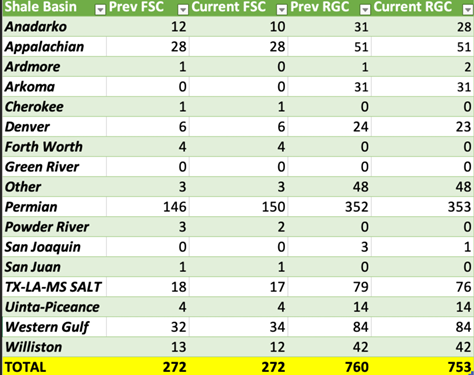

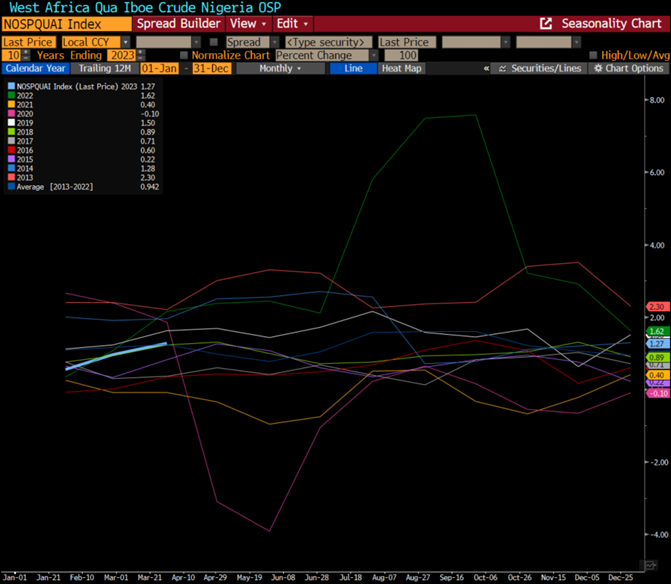

The frac spread count remained steady this week as there was a shift in activity across the different regions. We will start to see some activity diminish across the gas heavy basins while the oil regions start to see a bit more activity. This is common as we transition into shoulder season, and it’s only supported further by the decline in natural gas prices. I cover it a bit more in the YouTube video that is reserved purely for clients.

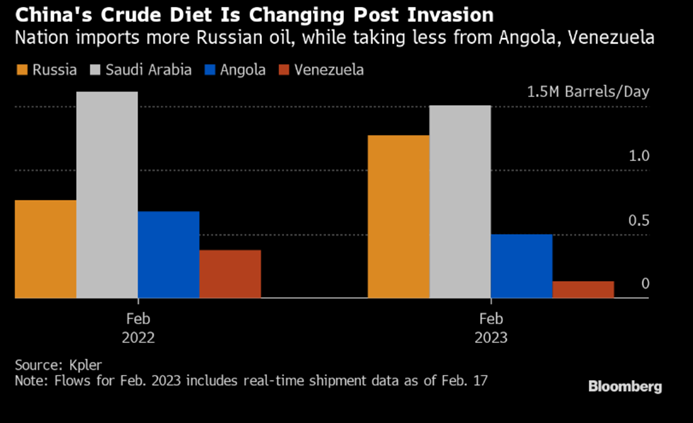

It will come as no surprise that a big factor in the physical market is China. They recently increased their purchases of Russian Urals, which resulted in a big slowdown in West African/ Middle East buying. China came in and did a sweep of some WAF cargoes to kick off Feb buying, but just as quickly as they came in- they stopped. “China doubled its purchases of Urals oil in the first half of February compared to the same period of January amid more attractive pricing and as Chinese demand rebounds after COVID-related lockdowns, according to traders and Refinitiv Eikon data.” When Saudi increased their OSPs (official selling prices), we predicted a big slowdown in ME purchases. A mixture of rising OSPs, cheaper freight rates, and the spread between brent-dubai (back to OSPs!) all help pull in more Urals. “Urals oil supplies to China are rising as freight rates soften and the Brent-Dubai spread narrows, making Brent-related Urals oil more competitive compared to Dubai-related grades in Asian markets, traders said.”

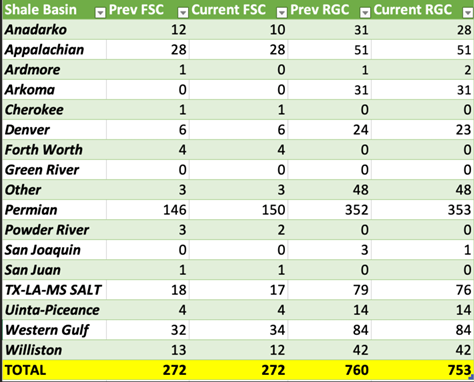

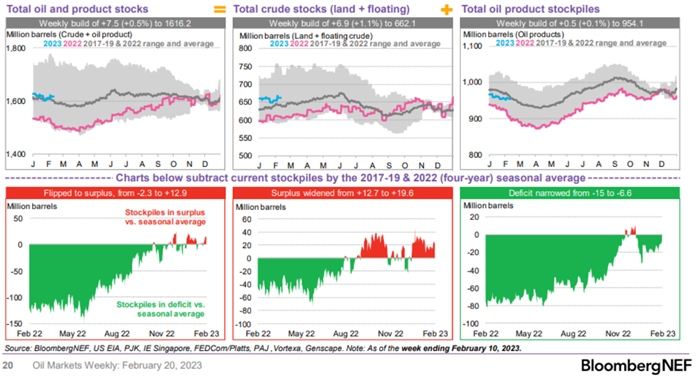

The physical market saw a fairly sizeable dip in terms of pricing, but as the prices fell buyers showed back up scooping some discounted barrels. There are clearly buyers in the market, but they are willing to be patient for some softness to come back into the market. As prices fell, there was some swift purchases that ended just as quickly as they began. This is going to be the market right now as companies/countries balance purchases of Russian crude and blends throughout WAF and Middle East. Iraq raised their OSPs, but they are still WELL below Saudi Arabian pricing. The focal point for Iraq was to clear a lot of the glut in the floating market, and they issued fairly steep discounts which will persist over the next month. The U.S. and Europe has stepped in as a sizeable buyer of Iraqi blends whole a lot of KSA flow has been reduced by cutting term contracts and/or not taking any additional volume. The below chart helps to highlight why the market can see these sweeps- When you reshuffle global flows from a highly optimized, just in time delivery to an extended supply chain with miles per ton surging. The delay in arrivals creates a significant more “lumpiness” in the market, but it’s complicated even further by the rising builds of refined products.

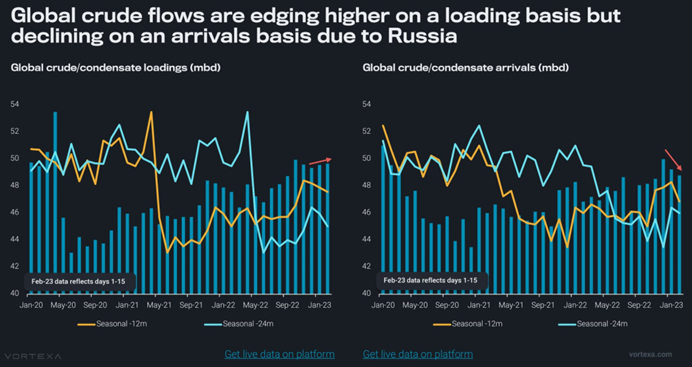

There was a lot of talk about the increase of Nigeria OSPs, but it’s always important to put increases into context. There were increases, but they are still well within the norms we have seen over the last ten years.

Even with the increases in OSPs, we are still below the “normal” price levels for Nigerian crude flowing into the market. A large part of that is driven by the persistent elevated floating storage, and the steady decline of purchases coming from Asia. “Angola is among the hardest hit at the moment, with daily exports to China falling 27% so far this month compared with whole of February last year, according to data and analytics firm Kpler. Flows from Venezuela, Nigeria and the UK are also down.” Even with an expected increase of Chinese demand, we aren’t going to see renewed buying of WAF crude as Russia dumps more product into the market.

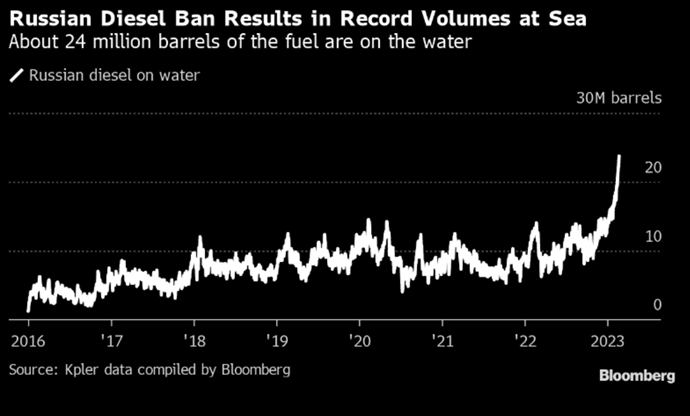

The flows are going to be even more complicated as Russia dumps more diesel into the market as well. Margins are already being compressed around the world, and as more Russian product moves into the market builds will continue- especially in Asia.

A record amount of Russian diesel is afloat on the sea as European Union sanctions force the nation’s cargoes to find new buyers.

Some 24 million barrels of Russian diesel-type fuel is being held in vessels’ storage tanks, the most in Kpler data that dates back to 2016. For the first time in at least seven years, the single most popular destination for the cargoes is “unknown.”

- At least five tankers laden with diesel-type fuel loaded at Russia’s Baltic port of Primorsk are floating off the coastlines of Morocco and Tunisia

- Kazakhstan applied to Transneft to send 20k tons of crude via Druzhba for German refineries

- Eni Capital Markets Day and earnings are scheduled for Thursday

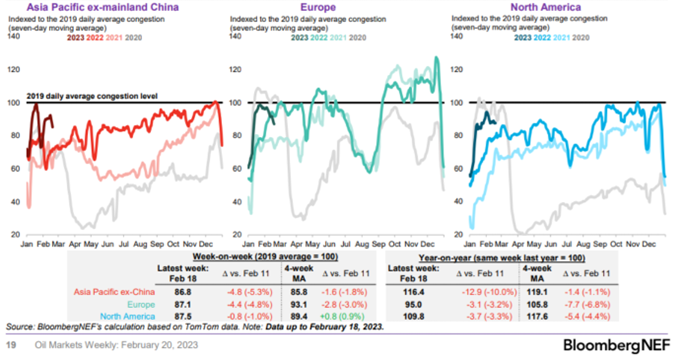

Russia is sending more product into Latin America, which is historically a U.S. export market. This will divert more U.S. flow from LatAm into Europe. So far, we have seen Russian exports increase into LatAm, Africa, and Asia- and the key point to watch will be Singapore Middle Distillate storage to see how demand vs supply metrics are changing.

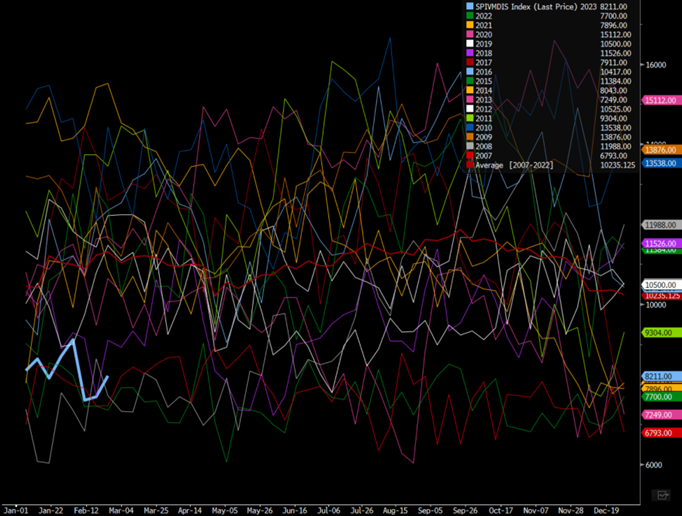

Singapore Middle Distillate remains near the lows but the margins are shifting quickly as light distillate (gasoline) remains a broad overhang.

Middle Distillate Storage in Singapore

When we look at the U.S., we have broken below the low of the recent range while still well above the highs from 2018-2021. The crack spread will still support the U.S. creating a maximum amount of diesel, but if this approaches $30- we will see additional run cuts. If exports slow driven by Russia taking our market share, we will see this adjust lower quickly.

Where we expect to see the biggest impacts is in Asia where a large part of the additional Russian product will end up. The crack spread has already pressed lower, and if we slip below $20- we will see additional run cuts in Asian (non-China) refiners. India has already maximized their runs as they import discounted Russian Urals and ESPO, and they export a rising amount of distillate into the Atlantic Basin. We are seeing a steady level of runs from China and India, which mixed with Russian flows- will put a huge damper on margins leading to run rate reductions.

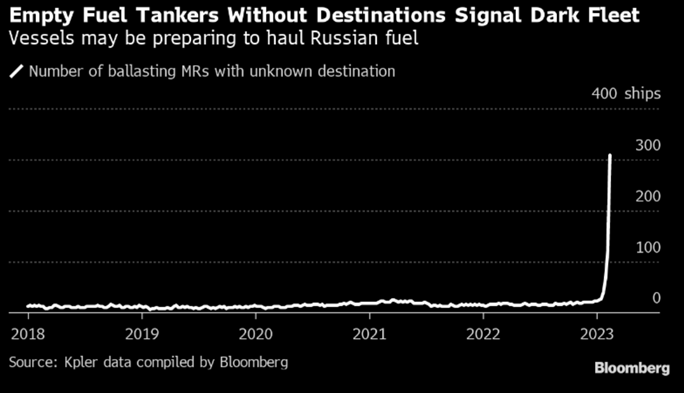

Our biggest concern in the energy markets right now is a refined product glut. We have discussed the increase of middle distillate while light distillate (gasoline) is already at record levels. The increase of ships in the “dark market” shows the amount of new boats that will start moving Russian product.

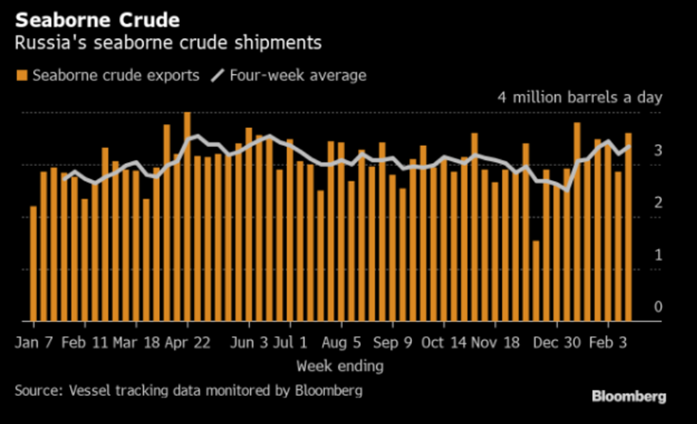

The shifts in the market call into question the decision for Saudi to raise OSPs, and we have seen other Middle East nations follow suit but by no means to the same degree. Russia saw a big surge in exports prior to their announced production cut, but as we have highlighted- the cut is due to both refiners and ports being overwhelmed. There had to be some sort of adjustment, so might as well claim this is in “retaliation” for price caps.

As Europe stops their buying of refined product, it has to find a new home. We have highlighted that diesel would push into broader markets, and it will result in more margin compression for refiners. This will put more product into storage, which will hurt underlying oil demand over the coming few months.

“Russian exports of gasoil and diesel to Africa are on track to reach a record of more than 180k b/d this month after European Union sanctions, according to FGE.

- That trend is “expected to continue as Russian volumes get backed out of Europe and find new homes,” the consultancy said in a Feb. 17 note, citing Kpler data

- The increase in shipments from Russia to Africa will close arbitrage opportunities for refiners in Asia for “this regular outlet,” FGE said

- Given the change in flows, and seasonal lull in Asian demand in 2Q, the HSGO balance in Asia will remain in a “relatively large surplus”

The underlying refined product market is experiencing an increase in supply as demand comes under pressure. The builds will accelerate as demand slips further heading into shoulder season, which will move us closer to “seasonal” norms. The biggest difference is the TYPE of product that is sitting in storage- gasoline vs diesel.

Global air travel has flatlined as well as driving activity rolls a bit more across key demand centers. The U.S. will get an uplift this week driven by February break but that will fade quickly back to the average of around 8.4-8.5M barrels a day.

Even as builds increase, it’s still mainly driven by the gasoline/light distillate builds and NOT diesel/middle distillate. This has been the case, and we don’t see it pivoting anytime soon, BUT we do see more middle distillate pushing into the market by way of Russia and India. This will compress margins and hurt underlying run rates.

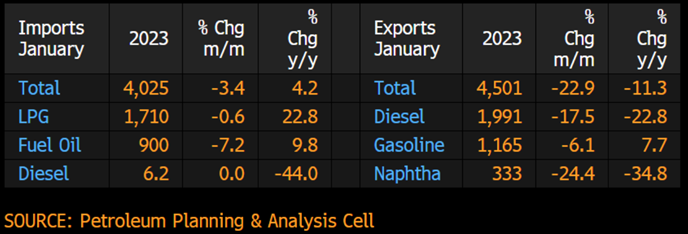

India had a nice increase in refined product throughput resulting in Jan imports increasing: “India’s crude oil imports in January rose 3.6% y/y to 20 million tons, the highest since July, according to provisional data published by the oil ministry’s Petroleum Planning & Analysis Cell.”

India’s refiners raised crude processing rates in January, matching the highest level in five years, on the back of rising domestic consumption, according to government data.

- The nation’s 23 refineries processed 22.8m tons in January, the highest level since January 2018, a report from the oil ministry’s data analysis wing Petroleum Planning & Analysis Cell show

- +5.1% y/y, +2.2% m/m

India benefited from steady increases in demand, but they also have a growing concern of local product availability. There is a rule called “Section 11 of the Electricity Law for the larger public interest” to help ensure enough power is available to the broad populace. The view is that peak demand will be about 229GW in April, which is why India is trying to protect local demand and ease the burden on domestic coal supplies. This will push power plants importing coal to run at max, but these concerns will also lead to a push across other molecules. We will see refiners running harder to take advantage of the spread between Russian Urals and diesel/middle distillate.

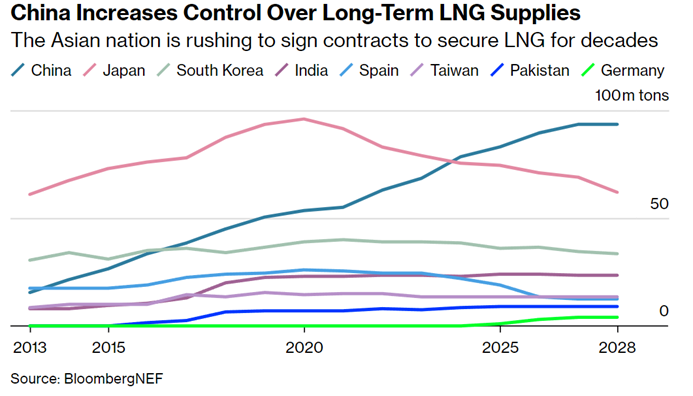

“The ministry said it would invoke Section 11 of the electricity laws in the “larger public interest” and the order will be effective for three months starting March 16. It previously invoked the emergency rule last summer at the height of a power crisis. India’s electricity laws allow the government to force any power station to operate as directed in extraordinary circumstances, such as a natural disaster or a threat to national security or public order. India is invoking an emergency rule that will force some of the country’s biggest coal power plants to operate at full capacity, as the country prepares to meet surging electricity demand and avoid blackouts. Power stations operating on imported coal will be asked to run at full capacity for three months during the summer season to ease the burden on domestic coal supplies, according to a Feb. 20 power ministry order seen by Bloomberg News.” The issues are also expanding to LNG and natural gas availability heading into the shoulder season. China has increased their control over long term LNG, and their slower demand put more volume on the water and allowed Europe to buy the excess. But now with China reopening, the ability to pick up those “extra” cargoes are going to be limited.

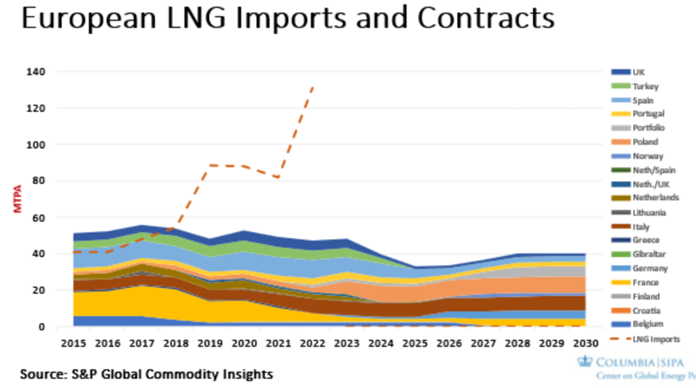

Europe imports are going to continue increasing as limited piped natural gas persists. The LNG market will become more and more important for Europe, and the availability in the market gives China more control again. “China is estimated to have resold at least 5.5 million tons of LNG last year, according to ENN Energy’s monthly research report in January. That’s equivalent to roughly 6% of total spot market volume, making the country an enormous swing supplier.”

China also keeps locking up new deals, which will put them in more control of supply over the next decade. “China has signed more contracts with US export projects than any other nation since 2021, according to BloombergNEF data, and Sinopec inked one of the LNG industry’s largest deals ever with Qatar last year. More deals are on the horizon, as firms are in negotiations with exporters in the US, and also locked in talks with Qatar, Oman, Malaysia and Brunei, according to people with knowledge of the discussions.” Europe needs to get more aggressive with their purchases of long term contracts from the U.S. to help counter some of the Chinese expansion.

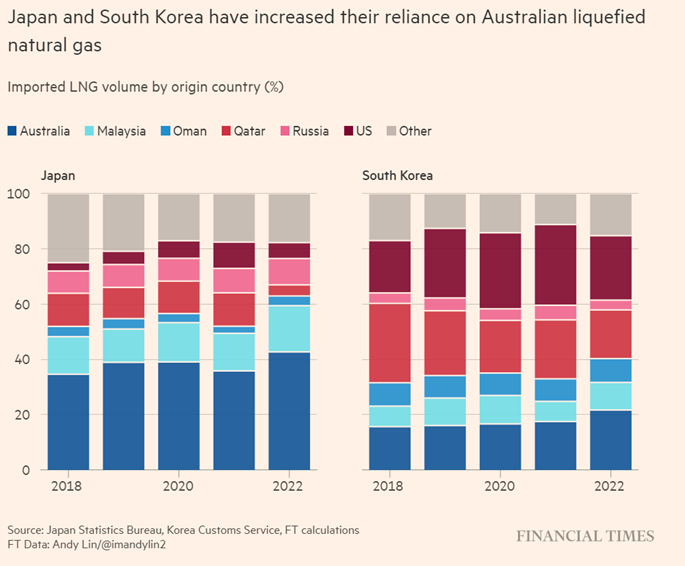

As China changes the landscape, Asia is relying more on Australian natural gas, which will keep European prices bid. We expect to see prices remaining elevated as Europe looks to increase their natural gas purchases. Piped gas has diminished over the last year, and there won’t be a way to replace the Russian piped gas from other “cheaper” sources outside of going to the floating market. This will keep prices elevated, and we have already seen companies (such as BASF) look to adjust their footprint away from Europe. Power is short in multiple areas and countries are trying to structure ways to bring in more coal and gas flows.

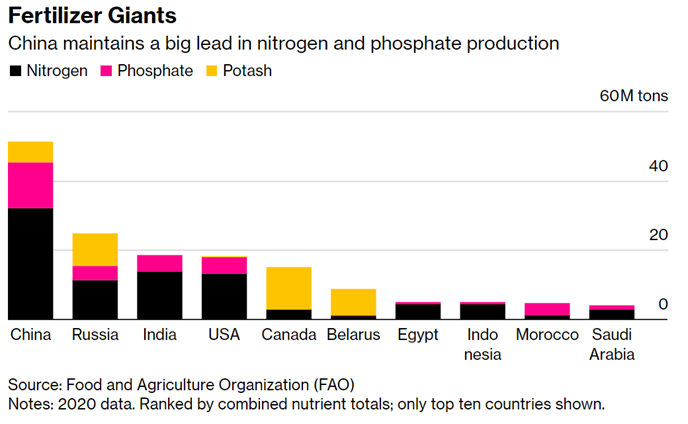

The Indian issues also aren’t limited to power and general energy, but also expands broadly into the agriculture world. Fertilizer issues aren’t going anywhere with more supply chain disruptions and shifts on the geopolitical spectrum. China/Russia still control a huge amount of the fertilizer market, and there are clear pivots along multiple levels- including availability as China keeps more in country.

The below quotes are some key themes that Trivium has pulled out regarding food security. Many of them are focused on creating a more diverse diet, and finding ways to increase local production of food. A large part of that is hinged to cheaper production and expanding rural development. By keeping more fertilizer local, it will help keep prices lower, and hopefully (in their view) drum up more local yields.

Xi highlighted the importance of boosting the income of low- and middle-income households, which typically consume a relatively high proportion of their earnings.

- Xi also called for expanding consumer credit to support home renovations, education, healthcare, elderly services, sports, and the purchase of new energy vehicles.

On investment, Xi listed the areas that should get government support, including:

- Transportation

- Energy

- Water conservancy

- Agriculture

- Inter-regional connectivity infrastructure for city clusters

We’ve spent the last couple days combing through the 2023 No. 1 Document – the Party’s annual rural policy guidance.

ICYMI: Top leaders are obsessed with food security. This year, they’re looking to deliver it by:

- Pushing hard to boost traditional staple crop yields

- Looking for new sources of food security, from the grasslands to the oceans to the science lab

But food security isn’t the only thing on Beijing’s rural policy agenda.

The No. 1 Document also flags developing rural industries as a critical priority this year. Specifically, this includes:

- Expanding the food processing industry

- Improving cold chain logistics to ensure products stay fresh

- Investing in agritourism, e-commerce, and other locally appropriate rural industries

It’s not all about adding value to agriculture – the doc also calls to make better use of surplus rural labor by (Xinhua):

- “Guid[ing] the transfer of labor-intensive industries to the Central and Western regions and to the county level.”

Get smart: This isn’t a touchy-feely poverty alleviation initiative – it’s aimed at solving concrete economic challenges, like the low profit margins of agribusiness, and the high cost of urban labor.

Get smarter: For decades, corporations were largely unable to lease land to set up rural operations.

- That’s only recently begun to change. Building productive, profitable industries will take time.

But boosting yields isn’t the only way Beijing wants to deliver on food security.

The No. 1 Document also calls for officials to:

- “Construct a diversified food supply system [and] establish a broad concept of food”

Some context: In the 1950s, food security meant averting famine – with policy focused on producing dietary staples like rice and wheat.

- Chinese diets have evolved a LOT since those days, but food security policy has remained overly focused on just a few staple grains.

That’s where the broader concept of food comes in. The No. 1 Doc calls for a bunch of forward-looking efforts to expand domestic production of everything people eat, including by:

- Developing more plant, animal, and microorganism-based foods

- Expanding livestock feed and forage production

- Building an ocean ranching industry

Get this: Xi Jinping himself pushed for this broader approach to food security at the 20th Party Congress.

Get smart: Necessity, the saying goes, is the mother of invention.

- The more Beijing feels its food security is under pressure, the more uptake of in-ovative solutions we expect to see – from plant based meats to microbial livestock feeds to open ocean fish farms.

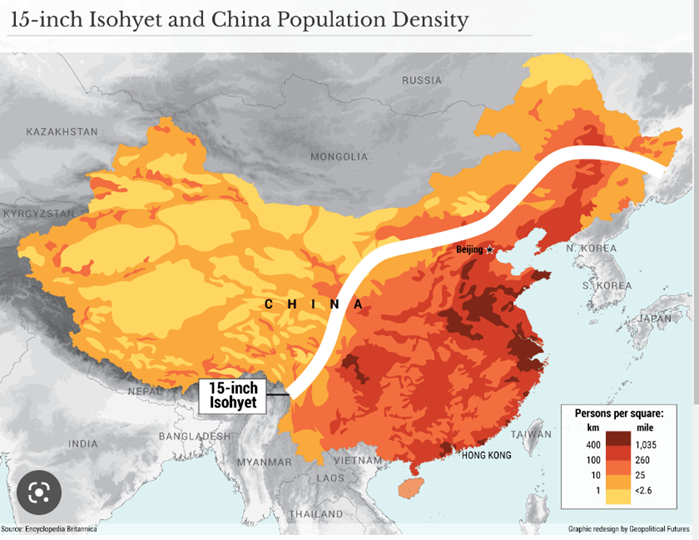

The inefficiency of China is a broad issue especially because they have maxed out to a large extent the amount of fertilizer the area can handle. It is also made worse by the location of the 15 inch line, and where a large percentage of their population currently live. The ability to expand yield further is going to be difficult, and they have already poisoned some land by overfertilizing.

On a different side, India won’t allow new exports of sugar to protect local prices. “India won’t allow any more exports for now on concern that weaker production will threaten domestic supplies, Bloomberg reported on Friday. That means there won’t be additional exports beyond the 6 million tons India has already allowed this season. Cuts to production estimates for key growers combined with strong demand is bolstering the case for lower Indian exports and tight sugar stockpiles globally, according to Marex analyst Robin Shaw.”

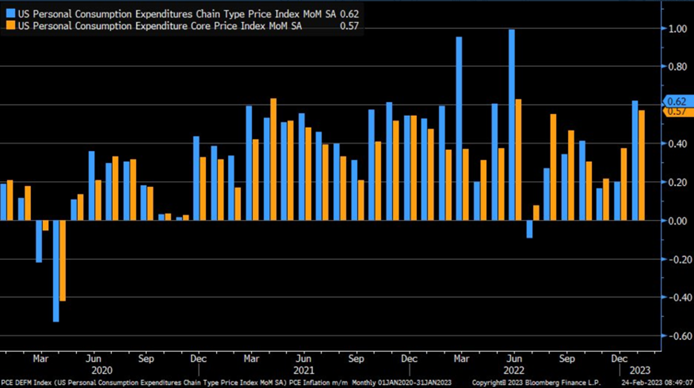

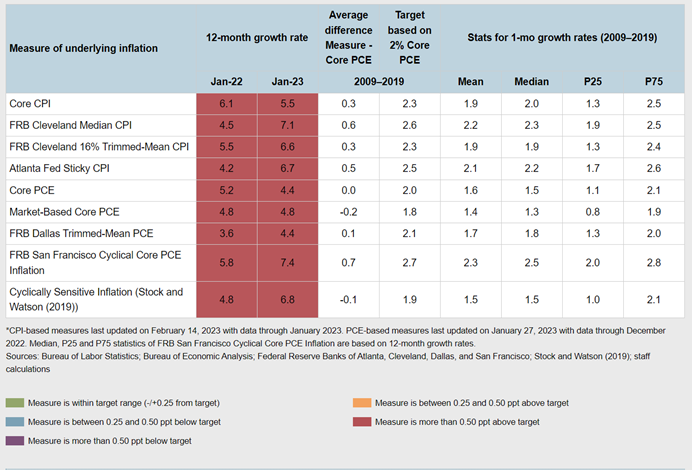

We are seeing cuts on a many different “foodstuffs” driven by droughts in Latin America and now more pressure in India. Many of these factors are going to keep inflation pressures elevated around the world, and the U.S. isn’t going to avoid these issues. We have been calling for and highlighting an acceleration in U.S. inflation, which came again by way of the PCE data sets. January PCE inflation +0.62% m/m; core +0.57% m/m … strongest gain for both series since June 2022. There hasn’t been a “negative” month in close to a year, and now we are pivoting higher again with more stickiness happening around services and key core metrics.

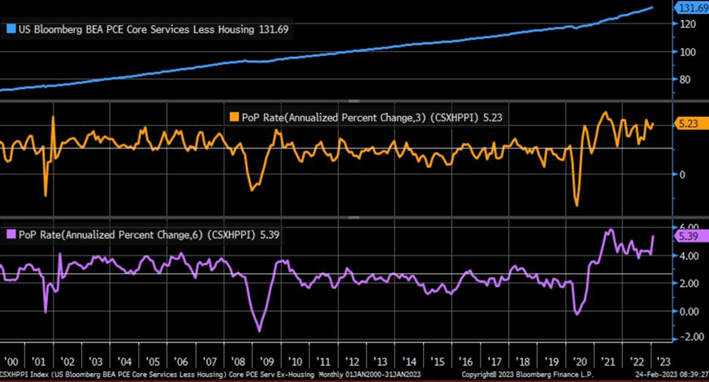

PCE Core services ex-housing is the one that the Fed watches the “closest” and it shifted higher in January with the three month annualized change also moving up. Even when you adjust for the six-month annualized, the data is pointing to another bump in the wrong direction.

We have been pointing out that there is NO PIVOT coming from the Fed, and we are likely going to see Fed Fund Rates moving to about 5.5% following these data points. This just confirms what we have been saying for months now regarding the stickiness in inflation, and how we would see it accelerate again in January.

It will slowdown a touch in February, but still remain positive- just not to the same degree as January. The biggest sticking point will be core inflation, which is driven by “sticky” inflation that is anchored in service costs. Some of the key reasons we see these drivers- Median CPI/ Trimmed-Mean/ Sticky CPI continue to outpace “Core CPI”. When we align all of the key leading indicators, the PCE Deflator data supports more pricing pressure in the market.

The global market is drifting further into a recession with more pressure coming from all sides- especially China. I will cover more on China next week as their economy flounders and really falls under the weight of their leverage.