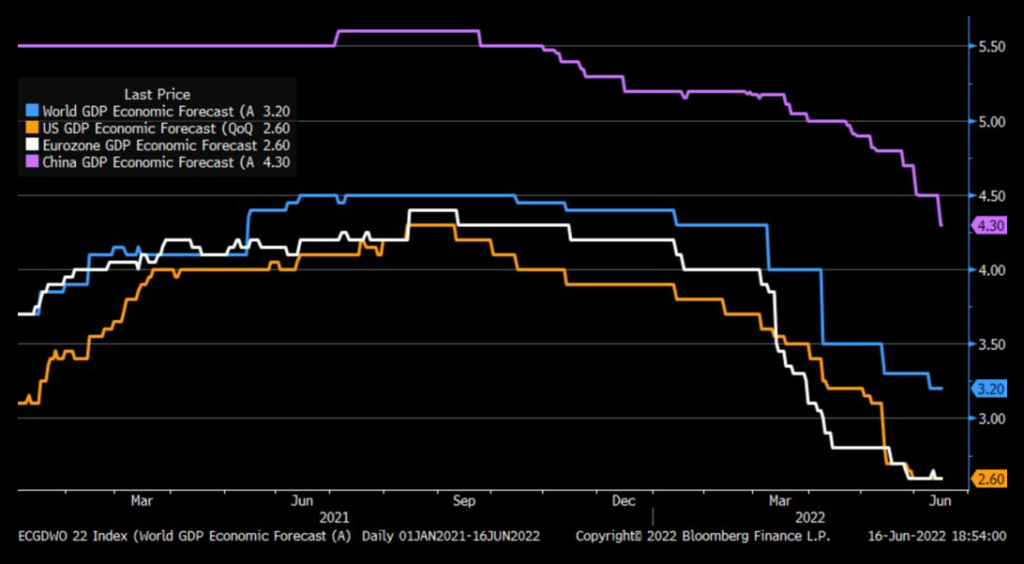

Starting off with the global GDP estimates, we know that the World Bank recently reduced down their projection for world GDP growth. Recently, there has been more downgrades as the image below shows. Mark in this segment here rightly says that there is still a lot of more room to go down.

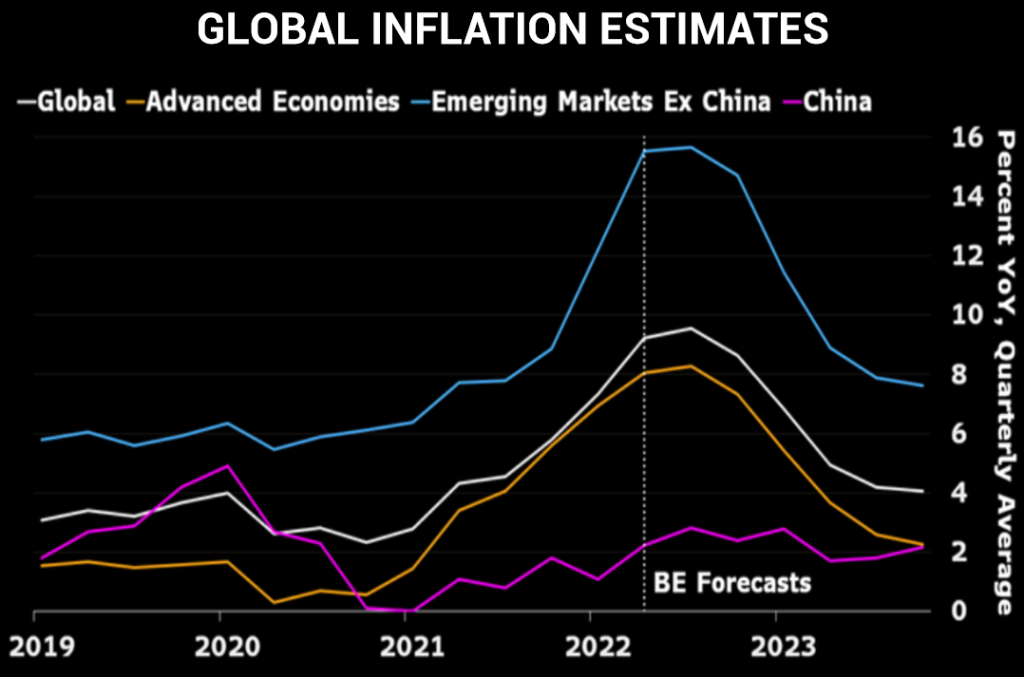

Global inflation continues to be a problem. The peak has now continued to go back and now they think that it will peak in August to which Mark also agrees. But will it mean that all be hunky dory moving forwards? It will slow but it will not stop going up. There will be no prominent downward move but instead we will be facing Stagflation. Compared to the peak levels, yes, it might look low. But only in charts, not in real life.

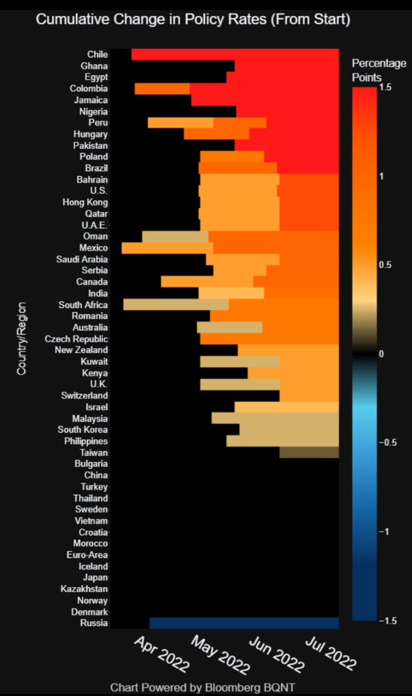

Global central banks has been raising interest rates from the past 6 months. The image below shows, that emerging markets are on the forefront of this net tightening cycle as they want to get ahead of inflation. The story with the developed world is also the same and I have written much on this in the past few days.

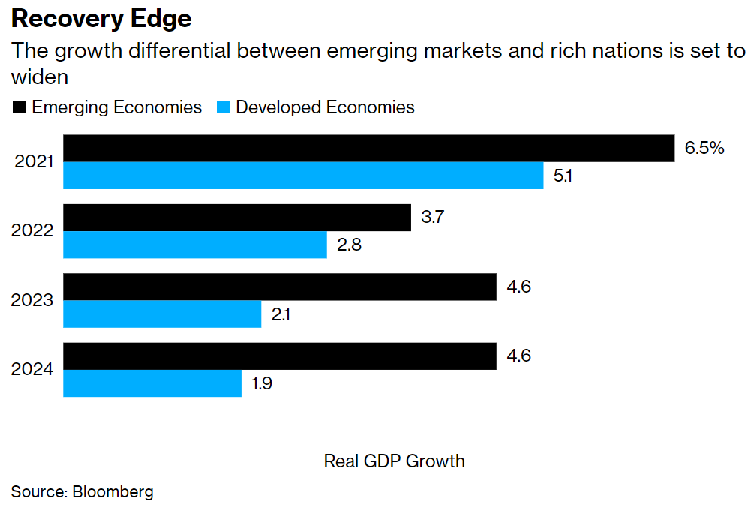

Global consumer confidence is also shaking up. IT is below where it was for COVID. Once gain, I’d like to focus on difference between emerging markets and developed countries. The chart below might show EMs doing better in terms of real growth but the point to note here is that there is a lag effect. As developed countries slow down (which are markets for many of these EMs), the slowdown will be contagious.

EM are also expected to face more downgrades, something, once again we at PVN, have been saying from many months.

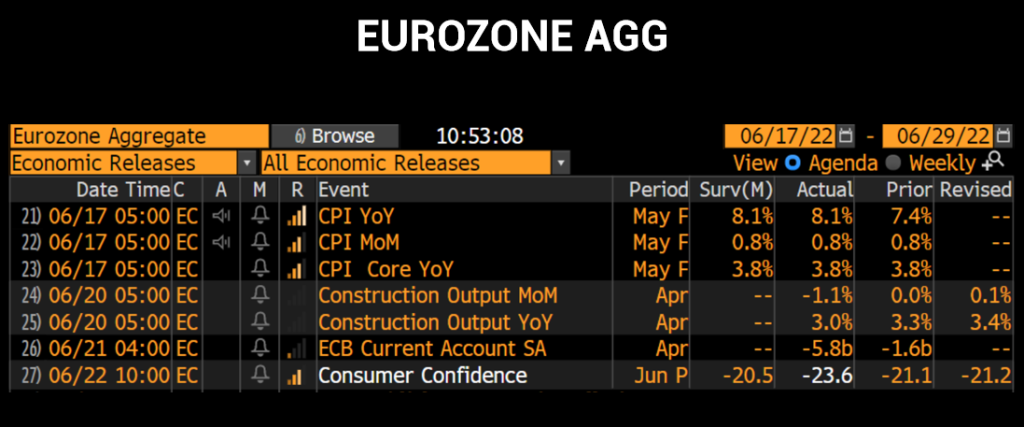

Now we will shift to what’s happening in Europe. We did a show titled ECG Fragmentation but one might ask what exactly is this fragmentation? Within the Eurozone many countries share the Euro but they have their own debt. Mark gives us the example of U.S. Each state has municipal debt but that is different from Federal borrowing which includes U.S. treasuries, bonds etcetera. But in the case of Europe, we look at them seperately. This is what is creating “fragmentation” as the yields are shifting between the countries such as Italy and Germany but the resulting spreads are what the ECB is trying to control. Bank of England has been raising rates while the ECB has gone wihtout an increase from 132 months. This creates all sorts of issues such as real wages.

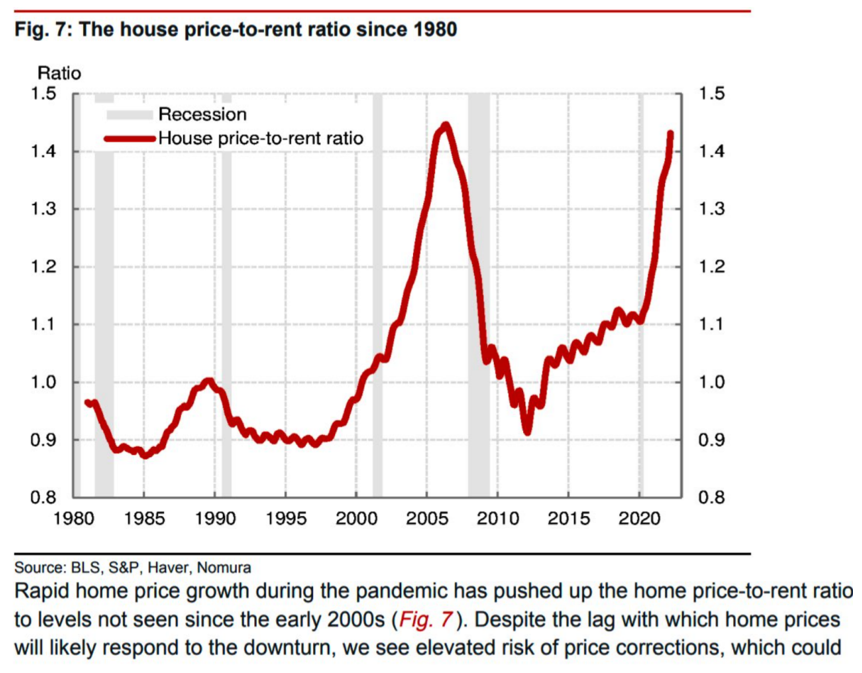

Lastly, a brief look at the housing market. Existing homes sales are coming down. The house price to rent ratio has hit its highest point since 1980 as shown by the chart below putting further pressure on the consumers. Housing contributes around 45 percent to the overall CPI figures becoming a major part of inflationary pressures. New home prices have come down as there is a huge backlog waiting to be cleared. There has been a big drop in investment in housing. Key point: housing represents 15 to 18 percent of GDP. Mark’s segment here is worth watching: https://www.youtube.com/watch?v=JuC_SpQnCs0

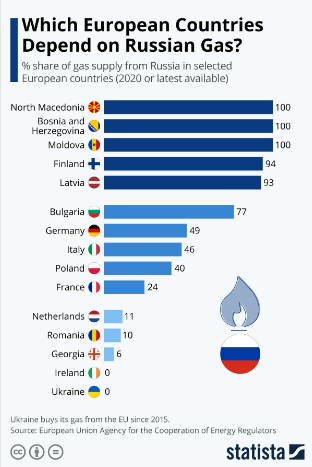

Another important news is that of the gas rationing by Germany as the country moves to the second stage of its emergency plan in case of a disruption to gas supplies. IEA has warned that this might be the case as we move into winters.

More on gas rationing during next week!