The Forever Land of the Future is Burning — Brazil Crisis Is Only Starting

And It’s Not Just the Rainforest

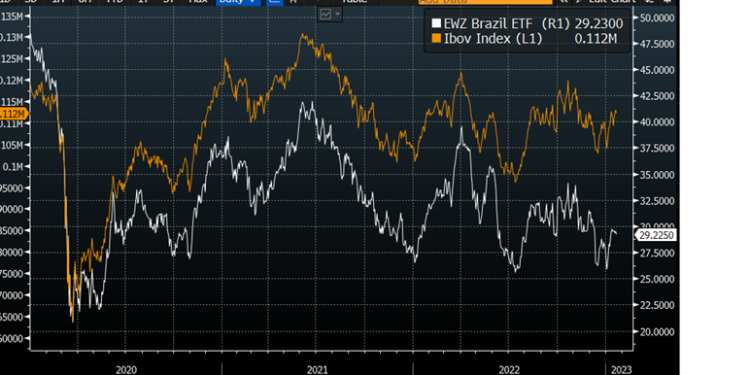

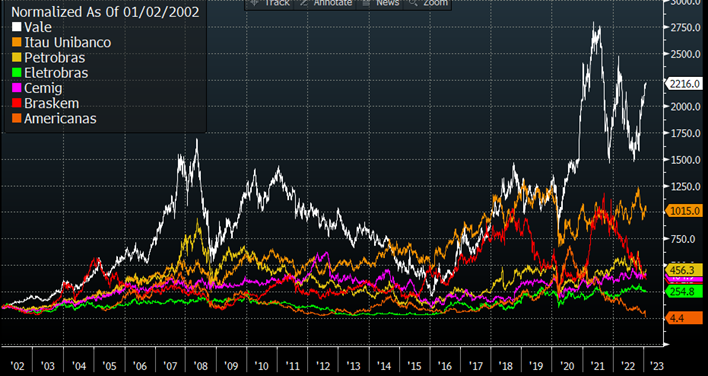

The markets’ love for Brazil cycles almost as often as the World Cup comes around and, much like the national team’s Qatari adventure, this is not going so well. Brazil is primed to be one of the main beneficiaries of the commodity super-cycle. And while we agree that we are short on molecules from food to energy, that benefit may not necessarily fall to the most obvious producers, like Brazil. There are several reasons for that, but they mostly boil down to one thing – Brazil’s government and institutions.

This is an unpartisan criticism of the Brazilian government, both left and right wing presidents have created significant barriers to Brazil’s capturing an eventual boom in commodity prices. Chief among them is an unsurmountable spending bill (much like every other country in the world, it seems), coupled with ageing demographics and a system that is increasingly authoritarian and complicated to navigate.

In the longer-term, we think there’s a relative case for Brazil relative to other emerging markets or Europe (at least they are not closing down their hydros and nukes). But in the short-term, the fire is burning and what is already cheap, may get even cheaper. There are three key developments in Brazil that create HUGE headwinds in 2023.

Risk 1 – Lula Goes Full MMT

Perhaps the most well-known and understood risk in Brazil is that Luis Inacio Lula da Silva is back and this time he’s going full-on Modern Monetary Theory from the start. Most Brazil bulls think Lula will be the moderate version of 2003, branded “Lula Paz e Amor” in Brazil, but everything he has done to date points the other direction. In 2003, Most of Lula’s cabinet comes from his own Workers’ Party (PT) after complaints that his prior collision-government drove the major corruption scandals (Mensalao and Petrolao).

New finance minister (ministro da fazenda) Fernando Haddad was the PT’s 2018 presidential candidate, and by his own admission, has very little training in finance or economics. The manifest published by the PT leans on MMT for support of greater domestic debt issuance to fund social programs and heavier taxation of the wealthy. Brazil’s working-wealthy and corporations are already taxed at very high-levels, but there are MANY ways of avoiding taxes.

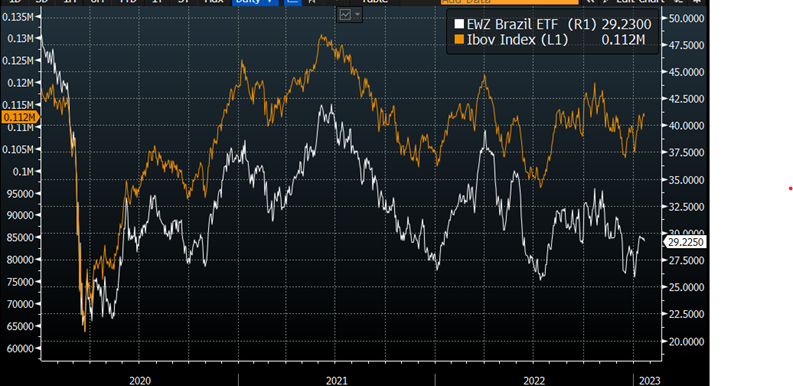

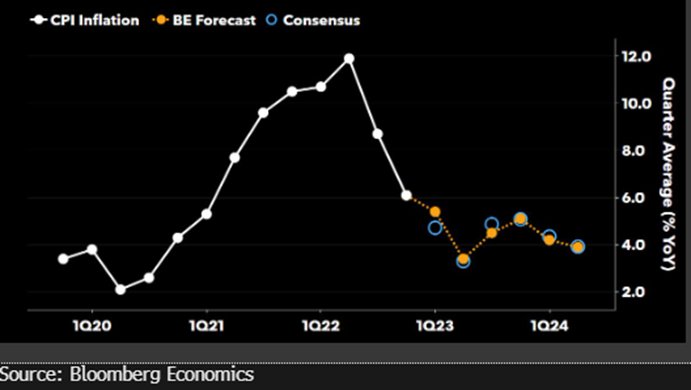

Brazilian have seen a significant increase in employment over the past year, more than overcoming the losses from the pandemic. But real income is still lagging the loss of government transfer during the pandemic. Inflation is the major headwind, climbing to 9.3% in 2022 vs. GDP growth of only 3%. That prompted Brazil’s SELIC rate to rise 13.75%, which is now limiting investments, with GDP expected to grow a measly 0.75% in 2023.

If Lula follows the policy moves of Dilma Rousseff and his 2nd term, then it is highly likely that Brazil’s development bank (BNDES) will provide subsidized loans to construction companies and conglomerates. Those rates tended to be below 5% when the SELIC was over 10%. That led to significant gains for those companies, especially banks and some utilities.

Lula’s speech that BNDES will finance Argentina’s Nestor Kirchner natural gas pipeline is another sign that he plans to grossly increase domestic spending. Using external sources, such as BNDES, Caixa do Brasil and Banco do Brasil, was one of the tactics to by-pass spending limits set by congress. Lula also mentioned that the contractors are likely to be Brazilian, the same at the heart of the Petrobras corruption scandal.

The other controversial point in his speech, a joint currency between Brazil and Argentina, was more for show than actual risk. The Brazilian government was quick to walk back any notions that there would be a single currency (the “Sur”) for the Latin America in a similar vein to the Euro. Rather, the Sur would only be a way of settling trade between the two countries and would not be a day-to-day currency. The likelihood of the Sur ever being implemented is next to zero. To move away from dollar-denominated trade would risk backlash from the US and all the economic pain associated with poking your second-largest commercial partner.

Risk 2 – Americanas Fraud Contagion

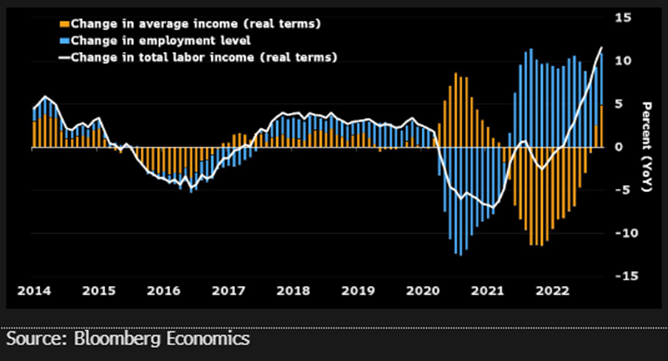

Lojas Americanas have long been a stalwart of every major Brazilian city and every Brazilian value-investor fund. In comes a former bank CEO and less than 10 days into his reign, the company releases it has found a R$20 billion ($4 billion) gap in its Receivables account. That has unleashed a flurry of in-fighting and preemptive legal actions between some of Brazil’s heavy-weights of finance.

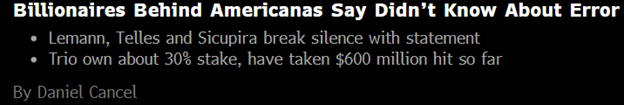

Americanas’ main sharehodlers are the famous 3G trio, one of Warren Buffet’s preferred partners. The trio, including Brazil’s richest man, Jorge Paulo Lemann, own stakes in InBev AB, Burger King, Kraft Heinz, among many other global consumer stalwarts. Americanas was one of the group’s first major coups, the equivalent of Walmart or Target in Brazil. Long seen as one of the premier-managed companies in the Bovespa Exchange.

Americanas’ fraud and its chapter 11 filling (its equivalent in Brazil) are a huge blow to consumer confidence and may cost thousands of jobs in the country. But it has also prompted inquiries into how much 3G knew of the fraud, its dealings with other Brazilian financial institutions and who is at the other end of the over $4 billion shortfall.

BTG Pactual, owned by Andre Esteves, another of Brazil’s richest people, issued a statement that 3G Capital may have been aware of the fraud and has used other tactics in the markets that are not beyond reproach. Mind you, Esteves was incarcerated for his role in Petrobras’ corruption scandal, so it may be a bit of pot meets kettle. Still, BTG is a critical player in Brazil’s capital markets and stirring a fight between the richest men in the country is hardly a winning proposition for anyone involved. Americanas could severely hamper issuances out of Brazil, considering the question it raises over compliance, governance and the fights between pillars of the market.

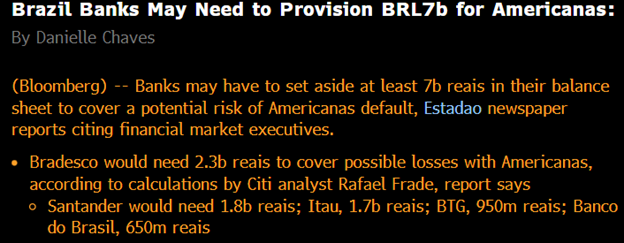

It may also lead to contagion from banks that are counterparties in both the receivables and part of Americanas’ very large consumer-credit facilities. Banco Safra, Banco Santander Brasil and others have all announced large write-downs related to the Americanas fraud. Many smaller suppliers will be hurt by Americanas’ filling, with stories of dairy farmers, trucking companies and the over 44,000 employees that face uncertain futures.

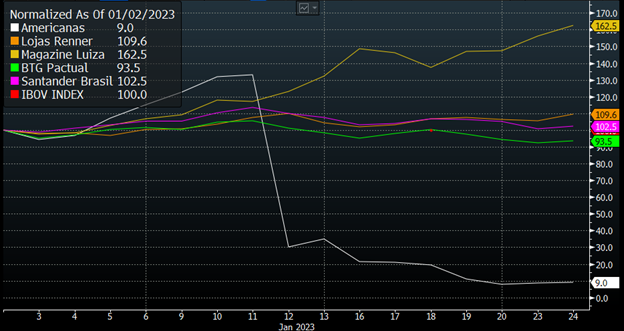

While Americanas is clearly reflecting its chapter 11 filing, Brazil’s broader market seems to underestimate the effect of the demise of one of its main retail channels. Americanas is down 91% year-to-date vs. IBOV flat, Banco Santander +2.5% and BTG -6.5%. Perhaps more telling is that Magazine Luiza, a discount retailer that competes with Americanas, is up a whopping 62.5% on the year. The market clearly believes that customers will just move their shopping over to Luiza, without any repercussions on their purchasing power.

Risk 3 – Rogue Judiciary

Brazil’s robed crusader, Supreme Court President Alexandre de Moraes, got his own New York Times special touting him as the defender of democracy. Minister Moraes took swift action against the rioters that broke into Brazil’s capital of Brasilia on January 8. But Minister Moraes is also spearheading one of the most wide-reaching anti-free-speech campaigns in Brazil.

In the aftermath of the riots, Minister Moraes unilaterally suspended Brasilia’s governor, Ibaneis Rocha, for 90 days alleging he was responsible for security in the capital. He also ordered the suspension of social media accounts of any user spreading “anti-democratic propaganda” and the end of any protests, even non-violent in roadways or near army camps.

He has placed former president Jair Bolsonaro under investigation for his roles in the riots, suspended congress-people’s accounts on social media and arrested two local government officials charged with security in Brasilia.

And while there are those in Brazil that support Minister Moraes’ aggressive pushes into executive powers, it clearly creates a path to conflict with the federal and state governments. For now, the federal government is in alignment with Minister Moraes, but it is almost certain that they will run afoul of each other. It may lead to gridlock or worse, widespread unrest.

There are significant risks left in Brazil and the hope that a commodity boom will bail it out are probably overly optimistic. China is now Brazil’s largest trading partner and its slowdown will have an effect on the country’s exports. Add to that the contagion risk from Americanas on the domestic consumer and there’s a cocktail for significant pain.

The recent appreciation in the BRL may be setting up a significant coil. We see several significant risks in the country. We favor exporters that are more insulated from a currency devaluation standpoint like Sao Martinho (SMTO) and eventually some of the better run utilities (CPFL CPLE). Banks like Itau (ITUB4) and BTG may also do well once the initial hit from Americanas is put behind it.