023 (4.9% up compared to now). The natural gas spot prices can shoot up (by 16%) from the current level and average $5.68/MMBtu in Q2 2022 and decline to $5.23/MMBtu, on average, in 2023. However, the geopolitical volatility arising from the Ukraine-Russia conflict has made it difficult to estimate the price with a fair degree of accuracy.

According to EIA’s recent analysis, the most significant natural gas demand driver in 2022 will be the colder forecast temperatures resulting in higher consumption in the residential and commercial sectors. On top of that, higher industrial activity and the need to replenish Europe’s natural gas inventories will lead to increased demand for LNG.

Clean Energy Projects

BKR has created Climate Technology Solutions (or CTS) and Industrial Asset Management (or IAM) in other initiatives. It has made various investments, partnerships, and acquisitions in growth businesses like direct air capture technology, emission-free gas-to-power technology, and e-fuels production by blending green hydrogen and CO2. Although success is not guaranteed in these fields, BKR is a forerunner among the oilfield service that provides new market opportunities in clean power and low carbon fuels.

Oilfield Services: Outlook And Performance

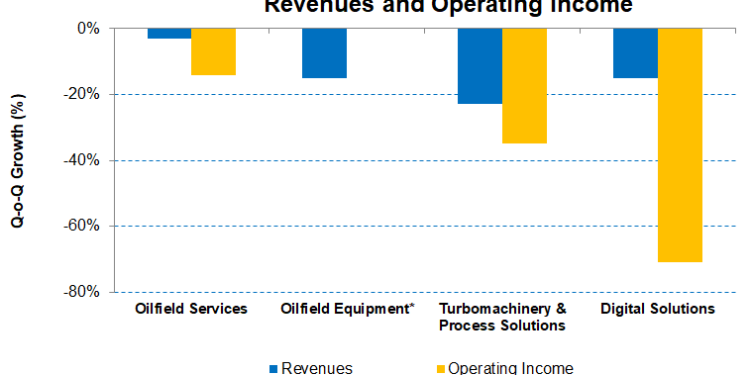

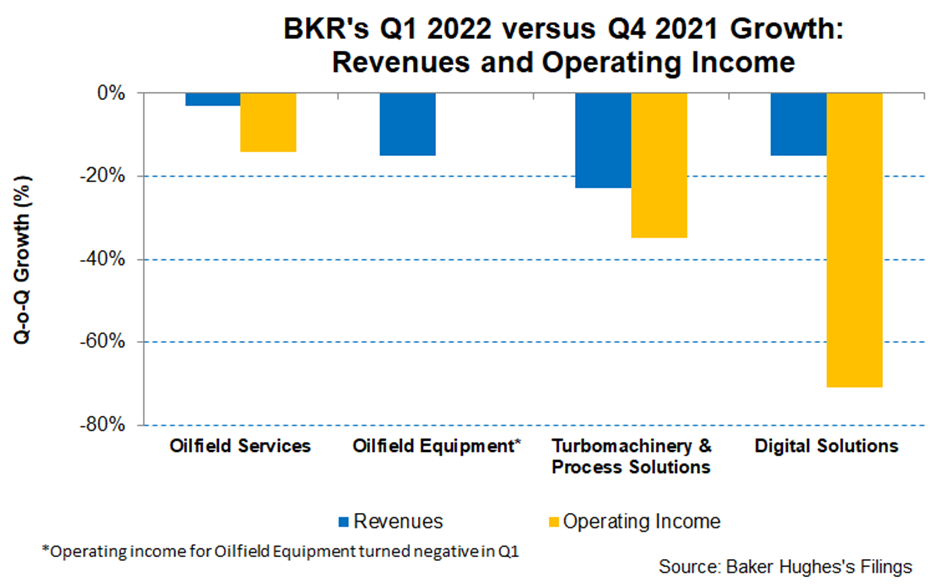

In Q1, revenues in this segment decreased by 3% compared to a quarter ago, while the operating profit registered a 14% fall. Weaknesses in the international regions led to the fall. For the rest of the year, international activities can recover by “low to mid-double digits.” Southeast Asia, Latin America, and the Middle East will lead the market growth in 1H 2022, while the Middle East can become the primary driver in 2H 2022 and 2023. Production in the Middle East is expanding capacity, stimulating a multi-year growth cycle. There are, however, a few stumbling blocks. The supply chain disruption adversely affected its production chemicals business. To counter this, it can change its sourcing structure by opening a production chemicals facility in Singapore and forging joint ventures.

North American activity growth can surpass international growth, registering a growth rate exceeding 40%. The drilling and completion activity can accelerate in 2022. However, the shortages in labor and equipment and E&P capital discipline can curtail the potential growth.

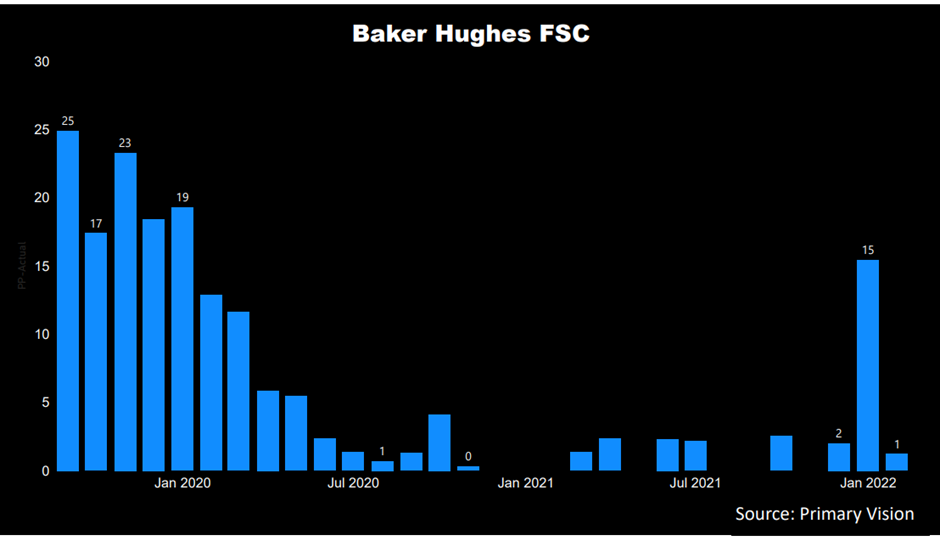

Investors might be interested in knowing the frac spread count changes – a key indicator for the oilfield services companies. According to Primary Vision’s forecast, the frac spread count (or FSC) reached 271 by the third week of April and has gone up by 16% since the start of 2022. Although BKR’s frac spread count did shoot up in January, it decreased and normalized in February. We did not see any active frac spread operated by Baker Hughes in March until the third week of April.

The Oilfield Equipment (or OFE) Growth Drivers

The segment revenue is headed for a revenue ramp-up in Q2, with sales moving up by “mid-single digits,” as expected by BKR’s management. Operating income can increase modestly in Q2 versus Q1. As the year goes by, the management expects to see a recovery in offshore activity, which can convert to rising project awards. Order backlog conversion should also pick up. However, these positive factors will be more than offset by SDS deconsolidation (subsea drilling systems). The loss from the business removal can result in revenues falling by “double digits “, while the margin contract by “low single-digit” range.

The subsea tree market and flexible pipe market, the key offshore energy indicators, are likely to improve in 2022. In Q1, it received an order for 12 subsea trees for a deepwater gas field in Asia. In Latin America, it won awards for flexible pipe systems for a few post-salt revitalization programs used for increased oil recovery. A positive order outlook, particularly in the Middle East, should see the topline improving in the international wellhead business.

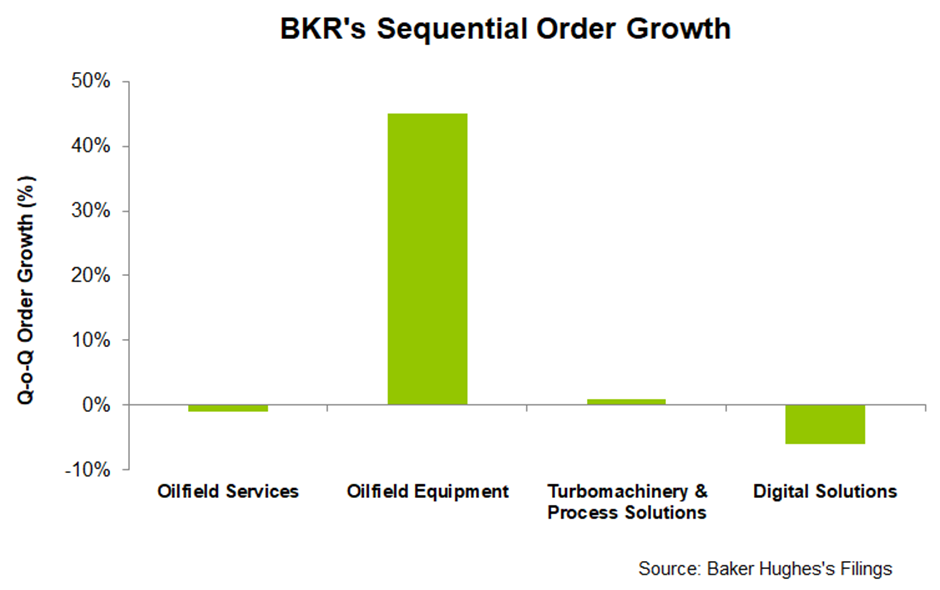

In Q1, the segment revenues decreased by 15%, while the operating income turned to a loss the quarter. However, in Q1, the backlog in the OFE segment increased by 45% compared to Q4 2021 and indicated topline improvement by the later quarters and into 2023.

Analysis: The Turbomachinery & Process Solutions (or TPS) Segment

Here, revenue growth can range from “high single digits” to “low double digits” in FY2022 versus FY2021. Although higher equipment volume from planned backlog conversion is a positive, the segment margin rates may remain unchanged or increase marginally. The management also sees with opportunities in pumps, valves and new energy areas.

In Q1, the segment revenues declined steeply (23% down), while the operating income decreased by 35% during this period. Nonetheless, the outlook suggests an improvement driven by $3 billion of new LNG orders. In the long term, the supportive policy adoption in many parts of the world to adopt natural gas will benefit BKR. In the medium term, the number of projects should accelerate. The management believes that 100 to 150 MTPA of LNG FIDs will be authorized over the years.

The Digital Solutions Segment Outlook

In Q2, the company expects to generate higher revenue based on a sustained positive book-to-bill ratio. Also, the operating income margin may improve by “high single digits” in FY2022. AS energy activities rise, the company expects demand to arise from the industrial end markets. However, the supply chain challenges and an electronic shortage will lead to higher costs.

Revenues in the Digital Solutions segment decreased (15% down) due to the supply chain difficulties growth while operating income fall was even steeper in Q1 to versus Q4 2021. Orders in this segment decreased by 6% sequentially.

Dividend

BKR’s annual dividend is $0.72 per share, amounting to a 2.04% forward dividend yield. Halliburton’s (HAL) forward dividend yield (1.21%) is lower than Baker Hughes’s.

Cash Flows And Debt

BKR’s cash flow from operations was $72 million in Q1 2021, which sharply decreased compared to a year ago (82% up). Although year-over-year revenues remained flat, substantial growth in the working capital requirement following lower collections from international customers and a build-in inventory led to the CFO’s fall. As a result, free cash flow (or FCF) also turned negative in the past year. In Q1 2022, the company expects free cash flow to improve as earnings and collections rise. It also expects free cash flow conversion from adjusted EBITDA to be ~50%.

Although cash flows are negative, the robust balance sheet alleviates investors’ concerns. Baker Hughes’ liquidity (cash plus revolving credit facility) amounted to ~$6.2 billion as of March 31, 2022. Plus, it has a commercial paper program with an authorization for up to $3 billion. Its debt-to-equity (0.41x) is significantly lower than the peers’ average, suggesting the balance sheet strength. During Q1, it purchased shares worth $236 million at $29 each, on average, which was higher than the rate it purchased in the previous quarter. The current stock price is higher (~$33 per share).

Learn about BKR’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.