- An excess supply of equipment, the supply chain disruption, and the inflationary pressures on labor and material will remain KLX Energy Services’ headwinds

- The financial risks remain high due to negative shareholders’ equity and negative cash flows

- An improvement in pricing and utilization will lead to KLXE’s topline and operating margin improvement in Q2 and 2022

- The company’s drilling, completion, production, and intervention activities are robust in various geographies

Healthy Industry Activity Pulls The Q2 Drivers

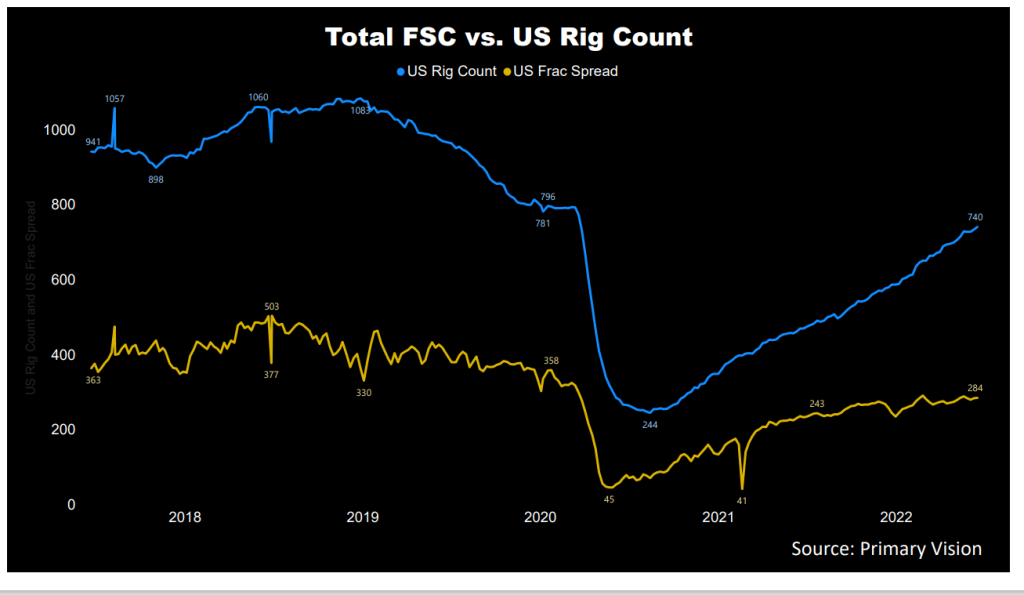

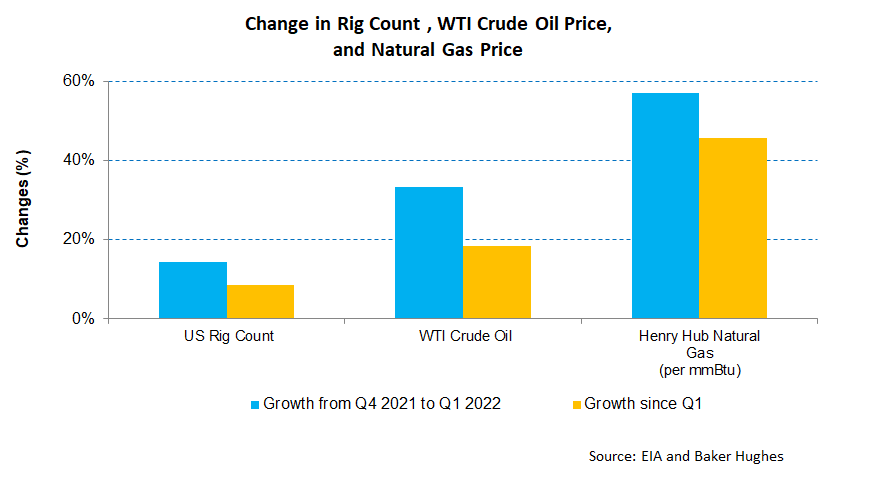

As the US drilling and completions markets recovered, the demand for equipment and services soared. KLXE’s management is optimistic about a pricing recovery in late 2022 and 2023. The technologically advanced assets will likely drive the pricing due to their efficiency advantage. The US rig count has increased by 26% in 2022, continuing with the momentum gathered in Q4 2021. The crude oil price curve has steeped, rising by 51% in 2022. As estimated by Primary Vision, the frac spread count has marginally lagged the rig count’s growth.

The reopening of world economies has shifted the energy market sentiment that went bearish in the past two years. However, the oilfield services companies did not benefit much because of the fragmented nature of the industry. Plus, excess equipment availability kept pricing low.

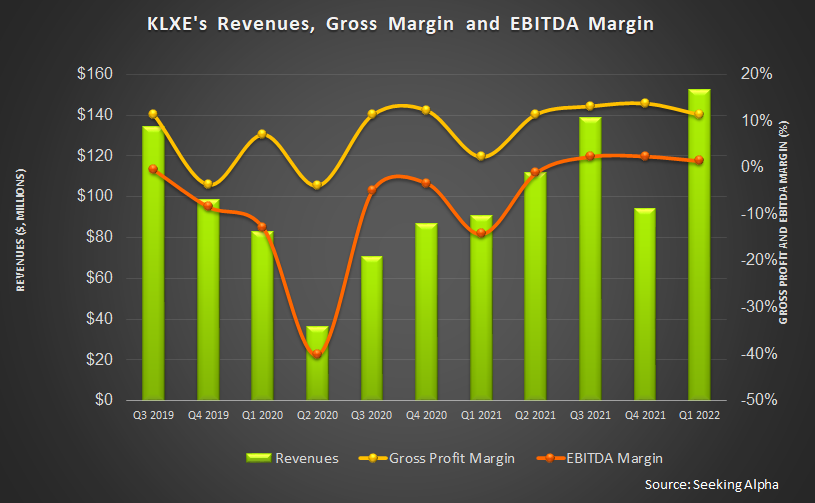

Although the first couple of months in 2022 remained subdued for KLXE, it exited the quarter generating $58 million in revenue in March, or ~40% of the Q1 revenues. The March EBITDA, when annualized, would be $46.5 million, which is 137% higher than the Q1 EBITDA. Given the current run rate, the company is positioned to outperform in Q2.

The Q2 Outlook

The pace of pricing improvements in its service portfolio is accelerating as it exited Q1 and into early Q2. Various of its service portfolios experienced high-single to low double-digit sequential percentage increases. The coiled tubing pricing, for example, was up 12% in Q1. Utilization for the coiled tubing was 30%. Directional drilling was 32%, while utilization was 23% in the wireline fleet. Although utilization has been relatively low, it leaves additional asset capacity to deploy into the market when the activity increases. Investors may note that the company’s services include directional drilling, coiled tubing, thru-tubing, hydraulic frac rentals, wireline, fluid pumping, flowback, pressure pumping, and well control services.

With the tailwind of improved pricing and excess capacity in service lines where the demand-supply is getting tighter, KLXE’s management expects Q2 revenues to increase by 16% to 20% compared to Q1. It also expects the adjusted EBITDA margin to inflate to 7%-9% compared to 3% in Q1. So, in Q2, a robust pricing growth and continued improvement in utilization can compress whitespace and drive revenue and adjusted EBITDA margin expansion.

The Q1 2022 Drivers And Segment Performance

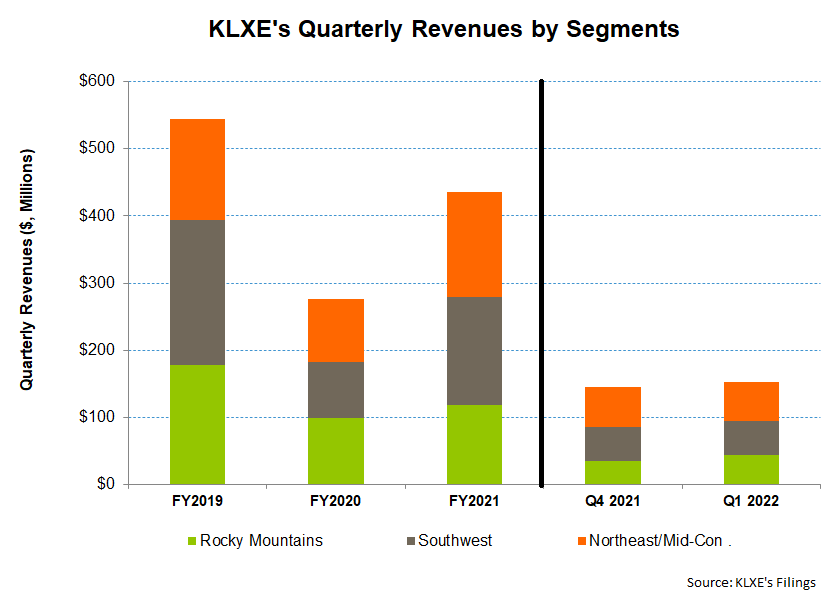

During Q1, the company’s revenues increased by 5% compared to Q4 2021, following the increase in drilling, completion, production, and intervention activities in various geographies. However, its EBITDA margin shrank during Q1. The adverse effects of seasonality and COVID-19 reduced demand. Plus, higher costs associated with the supply chain disruption and the inflationary pressures impacted labor and raw materials and reduced the margin.

Revenues in KLXE’s The Rocky segment increased 23% in Q1 compared to a quarter ago, driven by an increase in coiled tubing, fishing, rentals, wireline, and dissolvable plugs in the DJ and Central Rockies. The adjusted operating loss in this segment also lessened in Q1 due primarily to better pricing and utilization.

Revenues in the Southwest segment increased by 3% in Q1 compared to a quarter ago, driven by directional drilling, frac rentals, and fishing increases. The quarter-over-quarter adjusted operating loss also lessened in Q1.

Revenues in the Northeast and the Mid-Con decreased by 4% in Q1 compared to a quarter ago, following lower directional drilling and dissolvable frac sales. The underperformance in the financial result is also reflected in the margin deterioration in Q1 versus the previous quarter. However, the management expects the segment margin to rebound in Q2, given a substantial backlog.

Cash Flow Is Negative, And Risks Exist

As of April 30, 2022, KLXE’s liquidity (cash and including revolving credit facility) was $57.7 million. The company’s total debt was relatively high ($275 million) as of that date. Its shareholders’ equity has been negative for many quarters due to a huge accumulated deficit in the balance sheet. A negative shareholders’ equity is a source of risk and is viewed adversely by the investors.

KLXE’s cash flow from operations (or CFO) remained negative in Q1 2022 but is still an improvement compared to a year ago. Revenues increased in the past year, partially offsetting some of the effects of the significant working capital requirements on the CFO. As a result, free cash flow also turned negative. In FY2022, the management expects capex to more than double compared to FY2021. Most of the capex would be spent on maintenance work.

Learn about KLXE’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.