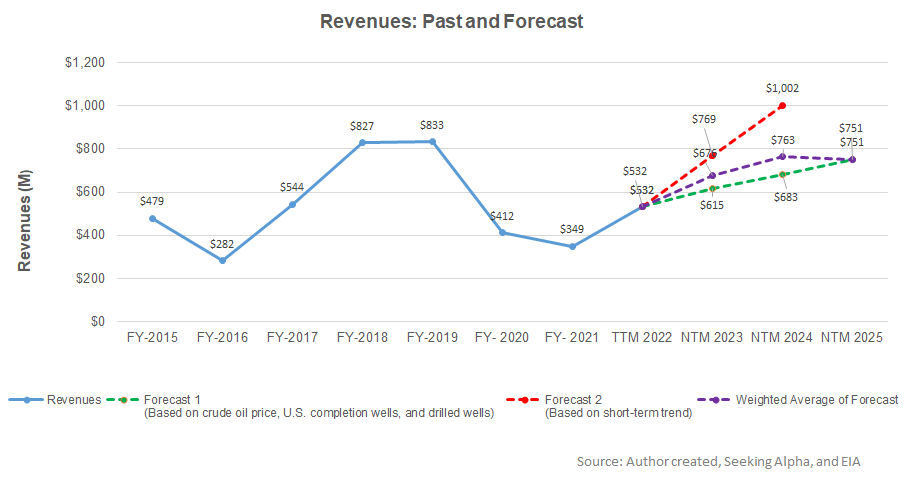

- Regression estimates suggest 27% revenue growth in NTM 2023, but the rate can decelerate considerably over the next couple of years.

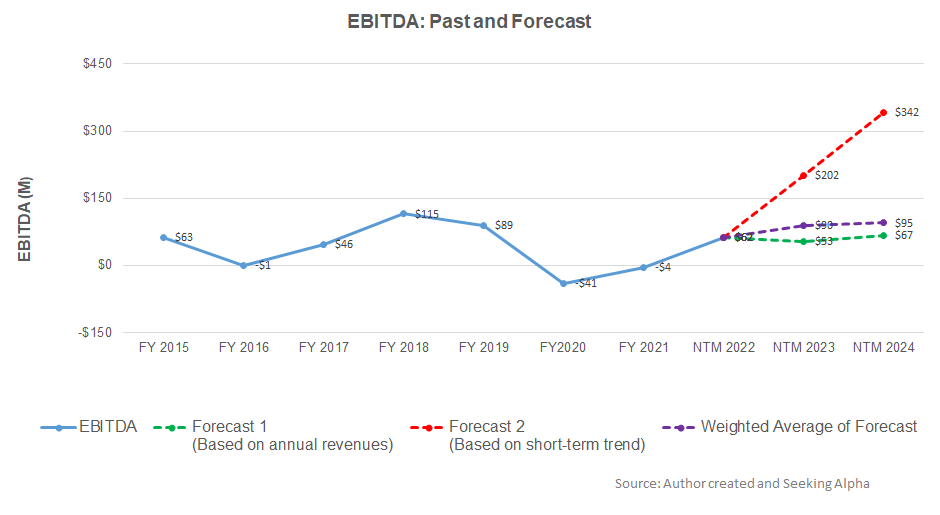

- The EBITDA growth rate is 27% in NTM 2023 but may fall in NTM 2024.

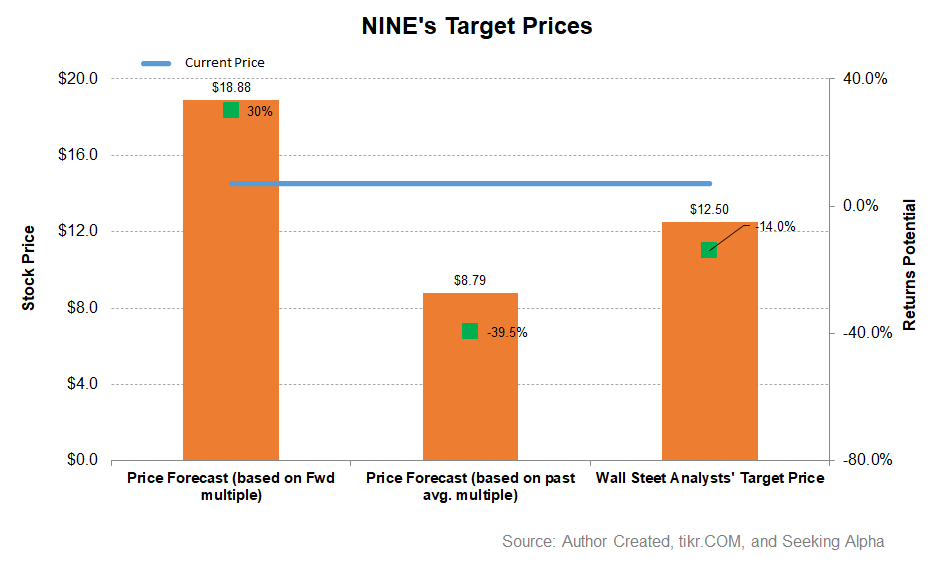

- The relative valuation suggests the stock is reasonably valued; the model also suggests a positive upside bias at this level.

Part 1 of this article discussed the Nine Energy Service’s (NINE) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Based on a regression equation between the crude oil price, US completion and drilled wells, and NINE’s reported revenues for the past seven years and the previous eight quarters, we expect revenues to increase by 27% in the next twelve months (or NTM) 2023. The growth rate can decelerate to 13% (sequentially) in NTM 2024. The model indicates revenues can decline in NTM 2025.

Based on the regression model, I expect its EBITDA to improve by 27% in NTM 2023. The model suggests that EBITDA growth will decelerate to 13% in NTM 2024.

Target Price And Relative Valuation

EV has been calculated using NINE’s EV/Revenue multiple. The returns potential using the forward EV/Revenue multiple (1.34x) is higher (30% upside) than sell-side analysts’ expected returns (14% downside) and the past average EV/Revenue multiple (39% downside) from the stock.

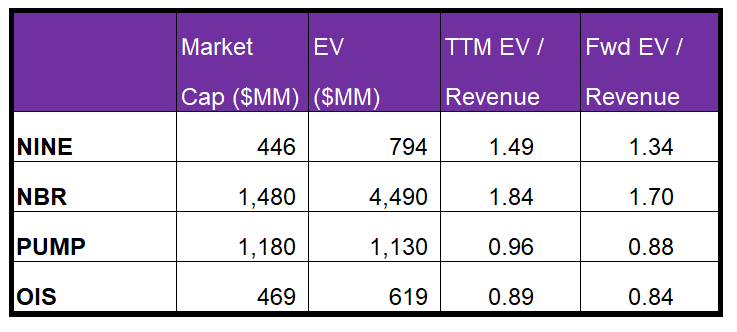

NINE’s forward EV/Revenue multiple contraction versus the current EV/Revenue is steeper than its peers, typically resulting in a higher EV/Revenue multiple than its peers. The company’s EV/Revenue multiple (1.49x) is higher than its peers’ (NBR, PUMP, and OIS) average (1.2x). So, the stock is reasonably valued compared to its peers at this level.

What’s The Take On NINE?

As the crude oil price retains its upward momentum, the fracking equipment market will likely benefit. In this environment, NINE will primarily strengthen its completion tools and cement business offerings, although it will continue to widen its revenue base. Pricing in the cementing and coiled tubing business will increase, which should boost its operating margin. Investors should also note that the company has a significant market share in the dissolvable plugs market. Although the business faced tremendous competition from various players, NINE plans to tap into a growing international market. As a result of these positive developments, the stock price outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

The supply chain disruption will continue to lead to wage and material inflation and may mitigate growth in the cementing business. Plus, the typical seasonality can lower revenue growth in Q4. However, a better margin will boost its cash flow generation over the medium term. Investors should also stay cautious of the negative shareholders’ equity as it may refinance its capital structure in 2023. Nonetheless, given the stock’s at-par relative valuation, investors can hold on to it for a medium-term return.