- The upstream and oilfield services markets are reasonably strong, but the economy is “increasingly uncertain,” observes Baker Hughes

- The natural gas and LNG prices will likely remain elevated

- Higher offshore and LNG projects in the international markets will primarily drive BKR in 2023

- A falling cash flow and a marginal deterioration in leverage could bring discomfort to the management

Explaining Market Outlook

BKR’s management acknowledges the current turmoil in the economy following the high inflation rate and has termed it “increasingly uncertain.” Despite the uncertainty, the energy market is likely to hold ground. The management expects supply constraints and production discipline to offset any demand weakness. The upstream sector is expected to achieve more durable upstream spending, the current volatility in the crude oil price notwithstanding.

In contrast to their crude oil counterpart, natural gas and LNG prices will likely remain elevated following a stressed-out global supply, particularly following the Russia-Ukraine conflict. The market can get even tighter in 2023. BKR also believes the natural gas market would need significant investment in the medium-to-long term. While the current elevated pricing environment is conducive to new projects, it also adversely affects demand. Established players with brownfield LNG projects and faster-to-market modular lines can beat the competition. So, BKR is at an advantage because of its capabilities in this operation.

A Comparison: North America vs. International

BKR banks on the growth projection in its international operations in the medium term. Its global business should benefit from net pricing increases and moderating supply chain pressures. Latin America, West Africa, and the Middle East will lead the offshore activity recovery while the drilling services and completions business follow suit. Brazil, Mexico, and Guyana will lead the party in Latin America. Saudi Arabia and UAE in the Middle East will exhibit growth in 2023. Overall, its revenues from international operations may see “double-digit” growth in 2023.

The environment in North America is more nuanced. The US market is dependent largely on oil prices. We will likely see increased activity from the private operators in Q4, although the momentum may subside in 2023. The company expects drilling and completion capex can increase by “mid to high double digits” in 2023.

Resegmentation and Acquisition

BKR will simplify and streamline its organizational structure by consolidating its reportable segment into OFSE and IET. The process may result in at least $150 million of cost savings and a 25% reduction in the executive management team. These changes are expected to increase shareholder value and improve growth opportunities, focusing on early-stage new energy investments and tuck-in M&A. However, the cost reduction projects and the global footprint optimization resulted in $235 million of related charges, which affected the company’s net income in Q3.

Earlier in 2022, the company acquired Mosaic, NET Power, and HIF Global. In Q3, it announced several strategic investments, including the Power Generation division of BRUSH Group, Quest Integrity, and Access ESP. The investments helped it diversify into electrification, inspection capabilities, and ESP technology.

The Natural Gas Market

The natural gas export price increased by 77% in the past year until Jul 2022. The LNG export price mirrored the gas export price during the same period. The EIA expects natural gas production to increase by 4% in Q3 2022 compared to Q1 2022 and even more in Q4. The natural gas spot prices can average $7.40/MMBtu in Q4 2022 and decline below $6.00/MMBtu in 2023. Despite the near-term pricing volatility arising from the Ukraine-Russia conflict, natural gas prices will soften due to higher US natural gas production in the medium term.

Oilfield Services: Outlook And Performance

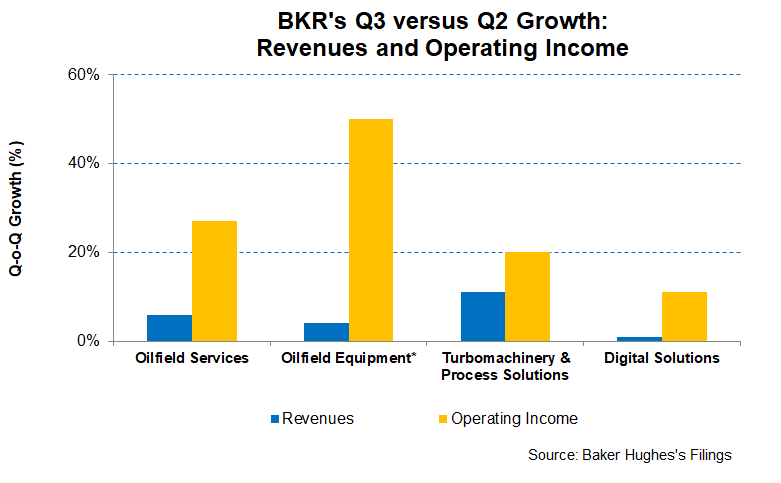

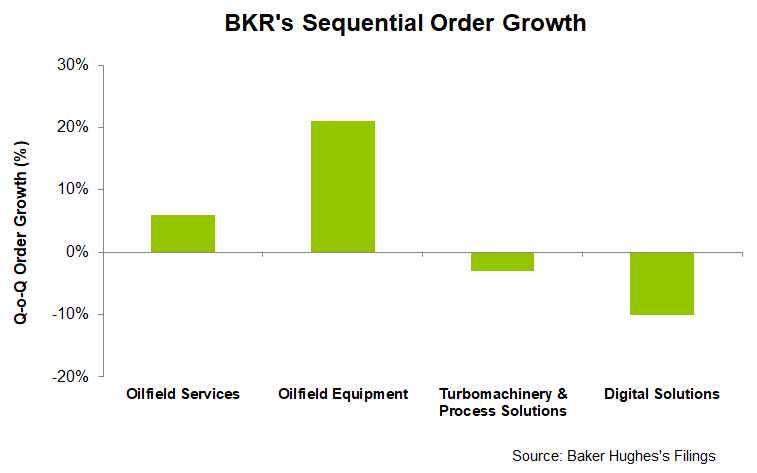

In Q3, revenues in this segment increased by 6% compared to a quarter ago, while the operating profit registered a 27% rise. The primary driver in this segment has been the chemicals business which witnessed a sequential margin rate for the past two quarters. The management expects margin growth to continue before it normalizes in 2023. So, BKR’s OFS segment sees EBITDA grow by 20%, while revenues can see a “solid sequential increase” in Q4.

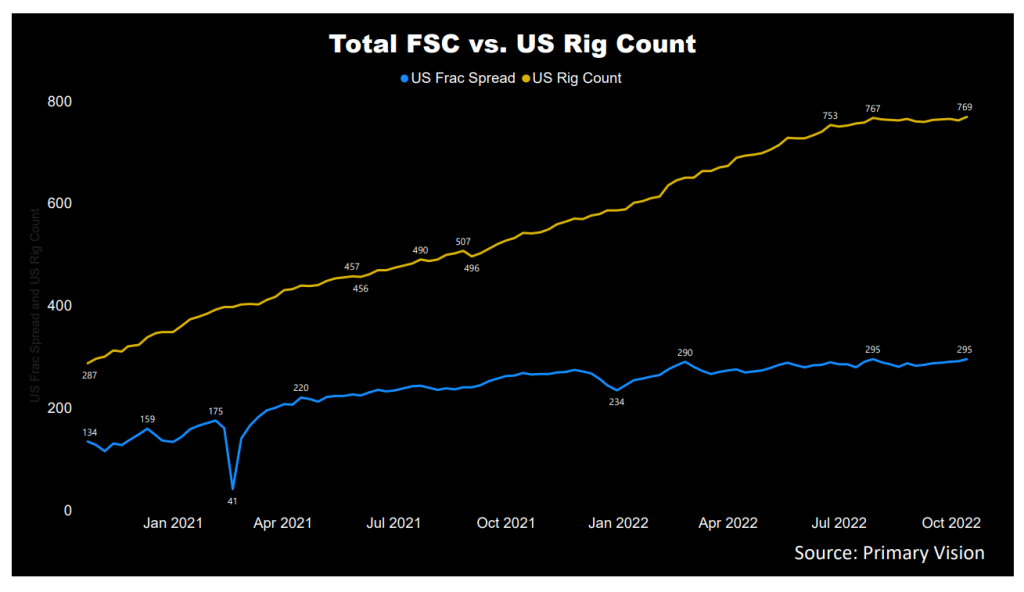

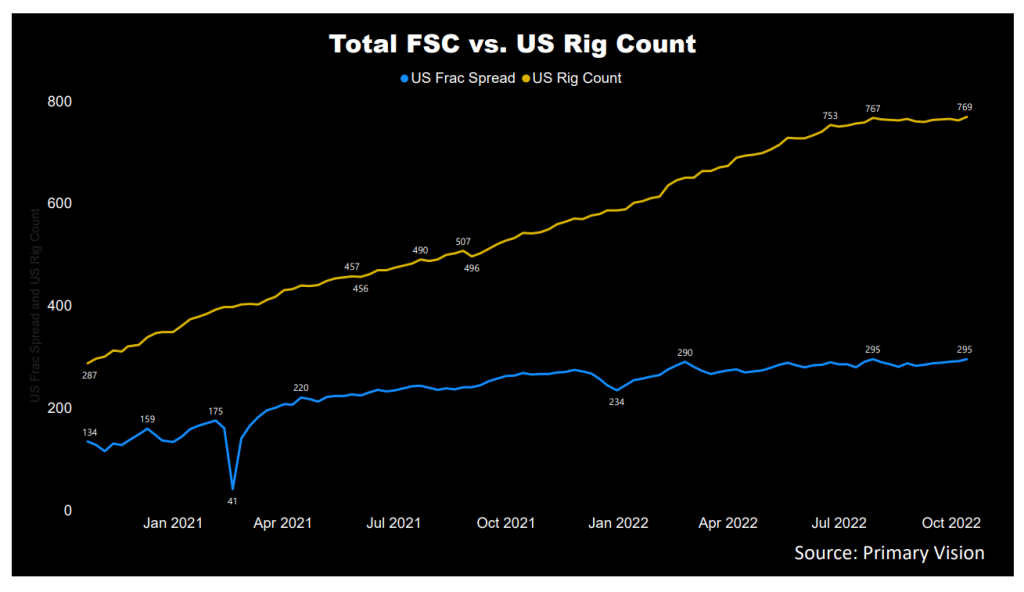

In this context, investors might be interested in knowing the frac spread count changes – a key indicator for oilfield services companies. According to Primary Vision’s forecast, the frac spread count (or FSC) reached 295 by the second week of October and has increased by 24% since the start of 2022. The rising count is a positive for BKR’s 2022 outlook.

The Oilfield Equipment Growth Drivers

In Q3, the segment revenues increased slightly (by 4%), although the operating income zoomed (50% up) during the quarter. The Flexibles business recorded year-to-date orders of over $1 billion in this segment. So, the company is reassessing the subsea equipment business. To improve margin, it has initiated the realignment program, which would yield $60 million in cost savings from integrating multiple functions and capabilities. It also plans to remove supply chain deficiencies and leverage the shared engineering resources.

Following continued offshore recovery and backlog conversion, the company expects “mid to high single-digit growth” in revenue while expecting operating income in FY2022 may reach the breakeven point.

Analysis: The Turbomachinery & Process Solutions (or TPS) Segment

Sequentially, in Q3, the segment revenues increased by 11%, while the operating income went up by 20%. As we discussed in our previous article, the segment suffers from various pressures, including the continued market pressure on TPS services. However, multiple LNG projects and FIDs in 2022 and 2023 should drive revenues. Year-to-date, it reached 31 MTPA. It continues to expect to reach 100 MTPA to 150 MTPA in 2023.

Backed by higher equipment volume from planned backlog conversion, revenue can increase by “double digits,” year-over-year, in Q4. However, an adverse equipment mix can lower operating profit in the next quarter.

The Digital Solutions Segment Outlook

The segment will continue to face challenges from chips and electrical components shortages. In Q3, it rationalized the supply chain structure with a combination of the DS portfolio with TPS to create industrial and energy technology. Removing the functional layers and the integration process would lead to initial cost savings of at least $50 million by the end of 2023.

Revenues in the Digital Solutions segment remained nearly unchanged in Q3 while operating income went up by 11% from Q2 to Q3. Orders in this segment decreased by 10% sequentially. In 2023, the company expects a ” mid-single digits” sequential revenue growth. A recovery from chip shortages ease and a robust energy market would be partially offset by declines in the industrial businesses due to the global economic weakness.

Dividend

BKR’s annual dividend is $0.72 per share, amounting to a 2.98% forward dividend yield. Halliburton’s (HAL) forward dividend yield (1.58%) is lower than Baker Hughes’s.

Cash Flows And Debt

BKR’s cash flow from operations was $990 million in 9M 2022, a sharp deterioration compared to a year ago (38% down). Although year-over-year revenues remained flat, adverse changes in working capital led to the drop in CFO. As a result, free cash flow (or FCF) dropped even more sharply (61% down) in the past year. In Q4, the company expects FCF to improve, which should also improve the free cash flow conversion from adjusted EBITDA.

Baker Hughes’ debt-to-equity (0.46x) is significantly lower than the peers’ average, although the leverage deteriorated marginally compared to a quarter ago. During Q3, it repurchased shares worth $265 million at $24.8 each, on average, continuing with its previously announced program. The current stock price is higher (~$26 per share), suggesting the management has concerns over the current stock price level.

Learn about BKR’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.