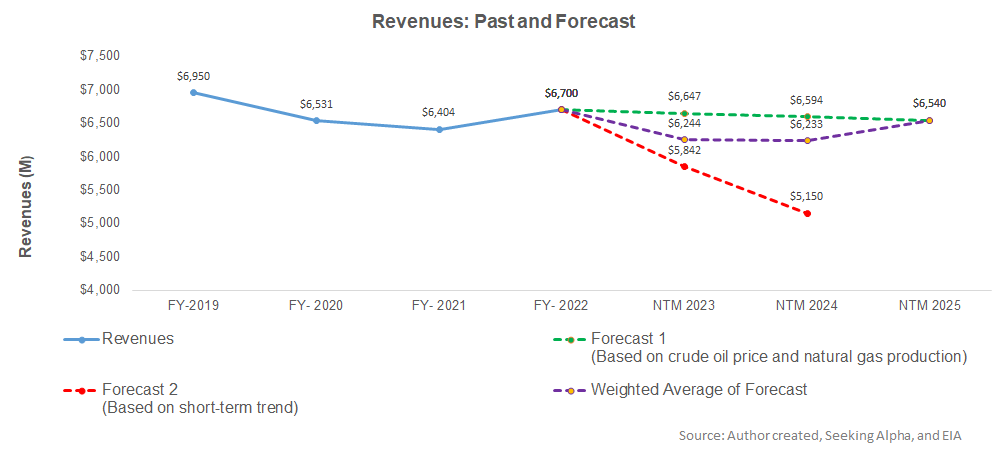

- Our linear model suggests a revenue decline in NTM 2023, but the decline rate can stall in NTM 2024.

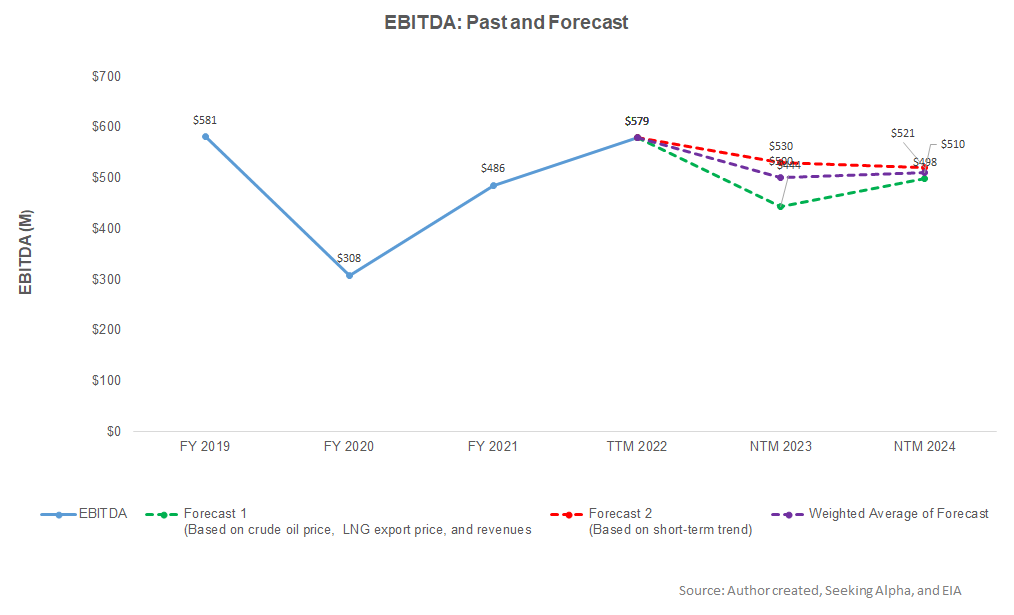

- FTI’s EBITDA can fall sharply in NTM 2023 but steady in NTM 2024.

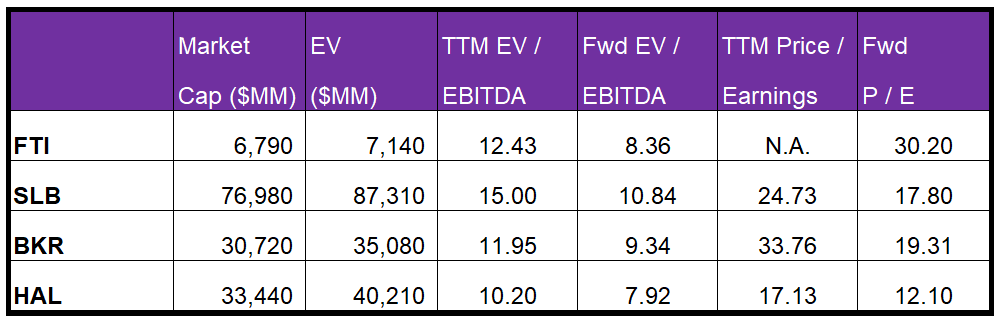

- The stock is marginally undervalued versus its peers at the current level.

Part 1 of this article discussed TechnipFMC’s (FTI) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Revenue Forecast

Based on a regression equation between the key industry indicators (crude oil price and natural gas production) and FTI’s reported revenues for the past eight years and the previous four quarters, its revenue is expected to decrease by 7% in the next 12 months (or NTM) in 2023. The decline rate may plateau in NTM, while revenues can increase in NTM 2025. For the short-term trend, we have also considered seasonality.

Based on the same regression models and the forecast revenues, the company’s EBITDA will likely decrease by 14% in NTM 2023 but can remain steady in NTM 2024.

What Does The Relative Valuation Tell Us?

FTI’s forward EV-to-EBITDA multiple contraction versus the adjusted EV/EBITDA is steeper than its peers because its EBITDA is expected to rise more sharply in the next year. This should typically result in a higher EV/EBITDA multiple than peers. However, the company’s EV/EBITDA multiple (12.4x) aligns with peers’ (SLB, BKR, and HAL) average. So, the stock is slightly undervalued at this level compared to its peers.

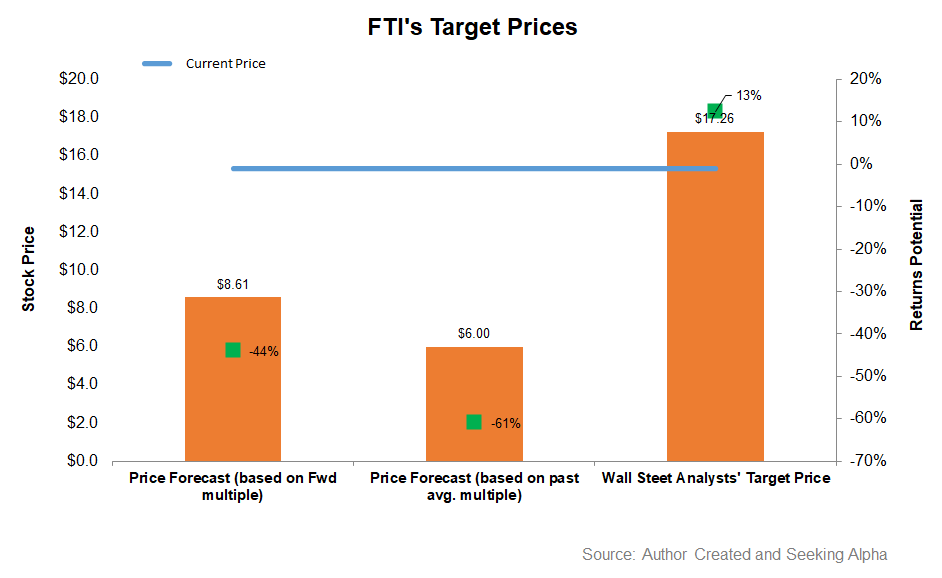

Analyst Target Price And Rating

Returns potential using the past average EV/EBITDA multiple (6.2x) is lower (44% downside) than the returns potential using the forward EV/EBITDA multiple (61% downside) and the sell-side analysts’ expected returns (13% upside) from the stock.

According to data provided by Seeking Alpha, 20 analysts rated FTI a “buy” in the past 90 days (including “Strong Buy”), while three recommended a “hold.” None of the sell-side analysts rated it a “sell.” The consensus target price is $17.3, which yields ~13% returns at the current price.

What’s The Take On FTI?

For FTI, the Subsea brings in larger projects over two years duration that offer significant growth opportunities because of the expanding customer base. Particularly, it finds opportunities in tieback activity in the Gulf of Mexico, the North Sea, and West Africa. In FY2023, its backlog could exceed $8 billion, which ~20% higher than the previous year. In Surface Technologies, Saudi Arabia and the United Arab Emirates would drive growth in 2023. So, the stock outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year

However, in Q1, the typical weather-related seasonality and a topline decline can happen. This is because of the restructuring operations in North America to eliminate underperforming assets, which would curb growth. Also, since late 2022, the US LNG export price declined because mild weather reduced demand for space heating, which is not conducive to FTI’s growth. In any case, robust liquidity will cushion against any cash flow pressure. Given the slight undervaluation compared to its peers, we expect returns from the stock price to strengthen in the medium term.