- Schlumberger plans to improve revenues by “mid-single-digits” and the operating margin by 50 to 100 basis points in Q2 2022

- While private producers’ short-cycle investment in North America will accelerate, eventually, the long-cycle development and exploratory projects will re-emerge.

- Free cash flow turning negative in Q1 can be investors’ short term concern; however, it plans to improve cash flows in the coming quarters in 2022

- SLB hiked the dividend by 40% in early 2022

Industry Drivers And Strategic Priorities

Schlumberger’s management has been discussing the foundation of multi-year upcycles at length for the past couple of quarters. In Q1, it reiterated this along with the critical short and long-term trends. It expects activities in the Middle East and international offshore activities to gear up in the short term. In March, as part of its fit-for-basin technology, it won a major contract award by Saudi Aramco for integrated drilling and well construction services in a gas drilling project. In the short term, commodity prices are likely to stay elevated as the effects of capital discipline and the supply dislocation from Russia put pressure on supply. So, private producers’ short-cycle investment in North America will accelerate.

Eventually, along with the short-cycle onshore shale production, the long-cycle development and exploratory projects will re-emerge. Because operators and large oilfield service companies are beginning to commit to increasing capex, the returns potential for their investment will be critical for determining the long-term oil and gas supply. The other key consideration for SLB is the net pricing gain in North America and different international geographies, which will lead to operating margin expansion.

Among SLB’s strategic journey toward digitization as I discussed in my previous article, it deploys the DELFI cognitive E&P environment on the Norwegian CO2 project to streamline subsurface workflows and longer-term modeling and surveillance of CO2 sequestration. The company’s digital solutions are used for subsurface characterization and dynamic reservoir simulation.

The Near And Medium Term Outlook

So, with continued short cycle activity in North America and a seasonal rebound in most of its international operations, SLB’s revenue growth can reach “mid-single-digits” in Q2 2022. The operating margins can expand by 50 to 100 basis points compared to Q1. In Q1, it recorded an adjusted EBITDA margin of 21% – a decline compared to a quarter before. However, the uncertainty around the ruble depreciation, customer activity decline, and the impact of sanctions can pull the expected growth chart down.

The management is more bullish on its performance in 2H 2022. A combination of positive factors, including a momentum gain in energy operators’ activity level, increased product backlog conversion, and a net pricing gain, can result in revenue growth in the mid-teens in FY2022 compared to FY2021. The adjusted EBITDA margin can also expand by 200 basis points higher than Q4 2021, which would take it to 24.2%. The growth story is based on higher discretionary capex, higher product sales, and operators’ capacity expansion in 2023. Much of the growth will be driven primarily by the Middle East and key offshore basins in the international markets. We may witness secular growth in shallow and deepwater environments as the long-cycle development projects scheduled for 2023 comes into play.

Frac Spread Count

In 2020, as part of a scale-to-fit strategy, Schlumberger had agreed to divest businesses, including the OneStim pressure pumping, pump-down perforating, coiled tubing business, and the Permian frac sand business to Liberty Oilfield Services (LBRT). As of December 31, 2021, it had a 31% equity interest in Liberty. Equity participation in LBRT ensured that SLB reaps the North American unconventional shale and frac spread count recovery. According to Primary Vision’s forecast, SLB’s frac spread count (or FSC) decreased in February and March after it reached a one-year high in January. Compared to the 2H 2021 average, SLB’s average FSC in Q1 is ~15% higher, which augurs well with the industry’s recent focus on hydraulic fracturing.

Industry Indicators Are Strengthening

In the past year until March 2022, the key US unconventional Basins, on average, saw a 1% rise in tight oil production. However, the US rig count recovery (61% up) significantly outperformed the production growth. According to the EIA’s Drilling Productivity Report, the US shale oil production is due for a steeper growth (2.8% rise, on average) by May. According to the EIA’s Short Term Energy Outlook, the Brent crude oil price can decline in Q2 compared to the current level due to the geopolitical tension and rising global oil inventory. It may fall even further (~21% lower) in 2023, although it will depend substantially on the Russia-Ukraine conflict.

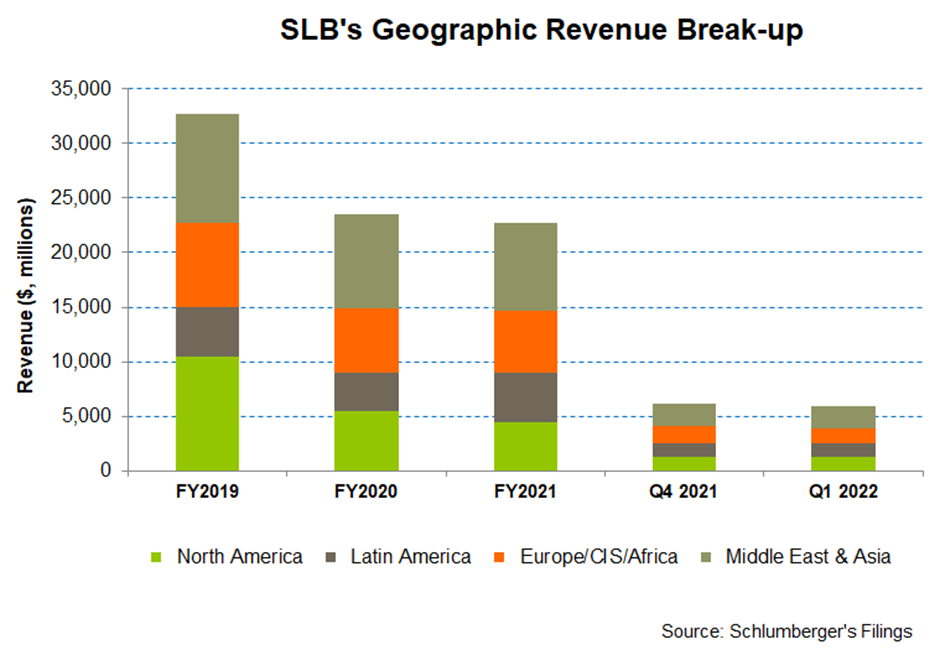

From Q4 to Q1 of 2022, SLB’s revenue share from international operations contracted marginally to 78%. Europe/CIS/Africa saw the steepest decline (12% down sequentially), followed by the Middle East & Asia. The commodity prices hike, operators’ capital discipline and the potential impact of supply dislocation from Russia contributed to the fall in its international topline. North America, during the past quarter, remained unchanged. In North America, short-cycle investments by private operators are beginning to take shape.

The Key Segment Drivers In Q1

In Q1 2022, Schlumberger’s Digital & Integration revenue segment revenues decreased by 4% compared to Q4 2021 because the adverse effects of seasonality affected the digital and exploration data licensing sales. The segment operating income also fell by 13% during this period.

Quarter-over-quarter, SLB’s Reservoir Performance segment revenue declined by 6% in Q1 due to lower Latin America and the Northern hemisphere activity. It also impacted the operating by 20% in this segment. Revenue growth in the Production Systems segment weakened by 5% from Q4 to Q1 as deliveries were delayed and logistic costs increased following the supply chain disruption.

However, the situation looks normalizing, and with the backlog improving, revenues and margin should normalize in the Production segment in the near term. Also, in Well Construction, the operating margin improved while the topline remained resilient due to robust drilling activity in North America, Latin America, and the Middle East.

FCF and Capex In FY2020

SLB’s free cash flow (or FCF) turned negative in Q1 2022 compared to a healthy and positive FCF a year ago. Steeply lower cash flow from operations (or CFO) reduced FCF. Although revenues increased in this period, a higher inventory balance due to the product delivery delay and preparation for project start-ups in Q2 caused the CFO to decline. Capex, too, increased in the past year. SLB will follow a much less capital-intensive strategy, as it has been reiterating for the past few quarters. The management estimates that the working capital and cash flow will improve in the coming quarters in 2022.

The company’s debt-to-equity is 0.90x, higher than peers’ (HAL, BKR, and FTI) average of 0.73x. So, the company must achieve a double-digit free cash flow margin in target FY2022, which will allow it to deleverage the balance sheet.

Dividend And Dividend Yield

Schlumberger hiked its dividend by 40% to $0.70 per share from $0.50 per share, with a 1.20% forward dividend yield. Halliburton (HAL) pays a yearly dividend of $0.48, which amounts to a forward dividend yield of 1.27%.

Learn about SLB’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.