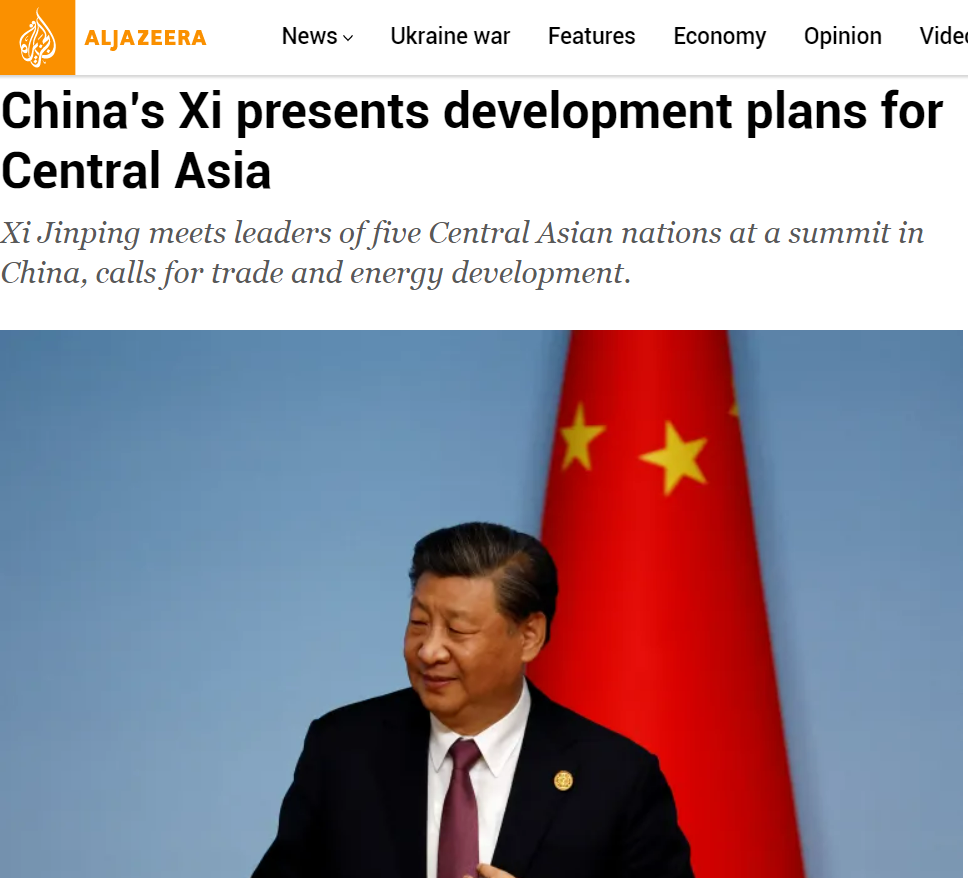

IT has been yet another interesting week. Xi revealed new and ambitious plans for Central Asia in the recent China-Central Asia Summit held in Xian. China is trying to establish its diplomatic strength using trade and economic cooperation which so far seems to be working in its favor. China has promised to provide $3.8billion in support and grants to Central Asian economies. On the other hand the recent economic data coming out of the second largest economy has disappointed many.

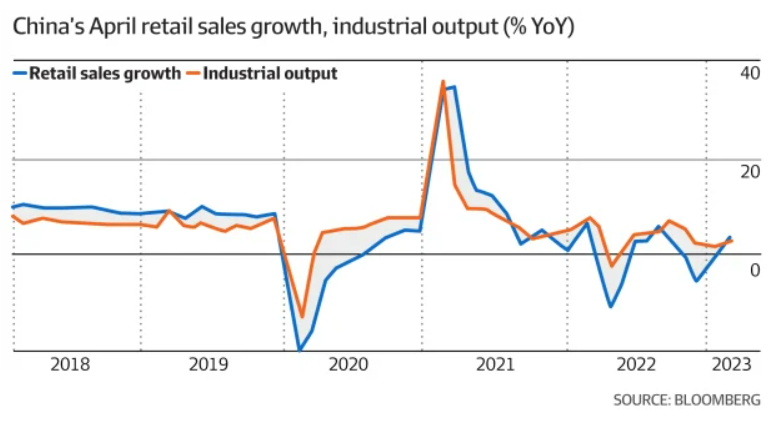

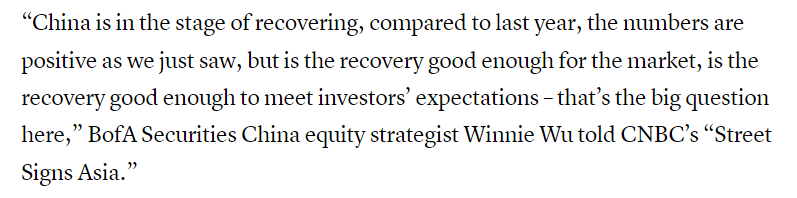

China’s consumer spending along with its industrial activity registered a slower than expected growth. Figures showing industrial production show a 5.6 percent YoY increase but much lower than the expected 11 percent. Retail sales jumped 18.4 which was also lower than the estimated 21 percent however there was also a recency bias in this data as the lockdowns had driven the figures to extremely low levels – hence, the relatively higher jump. Fixed asset investment was estimated to be 5.5 percent but came out at 4.7 percent. Imports also fell by 7.9 percent. Property sales are still weak and not reached pre-pandemic levels while consumers aren’t keen on applying for mortgages.

Source: Financial Review

Source: CNBC

Stocks also pared most of the gains:

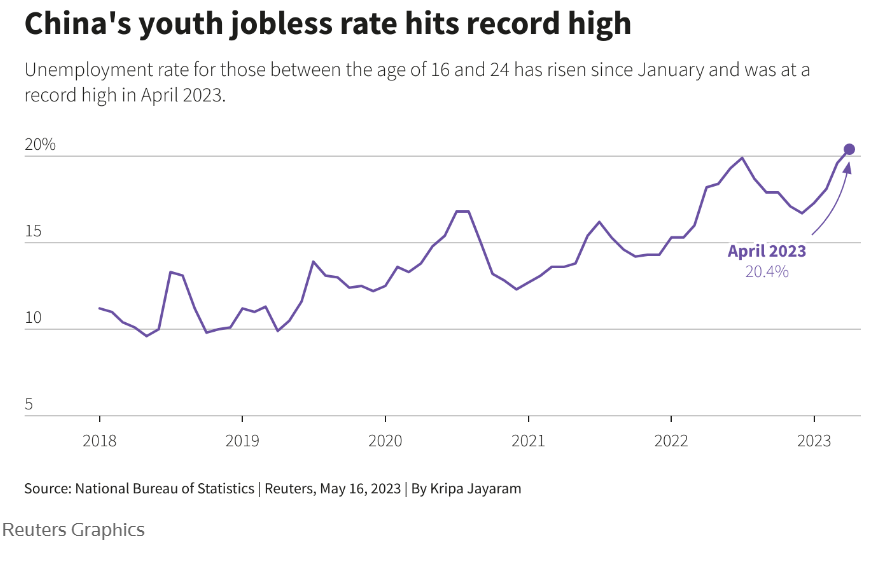

Another important and interesting reading was the increase in youth unemployment that came out at 20 percent – a record high.

Hence, I still maintain that oil prices will continue to slide. Recently, China, for the first time in 18 months, used its inventories which the country has been still adding despite lower imports and rising refinery processing. Global recessionary fears are also piling up and overall a severe economic slowdown is expected – but not yet realized.

Another important thread in the global economy right now is that of the possibility of a default – whether it will be a protracted one or a shorter version? What happens if it actually defaults? According to one estimate the economy can slowdown by as much as 6 percent!

I talk more about this in Monday Macro View – stay tuned! It will be out tomorrow.

Happy Sunday! Happy Reading!