We have talked much about inflation. It is here to stay and interest rates will (are) go (going) up. This is creating serious challenges for emerging markets that are facing a double whammy of rising inflation, tightening monetary policy and a strengthening dollar. But now we are moving to the inflation 2.0 i.e. stagflation, the worst nightmare for economic policymakers.

Stagflationary fears have started to settle in as more than 70 percent of investors are expecting an “economic storm“. There was a very interesting article in New York Times by Paul Krugman that argued that while inflation is a big problem lately it won’t be as bad as 1980s hence, he stressed the definition of stagflation matters. If one means that there will be high inflation, and high unemployment for a few months then the answer to the question: are we headed towards stagflation? is affirmative. However, if someone is expecting 1980s interest rates, unemployment and resulting recession, then the response would be negative.

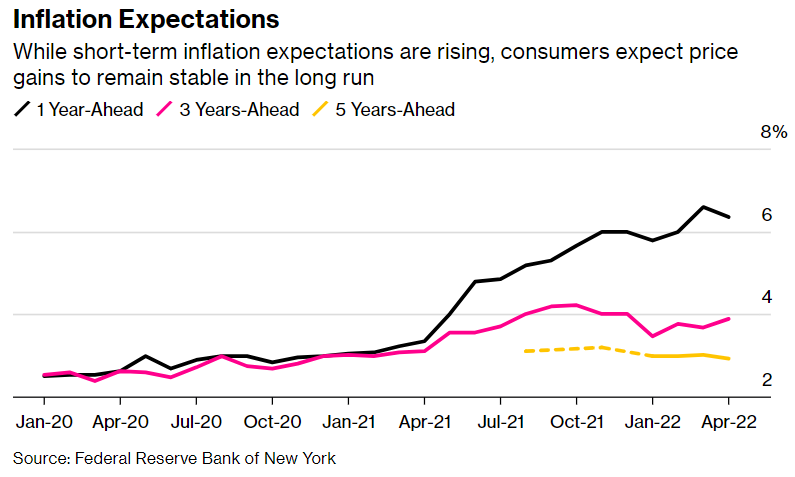

Why? Everything hinges on inflation expectations. In 1979 to 1980, the annual inflation was already at 9 percent when the oil price shock kicked in. That spiked prices even further and while Fed was able to reduce it down by policy tightening, the rates had to go all the way into double digit territory (20 percent) to appease the apprehensions and cool down the economy. That resulted into a prolonged period of higher inflation and unemployment (stagflation). However, this time, Krugman posits, things are different in terms of inflation expectations. A better comparison for contemporay stagflationary fears will be 2008 when the Western Financial Crisis happened. IT had similar ingredients as above but the only difference is that inflation subsided quickly and that might be the case right now.

But this hypothesis rests upon some serious assumptions:

- Inflation expections will be low and that it will come down quickly (which leads us into the debate of sticky vs flexible inflation).

- The oil price hike is over or there can’t be another shock that markets haven’t priced in.

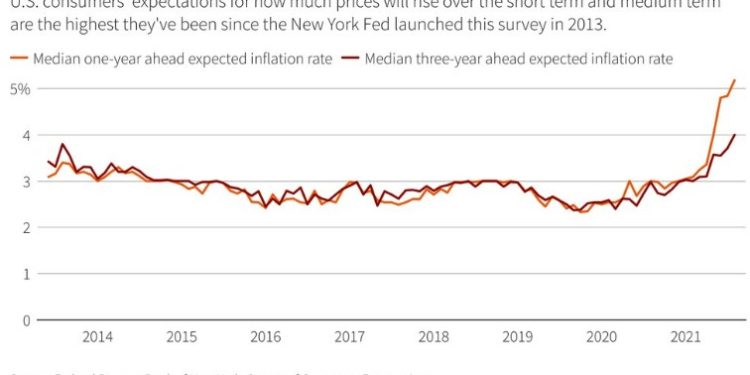

Inflation expectations are indeed under control at the moment. The thing with expectations is that they can swithc suddenly. According to a recently released survey by New York Fed, consumers expect inflation to touch 3 percent in next 5 years. However, the short term expectations remain highly bullish. If this continues to be the same way, then Krugman would stand true, and stagflationary fears might be overblown.

However, the above factor can register a drastic change in case there is another oil price shock which can come in the form of a complete ban on Russian oil, which will take global crude oil prices past $150 (and I personally think beyonf $170) easily. The likelihood of such an event looks very plausible as EU mulls this decision in all seriousness. With a rising demand, and growing fear of under-supply of oil (about 3 million barrels per day can be offline the market if this ban happens) panic can set in and we might face one of the largest oil price shock in history.

This can shift the whole global economic sentiment and a 1980 redux will be really possible.

As I recently told in a lecture, the future of developing countries in particular and the global economy in general is closely tied with European politics and Putin’s intrigues. We need to keep a very keen eye on the possibility of a Russian oil ban and its interaction with rising demand and falling supply.