- Nine Energy Service’s top line is likely to increase in the near-term following prices hikes across the service line due to higher demand and low supply

- The strategy to focus on dissolvable plugs will pay off as the industry growth is expected to be sharper by 2023

- However, increased activity level can push costs further, leading to pressure on the operating margin in the near term

- Negative cash flows and weakening shareholders’ equity can test its balance sheet strength

The Q2 Outlook

A strong inflection in drilling activity from Q4 2021 through Q2 will likely prompt NINE Energy’s service line to grow. The completion activity will also likely increase throughout 2022, thus leading to substantial price increases in coiled tubing and wireline. While the short-term looks quite encouraging for the oilfield services companies to improve their fundamentals, the way ahead is not free of challenges. For instance, higher pricing for the oilfield services can occur as a headwind for operators to add incremental rigs. Plus, growing production will put more pressure on labor demand. This, coupled with the supply chain disruption, would lead to wage and material inflation. The company will resort to pricing increases in its service lines to mitigate this.

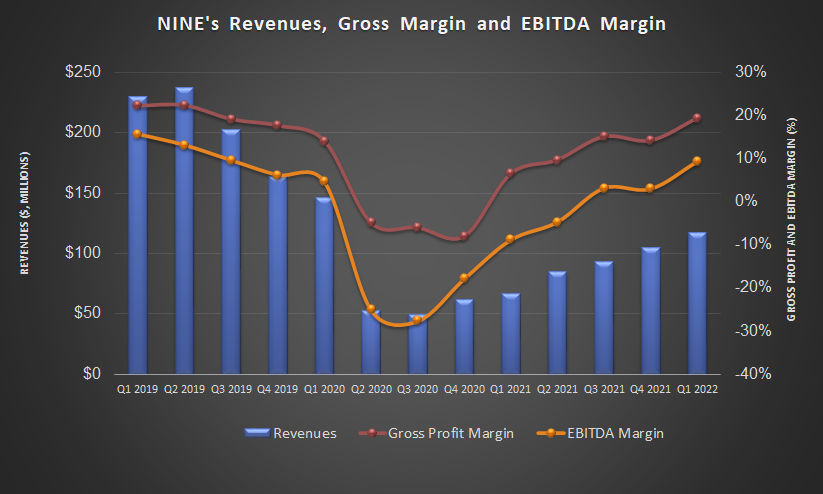

In Q2, the company’s revenues can vary between $130 million and $140 million, which means it will grow by 15% (at the guidance mid-point) compared to Q1. The adjusted EBITDA can also increase in Q2. But, the EBITDA margin growth will be lower due to the wage and material cost hikes. Over the medium term, the company expects to capture more market share, leading to more than doubling the adjusted EBITDA.

The Dissolvable Plugs Strategies

The business of the completions tools has been a critical marker for NINE’s recent performance. Although the US completion well counts increased by only 20% year-over-year in May 2022, the company’s completion tools sales increased ~44% during this period. The dissolvable plugs are likely to take a larger share of the overall plugs market in the US and internationally, particularly in the well downhole activity. Investors should note that the dissolvable plugs are environmentally friendly and reduce emissions compared to the traditional drill-out services.

Investors may note that the company manufactures fully composite, dissolvable, and extended-range frac plugs to isolate stages during plug-and-perf operations. The company’s advantage in selling these tools is they can be ramped up with low capital investment and labor requirements. While the dissolvable plug market growth picked up in 2021 compared to 2018, the growth rate will be much sharper by 2023. Energy drillers’ ESG initiatives will encourage the adoption of dissolvable as operators look for cost-effective ways and reduce emissions.

A Region-wise Activity Analysis

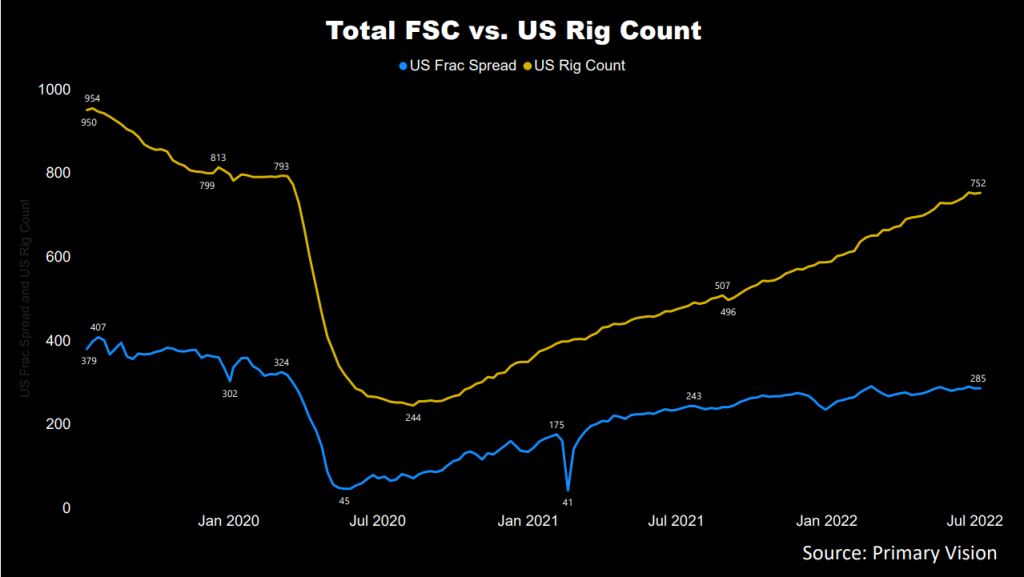

NINE’s management currently focuses more on the natural gas activities in Haynesville and Northeast. In 2022, the drilled wells in Haynesville increased by 45%, while the completed increased moderately. Drilled well count in the Permian was lower (21% up) than in Haynesville. The active frac spread count went up ~24% in 2022, according to Primary Vision’s estimates. The company’s management believes that the natural gas price’s sturdiness will positively impact the supportive activity in Haynesville in 2022. The frac spread count has increased by 6% since March-end, according to Primary Vision’s estimates.

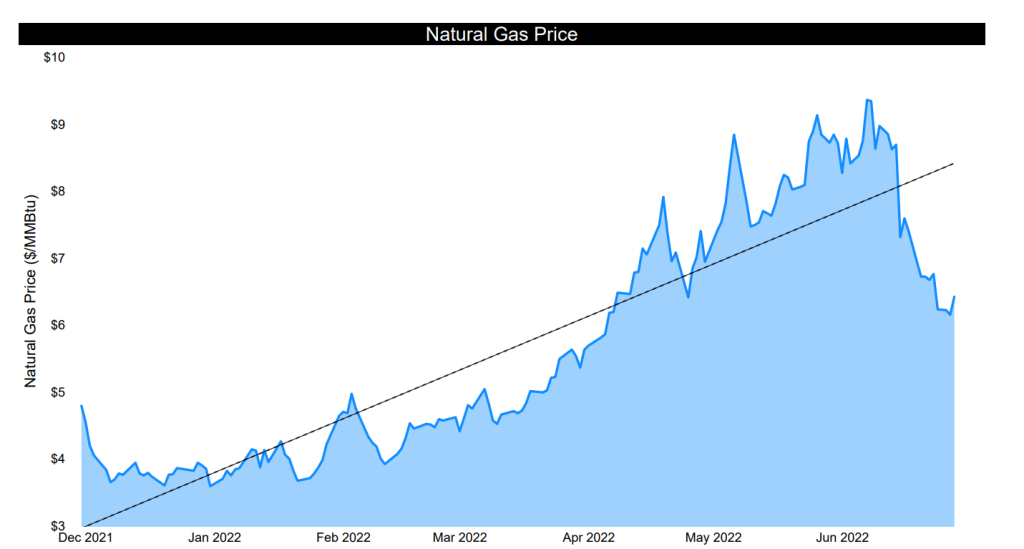

Tracking Natural Gas Price

The primary reasons the natural ga price increased substantially in 2022 are below-average natural gas inventories, steady demand for US LNG exports, and high demand for natural gas from the electric power sector. The EIA expects natural gas prices to average $8.69/MMBtu in Q2 2022, a 7% rise from the May level. While the average price can remain steady for the rest of 2022, it can dip steeply (by 42%) in 2023. However, the Russia-Ukraine conflict and its outcome can throw such estimates out, and natural gas prices can remain firm for longer.

What Were The Q1 Drivers?

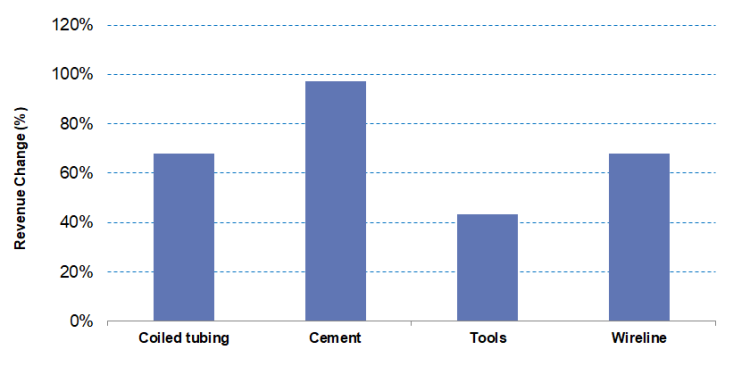

In Q1 2022, the company’s total revenues increased by 11% compared to Q4 2021. Revenues in cementing went up by 31% quarter over quarter in Q1. A higher rig count in 2022 allowed NINE to double net pricing in the service line. Its market share growth in Haynesville was especially noteworthy as it captured 33% of the market in the past two years, estimates the company. Over the past year, the company’s revenues from cementing activity increased the most (up by 97%), followed by coiled tubing and wireline (up by 68%, each).

In Coiled tubing, revenues increased by 11% in Q1 due to price traction, but cost inflation can challenge the margin growth. The revenue growth in the Wireline business was moderate (7% up quarter-over-quarter) in Q3. The company’s outlook on Wireline is the most conservative because it has been challenging to implement price hikes in this business due to the extensive competition in the market. Still, benign growth following improvement in industry activity can be expected in the near term.

Cash Flows And Liquidity

As of March 31, 2022, NINE had $74.6 million in liquidity. For the past few quarters, its shareholders’ equity has turned negative owing to significant net losses over the past two years. As a result, debt-to-equity is negative and, therefore, not meaningful. A negative shareholders’ equity and a significant debt level can put it at financial risk or limit growth prospects.

In Q1 2022, NINE’s cash flow from operations (or CFO) was negative, but not a steep decline compared to the negative CFO a year ago. FY2022’s capex can range between $20 million and $30 million. Although it offset its capex with asset sales in Q1, a higher capex can strain the balance sheet over the rest of the year.

Learn about NINE’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.