I recommend watching our FSC video today because we cover a lot of ground on the FSC side as well as some updated impacts on flows. I think the food and geopolitical backdrop is always pivotal, which I do a deep dive on here: https://www.youtube.com/watch?v=QDfu9x-XTtI

As always, I welcome any and all questions- just email me at mrossano@c6capitalholdings.com.

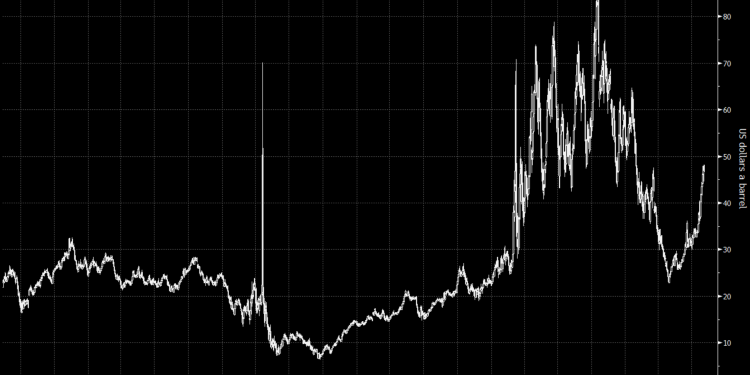

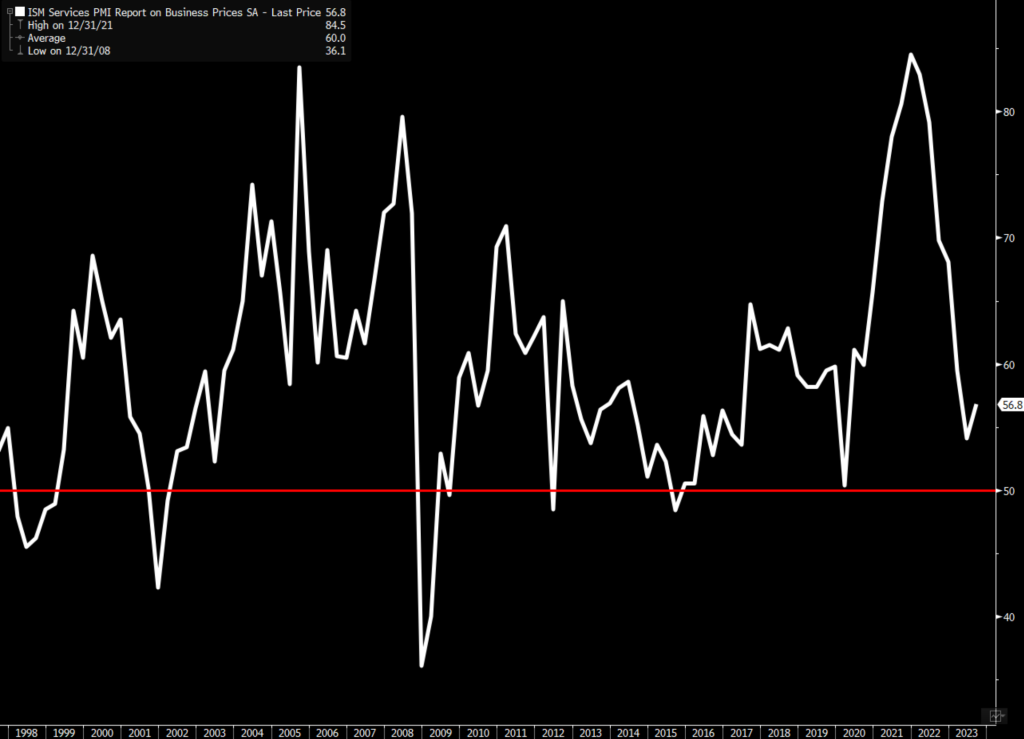

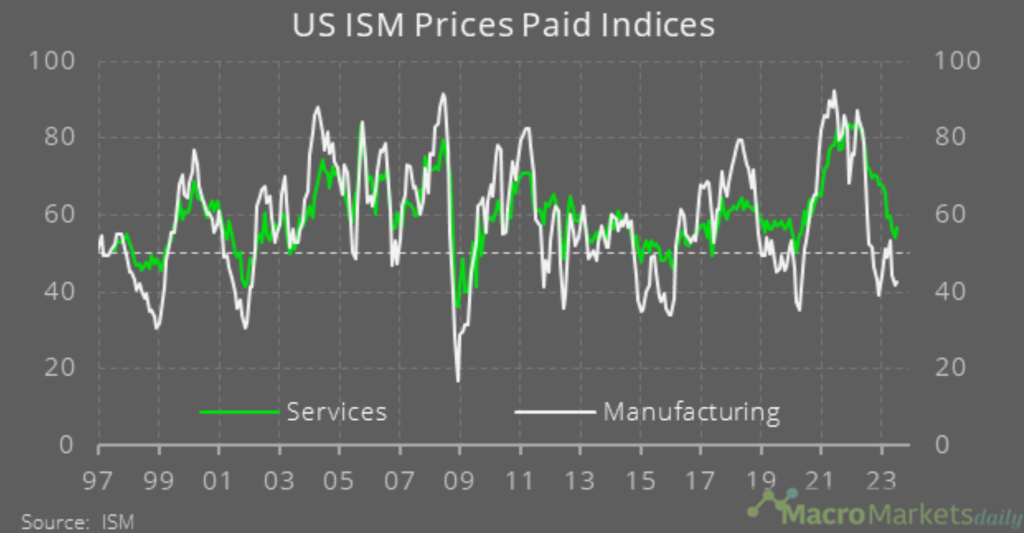

Saudi Arabia gave the market what they wanted with an extension of the 1M barrel a day voluntary cut into September. Saudi also made statements that the cut can be extended further and even deepened, which isn’t the most bullish statement if you consider the economic backdrop. Are they seeing more weakness in demand? What happens when inflation picks back up? Refiners are the largest buyers of crude in the world, and if storage of gasoline keeps rising- it will impact total runs. We have highlighted for months the problems in the distillate market, and with prices of disty heavy crudes remaining strong- it will limit what refiners can run. Gasoline storage is moving back up in Singapore and Fujairah while Europe remains at 2020 and 2022 levels. The volumes in Europe are making their way over to the U.S. East Coast (PADD 1), which will show counter seasonal builds as demand stays lackluster. Diesel storage remains tight around the world and given when crack spreads sit- we will see a big focus on maximizing this output. As those disty barrels stay expensive, it will keep the spreads elevated because the refinery incurs much bigger costs. This has to be passed down to the customer, which is already experiencing pain across the board. We have already seen service costs and manufacturing costs turn back up in July, and we see that cost pressure continuing throughout August. Given the tightness in PADD 1 storage, if we get a normal winter, there is going to be a lot of price pressure for heating oil customers.

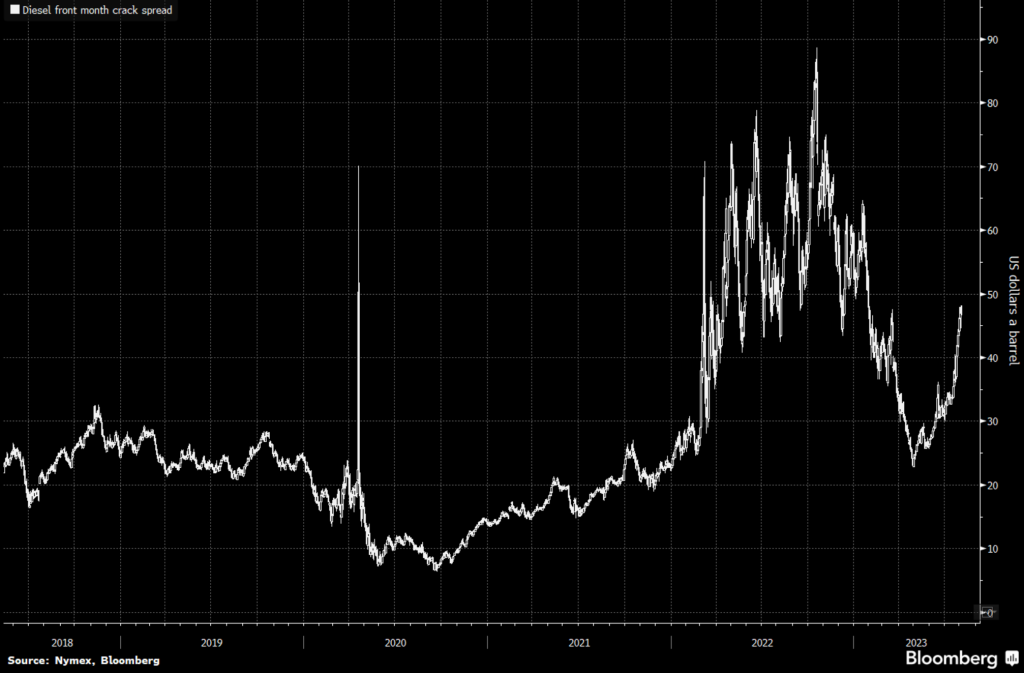

Asian distillate crack spreads are no different as we see a similar spike. The pivot in spreads is also pulling more product into the market instead of crude.

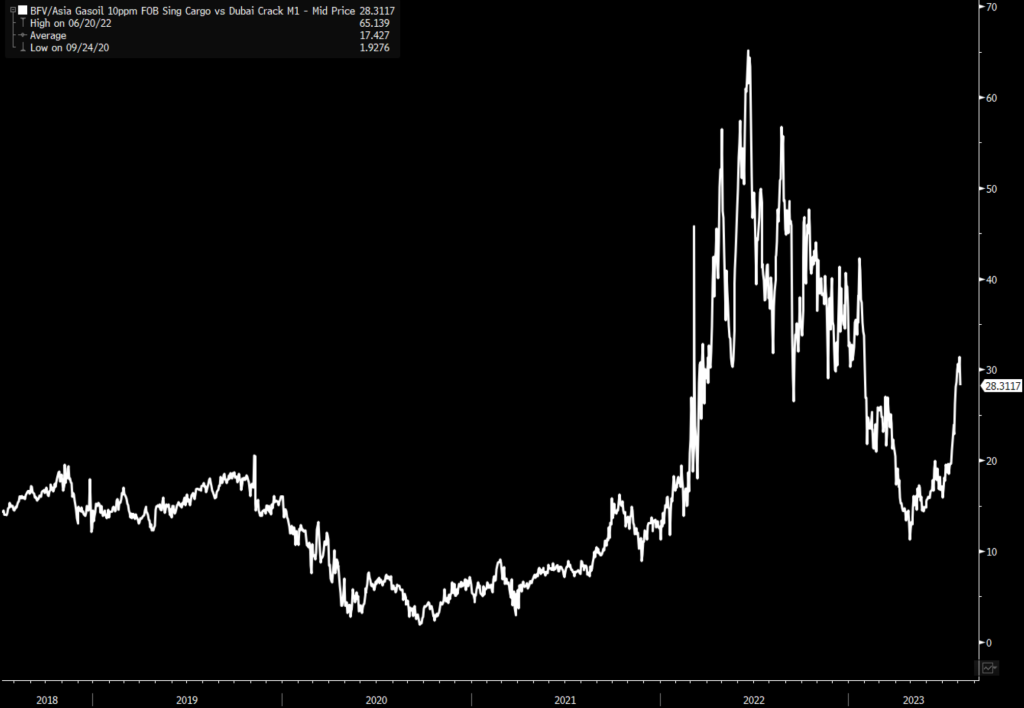

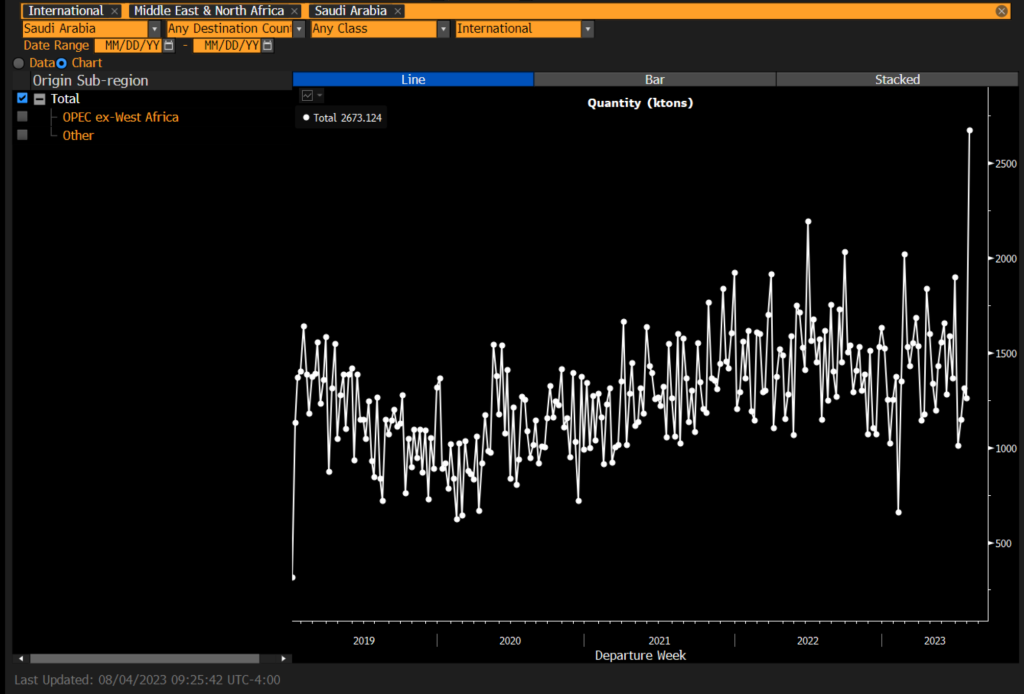

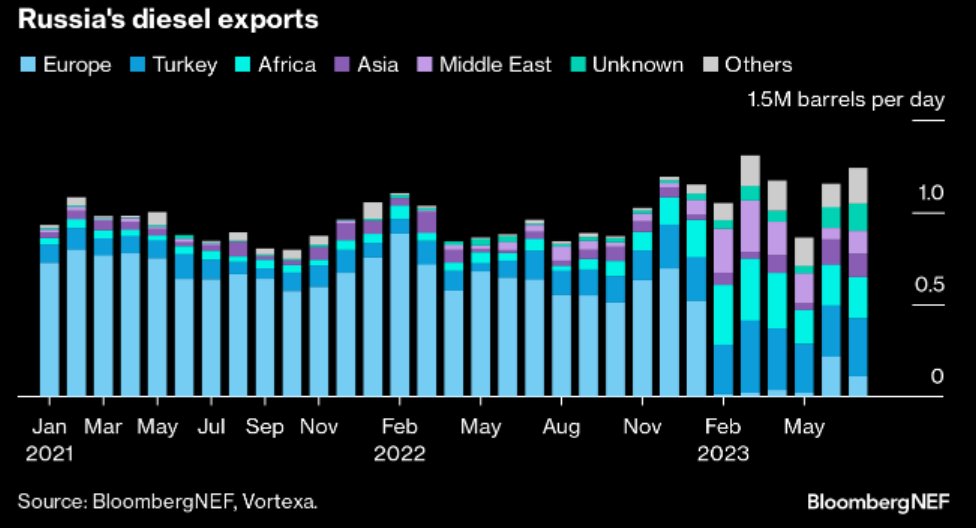

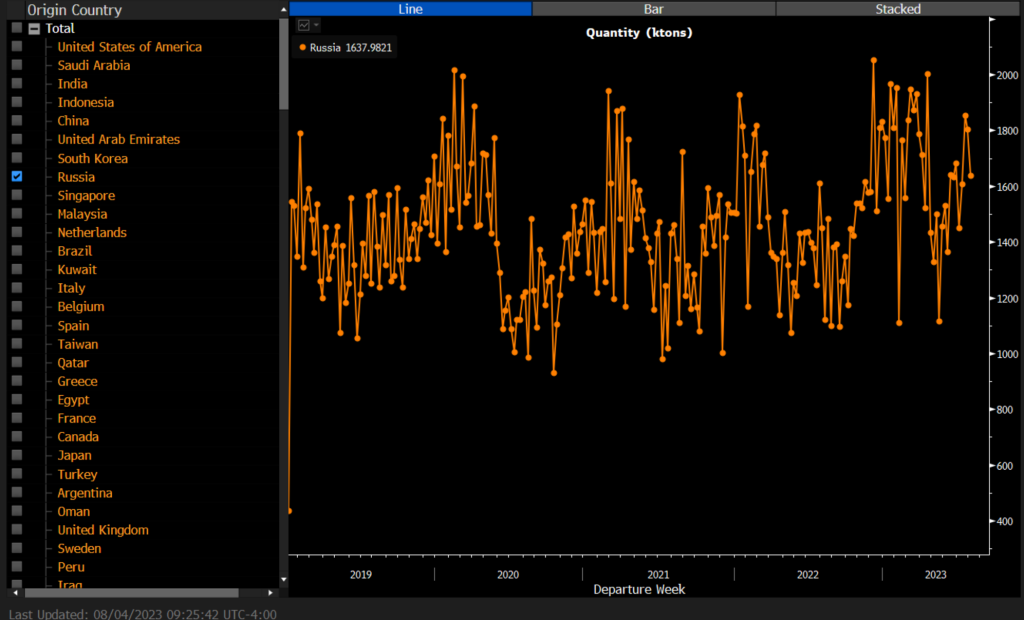

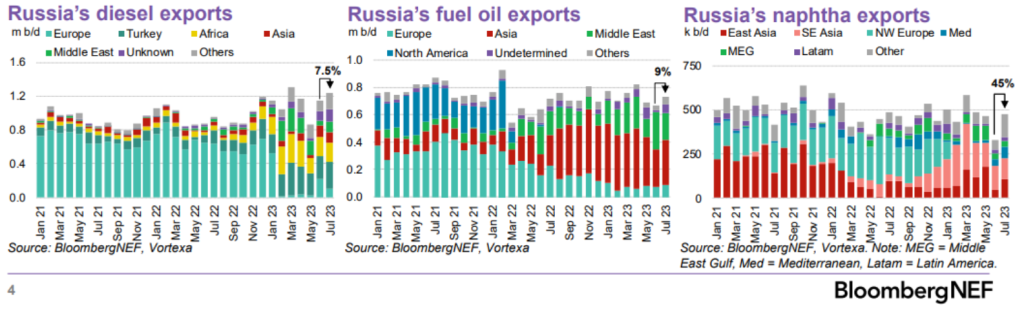

There has been a lot of talk around crude production and exports, but the market has been ignoring the amount of refined products being moved into the market- especially by Russia and Saudi Arabia. Back in 2014, KSA made a pivot to export more “high value” products such as petrochemicals and refined products instead of just crude. Saudi Arabia has just exported a RECORD amount of refined product (mostly diesel/gasoil) into the market because the margins are amazing. It makes sense to try to capture as much of that market as possible, and Russia is no different in their strategy.

Russia is following the same path especially as refinery maintenance ends. They saw runs get cut through April and May, but have since ramped back up. This means that their refiners can absorb more crude and turn around to sell a higher value product into the market.

I can’t stress enough to look at total flows and not just crude exports. Refined exports are reaching elevated levels across the countries that are “cutting” their crude exports and production.

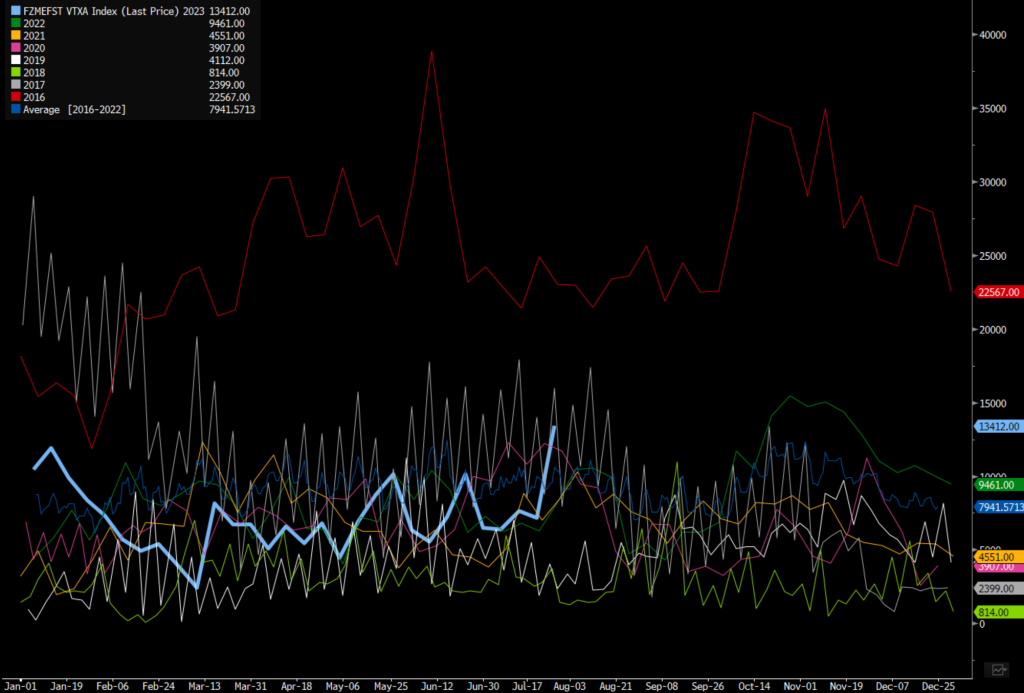

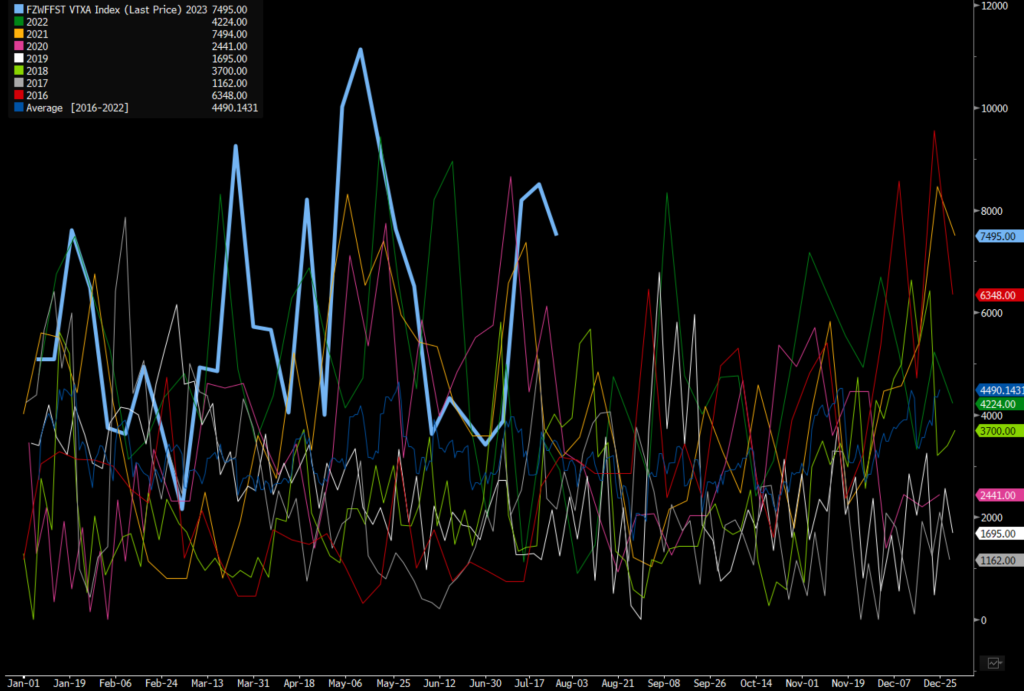

Saudi Arabia has successfully driven up the differentials for medium/heavy crudes and kept U.S. crude grades economic flowing into Asia. We always expected U.S. flows to maintain their share of the European market, but based on KSA policies- the U.S. is sending elevated (and near record) levels of crude into Asia. By carrying out this market initiative, they have hindered the flow of crude from the Middle East. If you look at the below chart, you can see a new 2023 record for crude in floating storage. Storage is sitting around levels from 2017, which was at the tail end of the OPEC pricing war. Given pricing, we expect to see more customers opting for other crude grades.

Russia, Iran, and West African grades will benefit the most from these adjustments. It’s why we are focusing so much on WAF to see how quickly the grades clear and at what differential. As you can see in the chart below, there is still an excessive amount of crude in floating storage, and we have already seen cargoes get deferred. Differentials are still elevated, but they are slowing being walked back down as buyers have refined from paying up.

- Sonangol Cuts Offer Price for September Cargo of Cabinda Crude

- 950k-bbl shipment for Sept. 21-22 loading is now being offered at Dated +$3.05/bbl; price was reduced on Aug. 1, the people said

- NOTE: The cargo was initially offered at Dated +$3.30 on July 20

The tightness in the medium/heavy market is driving up crack spreads, which the refiners passing down to the consumer. I would say that we were probably “more bearish” about demand vs the street, and so far, demand has fallen below even our expectations. We were expecting European demand to stabilize higher and for Chinese demand to outperform 2022 when the zero-COVID policy was still enacted.

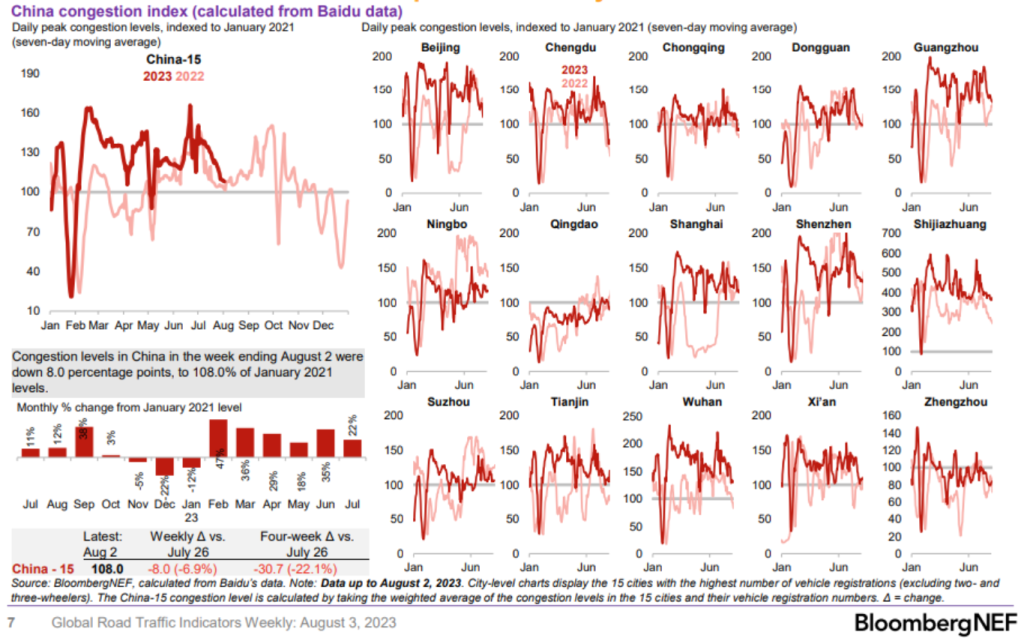

Chinese activity has come under pressure due to flooding and general inactivity driven by economic headwinds.

In the U.S, we have seen another increase in prices, which will put more tailwinds into the inflation backdrop. We are just showing U.S. prices below, but it’s something that is playing out around the world.

The impacts are already showing up in leading economic indicators for pricing. ISM manufacturing started to turn higher, while still remaining in contraction (deflation). But, ISM services is shifting back up and never fell down into contraction. This will help drive inflation higher in July with more follow through as we started off August strong.

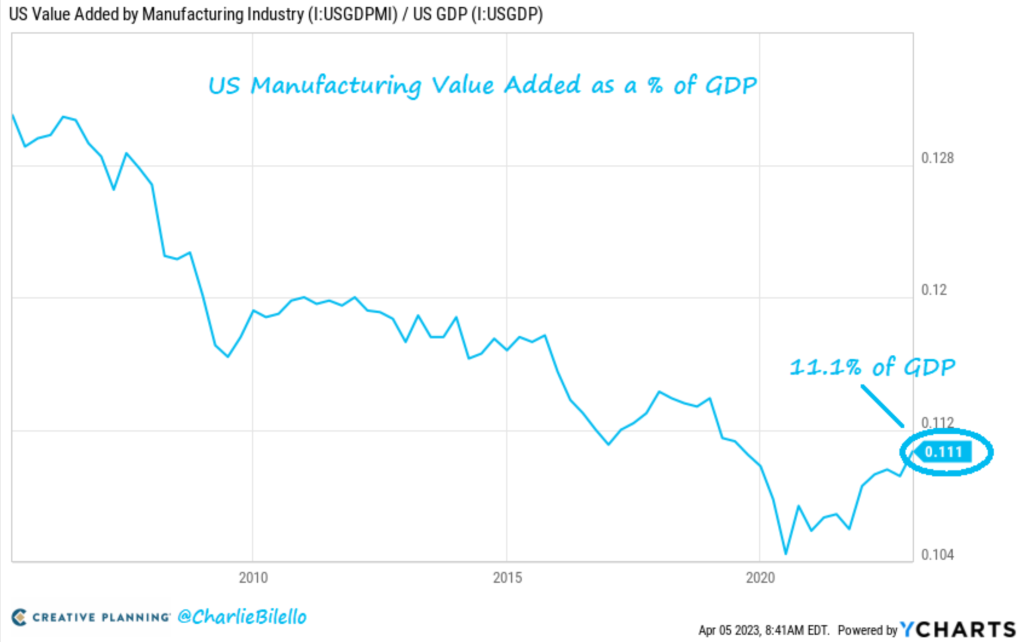

Even though manufacturing is in contraction still, it only accounts for about 11% of the U.S. economy. So, while the drop is good- it doesn’t pull things lower to the same degree that services will drive broad pricing higher.

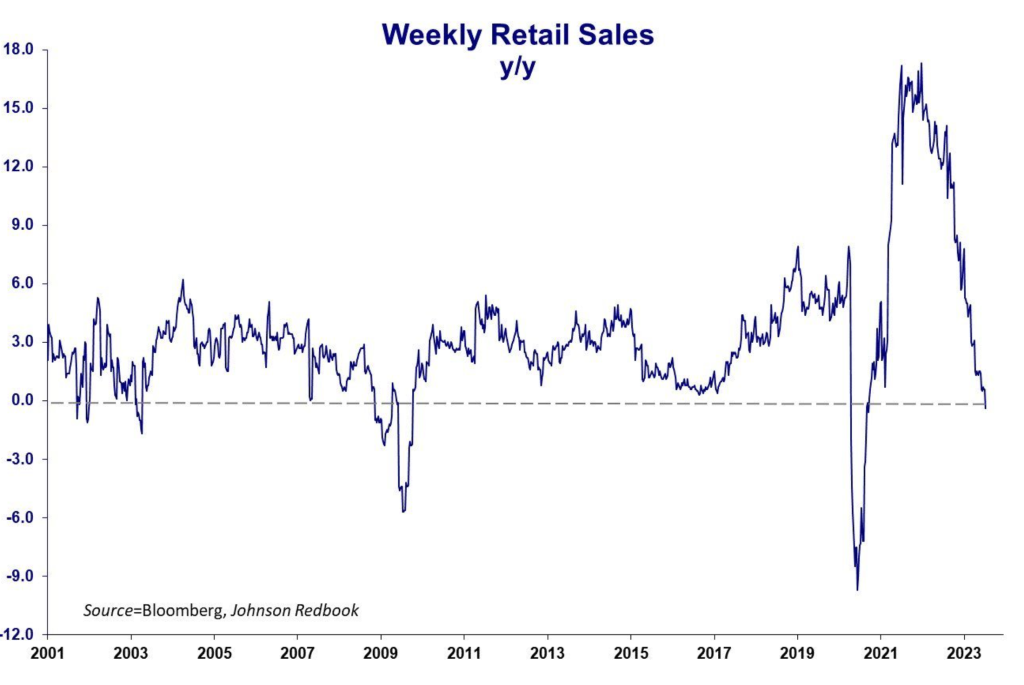

The increase in pricing is hitting on multiple levels, and we are finally seeing the fall out as leading indicators for retail sales turned negative. We have talked about the deceleration, but we have finally seen actual negative data.

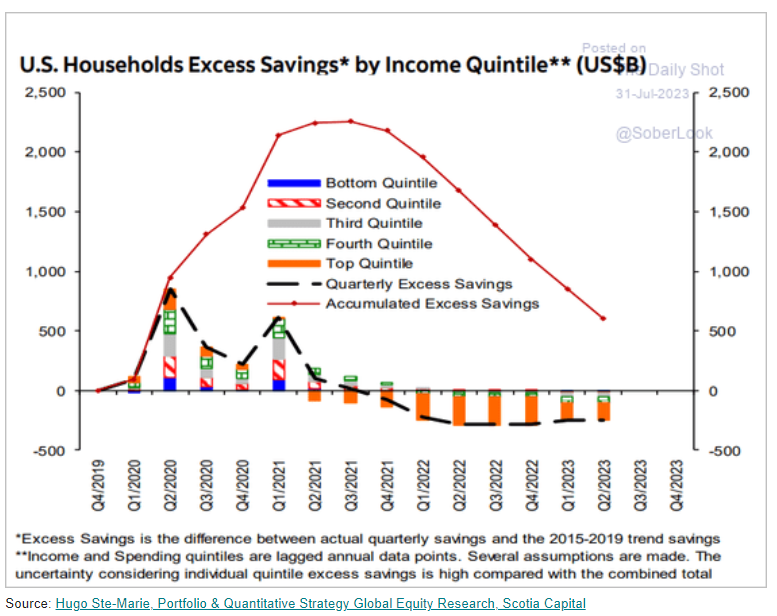

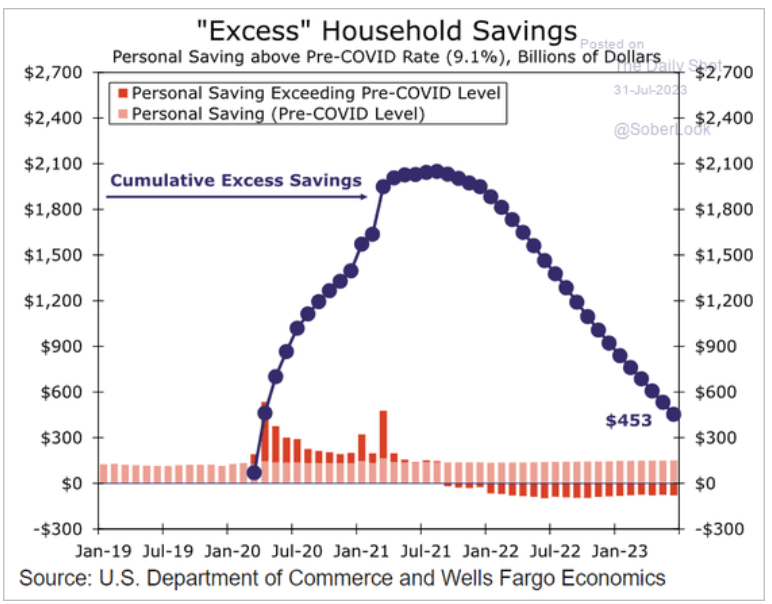

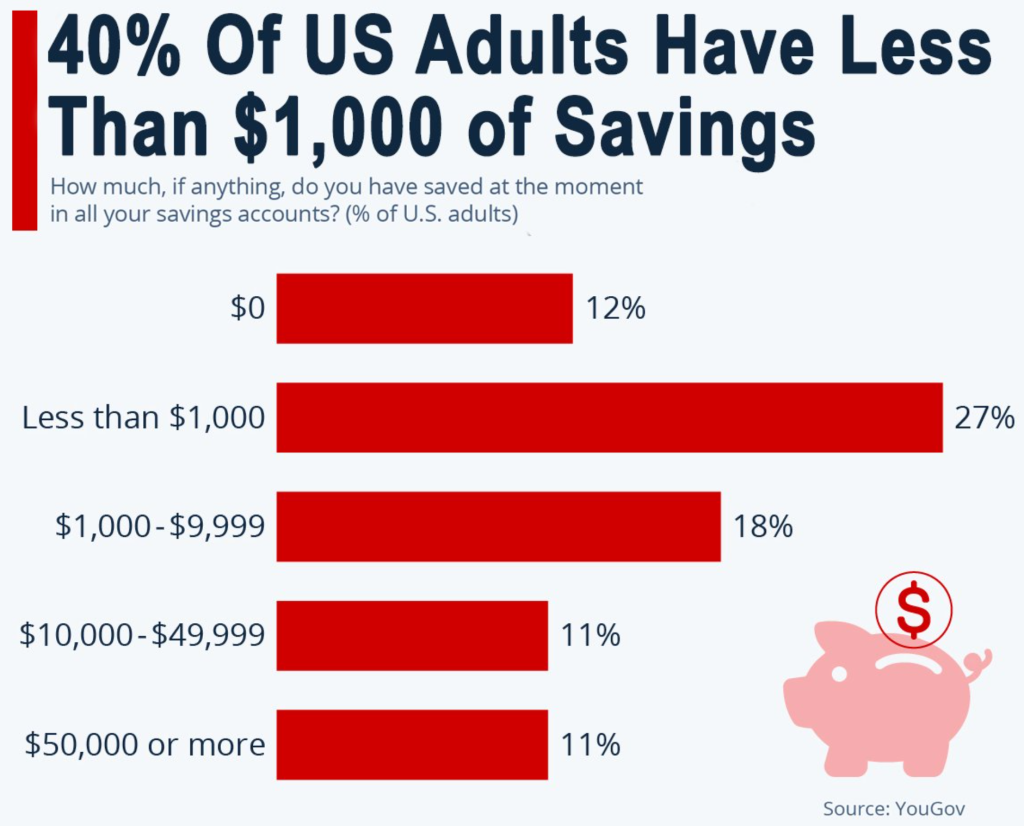

A lot of this is connected to a drop in underlying savings, and the rampant rise of credit card rates. We talked a lot in the past that we didn’t fight the amount of money in savings, but rather how quickly is was going to be drawn down. We believed that the money was going to be consumed FASTER than what the market expected, and we have seen a continuous draw down to a point of “pause.” The money left in savings now is something we think will be “trapped” given it sits at the highest quintile. They have no incentive to pull it down and spend it at this point, while the people that need it most are living more and more off of credit.

Just to put the level in perspective: US adults with more credit card debt than total savings 2021: 21% 2022: 27% 2023: 36% (Source: Bankrate). This tightness is also happening as 40% of adults now have less than $1k in savings.

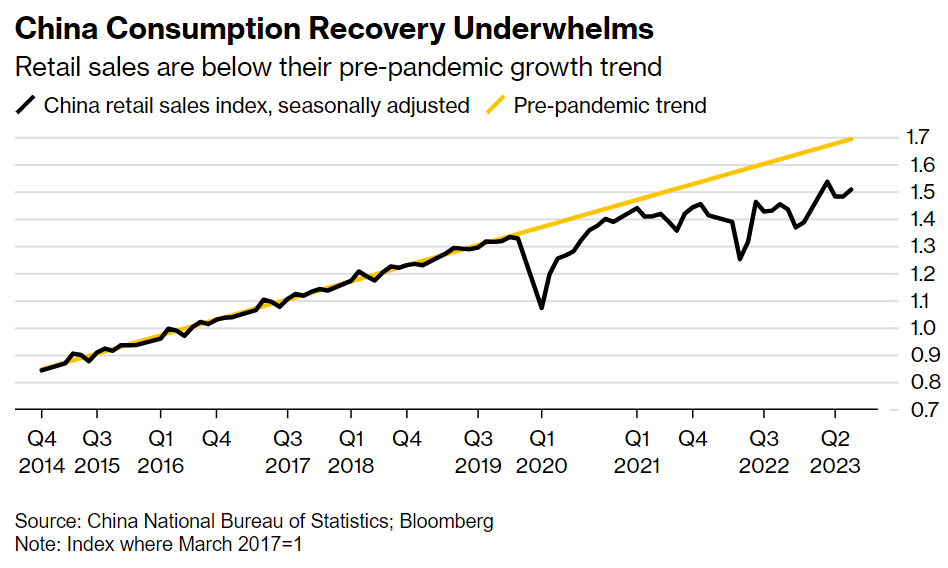

When we turn our attention to China, we can see how quickly the economy has lost steam- which was our base case. We believe that within 6 weeks the “Revenge” spending was going to dry up following the end of zero-COVID policy and start to drag down global growth estimates.

As we said from the beginning, it wasn’t going to be an “all stop” on buying but rather a flatlining of spending and underlying consumer activity. That has played out across all the economy with broad slowdowns in July that continued into August (so far).

“Chinese consumers cut back on spending on everything but travel and restaurants this month, contributing to sluggish revenue growth in the country’s key economic sectors as the economy’s recovery loses steam. Almost every major sector experienced a weakening in both revenue and profit margin compared with June, led by a steep slide in retail, according to China Beige Book, a US-based data provider. Sales in the travel and food and drinks businesses increased, defying the trend due to continued “revenge spending,” the firm said. China’s manufacturing, which has showed signs of improvement in the previous months, also faces mounting headwinds. While output barely rose from June, domestic orders slowed, according to the survey. Export orders improved, mainly due to increased demand in Asia, while those from the US almost contracted and from Europe they slowed sharply, China Beige Book said.”

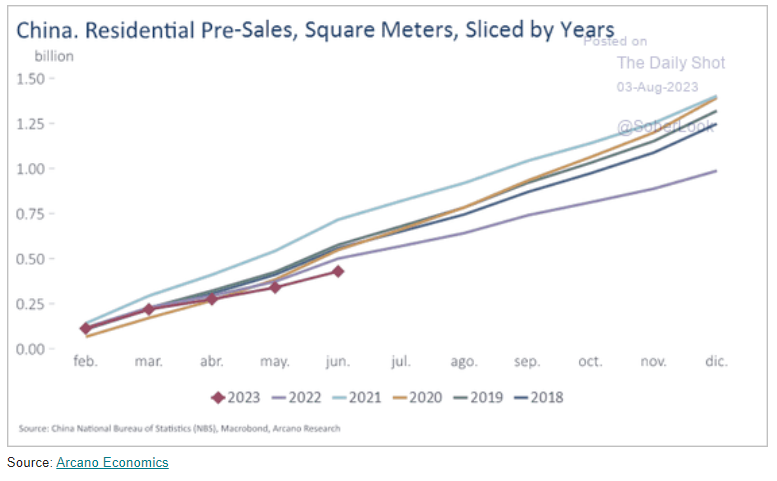

We have been highlighting that the stimulus will fall flat as consumers will stay on the sidelines. Consumers invested heavily into real estate and land, which has seen continued slowdowns with another round of pressure keeping their returns steeply negative. “Nearly 60 percent of China’s 100 largest real estate firms did not acquire any land in the seven months ended July 31. They collectively purchased CNY11.6 trillion worth of land, a dive of 20 percent from the same period last year.“

Last month, new #property sales by #China’s Top 100 property developers totaled 350.4 billion yuan ($49 billion), down 33.1% y/y and 33.5% m/m, according to data provided CRIC. Total sales in the first seven months of this year dropped 4.7% y/y to 3.4 trillion yuan.-Caixin

The announcements from China have been filled with rhetoric and nothing has changed. They have extended tax cuts that were set to expire for another four years and issued some other supply side benefits, but nothing has changed or addressed the demand side economics. All of the meetings have been filled with promises but no action:

“China is seeking to boost consumption to spur the economy’s recovery, although the government has stopped short of providing direct fiscal support to consumers and companies to increase spending. The National Development and Reform Commission, China’s top economic planning agency, released a wide-ranging policy document Monday focusing on removing government restrictions on consumption, such as car purchase limits, improving infrastructure and holding promotional events like food festivals. Like the measures announced Friday — which are focused on boosting manufacturing in the consumer-goods industries — the latest steps are targeted toward improving the supply of goods in the economy, rather than demand. The government has refrained from giving cash subsidies to residents since the pandemic began, focusing its support instead on providing benefits and tax breaks to companies instead. “Policies so far have tried to stimulate consumers to spend, but the fiscal policy has not stepped up,” said Hao Hong, chief economist at Grow Investment Group. “China’s fiscal deficit is even shrinking despite the mounting downward pressure on the economy.” “There aren’t much new policies in the document, and there’s no real money provided to help families,” he said. The NDRC’s Li said the agency is studying new measures to optimize broad-based policies to support car consumption. Even so, whether it comes to cars or other consumer goods, the country needs to create demand through supply-side reforms so that appropriate products are created, he said.

The State Council has promised to support the economy.

The readout from Monday’s State Council executive meeting said:

- “It is necessary to strengthen countercyclical adjustments…and introduce new policy measures.”

But don’t get too excited: The State Council then listed a bunch of policies that read from the same playbook as July’s Politburo meeting readout. Those are:

- Promoting private investment

- Cracking down on illicit fees imposed on businesses

- Bolstering investor confidence

- Fostering growth in strategic and emerging industries

- Optimizing real estate policies based on local conditions

- Stabilizing employment and encouraging entrepreneurship

The State Council also called for an extension of pandemic-era business tax and fee reductions.

Get smart: These policies signal a continuation of Beijing’s existing approach to economic support – one that does not rely on short-term stimulus, but rather focuses on improving the business environment.

Get smarter: The call for strengthened countercyclical adjustments indicates the policy conversation is moving toward more aggressive measures.

- Seeing how ministries and policymakers respond to this meeting readout will be crucial in determining whether there is a genuine chance in policy approach.

The government has refrained from giving cash subsidies to residents, focusing on providing benefits and tax breaks to companies instead. The new measures were announced after the official manufacturing purchasing managers’ index inched up to 49.3 in July from 49.0 in June to stay below the 50-point mark that separates expansion from contraction. The last time that the indicator had pointed to contraction for more than three consecutive months was between May and October 2019, before the pandemic. The non-manufacturing PMI, which incorporates sub-indexes for service sector activity and construction, dropped to 51.5 from June’s 53.2. Meanwhile, a US-based data provider said Chinese consumers cut back on spending on everything but travel and restaurants last month. Almost every major sector experienced a weakening in both revenue and profit margins compared with June, led by a steep slide in retail, China Beige Book said. Sales in the travel and food and drinks increased, defying the trend due to continued “revenge spending,” the firm said.

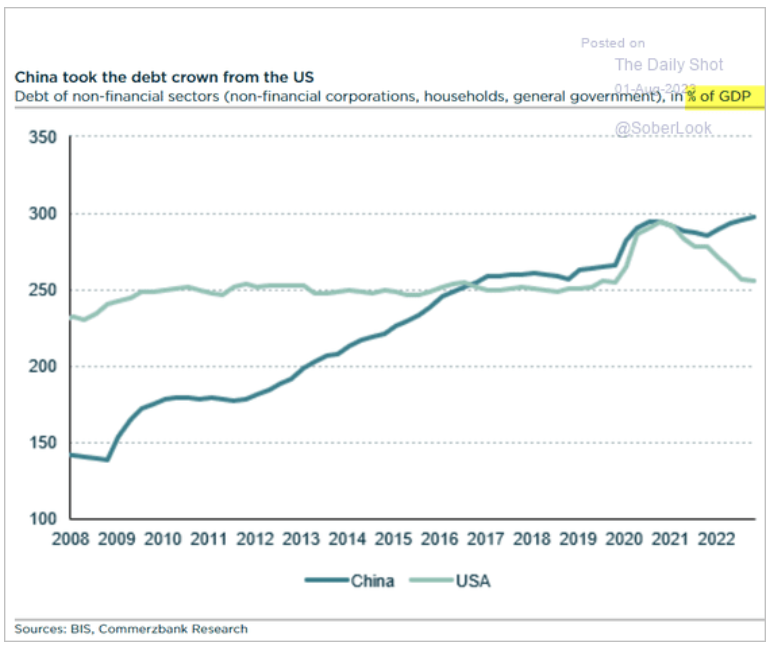

This comes at a time where the debt levels have exploded- especially because many of Chinese provinces pulled forward support to the beginning of the year. Now you have provinces actually PULLING BACK on investments and support.

Almost a third of Chinese provinces recorded shrinking investment in the first half of the year, the most widespread decline for the same period since 2020, as financially-strained local governments and companies cut back on spending. Some of the most debt-laden provinces, like Guangxi and Tianjin, had the biggest contraction in fixed-asset investment in the period, according to a Bloomberg News analysis of reports published by local governments. The decline in investment is weighing on the economy’s recovery, which has lost momentum since China’s reopening surge in the first quarter. Weaker economic growth, in turn, will make it difficult for some provinces to service their debt, resulting in a further pullback in investment. Local governments have pulled back on investment following a slump in land revenue, a key source of income in many provinces. In the first half of 2023, income from land sales dropped 21% from a year earlier, reducing revenue for the various government fund budgets by 17% and making it difficult for the Ministry of Finance to meet its income forecast for the year. Guangxi and Tianjin were among the 10 provinces cited by Fitch Ratings where local government-related debt was most at risk of refinancing pressure. Tianjin’s debt was almost three times its income last year, according to data compiled by Bloomberg, while Guangxi’s was 144%. Yunnan and Guizhou, which were also highlighted on the Fitch list, had debt ratios of 172% and 164%, respectively.

This is why the comment that “Chinese federal government has low debt” is absurd because it all rolls up to the top. The below charts show just how detrimental the debt bubble is for the rest of the country.

The below chart shows how some of the deficits have slowed as support still remains lackluster. The question is- if they were to ramp support- who are they borrowing from and at what rate?

“Several Chinese provinces have uncovered that local consumption vouchers issued in recent years were not only misused, they did little to increase spending – revelations that seem to undermine Beijing’s refusal to give out cash.“ The biggest problem with the consumption vouchers was not that they were inefficient (which they were), or misused (ditto), but that they were issued in amounts too small to matter. Relative to most local GDPs, the nominal amount of coupons was within a rounding error. So why were they so popular? I think because they seemed to allow local authorities to control spending, presumably into favored sectors, and because they seemed to involve a multiplier effect. Both reasons derive from a confused understanding of how household budgets work. The obvious failure of consumption vouchers to make a difference may set off a more intelligent debate on how to boost domestic demand sustainably but, as of now, and judging by the most recent stimulus proposals, there is as much confusion among policymakers as ever.

The pressure is abound with even more on housing:

Bejing is now rushing to help private companies… but too little too late after putting pressure on them for over a decade.

Beijing is hustling to help private companies.

On Tuesday, the macro planner (NDRC) led seven other ministries in issuing a task list to implement the July 19 guidelines from the Central Committee and State Council on boosting the private sector.

Get excited. The 28 items, in five broad categories, include action points that should improve the business environment for private firms, such as:

- Cracking down on overdue payments from government agencies, public institutions, and state-owned enterprises

- Streamlining procedures for bankruptcy filing and corporate de-registration

- Giving companies more time to comply with new and revised regulations

- Setting up an online complaint portal for beefs about business operations

The to-do list’s most eye-catching item calls on three ministries to put the private sector in the driving seat of the tech innovation campaign:

- “Support private enterprises to participate in major technological breakthroughs, and take the lead in undertaking research tasks in fields such as industrial software, cloud computing, artificial intelligence, industrial internet, genetic and cellular medicine, and new energy storage.”

Get smart: This is the most concerted effort to boost the private sector that we have ever seen in the PRC.

- But it comes in the wake of 10 years in which the Party has made private business feel unwelcome.

- That means that officials will need to go the extra mile to convince the private sector that this push is for real.

Good piece by @nate_taplin

He argues that China is facing real structural difficulties, not a temporary downturn, in which case rhetorical support for entrepreneurs and consumers may not be enough to turn things around.“

He continues: “Something more ambitious may be needed: direct fiscal transfers to households, big-bang improvements to China’s paltry social safety net or a convincing return to an ambitious, market-friendly reform agenda.“

I am skeptical about how much a “market-friendly reform agenda” will help, mainly because I think private sector weakness is a consequence, not a cause, of China’s economic malaise, but I agree that China urgently needs major direct or indirect transfers to households.

I have been saying very similar regarding the below view:

“I’ve been telling clients that recent numbers are bad enough that Beijing will almost certainly unleash the kind of supply-side stimulus measures to which it has always resorted, but those measures are in fact the source of China’s economic malaise. This Reuters article, for example, suggests that even officials in the best-performing property markets are worried about continued weakness in real estate activity, and are looking for ways to revive the property sector. While these various measures in property and infrastructure will certainly boost certain kinds of economic activity, they won’t increase the value of what the economy produces because they’ll mostly represent increases in non-productive investment. There will still be benefits to those sectors that supply this activity – for example producers of cement and industrial commodities – but these will be balanced by losses elsewhere as the stimulus measures fail to buoy the overall economy.”

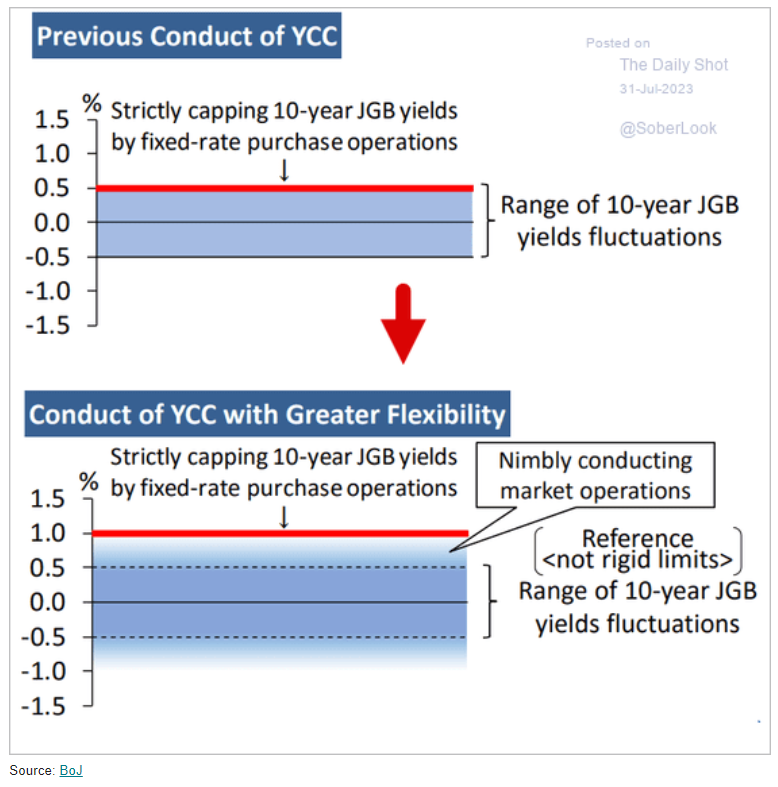

I know we pick on China a lot, but you can’t sleep on the craziness that is happening across Japan. They raised the ceiling on the 10 year to 1%, but left themselves open to step in at anything from .5%-1% to purchase bonds as described in the below diagram.

They have rolled out two unplanned purchases in the last week, which just points out some of the pressure points are just beginning. The market is going to put that straight to 1% no matter how much the BoJ buys.