- In FY2023, LBRT’s management expects 40% to 50% growth in adjusted EBITDA due to the deployment of premier design, the latest pump technology.

- However, the Russia-Ukraine conflict, the softening of natural gas activity, and elevated recession risk are its concerns.

- Its capex-to-EBITDA ratio can fall in 2024, which can perk up free cash flow.

- It has doubled its share repurchase program to $500 million, which can boost its share price.

Strategies And digiFrac Plans

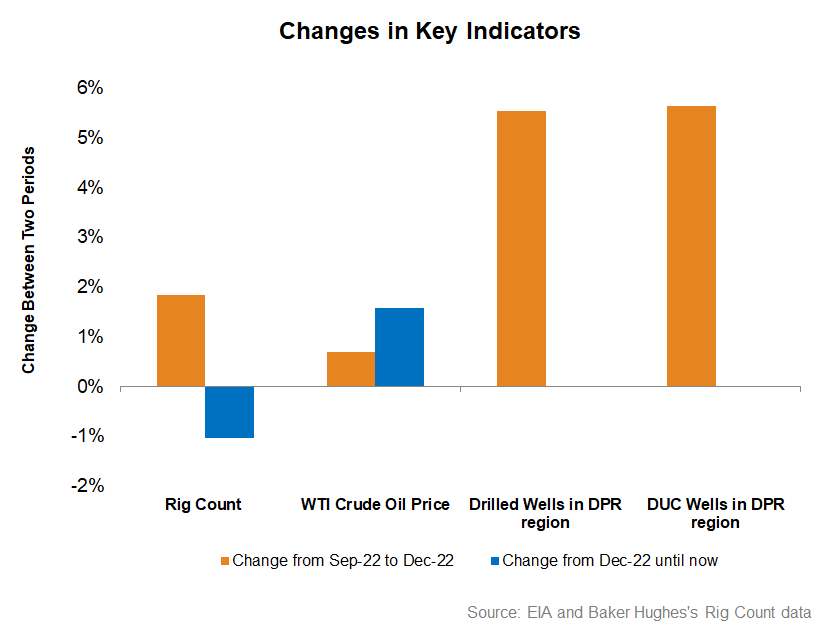

Our articles on Baker Hughes (BKR), Halliburton (HAL), and SLB (SLB) resonate with Liberty Energy’s views on the North American energy market strength. Here, the industry is in a multi-year upcycle. Demand remains steady while supply capacity is set to contract following a multi-year underinvestment. The industry majors are once again targeting projects with higher risk-reward opportunities. However, these oilfield services companies’ views do not necessarily match when international markets are concerned. LBRT’s management believes that the international geographies have a skewed path given the Russia-Ukraine conflict, the softening of natural gas activity, and elevated recession risk.

The frac market displays the trend of fully utilizing the existing frac capacity and strong demand for natural gas-powered fleets. Frac operators are increasingly retiring the legacy (i.e., diesel) fleets and adopting fuel-efficient DGB fleets. Older equipment is getting stacked and scrapped, sometimes faster than their replacements, resulting in a lower capacity. While the frac service pricing will remain high in the short to medium term, the more efficient fleets can create an oversupply in the long term, crashing their prices. As we discussed in our previous article, it deployed six reactivated frac fleets acquired through the OneStim acquisition from Schlumberger in Q3. This would take its frac count to the early 40s.

The company’s digiFrac set is one of the lowest emission fleets in the US. Currently, the company is deploying its first fleet of digiFrac. The design modularity of having pumps and high thermal efficiency power production allow it to commission the fleet on a pump-by-pump basis. These pumps are compatible with its conventional and dual fuel pumps.

FY2023 Outlook And Forecast

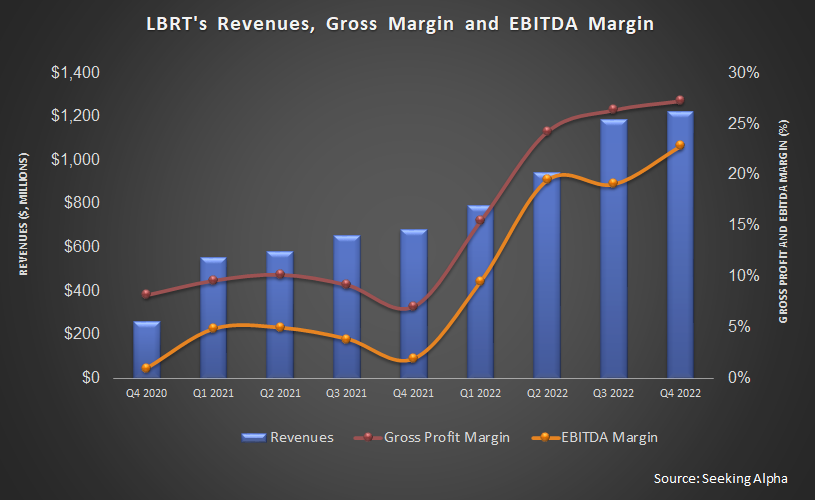

In FY2023, LBRT’s management expects 40% to 50% growth in adjusted EBITDA compared to FY2022. Its capex-to-EBITDA will likely stay at 50% in 2023 compared to the previous year. Although its pressure pumping fleet count would remain unchanged, the management expects its premier design and latest pump technology to generate a higher margin. It also plans to own a value chain with its own power generation. To maximize long-term returns, it focuses on improving sand and logistics. The strategy sets it apart from some of its peers who lease technology and contract power generation from other providers.

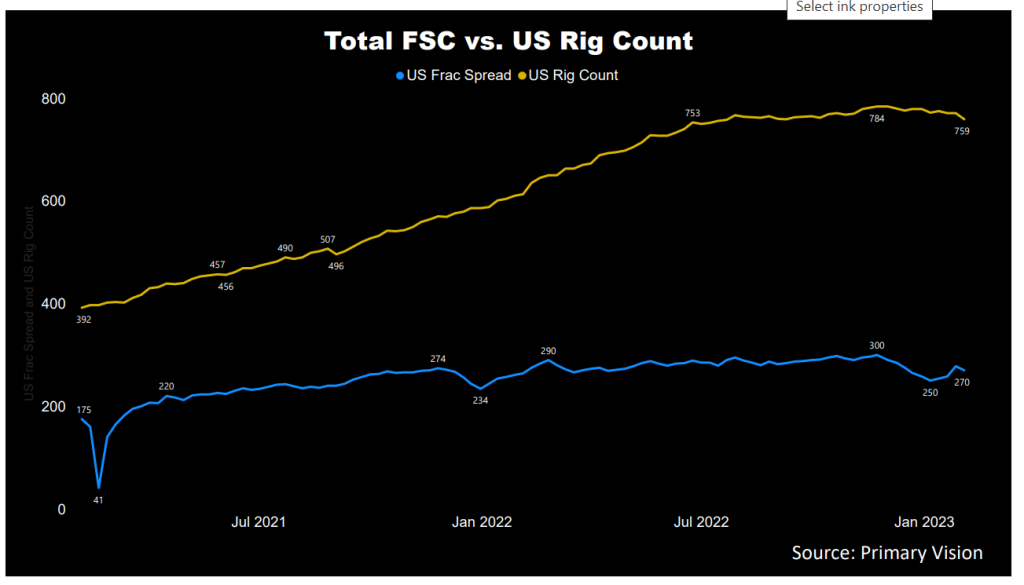

According to Primary Vision’s forecast, the frac spread count (or FSC) reached 270 by the first week of February and has inched marginally up over the past year. Over the past month, we saw 13 frac fleets removed from the count in the US. A falling frac count is negative for LBRT’s growth.

What Were LBRT’S Q4 Drivers?

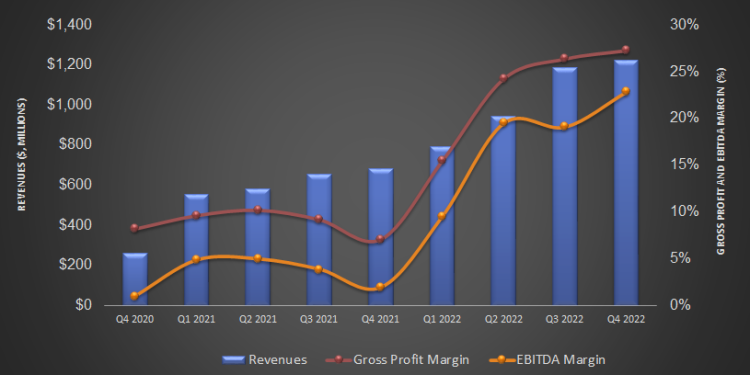

From Q3 to Q4, LBRT’s revenues increased by a modest 3%. The upward pricing momentum continued, and the typical effect of holidays and seasonality pulled the topline back. Nonetheless, the EBITDA margin expanded by 380 basis points in Q4. Net earnings improved to $0.84 per share from $0.78 per share a quarter ago. The bottom line recovery is impressive because it recorded charges related to the re-measurement of the tax receivable agreements.

Debt And Shareholders’ Returns

In FY2023, LBRT’s capex-to-EBITDA ratio can remain at 50% compared to FY2022. However, it plans to decrease the load. In FY2024, it can lower it to 30%. The 2023 capex is driven by next-generation low-emission frac technology, which is expected to be the mainstay over the medium term. The company’s debt-to-equity (0.18x) is lower than many of its peers in the fracking services industry.

LBRT is increasing its shareholder returns. In 2H 2022, it returned $134 million through share repurchases and dividend payments. It re-initiated quarterly dividend, following its $250 million share repurchase program in Q3. In Q4, it increased the repurchase program to $500 million. This indicates the management’s perception of a share price dislocation and confidence in its profit generation capability.

Learn about LBRT’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.