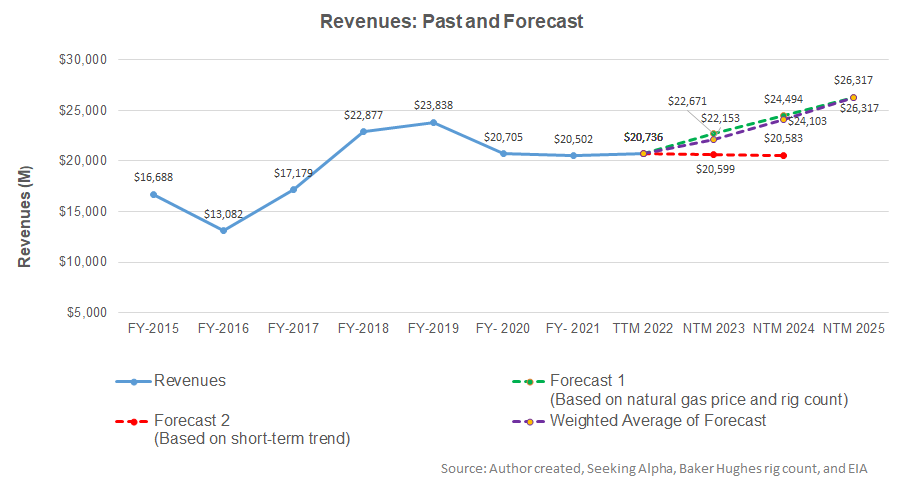

- Our regression model suggests a steadily increasing revenue trend in the next three years.

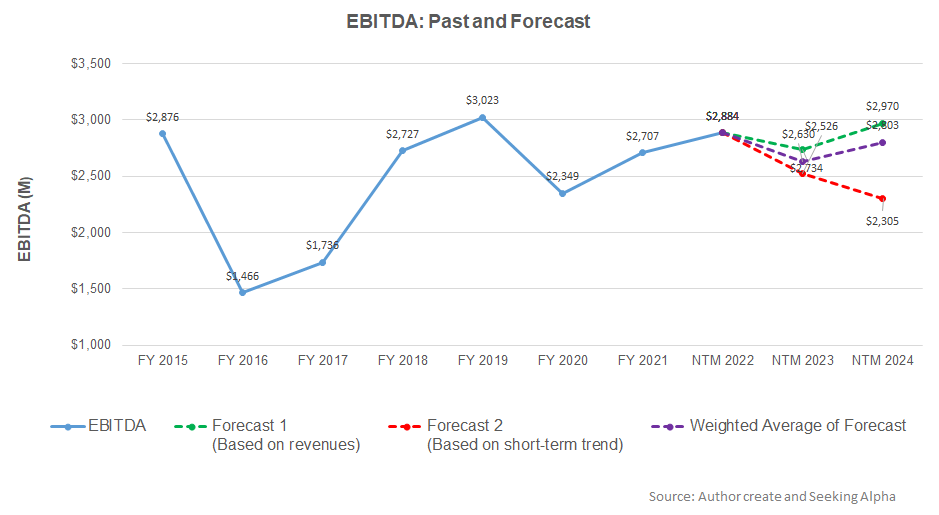

- EBITDA can decline in NTM 2023 but can improve in NTM 2024.

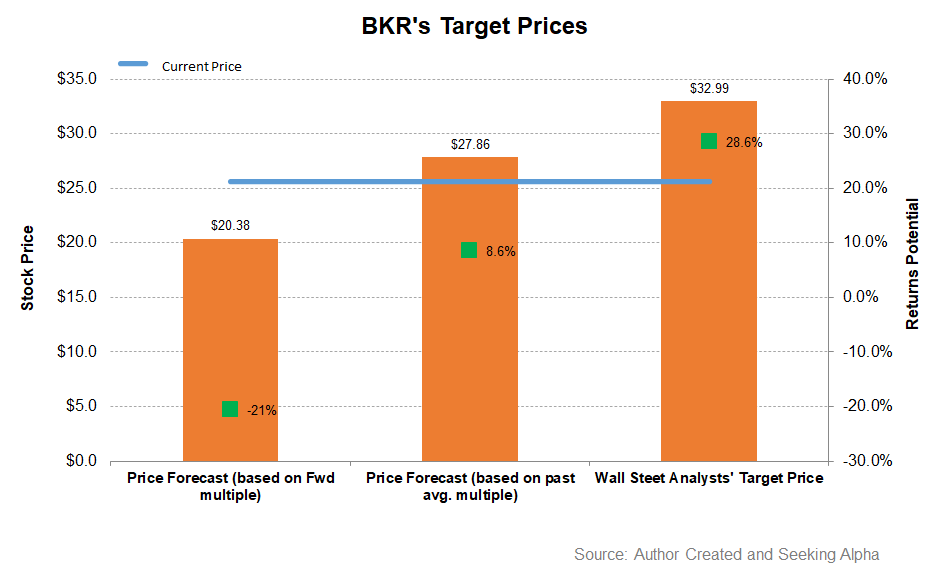

- The stock is reasonably valued at the current level.

Part 1 of this article discussed Baker Hughes’s (BKR) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Based on a regression equation among the natural gas price, global rig count, and BKR’s reported revenues for the past seven years and the previous eight-quarters, revenues will increase by 7% in the next 12 months (or NTM 2023) and further by 8.8% in NTM 2024, before reaching a 9% growth rate in NTM 2025.

Based on the regression model using the average forecast revenues, the company’s EBITDA is expected to decrease by 9% in NTM 2023. However, in NTM 2024, it can increase by 7%.

Target Price And Relative Valuation

Returns potential using BKR’s forward EV/EBITDA multiple (9.3x) is lower (21% downside) compared to returns potential using the past average multiple (9% upside). The Wall Street analysts have higher return expectations (29% upside).

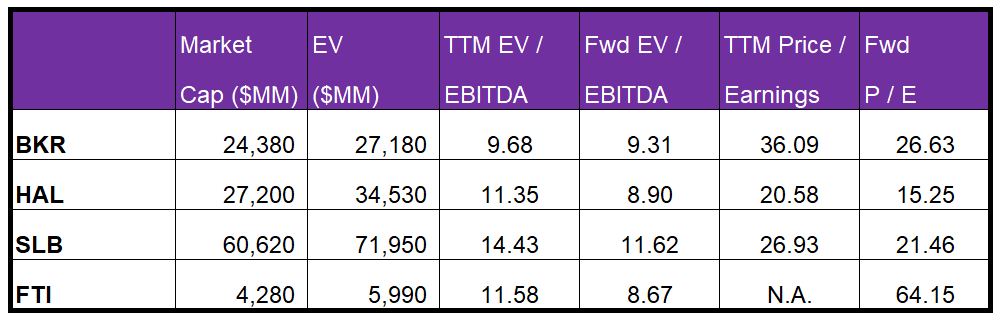

Baker Hughes is currently trading at an EV-to-adjusted EBITDA multiple of 9.7x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 9.3x. The current multiple is lower than the past five-year average EV/EBITDA multiple of 11.8x.

BKR’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is less steep than peers because the company’s EBITDA is expected to increase less sharply in the next four quarters. This would typically result in a lower EV/EBITDA multiple than peers. The stock’s EV/EBITDA multiple is lower than its peers’ (HAL, SLB, and FTI) average. So, the stock is reasonably valued versus its peers.

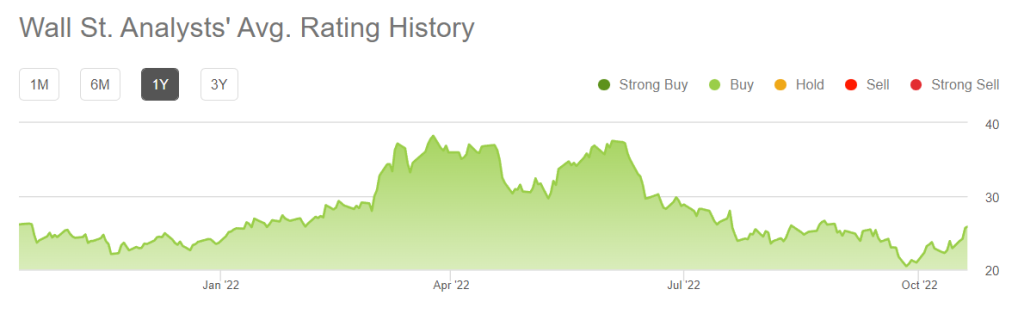

Analyst Rating

According to data provided by Seeking Alpha, 22 sell-side analysts rated BKR a “Buy” or “Strong Buy” in the past 90 days, while five of them rated it a “Hold.” None of the sell-side analysts rated a “Sell.” The consensus target price is $33, which yields 29% returns at the current price.

What’s The Take On BKR?

A rise in significant LNG projects and international drilling and completion capex will drive BKR in 2023. Latin America, West Africa, and the Middle East will lead the offshore activity recovery. Its global business should benefit from net pricing increases and moderating supply chain pressures. It will consolidate two reportable segments to reduce costs and simplify operations, resulting in at least $150 million in cost savings. Also, the sharp rise in order backlog in the Oilfield Equipment segment can stimulate revenue growth in 2023.

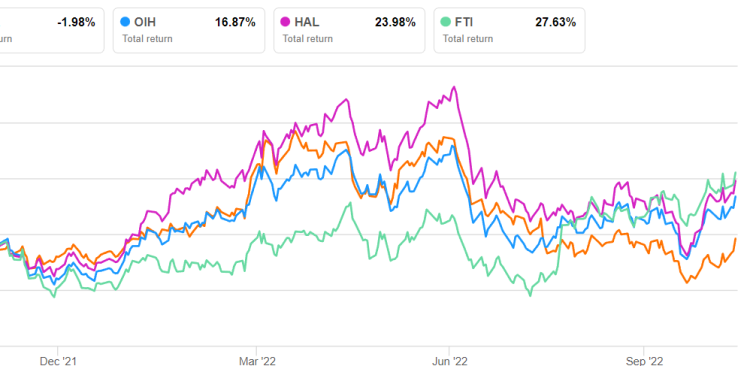

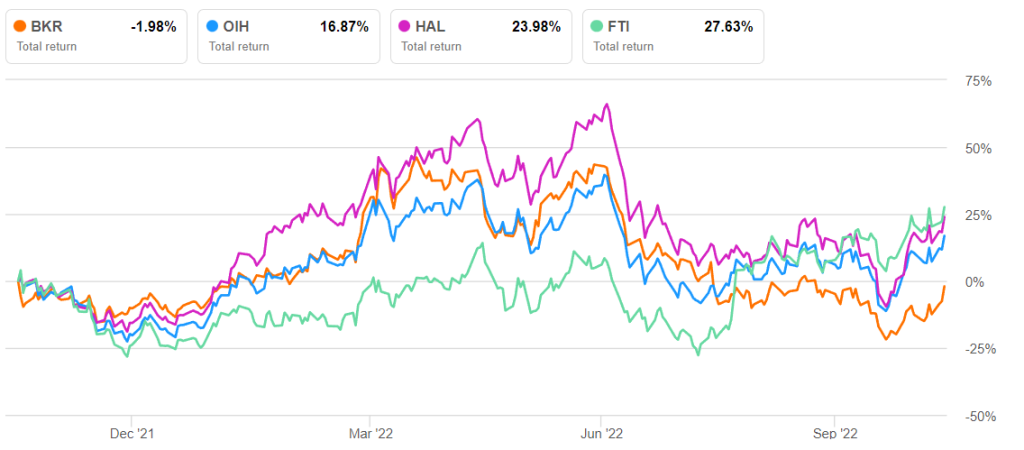

However, natural gas prices can soften in the medium term due to higher US natural gas production in the medium term. The current turmoil in the economy following the high inflation rate and the far-reaching effect of the Ukraine-Russia conflict can spin the world economy into a recession. So, the stock underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. Nonetheless, natural gas’s role as the medium to long-term driver has continued to be the mainstay of Baker Hughes’s attraction as a preferred investment avenue. It has low leverage and can withstand the pressure of cash flows. The stock is reasonably valued versus its peers. We consider the stock apt for a “hold” for steady returns in the long term.