- Continued industry activity and net pricing improvement will likely carry the topline and margin momentum for KLXE.

- Cost controls and strict capital discipline can help generate positive free cash flow in 2H 2022 and into FY2023.

- Credit maturity extension removed fixed charge coverage ratio holdback and a 50-basis point margin increase in Q3.

- KLXE’s financial risks remain high due to negative shareholders’ equity.

The Strategic Adjustments

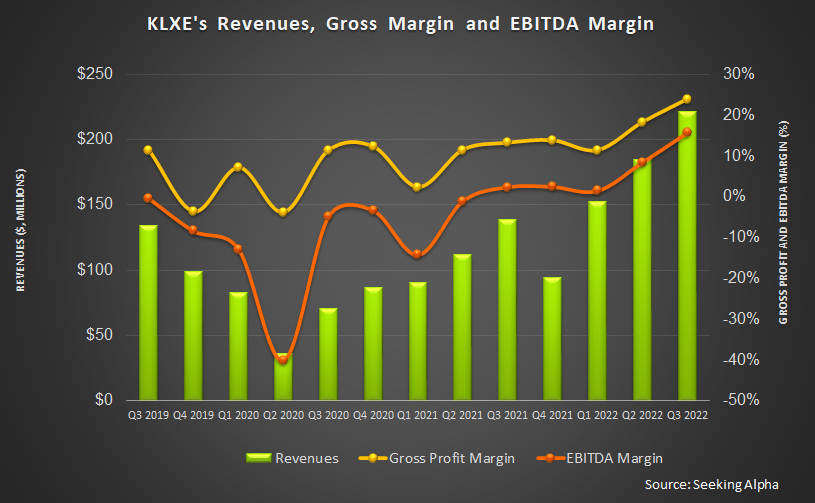

As discussed in our previous iteration, the oilfield equipment, and services demand has stayed elevated in the US because of underinvestment and tight supply. The current backdrop will improve utilization and net pricing, leading to margin expansion for KLXE in 2023. It experienced activity and pricing gains in some of its smaller markets and natural gas-oriented plays. Pricing rose ~ 5% to 10% in most of its product service lines (drilling, completion, production, and intervention) sequentially in Q3. We expect margin improvement across its portfolio in 2023. Pricing and higher utilization led to a 730 basis-point adjusted EBITDA margin gain in Q3 versus the previous quarter. The company has also devised a strategy to cross-sell through diversification.

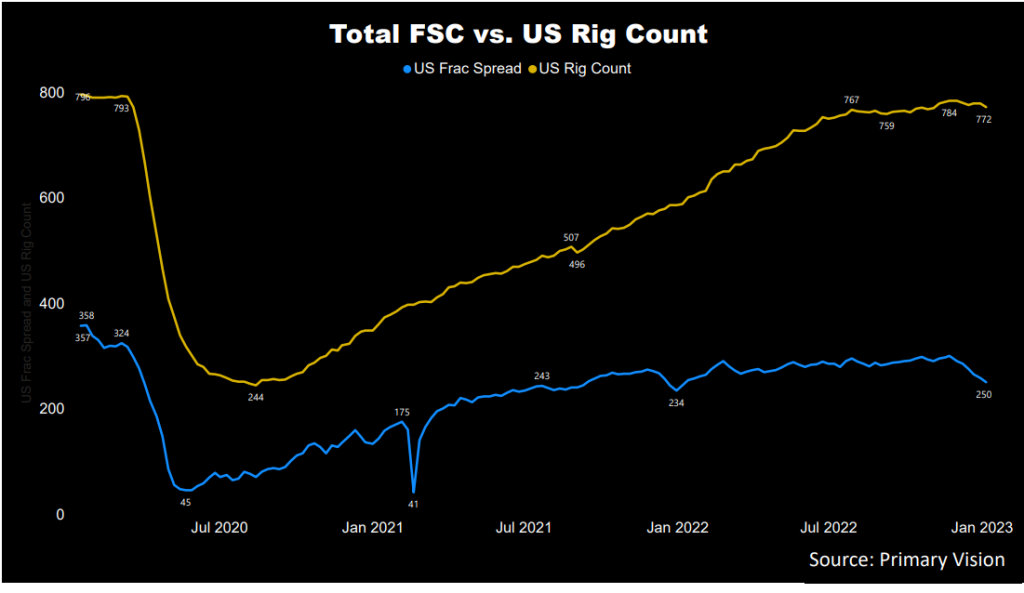

The other prospect that KLXE plans to explore is the strategic M&A opportunities as the payback period shortens. The seen sell-side M&A picked up in the past few months. Some of KLXE’s pure-play frac competitors have begun to add complementary service lines and diversify platforms. This follows the rise in industry activity. The US rig count has increased by 33% in 2022, while the crude oil price, despite the decline in Q4, is still above where it started the year. As estimated by Primary Vision, the frac spread count has significantly lagged behind the rig count’s growth (up 7% in 2022).

The Q4 And FY2023 Outlook

Based on robust industry activity and net pricing improvement and with an expectation of further gains, KLXE will likely carry the momentum in the top line and margin in Q4 and 2023. In Q4, the management expects the adjusted EBITDA margin to range between 15% and 17%, which would align with the Q3 margin. However, the typical seasonal weather and a natural shift in activity can mitigate the topline growth in Q4.

It will exercise cost controls and strict capital discipline by selectively allocating assets and resources to regions in the near-to-medium-term. In FY2023, it expects to record $785 million in revenues (at the guidance mid-point), which would be 65% higher than FY2021. It may also generate positive free cash flow in 2H 2022 and FY 2023.

The Q3 Drivers And Segment Performance

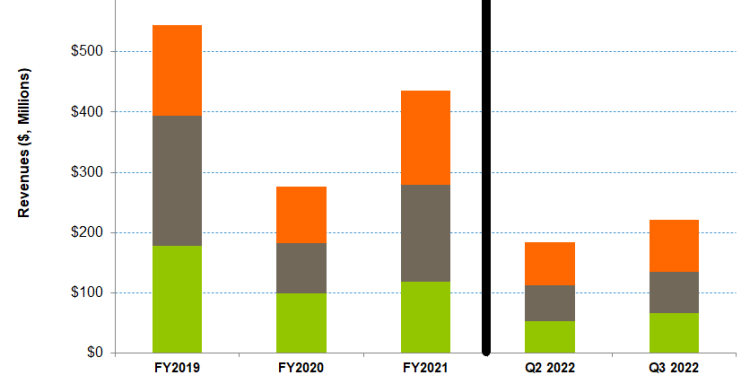

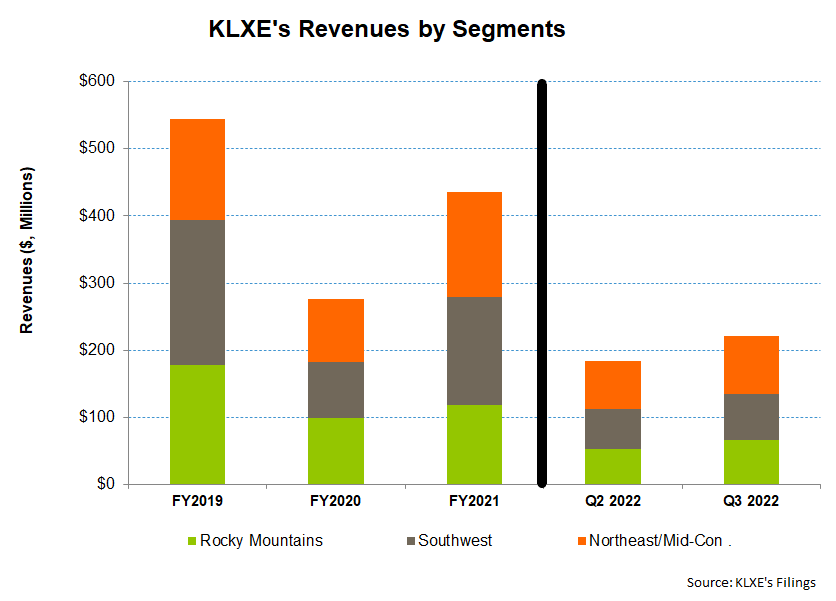

During Q3, the company’s revenues increased by 20% compared to Q2, as the core geographic market grew. Its gross and EBITDA margin expanded by 570 and 730 basis points, respectively. Plus, white space is reduced, leading to higher utilization and revenue growth.

Revenues in KLXE’s The Rocky segment increased 25% in Q3 compared to a quarter ago, driven by an increase in activity and pricing in the DJ Basin, Wyoming, and Bakken. Increased revenues led to a higher 193% adjusted operating income in Q3.

Revenues in the Southwest segment increased by 14% in Q3 compared to a quarter ago, driven by similar pricing and improved coiled tubing, wireline, and rental activity. The adjusted operating income also increased by 160% in Q3.

As pricing and activity across the service line improved, revenues in the Northeast and the Mid-Con increased by 21% in Q3 compared to a quarter ago. The outperformance in the financial result reflected 136% operating income growth in Q3 versus the previous quarter.

Cash Flows And Shareholder Equity Are Negative

As of September 30, 2022, KLXE’s available liquidity (cash and including revolving credit facility) was $86.4 million. The company’s total debt was relatively high ($296 million) as of that date. In September, it extended the ABL facility debt maturity to September 2024, which resulted in the removal of the fixed charge coverage ratio holdback and a 50-basis point margin increase. Its shareholders’ equity has been negative for many quarters due to a vast accumulated deficit in the balance sheet. A negative shareholders’ equity is a source of risk and is viewed adversely by investors.

KLXE’s cash flow from operations (or CFO) turned mildly positive in 9M 2022 compared to a negative CFO a year ago. Although free cash flow stayed negative, the magnitude lessened. Revenues increased in the past year, partially offsetting some of the effects of the significant working capital requirements on the CFO. In FY2022, the management expects capex to increase by 171% compared to FY2021.

Learn about KLXE’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.