Despite clear indications of a global economic slowdown there still exists much confusion about the future of asset price valuations in general and oil prices in particular. I was on Asharq with Bloomberg yesterday and the host asked a very interesting question referring to the state of market as vagueness. In my mind there is no vagueness.

Oil prices will rise and fall. Global economic indicators will be perceived and interpreted differently but none of that changes the fact that a recession is afoot.

First, it is important to remind what is a recession? Informally it is defined as two consecutive quarters with negative growth. U.S.’ National Buraue of Economic Research (NBER), defines it as a “a significant decline in economic activity that is spread across the economy and lasts more than a few months.” It has a criteria: depth, diffusion, and duration. According to NBER a recession should effect the economy broadly and not a particular sector. That is exactly what has already happened as a sectoral slowdown has given birth to ideas such as Rolling Recession (about which I wrote here). However, I think that phase might be over now and we are heading for that broad based slowdown. A very important point mentioned under the Business Dating Cycle at NBER’s wesbite is that “The committee’s approach to determining the dates of turning points is retrospective”.

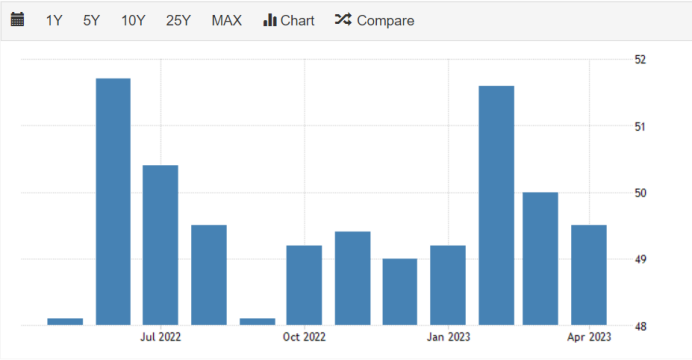

Recently some important data points came to the surface. The most important one is the unexpected fall in China’s PMI. China’s Manufacturing PMI fell unexpectedly to its lowest levels since the post-covid re-opening. It fell to 49 in April down from 52 in March. A subindex fell even further to 48.8 from 53.6 hinting towards weak economic activity. Index to measure New Export orders fell from 50.4 to 47.6 – Lowest in three months. This can also be corroborated by the recent increase in China’s oil exports and rise in refinery suggesting weak domestic demand as most of the oil still flows to strategic inventories.

Asia’s crude oil imports fell to its lowest in 7 months. Asia imported 26.39 mbpd last month as compared to 27.6 in March which was also lower when compred to what was strong start to the year with imports at 29.13 in January 2023. This decline was also most pronouned in China where oil imports fell down from a 34 month high of 12.37 in March to 10.67 in April.

Exports in South Korea also slumped suffering from the longest “losing streak” in 3 years. SK’s exports fell for 7th consecutive month. Exports to China were 26.5 percent down – 11th consecutive decline.

Now against this backdrop I find the following headlines funny. We move from ‘recession fears are fading’ to ‘markets down as recessionary fears are taking hold’ in a matter of a few hours!

I will try and cover more indicators in our Monday Macro View show tonight. Stay tuned! Happy Reading!