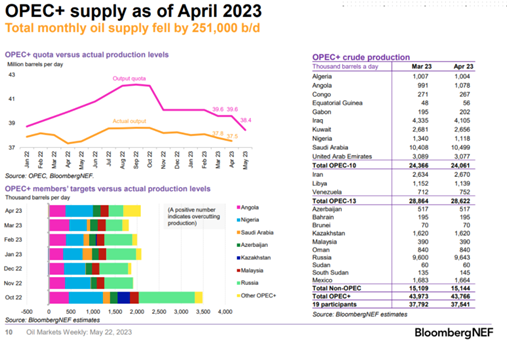

OPEC+ production fell because of Nigeria, which has been reversed for the most part in May. Angola is also increasing their exports in July as we get some additional growth out of West Africa. This is still well below their quotas- so there won’t be any risk of adjustment heading into OPEC. Actual production is still well below quotas- especially in West Africa. We believe that OPEC+ is going to stay the course on June 4th, and play up how they have provided a united front. The UAE was very clear that they don’t believe anything has to be adjusted till at least Oct, so I don’t believe that KSA will spend political capital to convince anyone to pivot.

The only risk we see is a potential “voluntary cut” that KSA would roll out- totaling maybe 100k-250k. This is a low probability setup because when you look at the cuts they rolled out and where prices have settled- it has cost them a bit of profit.

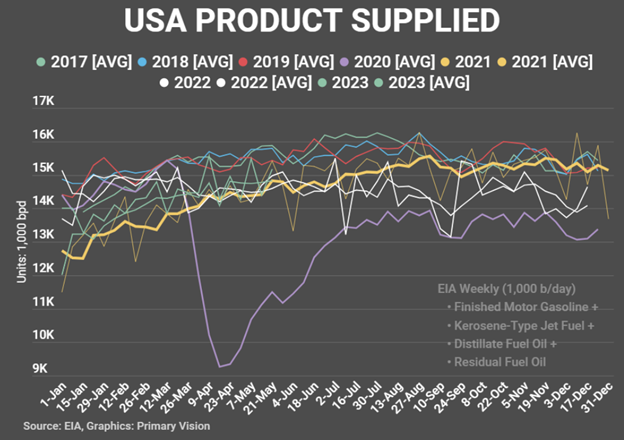

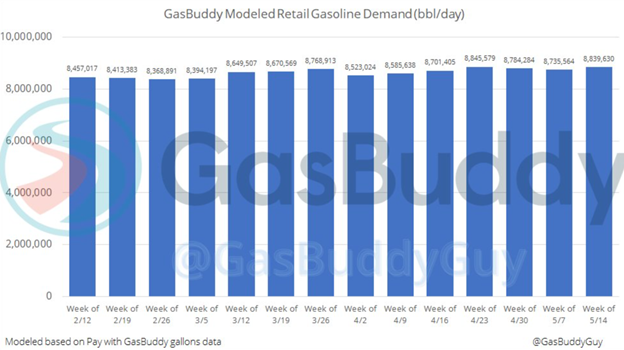

The problems remain in the demand world as economic cracks expand. The industrial/manufacturing side remains in contraction, and as we head into summer driving/travel season- the consumer is slowing down. Gasoline demand in the U.S. will have a nice pop for Memorial Day Weekend, but fade back a bit to around 8.8M barrels a day of demand. But, after the decline- we will see a steady rise in demand weekly as we head directly into July 4th weekend. From July 4th weekend throughout the next 6 weeks after, we will be at our peak. Based on the below chart, there is a normal bounce- but we are still below what has been “normal.” This will fade over the next week followed by the steady grind back higher.

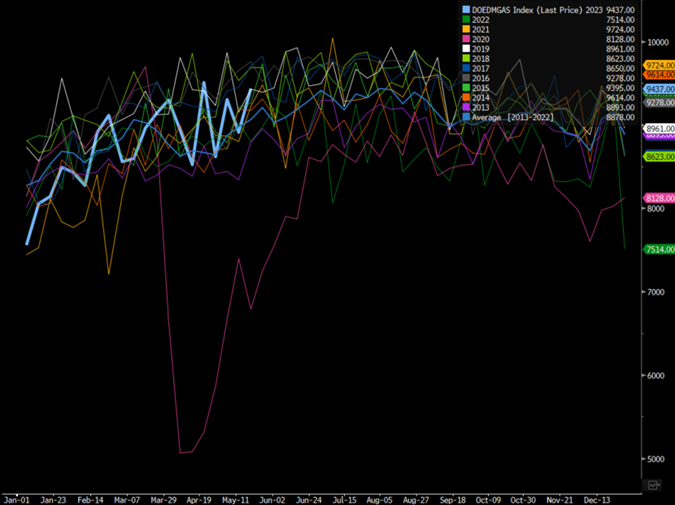

When we look at all the mobility fuels, we are still falling short of historical norms. On a 4 week rolling average, there is a consistent shortfall against previous years. So far, we are even falling behind 2022- but on an average basis- we will likely be very similar.

The data was confirmed from Gasbuddy when we look at the general level of activity. We believe that post Memorial Day weekend, there will be that brief pullback to 8.8M but move back higher over the next few weeks.

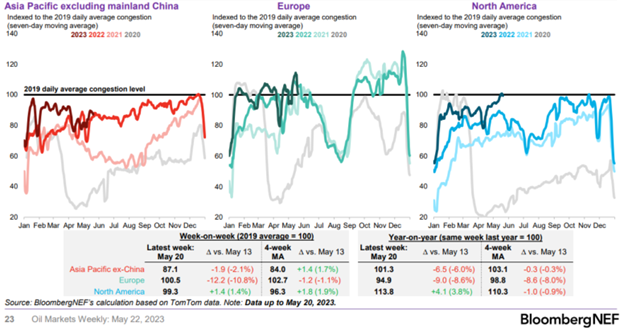

TomTom showed a bit of a bounce this past week in North America, but this should fade a touch again to be below 2019 levels by 5%-7%. Asia Pacific continues to track 2022 levels as Europe falls back into 2022 levels as well. We don’t see a surge in any of these regions, which will keep demand fairly capped as diesel demand pulls global demand lower.

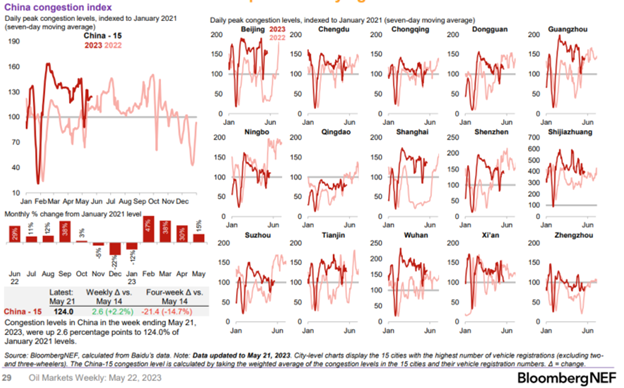

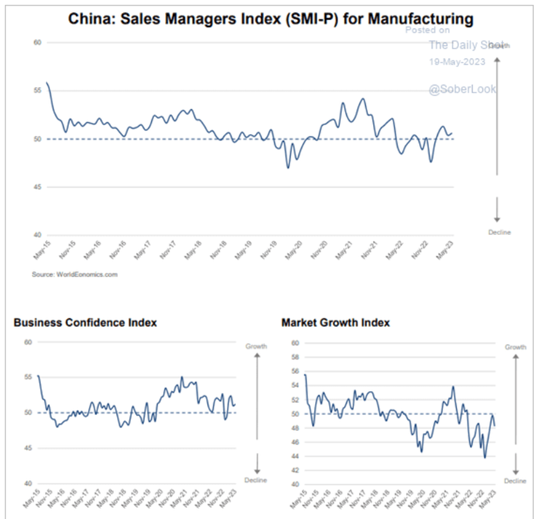

When we look at China, it’s following the path we laid out with a strong bounce following the end of lockdowns but a pullback closer to 2022 levels. We aren’t going to get this “revenge” spending as consumers remains soft and industrial activity disappoint estimates.

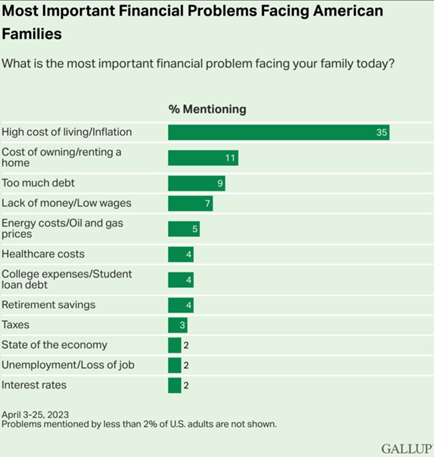

It should be no surprise that people are concerned about the high cost of living, and this isn’t something that is limited to just the U.S. “April survey from Gallup shows 35% of U.S. adults named inflation as their family’s top financial problem (highest share on record) … other than last year’s 32%, previous record was 18% in 2008.” I think this quote puts into perspective the kind of pain that is spreading throughout the U.S. and realistically around the world. Lending standards and other rate pressure isn’t limited to just the U.S., which is why this is a global problem pulling down broad economic issues.

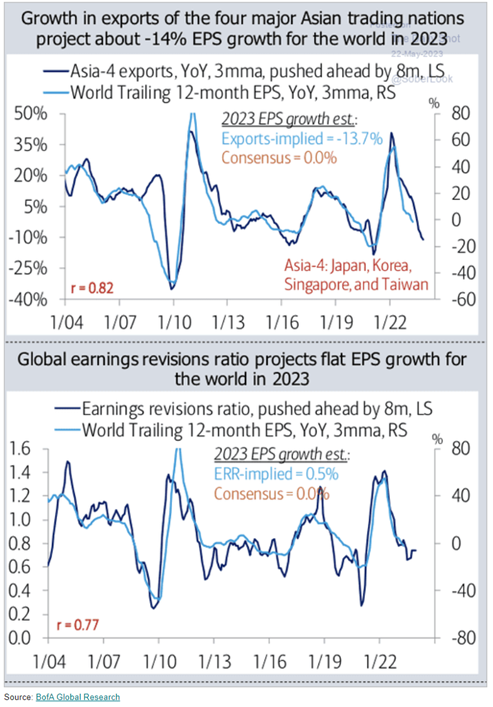

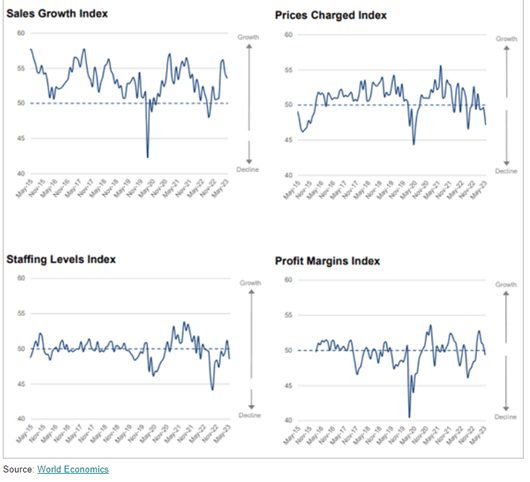

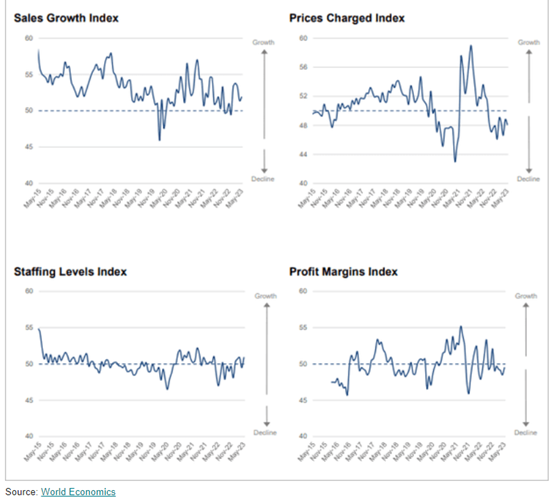

A lot of the leading indicators are showing more pressure on industrial levels when we factor in exports.

No matter where we look there is profit pressure in all the major exporting nations.

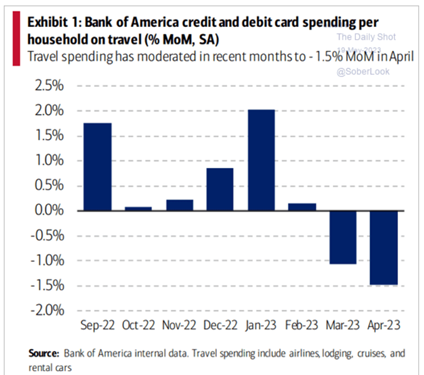

There is always a hope for a bounce in summer, but when we look at projections/current summer spending- it’s falling flat. Travel spending is on a downward trend heading into the summer months, and it’s unlikely to improve as inflation outpaces wages. Essentially, real wages are compressing further limiting the amount people will be willing to spend.

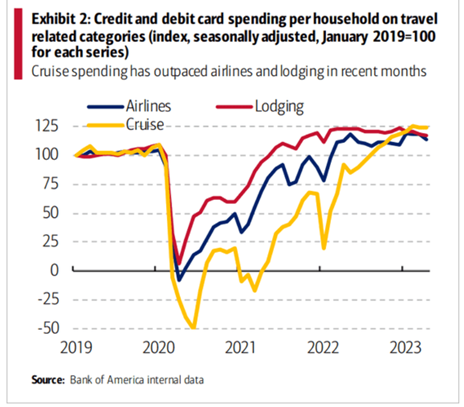

It’s always important to put this against seasonal norms, which we can see is normally elevated this time of year. This is why we aren’t saying the consumer will collapse, but rather disappoint against estimates and “seasonal norms.” The below chart shows the cracks forming in airlines and lodging, and we believe this will accelerate a bit as credit card rates move higher, and the Fed doesn’t reduce rates.

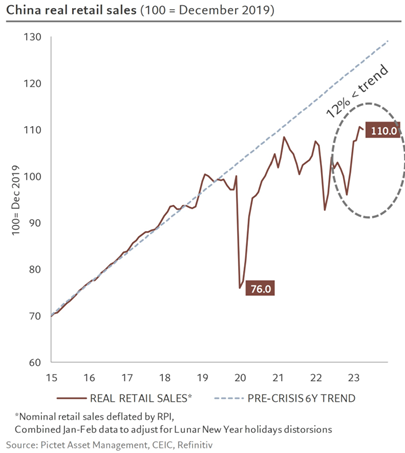

When we turn to recent Chinese data, there is a clear fade to the economic activity following the post COVID bump- inline with our estimates. This is a trend we see continues as retail/consumer activity flatlines and disappoints broader hopes. “Although up more than 18% y/y, in line with a big boost in consumer confidence (+11% y/y), retail sales volumes were actually down 0.5% for the month, not a catastrophe of course, but a loss of momentum.”

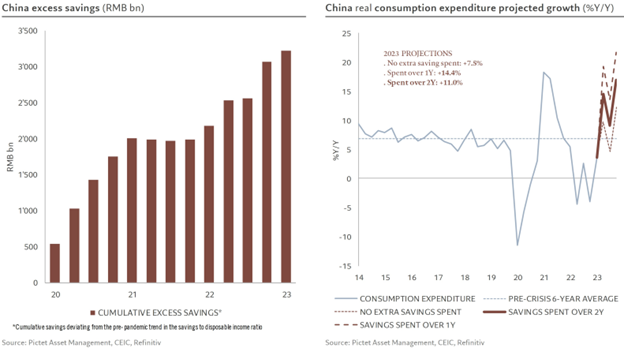

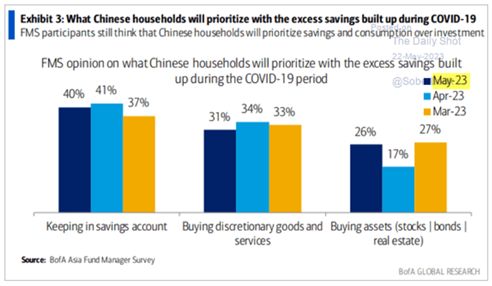

The below chart puts into perspective the hopes for Chinese retail sales, but we believe this remain lofty given the issues in local markets. Demand is waning, and we believe the excessive savings will stay in place and not translate to huge purchases.

This viewpoint is starting to get baked into expectations when you look at recent surveys. As this gets priced in, we will see more concern grow about Chinese growth.

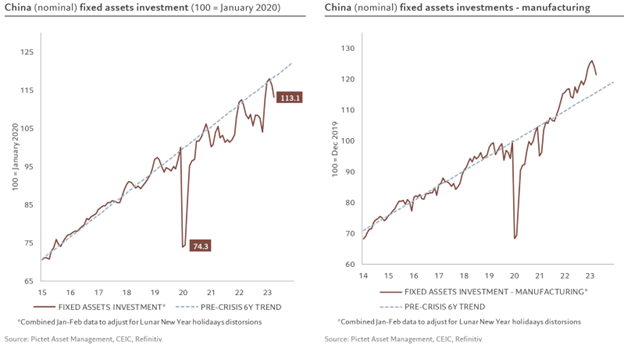

Broader investment is going to keep shifting lower as well: “’ Fixed assets investments lost 2.5% on the month, and are back below their long-term trend while manufacturing investments despite a monthly contraction and are still evolving above this trend.”

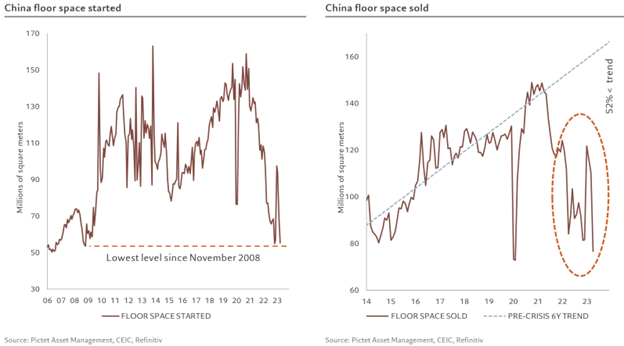

The real estate side is still mixed, as the recent data underwhelmed vs some of the previous numbers. “Disappointing as they were all down on the month starting with a big correction on housing with the supply of residential spaces at its lowest since 2008 and demand back at its cyclical lows.”

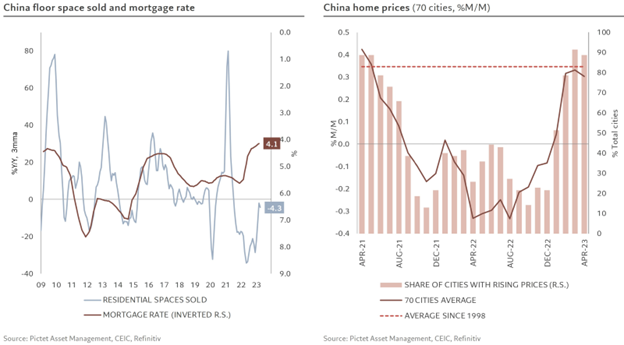

The below chart shows a slightly different perspective with some better numbers, but also showing a pivot on general momentum leveling off. It’s important to note that this support is leveling off even with a sizeable amount of mortgage support in the market. “Mortgage rates that have been cut by 150bps to 4.1% from their peak in Q3 last year, which helped home prices for three months in a row.” Based on the average, you can see how the support is leveling off.

Here are some other data sets showing something similar:

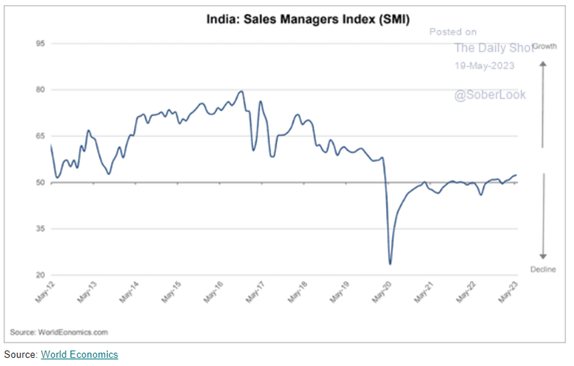

Another area that is expected area of global support is India. We expect India and China to post positive growth, but still be well below expectations. “India’s SMI report shows improving growth in May. This indicator is not nearly as upbeat as the S&P Global’s PMI.” The below chart is much closer to what we were expecting vs the nice surprise that came from the PMI.

We see more pressure coming on the demand front for the consumer as well as the broader economy. This will keep growth compressed as we head into the summer months.