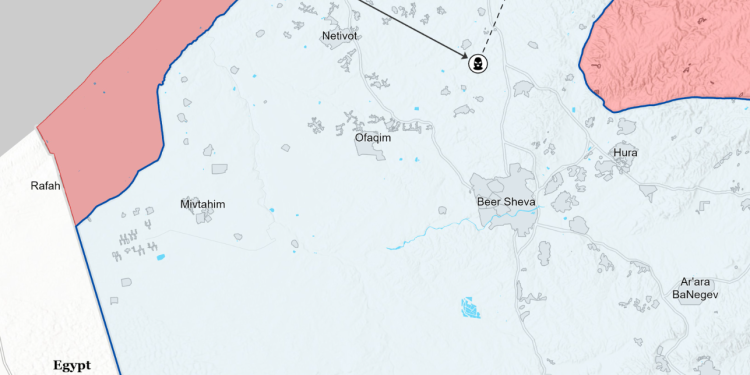

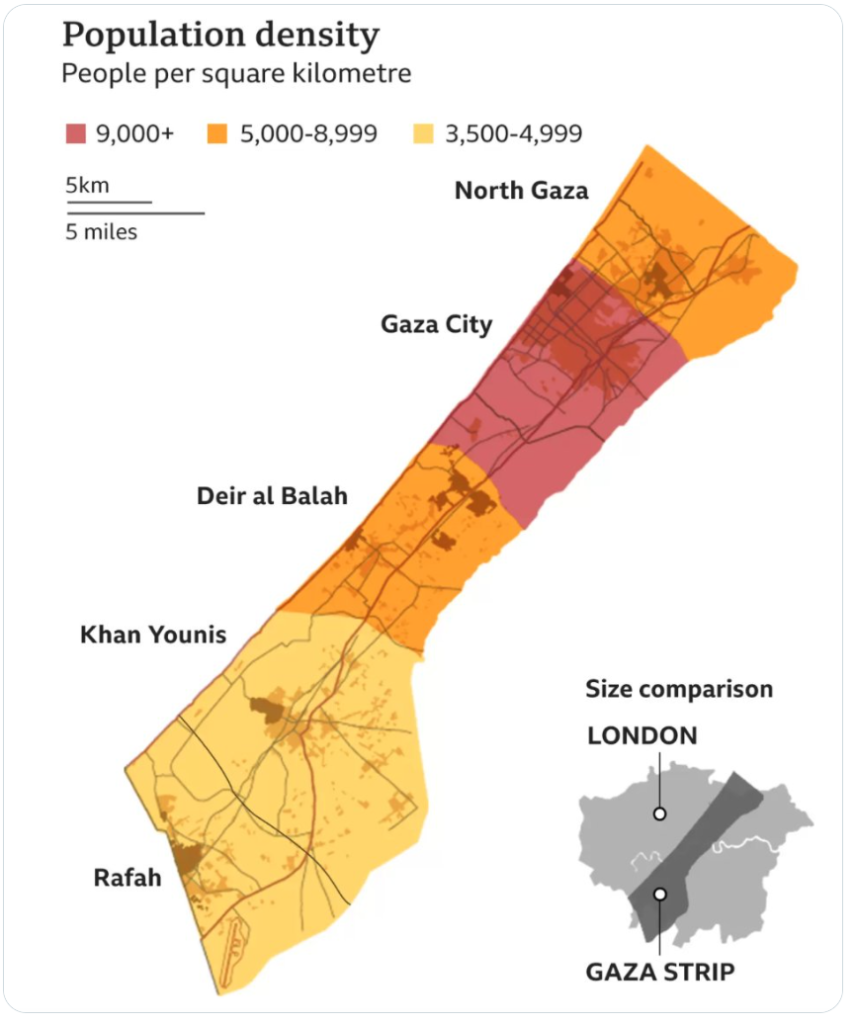

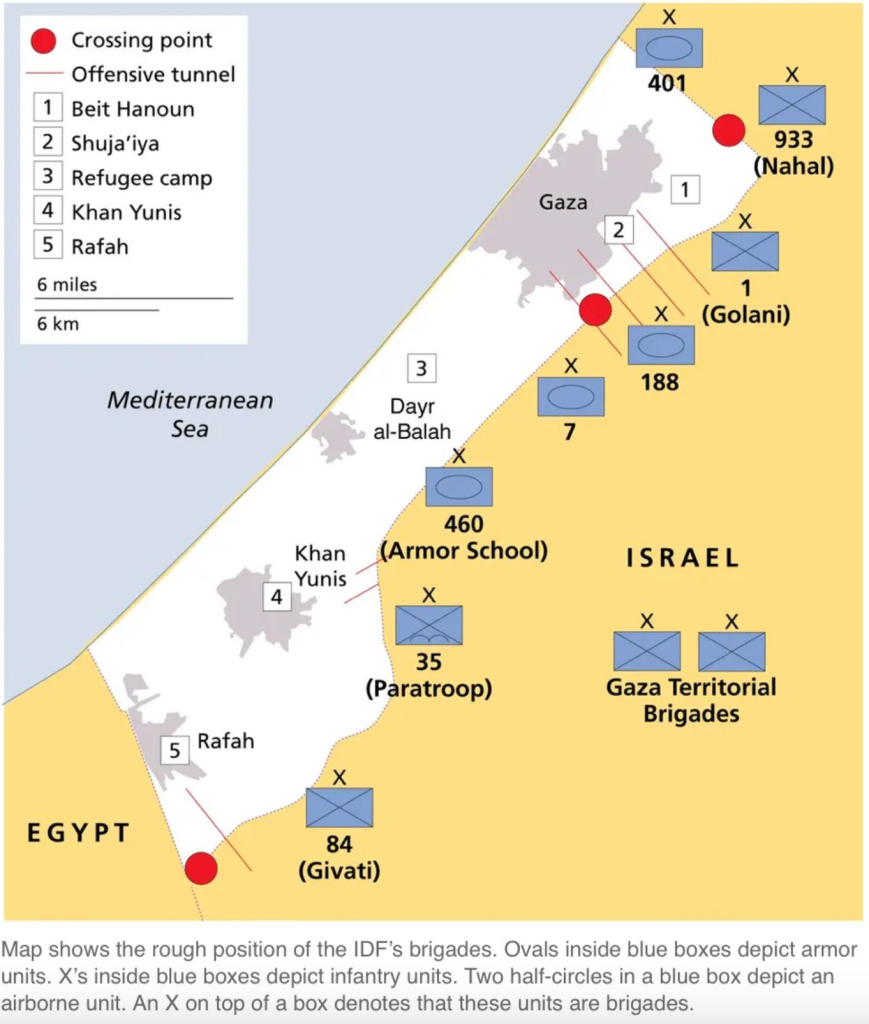

The weekend saw a big political shift when Hamas overran the border with Israel to attack military installations, civilian neighborhoods, and a concert happening near the border. This is a huge escalation originating from Gaza, and it came at a key political pivot point between Israel and the GCC. Iran has claimed to be the mastermind behind the attack, and the surprise was apparently given the greenlight from a secret meeting in Lebanon. Iran has since walked back their admission of planning given the rapid response of the U.S. and her allies. The U.S. moved an aircraft carrier into strategic position within 78 hours, and there are several other assets enroute. There has been a joint response from the U.S., U.K. France, Italy, Greece- among others. Two aircraft carriers just pushed off from ports in Virginia and are moving into the region. The most recent news and intelligence breakdown puts U.S. special forces on the ground with additional operations incoming. Hamas is a Sunni sect, but due to their alignment with the Shia backed Iran- they received a significant amount of aid and equipment. Iran isn’t their only backer with some material and equipment also originating from Qatar and Turkey- just to name a few. The below chart puts into perspective just how deep the breach was from the border:

The level of the breech is why the response is going to be so aggressive and advanced. The goal of Israel is to neutralize Hamas and remove the risk of another attack to this scale/magnitude.

Egypt has called up additional military assets to open the Rafah border crossing at the request of the U.N. Egypt is very concerned about Hamas “sneaking” through the border, and causing problems in the Sinai Peninsula. Israel has been very adamant about humanitarian aid moving through this border to be checked for potential weapons. This is another point of interest that can be supported by U.S. assets in the region. The border between Egypt and Gaza has been a point of contention when Hamas moved men and equipment into Sinai and created an ISIS branch in the region. This is when Egypt and Israel joined forces to help clear the region of terrorists.

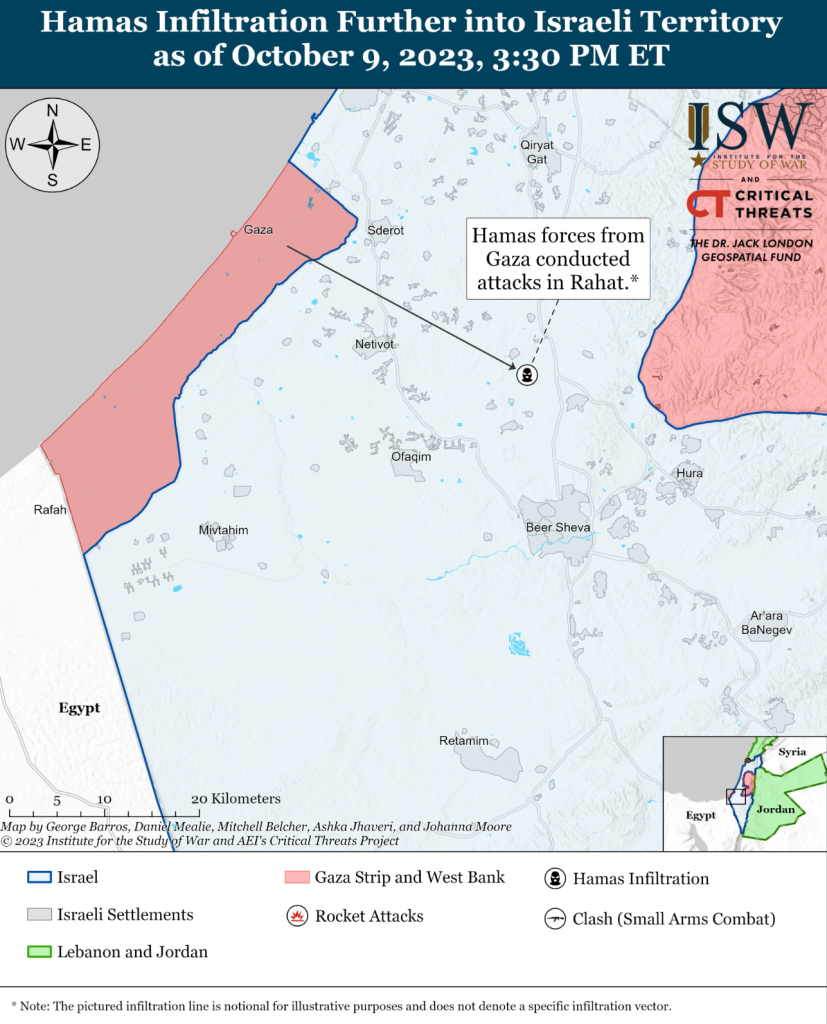

The U.S. and UN has offered help to the Egyptian military to secure the region, and allow Gaza civilians to cross the border. Hamas is telling civilians NOT to leave their homes, which will put innocent people in the way of the coming invasion. The IDF is very efficient and well-trained in urban warfare, but collateral damage will happen regardless if people don’t head south. We expect to see the invasion take place in a night or early morning push that will begin in the North in Gaza city.

Jordan has moved military equipment along the border to secure the region and keep Hezbollah and other Iranian assets from using Jordan as an entry point. This is a HUGE difference from previous wars in the region- instead Israel has some help along their borders. They also have normalized relationships with UAE and Bahrain- all of which are vastly different than the previous 75+ years.

It’s important to understand “how” this could have happened because there have been comments about false flags and other “deep-state” views. Overtime- borders can become softer and “less vigilant” as things become quiet. The Jewish Holiday “Sukkot” was also ending on Oct 6th, so the timing was perfect as many would be home with families. This would leave some key posts “undermanned” based on redistribution of assets as well as holiday time. Within the Israel parliament, there was a call to move assets to the West Bank and other potential points of conflict. The reconfiguring of deployments left gaps in the Gaza border that many believed would be safe with electronic surveillance. When you look at the well timed and choreographed assault, this was something rehearsed and practiced, which also highlights a gap in the intelligence community. Electronic surveillance can be “overwhelmed” with well times explosions, jamming, and other disruptive technologies. Given the distance the IDF had to travel to bring reinforcements, it would all Hamas to gain an advantage and small foothold after overrunning fortifications and the border walls. This was a mixture of a “snatch and grab”, guerrilla tactic, and land grab of strongholds. Unfortunately, these were well executed and resulted in hundreds of civilian deaths and kidnappings to achieve confusion.

The problem for Hamas- Iran really doesn’t care what happens next. The Iranian government’s goal was achieved to unify the Israel government against a Sunni sect to create a massive distraction in the region. This is also a good point to highlight the Iranian people DO NOT stand with the Iranian government. Iran has seen lenient oil embargoes while also receiving billions in frozen assets. Just as the government has done COUNTLESS TIMES- they take this capital and deploy it into proxy wars and showing relevance, while their people at home suffer. This action by Iran that is being proudly paraded around is just another flashpoint the people within Iran will use against the regime.

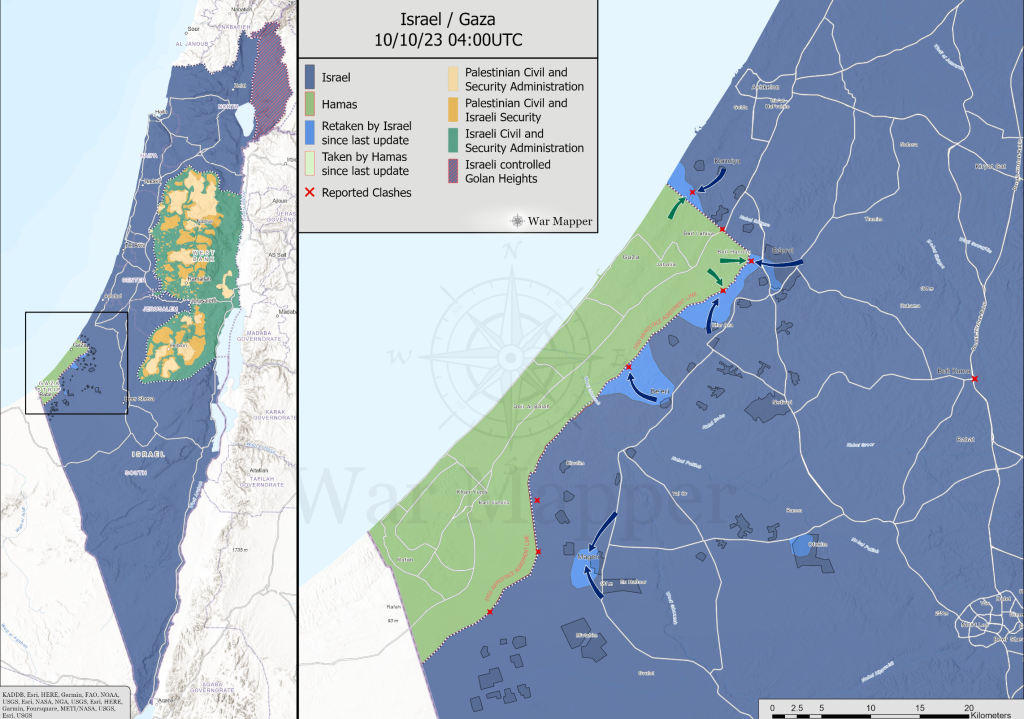

Israel will push into Gaza with a huge ground invasion that will see them take full control of the strip and bring back total control of the region. This will be a reversal of the 2005 exit by Israel, and it will be used to re-establish the 21 Israeli settlements in the region. The “Israeli Disengagement from Gaza” in 2005 saw a unilateral pullback of settlers and the military out of Gaza. The goal was to improve Israel security while also bolster “international status” by showing progress with Palestine. Israel will carry out airstrikes over the next several days to take out vital assets prior to what will be a lengthy ground invasion. This will be urban warfare over the next few weeks, and it’s important to put into context what the density looks like in the region. It will take time to move from block to block, especially as military assets will need to be kept in the north to keep Hezbollah from joining the fight from the North through Lebanon.

The below charts look at what urban warfare is going to look like as Israel prepares for their ground invasion.

There will be strategic staging areas to strike from multiple choke points, which will look similar to 2014 just at a much greater scale.

The below picture puts into perspective what the 2014 ground forces looked like when Hamas was penetrating into the country through tunnels. Israel called up about 79k reservists in 2014, but there are estimated to be a total of 300-350k called up for the coming response.

Hezbollah is very heavily involved in Lebanese politics, but they don’t have the support of the local populace. We have seen citizens stop Hezbollah activities along the border with Israel over the last few years, and a deal struck between the two governments on natural gas assets in the Med. It’s unlikely we see a broad sanction of activity originating from the North, but the risk is “too high” to not have heavy machinery and air assets in the region to push back any big infiltration. There has already been some escalation in the North with several artillery, fixed wing, and helicopter responses on attempts to cross the border. This has resulted in deaths on both sides, and has seen Israel take out some strategic assets along the border. Israel will remain with the stance of being reactionary on the border instead of moving deeper into the Lebanese territory. We already know that the local people are NOT in support of Hezbollah, and there is a focus on avoiding any and all collateral damage.

The below chart shows some of the border areas that are currently the focal point. There have also been several incidents in the Syrian “gray area” that is represented by the dotted line. Israel has already struck an Iranian military supply convoy in Syria, which is important to show they are remaining vigilant on keeping assets from entering Lebanon. The UAE has also stepped up their push to keep al-Assad from participating or “allowing” passage of equipment or escalation. While it’s good for the UAE to attempt using their political clout, Iran has a firm level of control over the al-Assad government.

Iran wants to slow the unity of the GCC with Israel at all costs, and this will be enough to pause- not stop- the agreements between Saudi and Israel. Israel signed a diplomatic accord with the UAE and Bahrain since 2020. India has been a key lynch pin in creating deals between Israel and the UAE to create a “New Silk Road” into Europe and the rest of the West. Iran wants to disrupt additional unity by being a key sponsor of Hamas, Hezbollah, and Youthis. KSA and Iran signed a reconciliation deal in March 2023 that outlined respecting each other’s sovereignty and not interfering with their internal affairs.

Israel has been very effective in striking Iranian assets in Syria, and this is a big way for Iran to disrupt actions in Syria while also driving a wage between KSA and Israel relations. I think this sums thing up well:

What Happened: Iran’s Islamic Revolutionary Guard Corps Quds Force helped the Gaza-based militant group Hamas plan and orchestrate the Oct. 7 attack on Israel that left more than 700 Israelis dead and dozens of people taken hostage, The Wall Street Journal reported Oct. 8.

Why It Matters: If the report is true, Iran’s involvement could be rooted in a desire to sink Israeli-Saudi normalization efforts, as Israel’s retaliation against the Palestinians will alienate many Muslims. Moreover, regional escalation will enable the Iranian government to continue consolidating its power around an external enemy — in this case, Israel — to distract the populace from Iran’s internal challenges. Israel may respond with military force against Iran, potentially inside Iran’s territory and not just in proxy theaters like Lebanon, Iraq and Syria. Such a direct attack would likely provoke retaliation by other Iranian proxies.

The below map puts into perspective the reach of Iranian assets and missiles in the region. Our carrier strike group has THAAD protection and can aid the Iron Dome with repelling “bigger” threats that could hit the region. It also supports our assets in Syria and Iraq from potential threats. One of the largest concerns is the Badr Organization that operates within Iraq and has been linked to attacks on U.S. assets.

As Israel plans a ground invasion, the U.S. moved the Gerald R Ford Carrier Strike Group into the region. This allows the U.S. to help with intelligence gathering and potentially participate in the operations. It’s unlikely we see the U.S. participate outside of intelligence and equipment, but it also provides our ability to responded quicker to escalations in Iraq and Syria. The IRGC are showing to increase their activity in Gaza and Lebanon, and it means they are likely planning bigger actions in Iraq and Syria. There is a growing call to designate Hadi al-Ameri as a terrorist as he operates the Badr within Iraq. They have been linked with several attempted attacks on U.S assets.

The U.S. has moved all locations to “high-alert” as we do expect to see more attacks on Israel and her allies. Iran has likely prepared Hamas for the likelihood of an urban invasion, and they will carry out planned guerrilla tactics and efforts to slow the progress of Israel. The longer the invasion takes the “worse” the optics will be for an Israeli-Saudi normalization negotiations. I don’t think this ends those talks in the long run, but it will create significant problems in the near and medium term.

What Happened: Saudi Arabia is willing to increase oil production in 2024 if oil prices are too high in an effort to help seal a defense deal with the United States that is part of Israeli-Saudi normalization negotiations, The Wall Street Journal reported on Oct. 6. Hours later, Hamas and other Gaza militant groups launched an unprecedented attack on Israel that killed more than 700 Israelis.

Why It Matters: The attack throws Israeli-Saudi normalization talks into a crisis, as the United States may be less willing to give explicit security guarantees to Saudi Arabia amid an uncertain security environment. Additionally, Israel’s retaliation against the Gaza Strip hinders the optics of Israel-Saudi normalization, as Riyadh has been pushing Israel to offer concessions to the Palestinians. But even if the normalization deal falls apart, Saudi Arabia could still increase oil production in early 2024 if prices go above $95 or $100 per barrel for a sustained period of time.

Egypt has had lukewarm relations with Israel ever since they teamed up on the Sinai Peninsula to clear out terrorists in the region. The two countries have also been working together on natural gas flows and utilizing Egypt’s pre-existing LNG capacity. Egypt and Israel share intelligence, and there are rumors that Egypt warned Israel of “something big” 10 days ago. It’s likely they heard something, but the questions is always- how credible is the information and the threat? I would say it’s likely Egypt informed Israel of the information, but the threat wasn’t deemed “Credible.” I don’t think this breaks Egypt and Israeli relations because they both need each other militarily as well as economically.

The Hamas attack has unified Israeli parliament and politicians, which will likely last throughout the operation. Israel will respond with strength to send a message to other Iranian proxies, but also to the GCC to highlight the strength of their military and the benefits of being an ally.

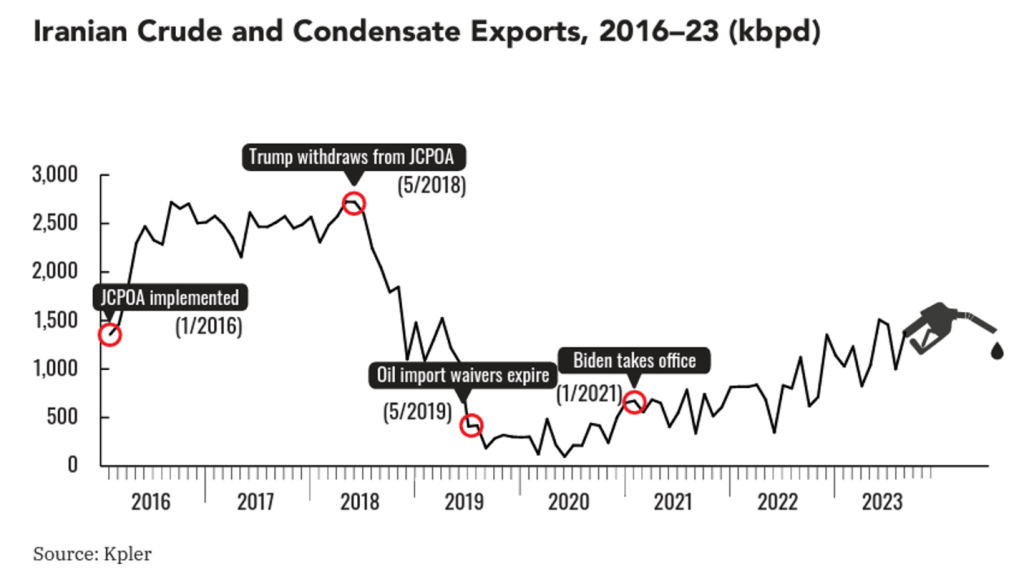

Iran has overplayed their hand, and it will result in renewed sanctions on their crude. There has been a lot of leniencies on their exports, but as they openly admit helping, supplying, and essentially planning the attacks- there will be a big drop in exports. Iran has seen their production grow from 2.5M to 3M since the agreement with KSA, but we will see more pressure to the downside of their production driven by the actions in Israel.

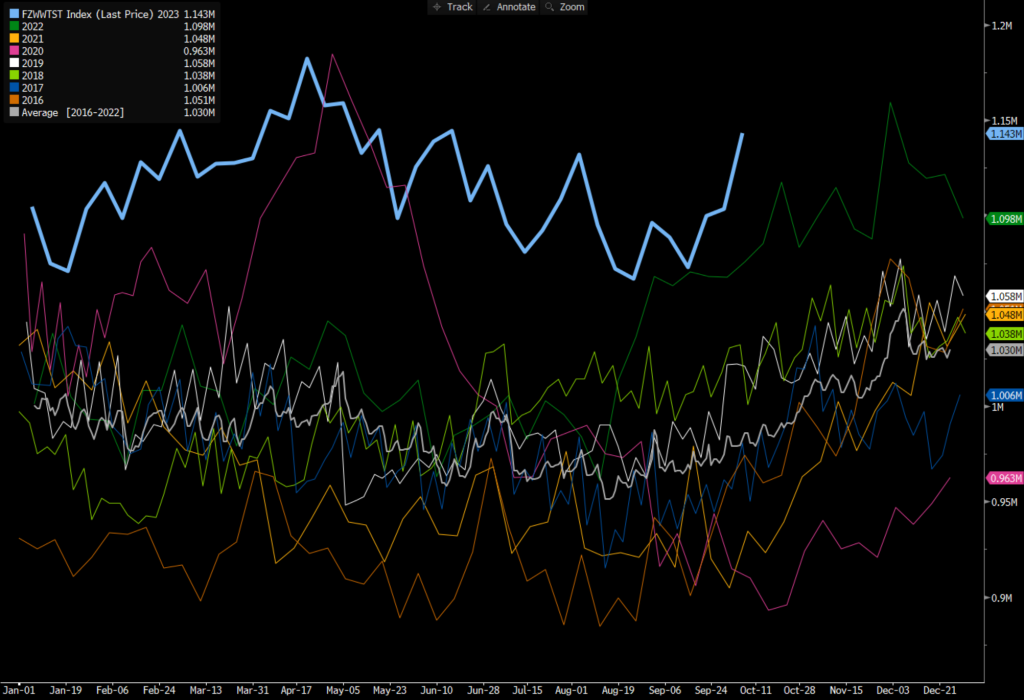

This will result in less exports over the near term- with a push back to about 1M in the near term.

India and China will pull back on their buying, and more crude will pile up in onshore and offshore storage. The below gives you an idea of pipelines in Israel, and we should see a lot of these assets shut in the near term. Israel has already announced the closure of Ashkelon as air operations continue in the region. This isn’t a huge surprise, but a prolonged shutdown will begin to push up LNG prices.

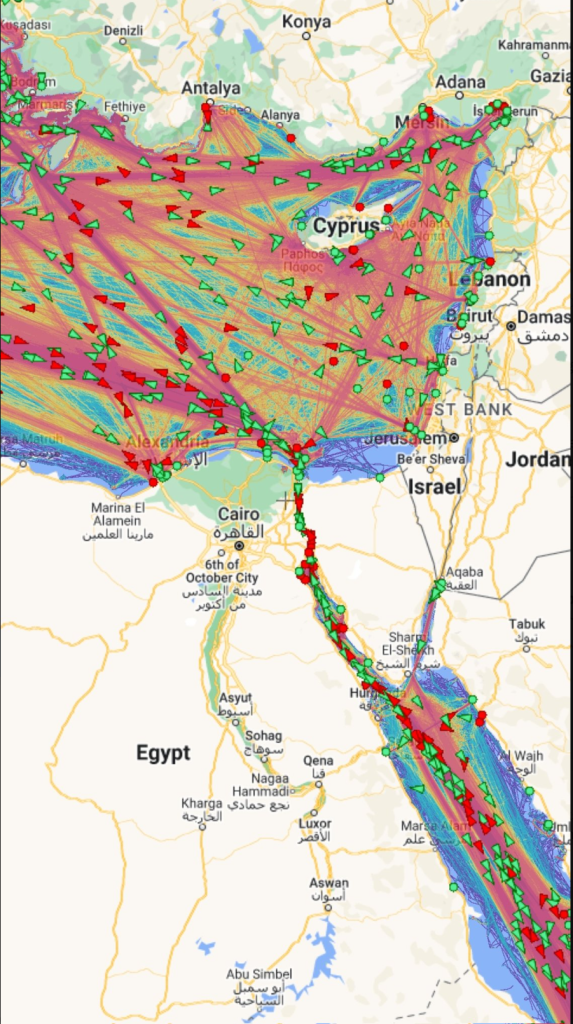

Iran could increase pressure in the Red Sea by taking utilizing the Houthis in Yemen, and by utilizing their own navy in the Strait of Hormuz. Egypt needs to contend with concerns about attacks on the Suez canal, which is just another reason they don’t turn away from Israel.

We expect to see more U.S. presence in the region, and it there will likely be less leniency with the Iranian antics. All GCC nations would experience significant disruptions if Iran “acts up” in either location, which is something Iran will want to avoid in the near term. Any disruption in the Suez will also have a big impact on LNG pricing as many vessels utilize the canal to flow into Europe.

In our EIA show and last week’s insights, we highlighted that Brent crude would likely bounce hard off of $84, but we didn’t expect the rise in geopolitical risk to be the main driver. This increase in risk just supports our view that Brent hits $90 before it slowly drifts lower to $83/$84 over the next few weeks. There is more demand destruction that is happening around the world, which is the biggest headwind to crude prices over the remainder of the year. Geopolitical pressure will come back into the market when Israel “officially” begins the ground invasion of Gaza. The concern will be around Iran’s reaction as well as other key players in the region. The below chart helps to highlight the “density” of trade in this region from 2021. This is another key reason the U.S. has such a heavy presence in the region.

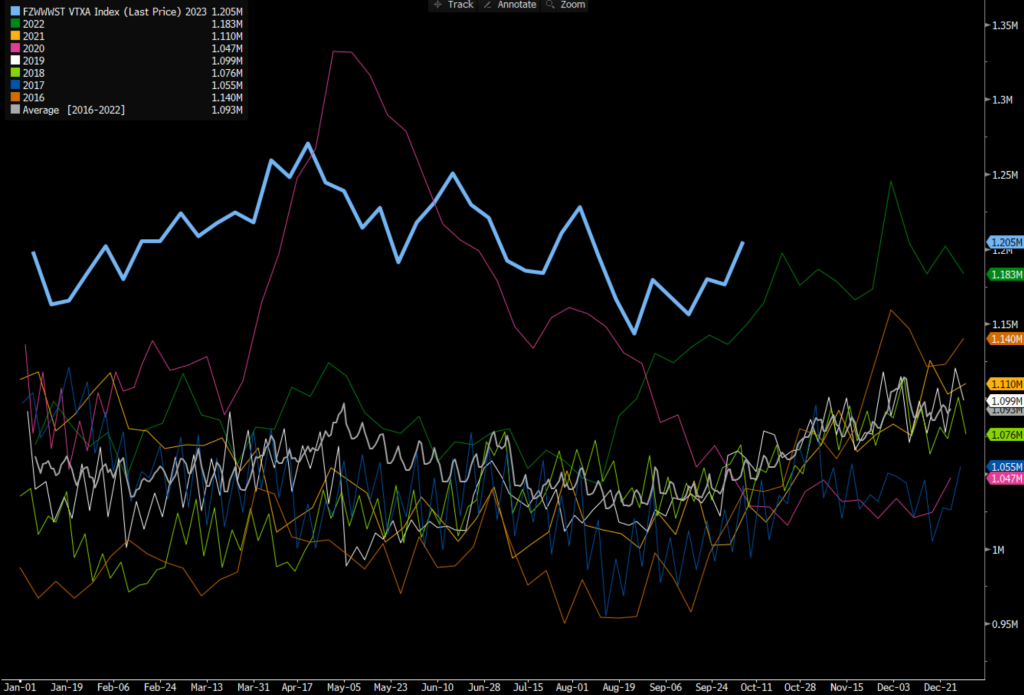

There has been a sizeable increase in floating storage in all places except Asia, but we have more crude hitting the water based on “Crude in Transit” as well as “Crude on the Water.”

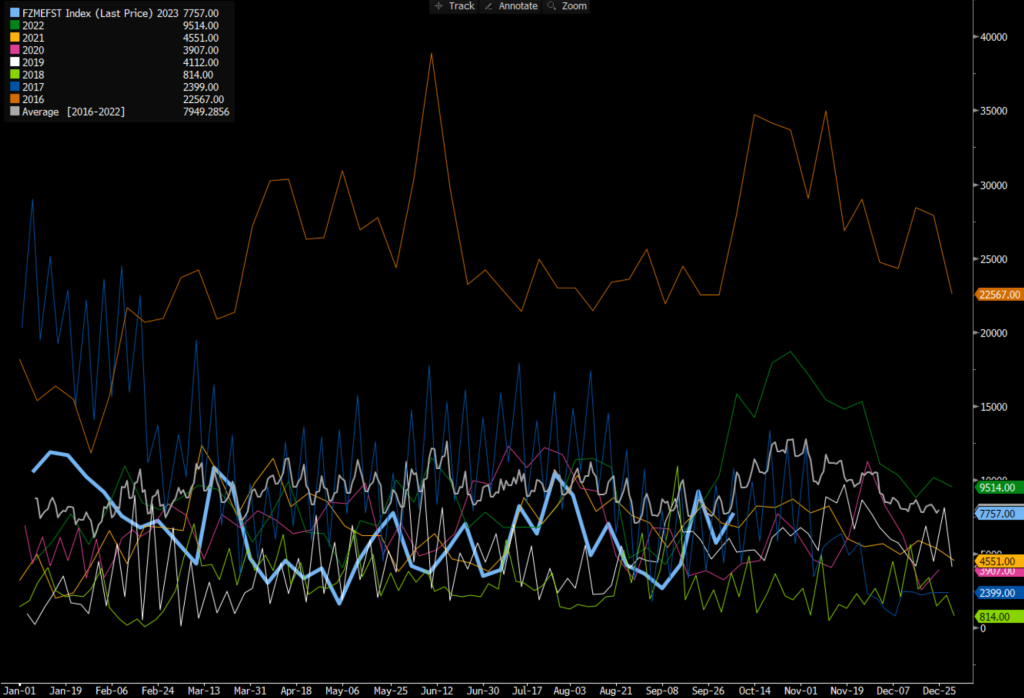

Global Crude Oil on Water

Global Crude Oil in Transit

These volumes will end up in key areas- especially Asia, but the bigger concern is- these volumes are increase while there are bigger builds in floating storage. The key areas to watch for floating storage are West Africa and the Middle East- both of which saw some increases.

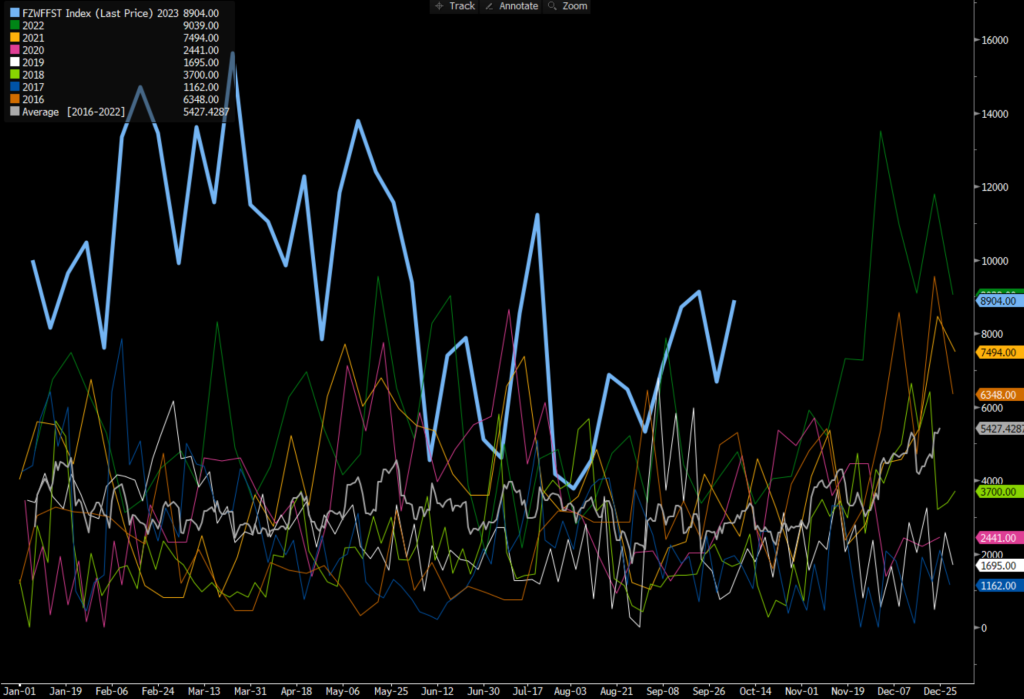

Middle East Crude Floating Storage

West Africa crude floating storage is showing more problems as sales of Nigerian volumes remains well below normal and lackluster.

The weakness in the physical market and increase in floating storage will cap the upside in crude while the geopolitical risk keeps the floor.

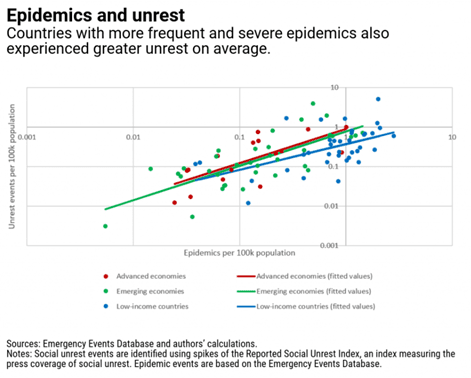

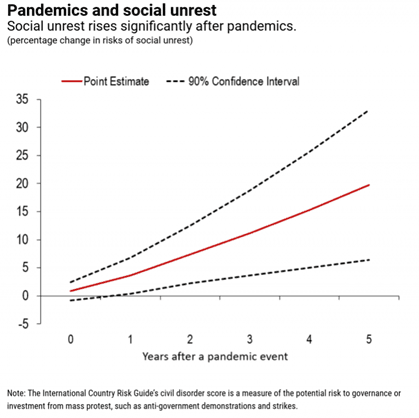

We have been talking extensively about our concerns surrounding the global economy and emerging markets. The actions of the last several days renew the concerns about emerging markets, and the issues on investing in countries with less stability. For those that have been following us, I wrote an article back in Feb 2021 that COVID and the economic repercussions would bring about a global recession, which would reinvigorate “tribal” differences or said another way- regional aggression ( https://primaryvision.co/2022/01/05/what-comes-on-the-other-side-of-covid19/). It should be no surprise to see a renewed fight between key factions across Africa, Middle East, and Eastern/ Central Europe. We contended that many of the fighting would be centered around poor nations and areas that have seen a sizeable decline in quality of life. It takes people who are angry and “disenfranchised” to be convinced to fight along tribal lines, which is becoming easier and easier as time progresses. The question becomes- do all of these “flare-ups” synch up to become a much bigger World War. This is where we turn to the major world powers- U.S. and China while on a smaller scale India and Russia. Russia is currently bogged down in Ukraine, and NATO/U.S has every intention of ensuring Russia is stuck in Ukraine. The question pivots to Asia and how the U.S./ India/ China interact over the next few years. We do see some additional skirmishes between India and China, but it’s unlikely this expands into a much bigger battle. It’s unlikely China attempts to move in on Taiwan, but as things heat up in the Middle East and countries redirect assets- it could become a viable option.

This is where it’s important to designate some important caveats. The CCP and Chinese population are NOT aligned when it comes to the current direction of the country. It will be difficult to get national support to move into Taiwan as economic discourse remains internally. The CCP would love to create a “distraction” but human losses would be massive on a Taiwan invasion so we think the CCP pushes their claims into Japan/ Philippines/ ASEAN nations as a form of saber rattling while avoiding a much bigger escalation. Many of the current skirmishes and wars are specifically along tribal lines- especially many where government and local populace are aligned in their anger. The Russian populace remains “ignorant” to what is happening between Ukraine and Russia, but Ukraine remains united in their hatred of Russia- going back well into the USSR period.

Economic strain is only going to get worse as we close out 2023 with more to come in 2024. The inability to blindly spend and print will create a much longer slowdown driven by power policies of the last 20 plus years. The concerns of investors will create more “flights to safety” which will help cap some of the rises in U.S. treasuries as more buyers’ flood into the U.S. bond market. The “flight to safety” remains but duration is a HUGE factor when you look at the yield curve. The 30 year bond auction was TERRIBLE across the board, which isn’t a surprise if you have been following our economic arc. On a lot of levels, this is a big miss- with a horrendous bid-to-cover and yields crashing through the top end of the range. We believe that the 30 year will push straight through 5% with a similar move in the 10 year over the next several weeks. Duration risk increases as the economic data deteriorates further, inflation accelerates, and bank stress grows. We have said from the very beginning- there is MUCH MORE RISK as the small/medium banks vs the mega banks. This current earnings season reconfirms that view.

US 30-YEAR BOND AUCTION BID-TO-COVER 2.350

HIGH YIELD 4.837% VS WI 4.8%

US SELLS $20 BLN

AWARDS 22.14% OF BIDS AT HIGH

PRIMARY DEALERS TAKE 18.17%

DIRECT 16.71%/ INDIRECT 65.13%

When we pivot to some of the key leading indicators, U.S. PPI has come in above estimates for several months in a row, which is a leading indicator for CPI. We have now seen CPI top expectations, and given the geopolitical and supply chain backdrop- prices will keep grinding higher. We made a call at the beginning of 2023 that by Q4 we would be slipping from “stagflation” into a deflationary standpoint as we pivot into 2024. Instead, we find ourselves firmly in a stagflationary backdrop with more risk to the upside vs downside in consumer pricing. Energy costs, supply chain, labor, and other core factors will keep “Sticky” inflation well above estimates and hit the consumer harder.

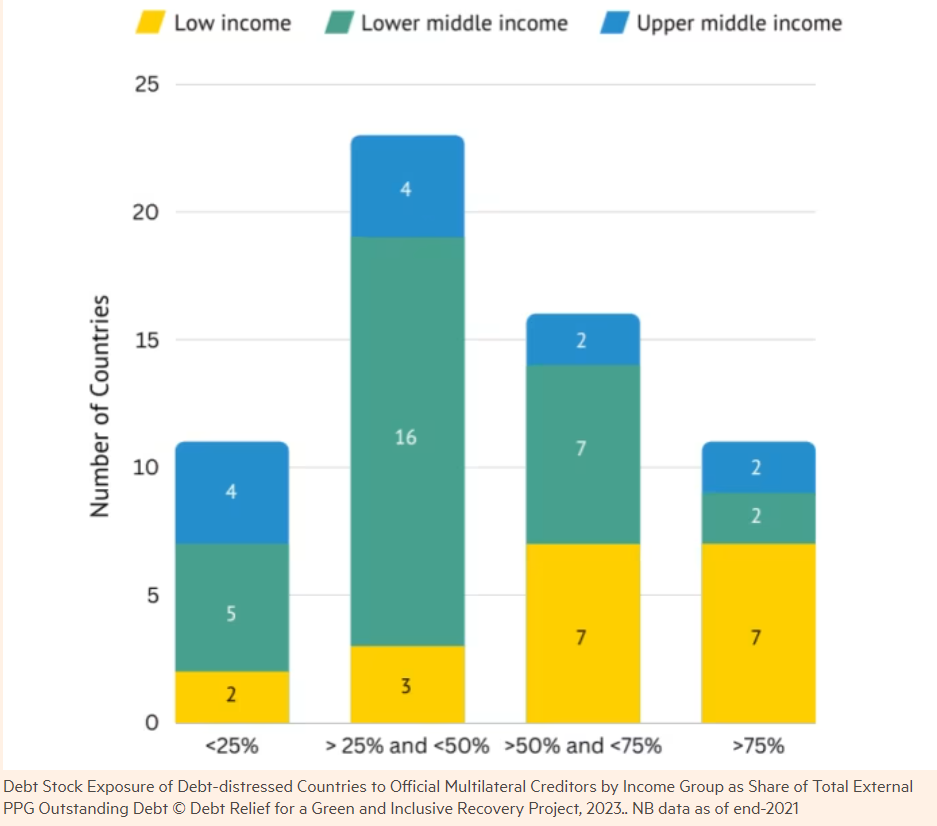

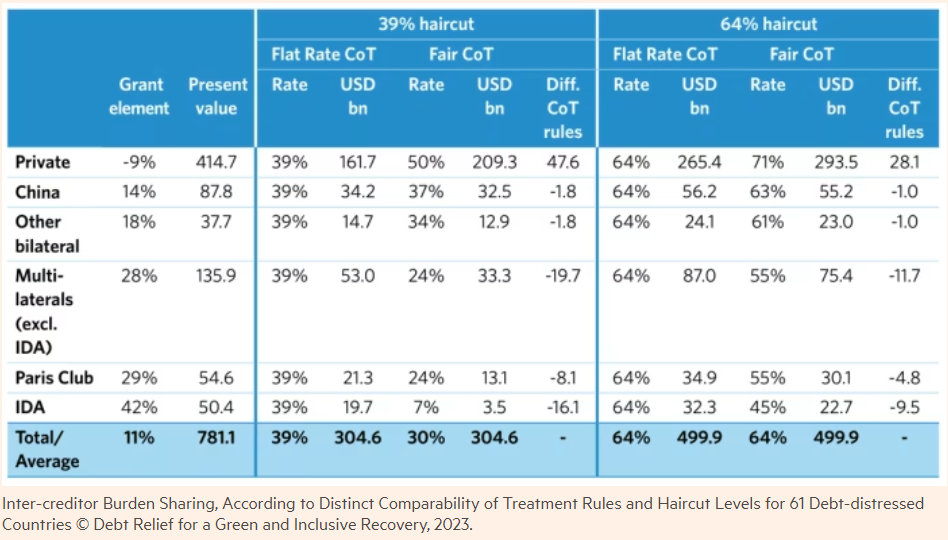

This is happening even in the backdrop of weakening global trade as we continue to see from core bellwethers of exports. China just posted another miss on imports/exports, and it’s unlikely we see that pivot higher into year end. As these exporting nations slow, it means they are also importing less from key Emerging Markets. This is increasing the strain on countries around the world that will likely need a “haircut” on their current debt holdings or face rolling defaults. Of 61 countries that desperately need debt relief, “27 countries in “debt distress” owe at least half of their total external public debt to multilateral creditors. For 11 of those countries, the exposure is above 75 per cent.”

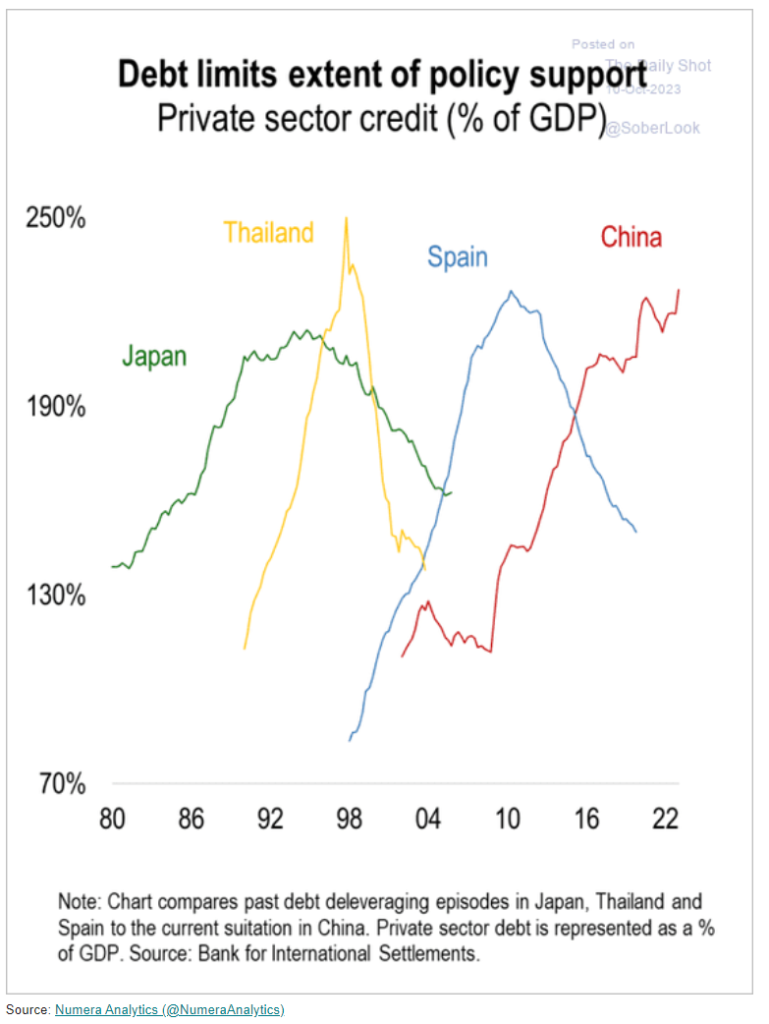

A haircut would be another big hit against the Chinese markets as they are very exposed to these key countries. As we’ve been saying, China’s banking system is NOT purely internal, and they have extensive risk to their assets and collateral. They don’t have the ability to post additional collateral, and will need external injections of capital that will be fleeting. This will force broad write-downs in 2023, which will only get worse in 2024.

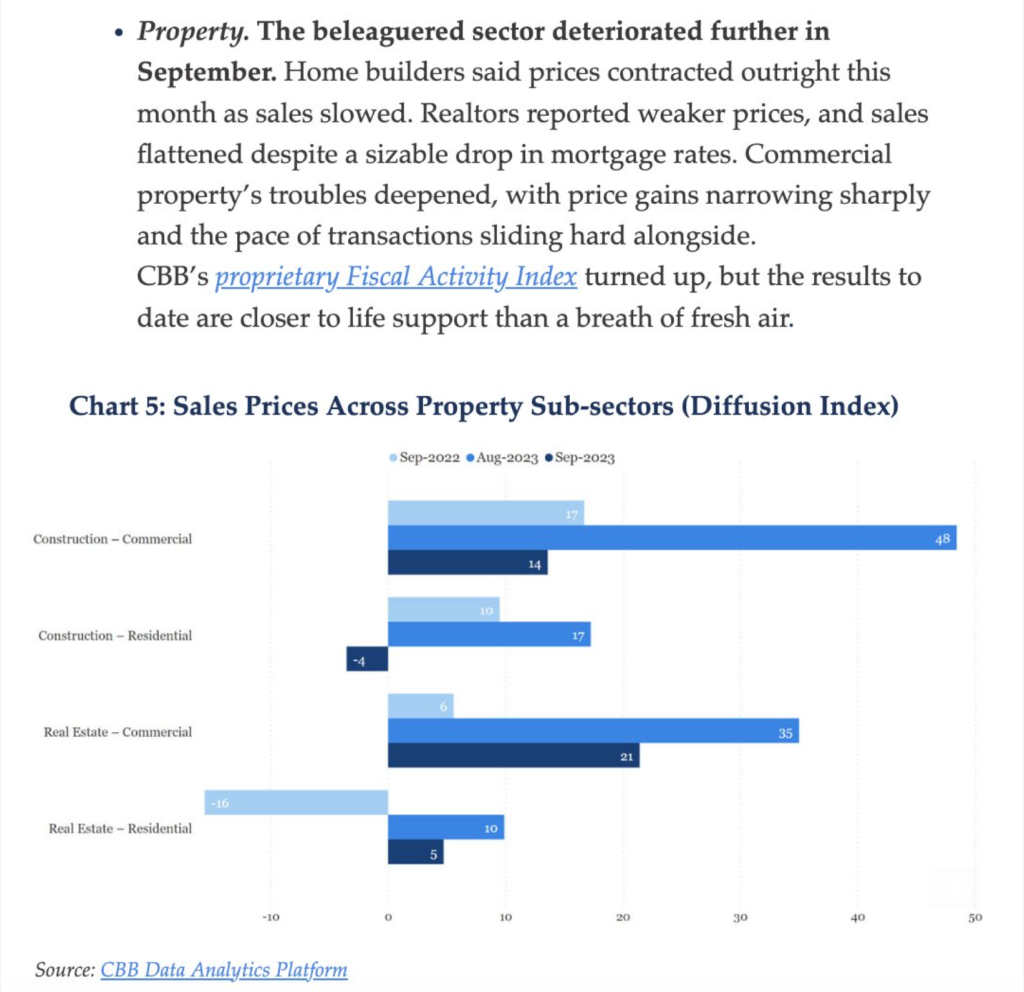

There have been several announcements of PBoC backstops with $1T RMB for infrastructure and a “Fund to support the market”, but China is fully in throws of the “Law of Diminishing Returns”. No matter how much money and liquidity they throw at the situation it will have a negative effect.

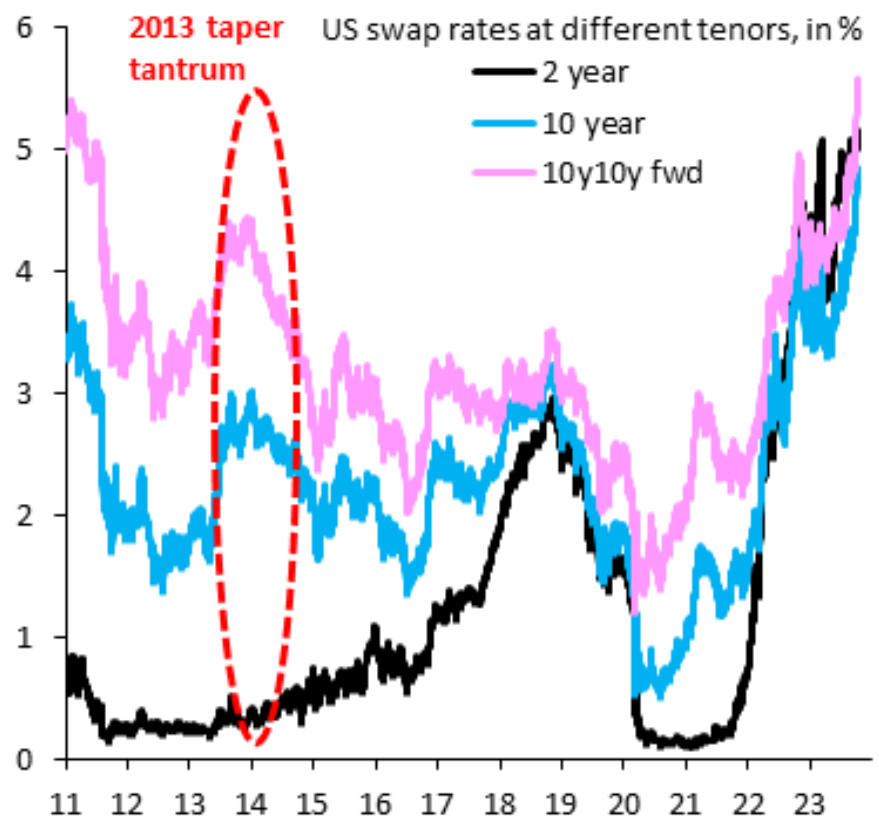

The U.S. is in a very similar situation- especially when you compare the Fed backdrop during the “Taper Tantrum” vs today. The rate of change of the movement in yields has been MUCH worse than 2013-2014 especially when you consider that rates are FAR from done going higher. In ’13-’14, the Fed stepped in to stem the bleeding, but this time the Fed is sitting on their hands with another .25% increase in rates likely within the next 1 or 2 meetings. They may skip November given the geopolitical backdrop, but the re-acceleration of PPI and CPI is going to complicate their ability to manage costs. As we have said the whole time, the Law of Diminishing Returns hits hard, and Powell (while I’m not a huge fan) isn’t stupid and understands the situation (or so I hope). He is trying to avoid the late 70’s playbook, and ensuring a controlled decline in asset prices instead of allowing a broad wage price spiral. This will bring down home prices and other hard assets in the medium term, but it will be a bumpy road because many things are still GROSSLY overvalued in the current interest rate backdrop.

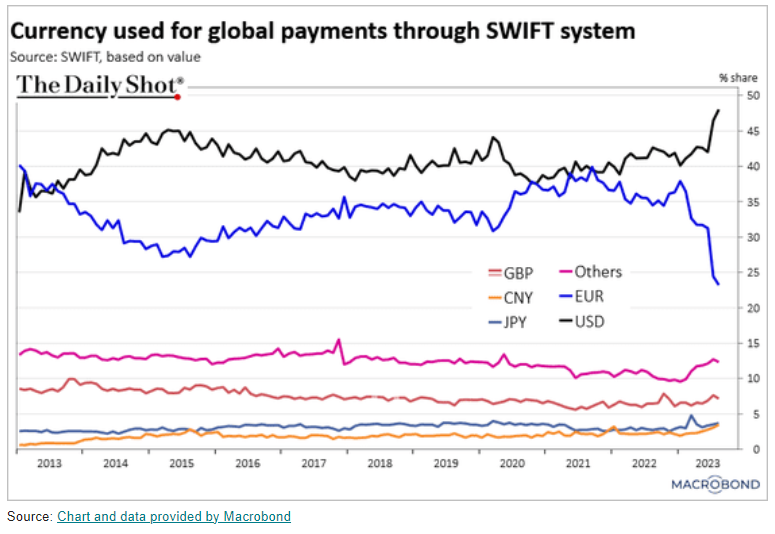

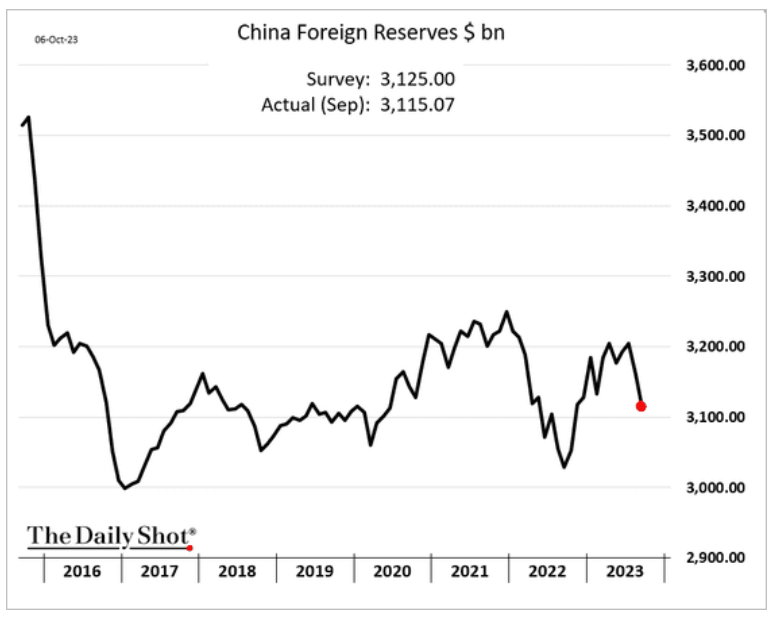

Another core belief of ours is that the US Dollar doesn’t lose it’s dominance on the world stage. Instead, as people race for safety and other currencies collapse “faster” the dollar will actually GAIN market share. The below chart puts into perspective that USD use in the swift system has reach a 10 year high, and we don’t see that changing any time soon. China was selling TSY to pull forward cash as we saw them miss estimates for FX reserves as pressure mounts on their collateral and exports fall (natural way to bring in dollars.)

Here is a chart of China FX reserves:

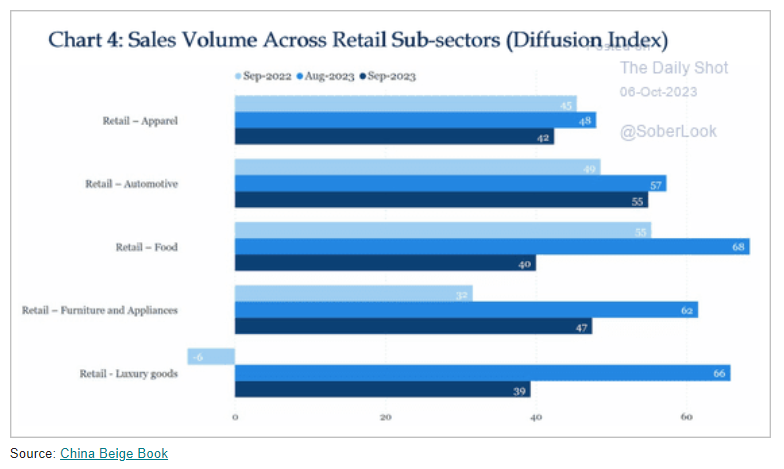

We also saw a disappointing breakdown in spending for Golden week:

Consumer confidence remains below pre-pandemic levels.

On Friday evening, the Ministry of Culture and Tourism released travel and expenditure data for the Mid-Autumn and National Day holidays (September 29 through October 6).

Compared to last year, spending was way up (Gov.cn 1):

- 826 million tourists traveled domestically – up 71.3% from 2022 levels.

- Domestic tourism revenue was RMB 753.43 billion – up 129.5% from last year.

But compared to pre-pandemic levels, the results were less than impressive:

- Domestic travelers were up 4.1% from 2019.

- Domestic tourism revenue was only up 1.5%

Do the math: Adjusting for inflation, and accounting for the greater number of tourists, expenditure per person was significantly below 2019 levels.

Get smart: Low levels of consumer confidence have dragged on economic growth this year, dissuading households from spending on consumer goods or purchasing new properties.

- This data confirms consumer confidence remains subdued, complicating Beijing’s recent efforts to boost consumption.

Get smarter: That said, there have been tentative signs of economic recovery throughout August, especially in state-dominated sectors of the economy.

- Should the economy continue to recover, spillover effects to the broader macroeconomy will boost consumer confidence.

The bottom line: The coming months will be crucial in determining if there will be a sustained recovery in consumer confidence and spending.

This is showing a follow on to the softness we saw in September:

We have said from DAY 1 that the consumer within China was fully tapped out, and I think this chart puts into perspective the current leverage of this pivotal spending group.

Xi is maintaining is rhetoric around “supporting” the private sector, but he firmly believes it needs to follow the state sector.

Xi’s capitalist plan to, erm, beat capitalism

Market-based mechanisms are at the heart of Xi’s plan to boost economic efficiency.

On September 30, Qiushi, the Party’s top journal, published excerpts of Xi’s February speech to newly elected Central Committee members and other top officials.

Some context: These speeches are akin to the US President’s annual State of the Union address. Xi uses them to lay out his political program and discuss key issues for the year ahead.

Spice alert: This speech was pretty spicy.

- Xi focused on Chinese-style modernization, describing it as a system to “create higher efficiency than capitalism.“

How to do this?

Predictably, Xi espoused the state’s role in allocating resources to boost innovation and increase efficiency.

But surprisingly, and more significantly, Xi called for a variety of market-oriented reforms, including:

- Building a market-based, rule-based, and international business environment

- Breaking down local protectionism

- Supporting the private sector and foreign-owned companies

Get smart: Xi used his most important speech of the year to call for market-based reform.

- That explains why there’s been so much Party-state love recently for the private sector.

- It’s also a sign that more market-oriented reforms are in the pipeline at the upcoming Third Plenum.

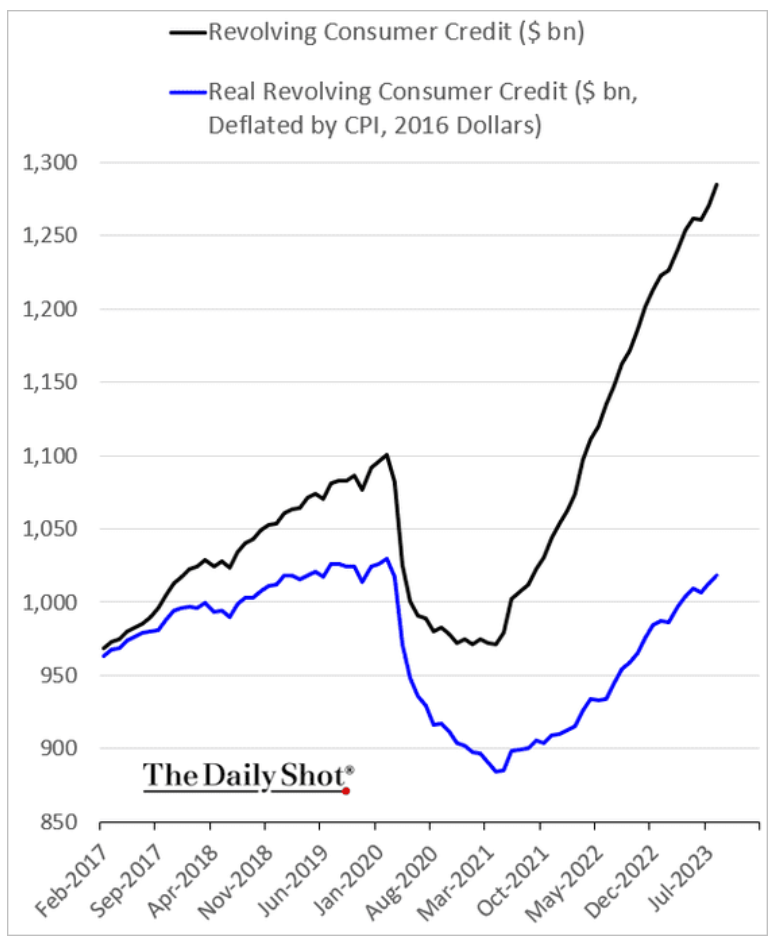

Even as he tries to talk a good game, he is still pushing for State actors to be the driver, and if we know anything about government entities- it’s their LACK of efficiency. The pressure is going to mount on the Chinese economy as the U.S. consumer falls further, the local consumer sits on their hands, and businesses reduce investment and hiring. Wages in the U.S. have fallen again, and as inflation picks up- “real wages” are going to get even worse. This comes on the back of borrowing in the U.S. pushing higher again:

Credit card interest rates are just pushing higher with little in the way of slowing:

The U.S. isn’t the only place seeing this level of stress- it’s a global problem. Our economic view remains intact, and is fully supported by recent data. The biggest risk remains a “Failed bond auction” which we believe will occur in Japan. As we stated in Feb 2021, this was all bound to happen given the level of stimulus over the last 10+ years, culminating with no socio-economic advancement.

We said that this lack of mobility was going to flare up regional wars between tribal factions. The current unrest is far from over with more to come… which just means we are VERY far from the peak of this misery index. Inflation and economic stress is only going to drive more unrest and geopolitical strife… more pain to come. Central Banks were using irresponsible policies for over a decade putting us in this position, and now the unwind of these failed policies is in full effect. Stay with us as we try to guide you through the coming storm!