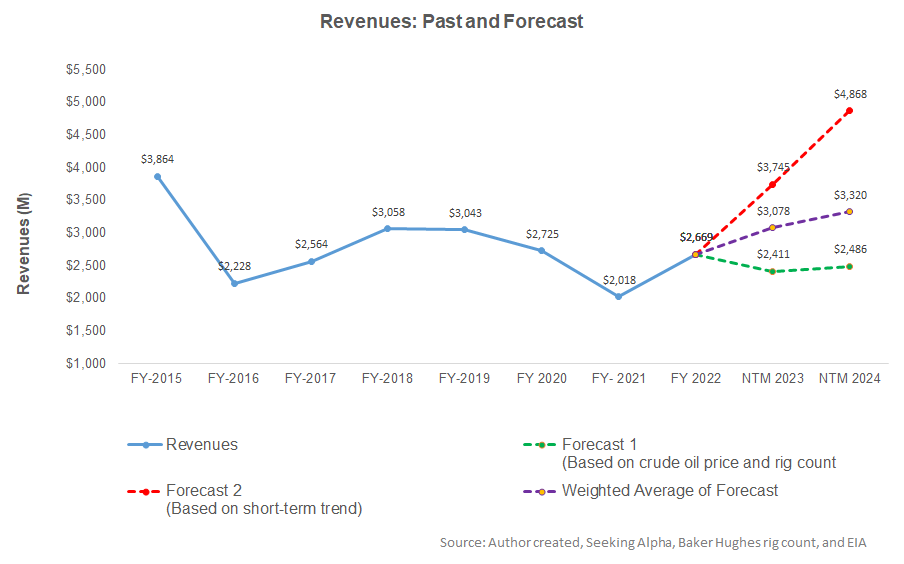

- Our regression model suggests that NBR’s revenue will increase sharply in NTM 2023 but may decelerate later.

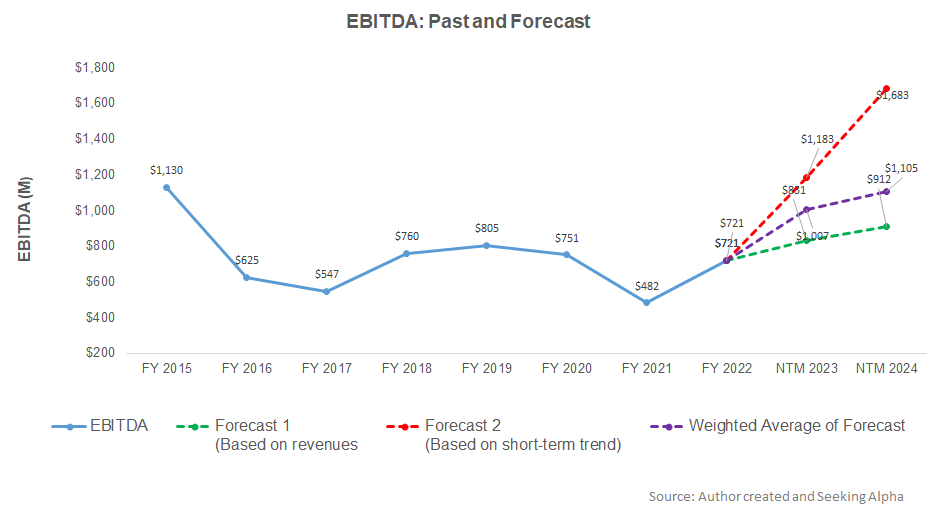

- Similarly, the EBITDA estimates point to s sharp slowdown in NTM 2024 after solid growth in NTM 2023.

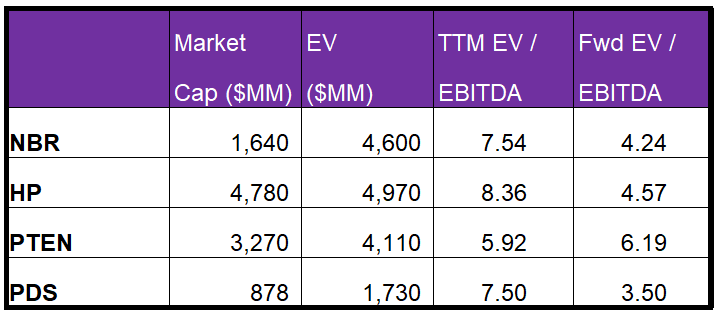

- The stock is reasonably valued versus its peers at the current level.

Part 1 of this article discussed Nabors Industries’ (NBR) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Observing a regression model based on the historical relationship among the crude oil price, rig count, and NBR’s reported revenues for the past eight years and the previous four quarters suggests that NBR’s revenues will increase by 15% in the next 12 months (or NTM 2023). It can grow further, but at a decelerated rate (8% up), in NTM 2024. For the short-term trend, we have also considered seasonality.

Based on the regression models and the average forecast revenues, the company’s EBITDA will increase by 20% in the next 12 months (or NTM) in 2023. In NTM 2024, the model suggests the company’s EBITDA growth will decelerate to 10%.

Target Price And Relative Valuation

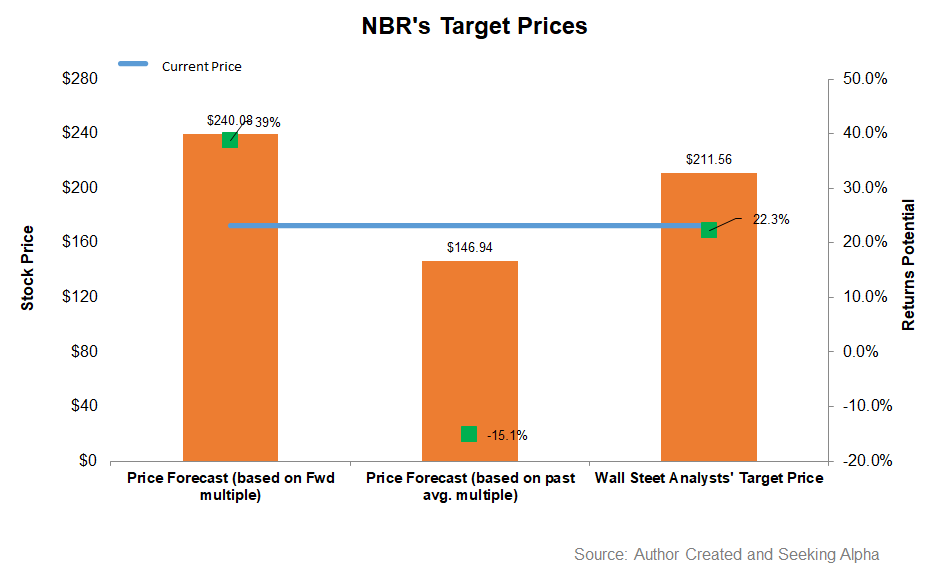

The stock’s returns potential using the forward EV/EBITDA multiple (4.2x) is higher (39% upside) than the returns potential (15% downside) using the past five-year average multiple (7.1x). In comparison, Wall Street’s sell-side analysts expect 22% returns from the stock.

NBR’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is steeper than its peers, typically resulting in a higher EV/EBITDA multiple than its peers. The company’s EV/EBITDA multiple (7.5x) is in line with its peers’ (HP, PTEN, and PDS) average of 7.3x. So, the stock is reasonably valued versus its peers at this level.

Analyst Rating And Target Price

According to data provided by Seeking Alpha, three sell-side analysts rated NBR a “buy” in the past 90 days (including “Strong Buy”), while five of the analysts rated it a “hold.” Two of the analysts rated it a “sell” (includes “strong sell”). The consensus target price is $200.7, suggesting a 7% upside at the current price.

What’s The Take On NBR?

As the leading-edge day rates recovery pushes through, NBR is starting to tweak its strategy of going short on contract duration and looks to extend the duration. It plans to concentrate on the most capable rigs and focus on premier fields. With the reactivation of high-spec rigs and elements of NDS added, revenues can go higher. International operations bring more opportunities for NBR. In Q4, it received five awards for new builds for its joint venture in Saudi Arabia (SANAD). Also, the company’s focus on technology also helped it increase the Drilling Solutions segment EBITDA in Q4.

NBR’s declining cash flows due to huge working capital requirements have been a concern. As a result, the stock underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. Although it has deleveraged the balance sheet, its leverage remains high compared to its peers. The stock is marginally undervalued versus its peers. However, investors may note that the reactivation costs are also high, limiting margin expansion. As the margin outlook strengthens, investors might want to hold it for gains in the medium term.