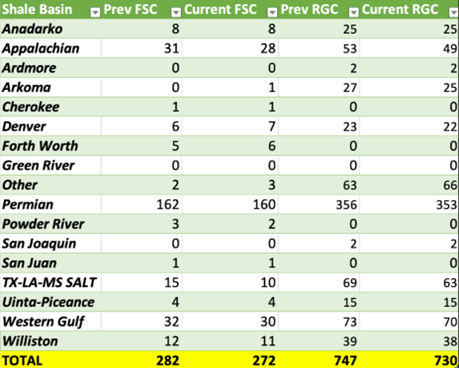

The frac spread count had a sizeable drop this past week driven by natural gas activity. As natural gas prices remain depressed, we no longer expect to see spreads sit between 285-295, but rather a reduction of 10 with a new range of 275-285. The shift has happened in both rig activity and completions across the natural gas space. We spoke about the slowdown in dry gas, but it’s now expanding further into the wet gas regions. The reductions in Appalachia, OK, and Haynesville will remain over the next few weeks causing us to adjust estimates. We don’t see a drop on the crude side, but there is a broader issue on Waha gas realizations. Waha gas is trading below $1 with Waha pool trading firmly negative, which is a broad issue on realizations. This will limit additional activity in some regions and keep E&Ps focused on oil-based sections.

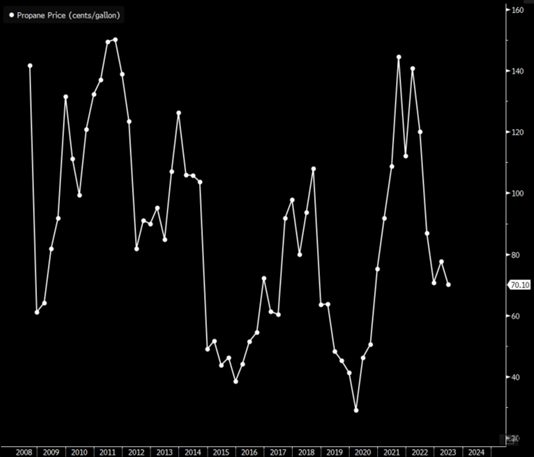

There is a shift in the way LPG and NGLs are pricing, which is a long term positive. We have discussed on the insights and EIA shows how local NGL demand has weakened on the back of soft chemical activity. But, even as that has transpired, we are still seeing a bit of a floor in LPG pricing as exports accelerate. The demand around the LPG remains robust with even more NGLs pricing themselves into the global chemical feedstock market. This won’t be enough to drive prices higher, but it will put a bit of a floor in how low things can actually move.

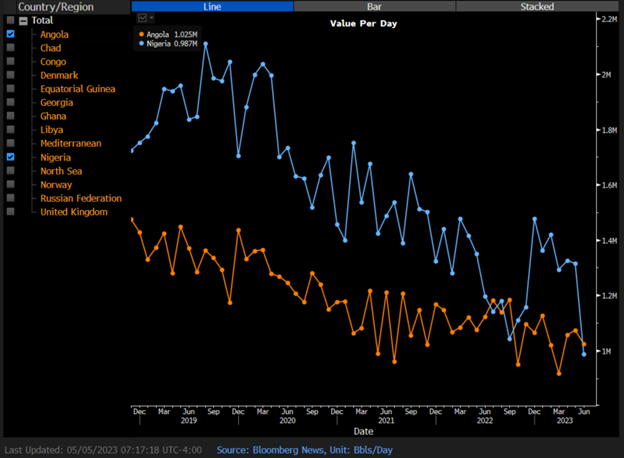

We talked about this on the EIA show, but I think this is an important update when considering the issues on West African flows. This is a pivotal swing region that is showing more pressure to the downside, and a key reason why we have been saying the physical market is weakening again. The below gives a good overview that we will dig into more throughout the rest of the insights.

WAF SALES:

NIGERIA:

- As many as 25 shipments of Nigerian crude for June loading are still searching for buyers

- That’s the bulk of the cargoes scheduled for next month, with at least 32 planned, according to data compiled by Bloomberg so far

- NOTE: June schedules were delayed of Exxon Mobil’s Erha, Usan, Qua Iboe and Yoho grades as a result of last month’s industrial action at the company’s terminals offshore Nigeria

- Additionally, as many as 10 cargoes from prior months are also yet to be sold, the people said

- NOTE: The unsold tally could vary depending on the rate of cargo deferrals following the Exxon Mobil strike

- Sales slow partly due to strong competition in Europe, where refiners can choose from an abundance of sweet crude from regions including the US, Mediterranean and North Africa, the people said

ANGOLA/CONGO:

- Angola’s sales have slowed from last week with about 6-7 cargoes still looking for buyers out of 32 scheduled: traders

- Compares with 7-9 unsold as of May 5

- The preliminary schedule for July loading is due to be released next week

- One cargo of the Republic of Congo’s Djeno crude is still searching for a home out of six planned

- Unchanged from May 5

- The next Djeno program is due about May 24

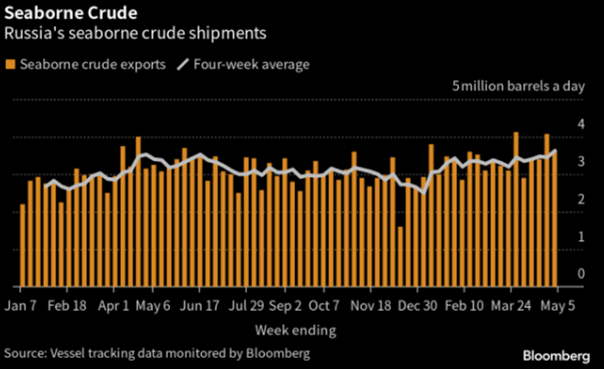

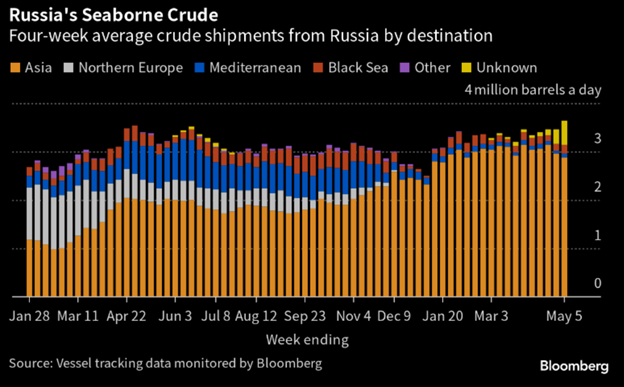

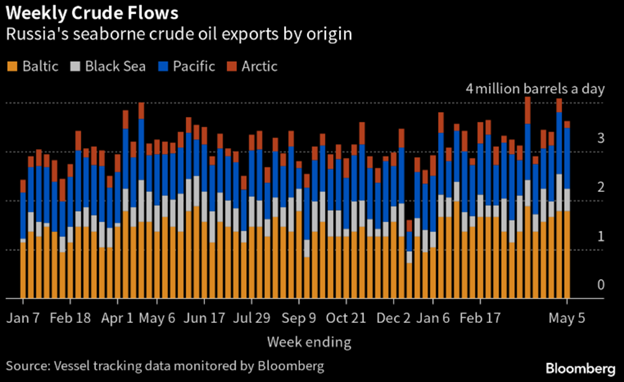

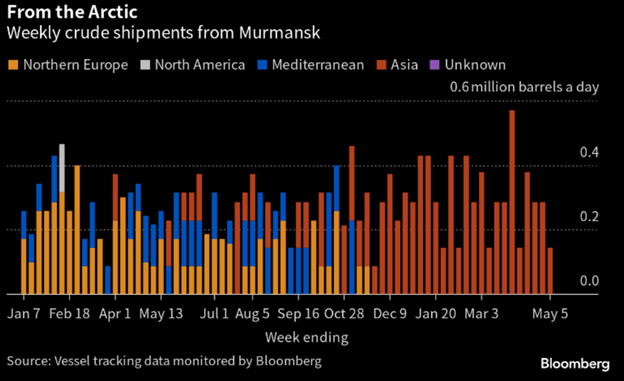

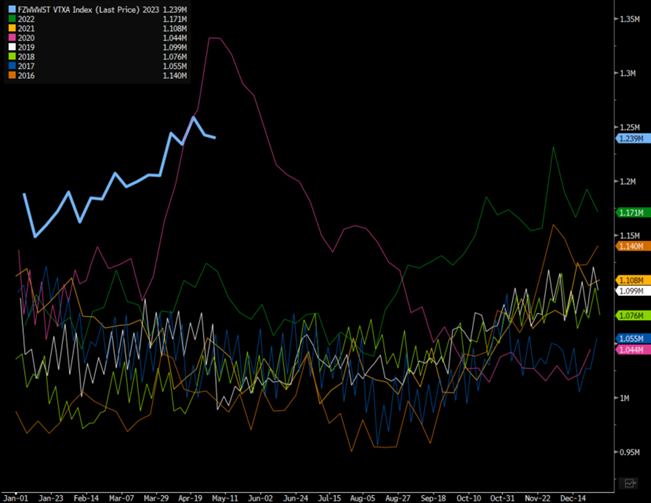

One of the key things we have highlighted is the importance of looking at seaborne crude and underlying exports to check for OPEC+ cut compliance. We discussed how Russia’s oil production cut had to happen because it was overwhelming their refiners and export infrastructure. Russia doesn’t have enough storage for their current production because it was never required as a large part of their flow moved by pipeline. As pipeline exports in crude and products dropped, Russia had to shift into the export market to a massive degree that their facilities just can’t handle. This is a long way of saying- Russia probably DID cut their production, but it doesn’t mean their exports would drop.

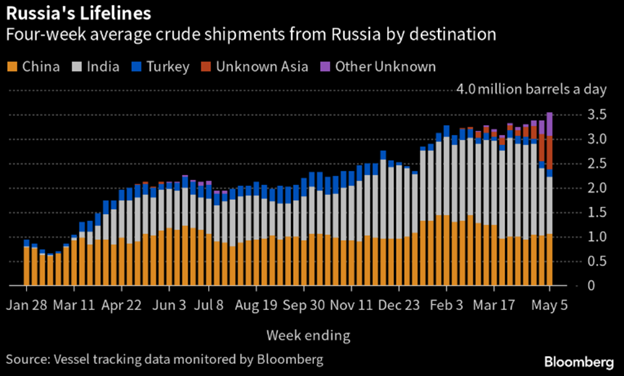

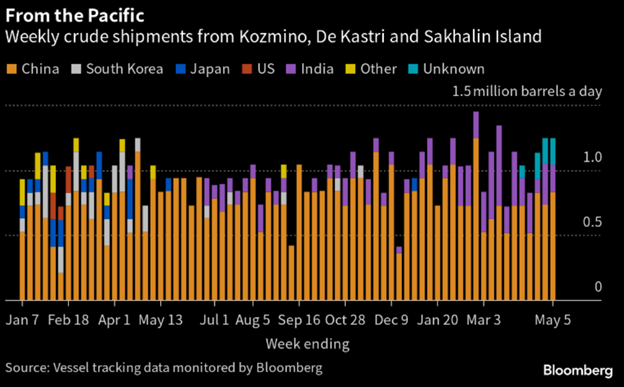

Crude shipments have maintained their pace even though the cut was supposed to take effect. The lion share of the flow is still heading to Asia with the largest component still being India/China.

The below chart puts into perspective the limitations of their export capacity, and why they don’t have the ability to truly push above the current level. This is a fundamental reason we believed the production cuts wouldn’t result in a drop in exports.

ESPO has been a pivotal for Russia to keep product flowing, which is now fully absorbed by China and India.

We still believe that Brent will hold between the $73-$77 range, but really average right around the $75-$76 thresholds. This is a spot where OPEC is comfortable keeping prices, but as demand deteriorates further there will be more downside pricing pressure. It will take time for this to price into the market and is likely a June event as diesel struggles and gasoline demand fails to materialize at current expectations. A key issue for the U.S. is the flow of gasoline into PADD 1 from Europe. We have been saying that as shipping rates fall and gasoline arbs open- a wave of European gasoline is going to hit PADD 1. “European gasoline arrivals in the US surged to a three-week high in the seven days through May 4.” There is still a significant oversupply of gasoline in Europe, which will find its way into the U.S. markets and keep the rate of change of gasoline storage well above seasonal norms. Diesel will face a similar situation as more Russian diesel takes U.S. market share and causes builds to accelerate above seasonal norms.

The end of April and first week of May saw some accelerated buying in West Africa, but the purchases have started to slow down creating some downward pressure on pricing.

PLATTS:

- BP offered 1m bbl of Angola’s Girassol crude for June 4-5 loading at $1.05/bbl more than Dated Brent: person monitoring window

- Decreased from +$1.10/bbl on May 5, +$1.90/bbl on May 4

The slowdown in purchases isn’t caused by a surge in supply as Nigeria and Angola flows have been dwindling. The shift in WAF all comes down to changing flows for Asia, as well as the massive bump of Russian crude into the region. Europe hasn’t been the buyer people were hoping for on the other side of COVID creating a broad glut in key areas.

West African floating storage is starting to creep higher again, and it will be important to see how much volume Asia and Europe picks up. It will likely remain at elevated levels but won’t hit the highs we saw in previous years.

The Middle East was able to clear some of their storage, but it will be important to see what happens through the month of May. Typically, volumes clear as we get to month end so the next few weeks will be important to see if the production cuts are having their desired effects in the region.

Total crude on the water remains at elevated levels with more cargoes going into transit, which has helped pull down some floating storage. There’s still an insane amount of crude sitting on the water with more coming as Russia maintains current exports. The biggest question market is- “How much will China continue to buy?”

Chinese imports have started to slowdown from a seasonal record, and it’s likely a lot of their big purchases have wrapped up for the season. When we look at seasonal spikes, April into May is usually the peak of buying until we get to the back half of August. There is typically a sizeable decline as we head into June that troughs around end of July/Early August. The market is expecting China to maintain a consistent buying program, but that doesn’t match up with historical purchases and underlying refinery operations.

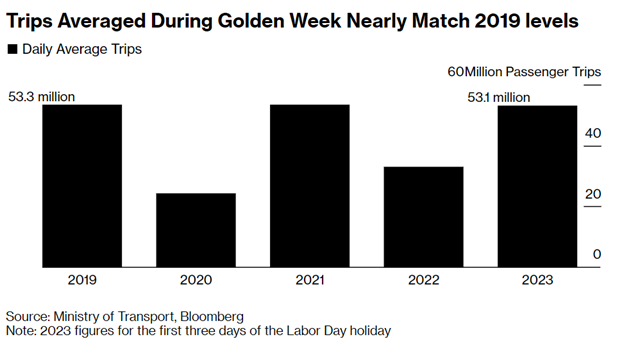

Chinese exports remain elevated, and the next leg of export quotas will be important to see what storage looks like internally. We have already seen a broad problem with diesel demand driven by slowing economic activity as we have seen on the manufacturing component and new orders. Consumer spending hasn’t normalized, but we did get a nice bump in Golden Week travel. The big focal point now will be how traffic rebounds following the holiday.

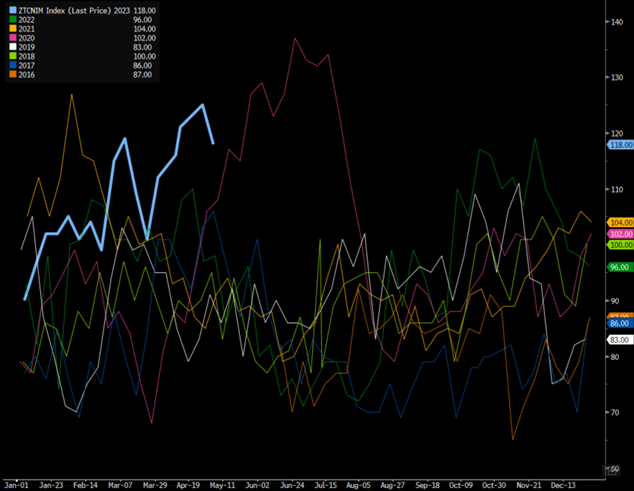

So far- the activity has tracked closely to last year in terms of movements, but so far- above 2022. It will be important to see how it bounces back from the dip, and if it can move back to the upper levels achieved in April.

China announced the new export quotas, which came in at the high level of estimates. The expectations were for between 9-13M tons with the following breakdown coming in:

- Refined products quota set at 9 million tonnes

- Marine fuel allotment at 3 million tonnes

This provides a broad opportunity for Chinese refiners to bounce between local or international markets more freely. Even as Chinese exports have diminished, they still remained above expectations, and this increase in quotas provides more flexibility. “This year, quota holders have greater flexibility to prepare export plans and capture arbitrage opportunities,” said Energy Aspects analyst Sun Jianan.” Typically, the second batch of quotas is below the first- so it’s important to look at this against y/y. “The quota was less than the first batch of 18.99 million tonnes in early January but double the allocation of 4.5 million tonnes issued around a year earlier, Reuters records show.”

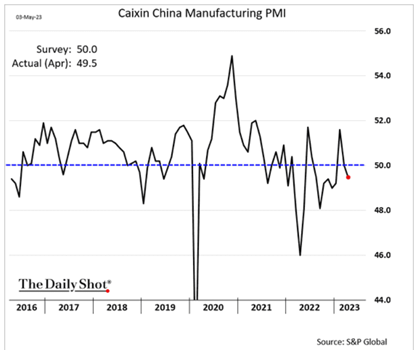

Chinese demand is also showing cracks as manufacturing slows further.

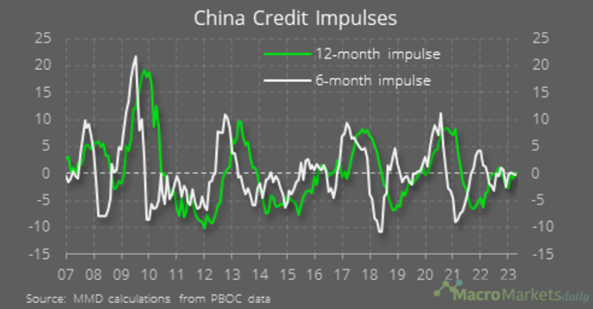

There is a lot of “hope” around Chinese demand that we don’t expect to appear to the degree the market expects. “So much for China opening the credit taps – after a jump in March, credit growth was much weaker than expected in April, and the credit impulse has been neutral for several months now.” We have been saying that the PBoC has a goal of maintaining credit impulses between -1 and 0 as they try to gradually remove liquidity from the system. We don’t see any massive stimulus coming to market, and instead- everything is pointing to more restrictive activity.

Another red flag for activity is the reduction in imports that also had VERY easy comps vs last year. There is hope that the drop in imports and slowing industry will spark more support, but we don’t think that is likely given the level of liquidity that remains in their market. SPBs (Special Purpose Bonds) have been massively front loaded, and the PBoC isn’t in any hurry to dump more on top of it.

On Tuesday, the General Administration of Customs released April’s trade data.

The headlines:

- Exports rose 8.5% y/y in dollar terms in April, compared with a 14.8% y/y increase in March.

- Imports dropped by 7.9% y/y last month, versus a 1.4% y/y fall in March.

- The trade surplus was USD 90 billion in April, compared with a surplus of USD 88.2 billion in March.

The sharp drop in imports puts the sustainability of China’s post-COVID economic recovery into the spotlight.

- The median forecast among analysts was for a 0.2% y/y fall in imports.

- April’s plunge also came from a low base, with shipments this time last year disrupted by COVID lockdowns.

Exports fared better, but a deeper dig into the data shows the growth was a little underwhelming.

- The y/y growth rate comes from a low base due to COVID disruptions.

- In m/m terms, exports fell 6.4% in April this year.

- The official manufacturing PMI also highlighted weaker overseas demand, with the exports new orders index falling from 50.4 in March to 47.6 in April.

Get smart: As the favorable base from last year fades, exports will shift from being a boost to a drag on growth.

- To offset that drag on growth, officials need to do more to lift domestic consumption.

Our take: This trade data may convince policymakers that additional support is needed to consolidate the post-COVID economic recovery.

Another broad headwind for activity is the crackdown on foreign companies as well as a push for state-owned enterprises (SOEs) playing a bigger role in China’s tech innovation push. By pushing more for SOEs, it will likely crowd out the upstarts, especially because money/ government support will flow to the government assets vs private sector.

Beijing wants state-owned enterprises (SOEs) to play a bigger role in the country’s tech innovation push.

- That’s the message from Monday’s meeting between the Ministry of Science and Technology (MoST) and the SOE administrator (SASAC).

Some context: After its massive reorganization in March, MoST is spearheading the country’s tech innovation push.

- That means MoST gets to decide where state resources will be distributed.

Wang Zhigang, head of MoST, gave SOE innovation his full endorsement (MoST):

- “Central government SOE are an important strategic force for sci-tech innovation.”

- “[We] should support them to…win the battle for key core technology.”

Zhang Yuzhuo, head of SASAC, didn’t shy away from asking for help. He asked MoST to support SOEs to:

- Set up national scientific labs

- Build state-owned tech champions

- Participate in major basic research projects

Get smart: Zhang and SASAC are likely to get what they ask for. That’s because Xi Jinping has signaled that he wants SOEs to lead the charge in developing core technologies.

Get smarter: This is a suboptimal innovation policy, to say the least.

- Showering resources in the state sector will crowd out the much more innovative private sector.

“China’s crackdown on data access to overseas firms is adding to concerns about how Beijing controls the flow of information in the country, making it difficult for investors to assess the state of the economy. In recent weeks, domestic data company Wind Information Co. has stopped providing some information to overseas clients, US consultancy Bain & Co. was targeted by investigators and business intelligence firm Capvision raided as part of a new anti-spy campaign. The lack of access to information goes much deeper than that, though. For at least a year or more, data providers — some official and others private — have been restricting information like academic papers and court judgments, official biographies of politicians, and bond market transactions. “At the end of the day it’s becoming harder to analyze what’s going on in China,” Hao Hong, chief economist at Grow Investment Group, said in an interview on Bloomberg Television on Monday. As Chinese data gradually becomes less available, “people learn to get around the issue” by using different data sources, he said.

Corporate Data

Wind in recent months stopped giving offshore clients access to its corporate registry database, according to multiple people familiar with the matter, citing regulatory requirements. Registry databases at Qichacha and TianYanCha — companies that provide similar services — have also been inaccessible for some time to users outside mainland China. There’s been no official confirmation or explanation for the data restrictions, although the Wall Street Journal reported that Beijing wanted to curtail the information in part because of a series of reports written by US research institutions that alarmed officials.”

There has been a growing crackdown on international/ foreign assets is creating a much bigger issue for further investment in China. We have been discussing the government crackdowns for years now, and Xi has been talking more on “anti-corruption” and other means of increasing internal controls. I agree with some parts of the below, but I do believe this is a broader target on international/foreign companies. There is clearly a connection to information leaks, but this has been growing for over a decade- with a big push over the last 5.

Recent national security raids on private consulting firms Bain, Capvision, and Mintz have raised alarms among the foreign business community.

- Fears are high that the raids form part of a broad campaign targeting foreign businesses.

Recap:

- In March, authorities raided the Beijing offices of US corporate investigations firm Mintz Group, detaining five of its staff.

- In April, authorities raided the Shanghai offices of US consulting firm Bain & Co, questioning employees.

- This month, officials confirmed they had raided multiple offices of the New York- and Shanghai-headquartered research company Capvision for counterespionage reasons.

Adding to the panic: An official information vacuum.

- Chinese officials have not publicly commented on the raids.

- Domestic media has been mum on the Mintz and Bain raids, while the Capvision probe has so far only been the subject of a 15-minute CCTV documentary.

- And we’ve not heard much from the companies themselves.

So what’s going on? There are still many unknowns, but we have a reasonable idea of what the campaign is and isn’t about.

Let’s get this out of the way first: The campaign isn’t targeting foreign businesses.

Instead, it is focused on a specific activity: Namely, insiders at Chinese companies or quasi-government bodies selling sensitive information – related to national security or commercial trade secrets – to firms, who then sell that information to foreign companies or governments.

CCTV’s Capvision documentary backs up this view. It noted that the company had persuaded Chinese experts to advise foreign clients “in sensitive areas including national defense, military industry, and cutting-edge technology.”

- It provided the examples of a former senior researcher at a state-owned enterprise and a former post-doc at a military research institute as examples of experts who had shared sensitive information with foreign clients.

Whether the firms brokering the passage of the information are Chinese or foreign is irrelevant.

- What is relevant is that there is a flow of sensitive information to foreign entities via third parties.

Previously, this trade took place in an unregulated gray zone: But – against a backdrop of growing tensions and competition with the US and its allies – stamping the trade out has become a national security priority.

- The major concern is that critical information obtained through this process could be used to sanction or outcompete Chinese companies.

This helps to explain why China recently updated its counterespionage law. The update expands the law’s coverage from state secrets and intelligence to “documents, data, materials or items related to national security and interests.”

The good news: Foreign companies can breathe a sigh of relief.

- The recent raids are not part of a broad campaign targeting foreign businesses.

The bad news: The raids are examples of the broadening concept of national security in action – with authorities desperate to plug information leaks across the board.

- The practical implications of this broadening are still unclear.

- Firms must tread carefully to avoid setting off recently laid national security tripwires.

More bad news: Getting business-critical information on China is only going to get harder – and that makes life tough for companies considering whether to increase their China exposure or reduce it.

COVID-19 caused another problem for Xi because it expanded inequality across classes as well as provinces. This flies in the face of the “Common Prosperity” goals that have been a pillar of Xi’s path forward. The below gives a key breakdown of something we believe will become a much bigger component of policy going forward.

The COVID-19 pandemic worsened inequality in China.

According to data released by the stats bureau on Tuesday (NBS 7):

- In the private sector, the average wage in the highest-paying industry was 2.91 that of the average wage in the lowest-paying sector.

- That’s up from a multiple of 2.26 in 2019.

Regional wealth gaps also widened.

- Workers in China’s eastern provinces make comparatively more than their counterparts in other regions when compared to 2020.

Get smart: These stats fly in the face of Xi Jinping’s Common Prosperity initiative to reduce inequality.

Get smarter: With the pandemic in the rearview and the economic recovery picking up pace, we expect Common Prosperity to become more of a policy focus.

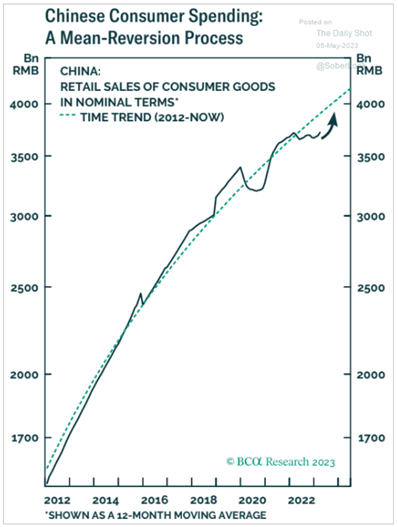

We continue to believe that the consumer will remain elusive as the global economy slows and industrial capacity wanes. Our view is that Chinese spending goes side-ways from here rather than closing the gap higher. There won’t be a “collapse” but rather a steady state at this level with more pressure to the downside in the near term.

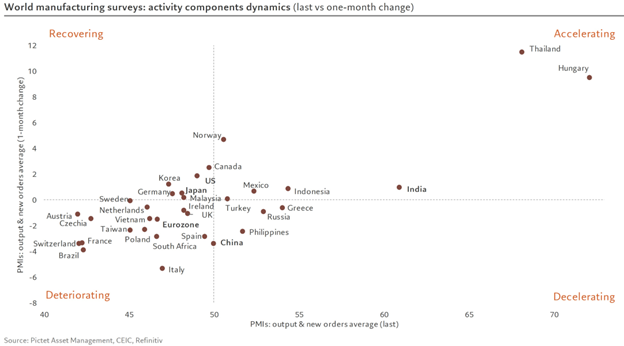

On a global basis, we are seeing a broad slowdown in industrial activity around the world. April global manufacturing PMI was down two tenths of a point to 48.7, below the 50 threshold for the 8th consecutive month. EM Asia ex-China is one of the only regions to accelerate over the month (+0.5pt to 52.7). 30% of countries stay in expansion (>50) of which 9% are slowing down and 21% are accelerating, Thailand the most. 18% are recovering, including the US & Japan. 52% deteriorating, Italy the most. We have been highlighting this as a key problem for underlying growth, and why we believe the IMF is overstating GDP in 2023 and 2024.

I think this chart gives a good breakdown of the struggling points of the global market. Many of the economic engines of the world are either decelerating or deteriorating.

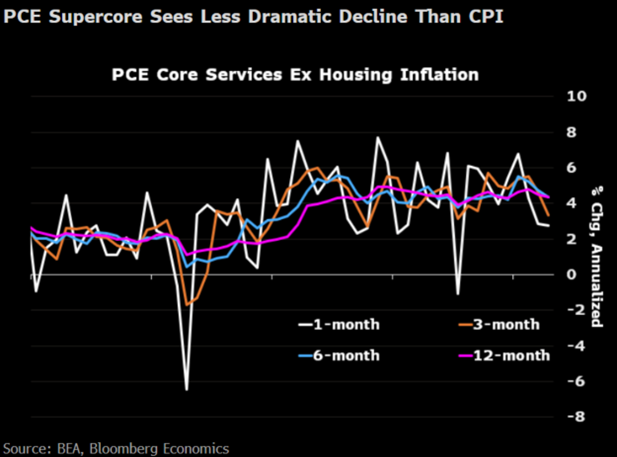

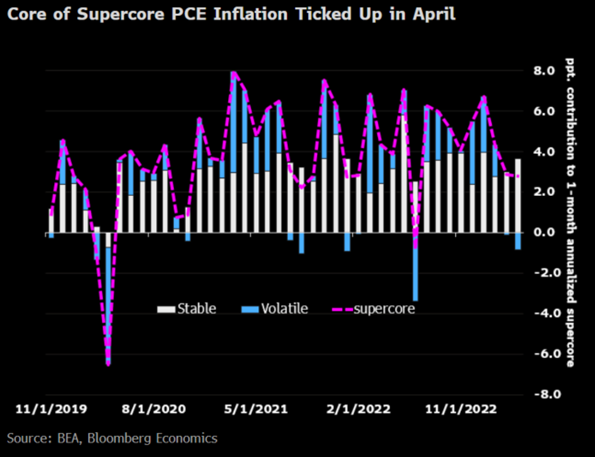

Another important point is the persistent inflation impacting the global consumer. The U.S. data breakdown I think does a good job of encapsulating what every region is experiencing. We have discussed the absurdity of only looking at 24%-25% of the consumer basket, because when you even expand it a little bit- you see how damaging price increases are for the average consumer. Even with this refinement, the PCE’s “sticky” group is still more comprehensive than the CPI’s supercore measure – it accounts for 41% of the consumer basket, in comparison to supercore CPI’s 25%.

- This exercise reveals that there has been barely any disinflation progress in recent months. In fact, the sticky group we just mentioned — call it the core of the supercore — likely accelerated in April.

- Bottom line: We don’t take much solace from April’s CPI and PPI readings. The news from the PCE version — due out May 26, a week before the next FOMC meeting — will likely be far less encouraging.

- There are two problems with that interpretation. First, the CPI’s supercore measure is a poor proxy of the one Fed Chair Jay Powell watches — PCE core services excluding housing rents. There are two notable differences:

- The CPI version accounts for only 25% of the consumer basket, while the PCE analogue accounts for about 50% of the basket;

- The PCE index is a more comprehensive measure of prices in the economy – for example, taking into account health-care costs that employers pay on behalf of workers. Airfares and hospital and physician costs, for example, are two categories where the PCE often departs from the CPI. In April, PPI medical-care services, which enter into the PCE, showed much firmer inflation than the CPI.

These issues are striking around the world and will keep the consumer under pressure- especially in the emerging markets.

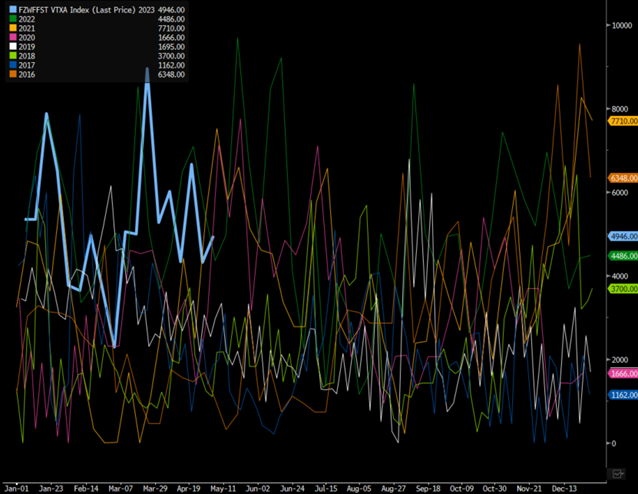

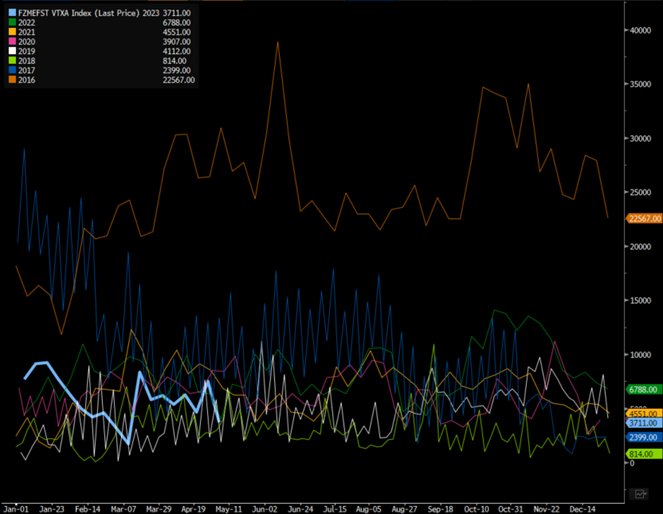

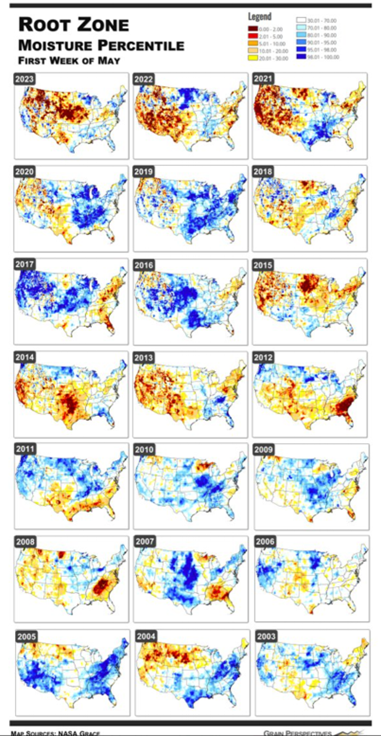

The global food situation is teetering on a knife’s edge as yields weaken, weather patterns shift, and geopolitical tension escalates. There are many ways to look at stress points for how a crop’s yield will be, and it shouldn’t be surprising that many of them focus on moisture/precipitation levels. A food crisis doesn’t build overnight, instead, it compounds over time as limited volume becomes available for the world. Every country has grain silos and other storage facilities to help bridge gaps, but the world also needs “bumper crops” to help refill the coffers for the lean years. The problem remains that the lean years are become more pervasive while the “bumper” years are fewer and far between. Droughts in pivotal growing regions are become more pervasive, which is made worse by over farming, soil degradation, overuse of fertilizers, poor crop rotation, and other limiting factors.

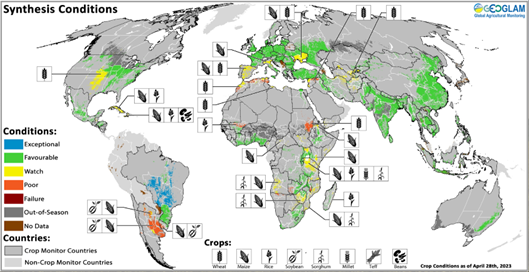

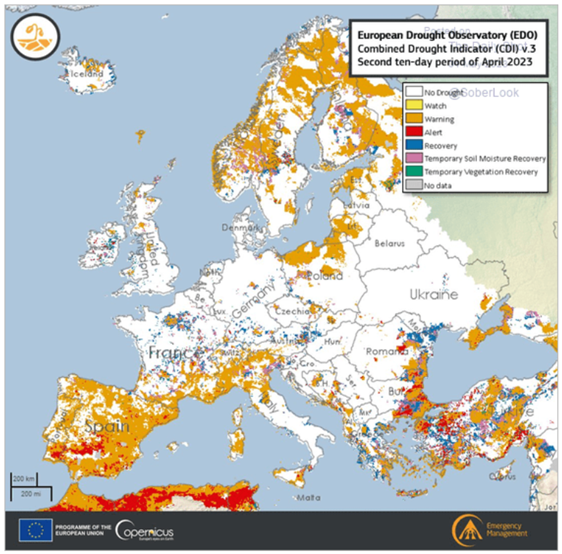

Here are a few charts looking at the drought conditions when evaluating potential yields. It’s important to track multiple versions of crop monitors because there can be some variation in methodology as well as timely data collection. On a global basis, we have seen some improvement out of India and Western Europe, while there has been further degradation in North America and Argentina. Brazil started off weak, but with recent rain fall- there has been a bit of a recovery. Central Asia and Africa continue to struggle, which is a huge problem when you consider where the most stressed farmers and local populace reside.

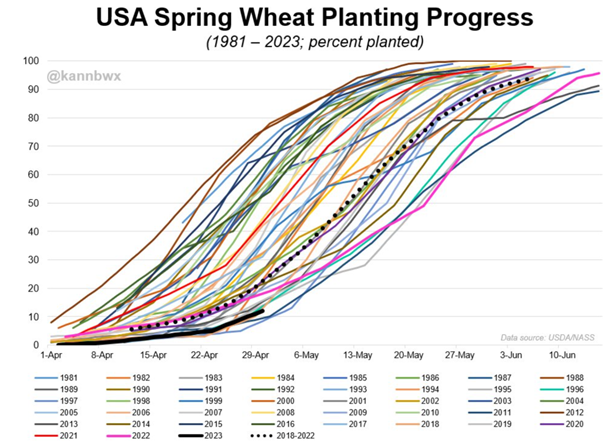

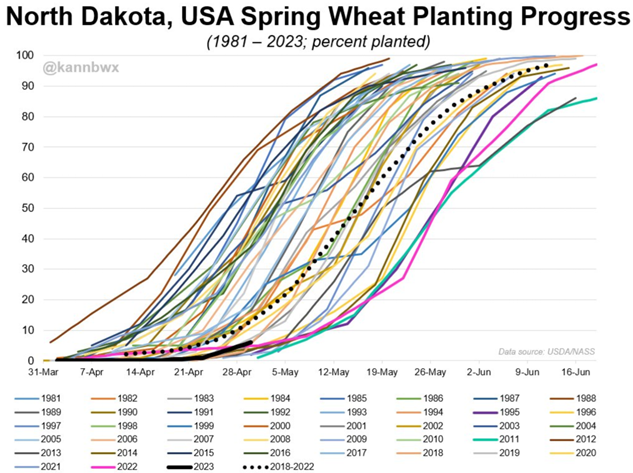

The availability of product is putting more stress on these sensitive locations that are struggling to source the shortfalls. There are several different growing seasons, and it’s important to track the progress of them as we go from one to the next. U.S. winter wheat was one of the worst harvests in our history, and so far spring wheat isn’t fairing much better. “U.S. spring wheat was 12% planted as of Sunday, the third slowest for the date behind 1997 & 2011. Last year started a bit faster, but overly wet spring weather led to a record slow planting pace by late May 2022. Spring wheat acres are forecast at 51-year lows in 2023.”

“Top spring #wheat grower North Dakota is 6% planted, behind average of 13% but ahead of last year’s 5%. ND has gotten a slow start in a handful of other years, but avoiding the 2022 progression will be key.”

Farmers are going to plant what they believe will unlock the most value mixed when it fits into their crop rotation. Each crop requires a different amount of nutrients and is either a net negative or positive for what it removes from the soil. For example, corn is essentially a weed that removes a lot of nitrogen from the soil while alfalfa is a net positive that replenishes nutrients in the soil. As corn acreage grows, it will require more nitrogen to be placed on the soil to ensure a successful crop and underlying yield. Wheat is a neutral crop, but there are global issues when we look at food flows for the global population.

Wheat is a pivotal crop for global consumption, but we are seeing problems in the U.S. as well as other areas in Africa as well as Russia/Ukraine. The deal that is front and center is the Ukraine Grain Export Deal. Ukraine is alleging that Russia is blocking ship inspections. “Russia has blocked the registration and inspection of ships that should take place under the agreement, the Ukrainian Infrastructure Ministry said Monday on Facebook. Ukraine urged the UN and Turkey — which together brokered the pact — to respond to Moscow’s actions.” “The Joint Coordination Centre didn’t reach an agreement Friday to authorize new vessels to participate in the Black Sea Grain Initiative, said Farhan Haq, a spokesperson for the UN secretary-general. Traffic through the corridor has suffered repeated disruptions recently. While several outbound grain-laden vessels were cleared on May 6 and 7, no inspections are taking place on Monday, according to Ukraine.”

Russia is claiming that two Ukrainian UAVs attempted to assassinate Putin in Moscow. This can be used as a means to not renew the current grain deal that is set to expire this month. Russia has also expanded who they blame for the attack: “Tensions in the Black Sea region escalated this week after Russia claimed the US was behind a drone strike on the Kremlin without providing evidence. The US has said it was not involved and Kyiv has denied any responsibility.” These pressure points are limiting wheat and corn flows out of the region, which has already taken down expected yields. “Russia pegs its 2023 wheat harvest at 78 million tonnes, down from more than 100 mmt last year. The estimate takes into account Ukrainian territories claimed by Russia.” The pressure keeps growing as Ukraine has been unable to receive the necessary personal, equipment, fertilizer, and seeds to launch a successful planting campaign. This doesn’t even include the farmland that has been mined and is the location of current battles and fortifications. Flows from the region- whether Russian or Ukraine- will be falling significantly pushing countries to source product from other regions.

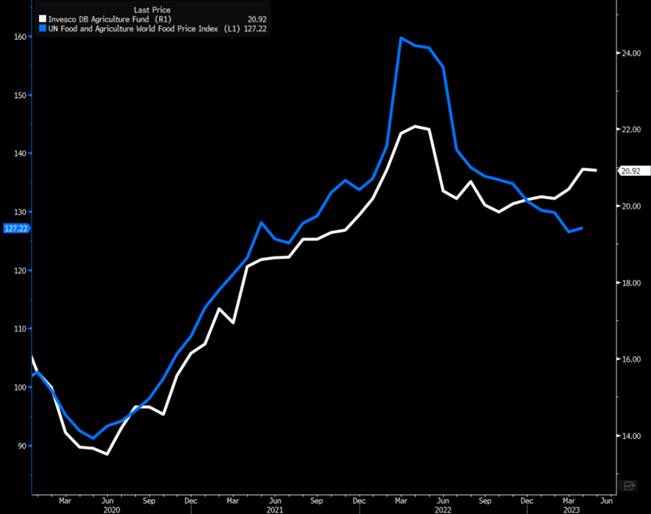

When we look at the UN Food and Agriculture Price Index, there has been some pullback in pricing, but even with the decrease- it still sits at historic levels. The Invesco Ag Fund factors in the futures, which has started to shift higher and highlights that the pressure on the consumer is far from over.

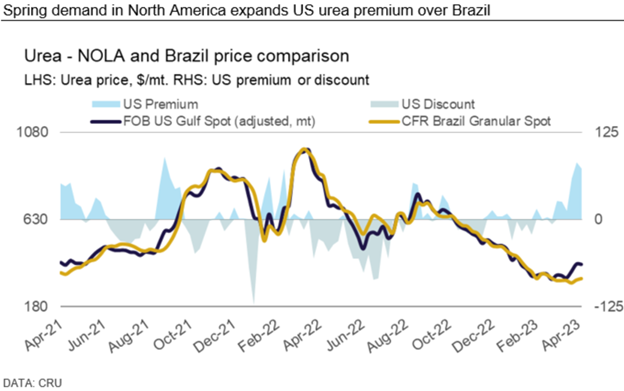

As wheat remains a problem, corn acreage has been accelerating especially in the U.S, which opens up an opportunity to pick up a key company that provides nitrogen to the industry- CF Industries. Prices for urea prices have been supported in NOLA (New Orleans), and we continue to see price appreciation given the advantaged feedstock in the U.S. “Last week, spring demand lifted urea prices at NOLA and they are expected firm for now, though weakness is expected by late May-early June. The Tampa ammonia price was agreed down $55/t for May. Support for AS prices in China and elsewhere gained marginal upwards momentum.”

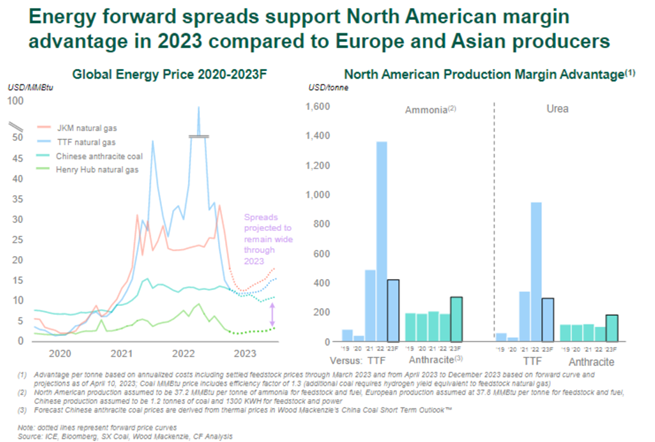

There is continued strength in the U.S. as corn acreage grows and natural gas (main input for Urea/AMS) stays at a significant discount vs global cost.

Global nitrogen demand is coming back as natural gas prices have fallen back down and farmers look to buy excess to replenish grain stocks. We have already covered all the different ways that the ability to cover shortages will be limited, but farmers will be incentivized to find ways to bump yield especially as costs fall. From the CF earnings call, “At the same time, forward price curves suggest that energy spreads between North America and high-cost producers in Europe and Asia will continue to be significantly wider than historical averages. As a result, we expect to continue to generate substantial free cash flow. This will enable us to both invest in growth and return capital to shareholders.” Pricing in North America started off sluggish as buyers were willing to buy discounted Russian flow, which reduced some demand for CF products. This will continue to be supported by the following “Pricing in North America has risen as demand emerged and all products started moving at a more normal rate. We expect this to be an active fertilizer season, application season in 2023 with corn acres in the U.S. expected to be up about 5% and wheat acres up around 9% compared to 2022.”

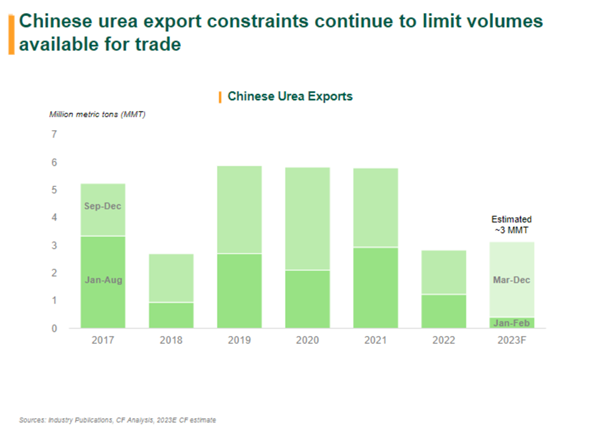

The market is still facing global Urea constraints as China has limited exports of all fertilizers. Rice requires a fairly high level of AMS, and we should see additional application to help bump yield. As China remains on the sideline, we will have more product flow from the U.S. to meet the demand.

The flow from the U.S. is supported by the advantaged feedstock vs the rest of the world.

India, Asia, and Latin America imports will remain elevated in 2023 supporting additional price appreciation on urea.

The recent WASDE data continues to show issues in the global food markets- especially on the wheat front. The market still sits in a problematic position following the tightness in the wheat market, which is a pivotal food stuff for the world- again- especially the emerging markets.