Frac’ing Outlook

We have already discussed RPC’s (RES) Q1 2023 financial performance in our recent article. Here is an outline of its strategies and outlook. At the end of Q1 2023, RES’s management continued to operate ten horizontal pressure pumping fleets but changed the mix. It added a new Tier 4 dual fuel equipment and sent old equipment for refurbishment. It expects to operate ten fleets throughout the remainder of 2023. It also plans to bring back the refurbished equipment, send another unit for repair, and the cycle will continue. In essence, the company is not planning to add capacity but improve the quality of its asset portfolio.

Until now (before the addition), about half of its fleets are ESG-compliant. By Q2 2024, it expects to increase the ESG-friendly composition’s share to ~75%. Recently, the company reactivated a fleet in East Texas but shifted it to West Texas. Also, it has two in the Mid-Continent, and the rest are in the Permian. Nearly half of these frac spreads are on-the-spot rates while the rest are dedicated (i.e., six to nine-month commitments). Rate-wise, however, the management does not see much difference in the choice between these two. Read our previous article to know more about RPC.

Analyzing Industry Indicators

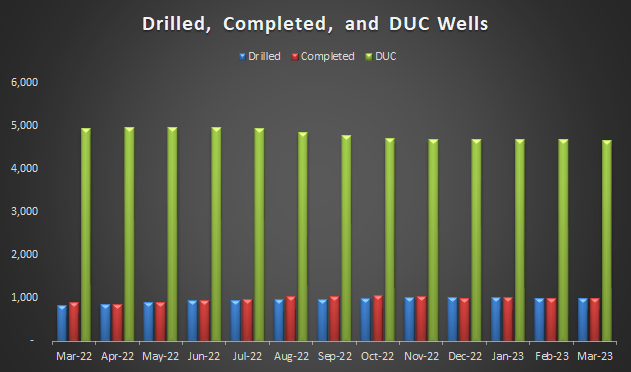

In the past year, until March 2022, the drilled wells count growth (20% up) outperformed the completed well count (12% up). But, the drilled but uncompleted wells declined (5% down).

Despite crude oil prices’ uncertain run over the past several months, the US rig count pressed ahead (8% up) and performed in line with the US frac spread count, as estimated by Primary Vision. So, the short-term indicators are somewhat volatile.

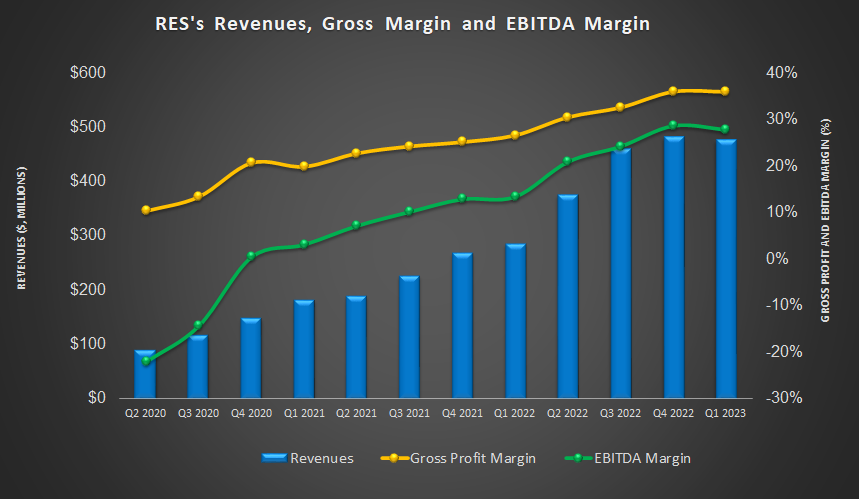

The Q1 Drivers

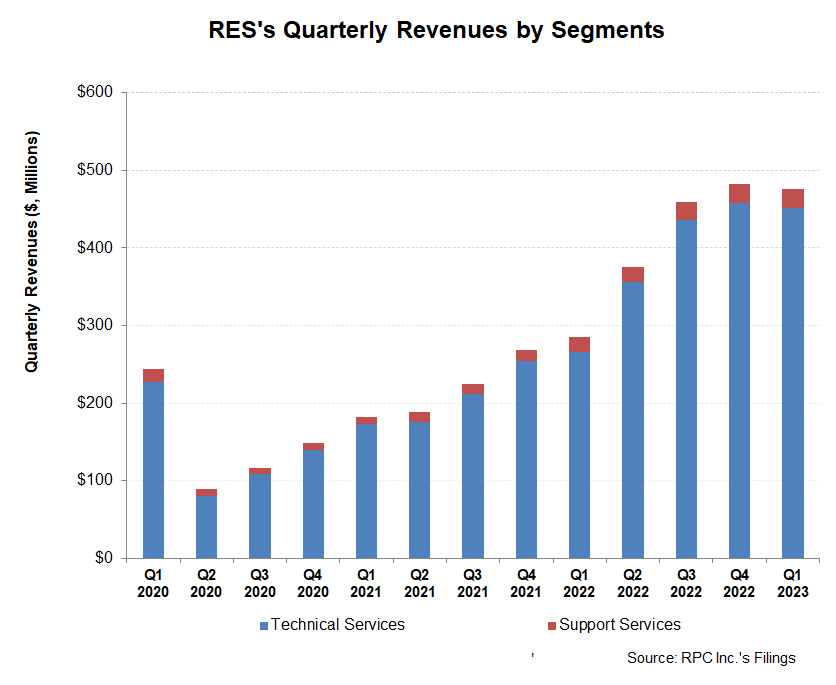

In Q1 2023, the company’s Technical Services segment revenues decreased marginally in Q1 compared to Q4 2022. The Support Services segment saw revenue growth (3.3% up) in Q1, while the operating income remained unchanged. Overall, the company’s cost of revenues (as a percentage of revenues) remained steady despite weather disruptions and an adverse change in the job mix in pressure pumping.

Cash Flows And Liquidity

As of March 31, 2023, RES had no debt and positive cash & cash equivalents balance ($178 million). To guard against any liquidity strain, the company can tap from its robust liquidity (revolving credit facility plus cash & equivalents) of $261 million. It has improved cash flow from operations significantly in Q1 2023 compared to a year ago, which turned its free cash flow positive versus a negative FCF in Q1 2022.

In FY2023, it plans to spend $250 million-$300 million in capex, which would be 72% higher than in FY2022. So, free cash flow may come under strain in FY2023.

Relative Valuation

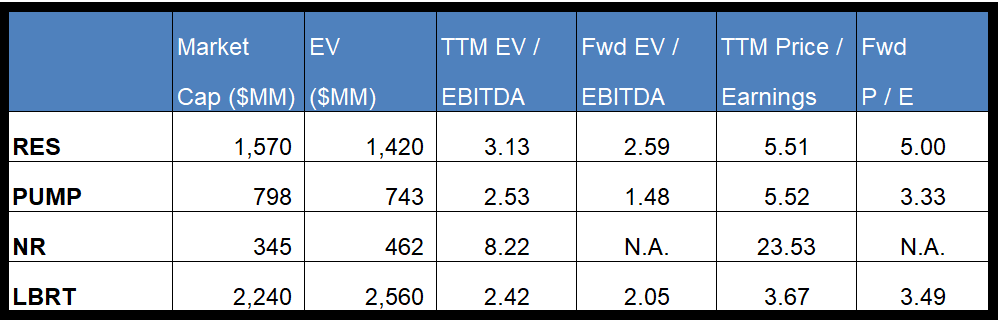

RES is currently trading at an EV-to-adjusted EBITDA multiple of 3.13x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 2.6x. The current multiple is significantly lower than its five-year average EV/EBITDA multiple of 29.7x.

RES’s forward EV-to-EBITDA multiple contraction versus the adjusted current EV/EBITDA is less steep than peers because the company’s EBITDA is expected to increase less sharply in the next four quarters. This typically results in a lower EV/EBITDA multiple than peers. The stock’s EV/EBITDA multiple is lower than its peers’ (PUMP, NR, and LBRT) average. So, the stock is reasonably valued versus its peers.

Final Commentary

After Q1, RES, while keeping the total frac spread operating unchanged, added a new Tier 4 dual fuel equipment and sent old equipment for refurbishment. Geographically also, it made readjustment with locations spread around East Texas, Mid-Continent, and the Permian. Nearly half of these frac spreads are on the spot rate, while the rest are dedicated.

The rig and frac spread count in the US remained steady over the past year because of the tight demand-supply balance. RES’s cash flow from operations increased significantly in Q1 2023 compared to a year ago, which positively turned its free cash flow. But its capex can grow in 2023 as it invests in converting the old equipment into more fuel-efficient pressure pumps. A robust balance sheet will allow it to remain relatively financial risk-free. The stock is reasonably valued versus its peers at this level.