Market Outlook

We have already discussed Liberty Energy’s (LBRT) Q3 2023 financial performance in our recent article. Here is an outline of its strategies and outlook. Given the relatively small spare production capacity in the energy sector, the current geopolitical volatility has tilted the balance in oil and gas markets in favor of an upside. Although the current North American energy market does not display much optimism, the management believes it “anchors a more durable cycle.” The current environment is also conducive to supporting the commodity price level and investments in the shale basins in the long term.

Liberty has set a strategy to withdraw underutilized frac spreads to maintain steady pricing. Completion activity and industry frac spread count dwindled in 2023. The industry is addressing the issue with consolidation, technological process upgrades, and disciplined investment. The recent M&A activities, including the proposed XOM-PXD and CVX-HES mergers, are cases at this point.

Frac Spread Count And Strategies

Readers may note that the US rig count dropped 8% from Q2 to Q3, while the US frac spread count was relatively resilient (2% down). Liberty reduced its frac fleet count by one in response to softer market conditions. This was in the lower range on its frac count reduction plan. The drop also reflects its higher frac fleet efficiency and improving utilization. The management believes the frac spread suppliers have adjusted to E&P operators’ flattish production levels. So, the current stability in commodity prices can drive a modest increase in industry activity beginning in 2024.

Instead of outsourcing the power generation part of its frac fleet, it started building the next-gen frac fleet. The company’s digiPrime units commenced operations in late September. Its digiFleets offer compressed natural gas delivered by Liberty Power Innovation’s Division. Our previous article discussed that LBRT deployed its first digiFleet comprising digiFrac electric pumps in Q1 to design and build natural gas-powered frac fleets. Currently, it plans to operate four digiFleets by 2023-end and six digiFleets by January 2024. So, it has maximized diesel displacement with natural gas.

Through the OneStim acquisition (from SLB), the wireline business has streamlined LBRT’s frac and wireline crew interactions. Higher efficiency helped lower production costs for its customers. It has now paired more frac and wireline crews and ranks as the top service provider.

LBRT’s Outlook And Q3 Performance

LBRT maintained its adjusted FY2023 EBITDA growth rate at 30%-40% compared to a year earlier. However, it expects the North American completion activity to slow modestly in Q4. The management also believes that improved profitability, lower capex, and efficiency gains will help it surpass the 2023 cash flow in 2024.

LBRT’s topline steadied in Q3. Its revenues in Q2 2023 increased by 2% compared to a quarter ago due to increased efficiencies across the fleet. It also integrated its services and a generated favorable product mix. So, it offset the loss of revenue due to the reduction in frac fleet. It also recorded improved pumping hours of sand pumped. It net income decreased modestly in Q2 from Q3.

Cash Flow & Balance Sheet

In Q3, LBRT increased its quarterly dividend by 40% to $0.07 per share. This reflects the company’s ability to generate strong free cash flow through the cycles. It has returned $325 million to shareholders in the past five quarters. Given strong free cash flow generation, it upsized the share buyback plan to $500 million in Q1.

In 9M 2023, led by higher revenues, Liberty’s cash flow from operations increased by 146% versus a year ago. Its free cash flow also turned positive in 9M 2023 compared to a negative FCF a year ago. As of September 30, 2023, its total liquidity was $322 million.

Relative Valuation

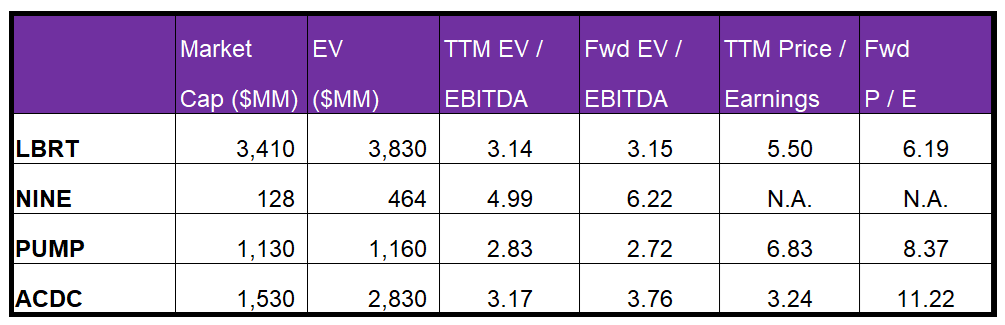

Liberty is currently trading at an EV/EBITDA multiple of 3.1x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is nearly the same. The current multiple is significantly lower than its five-year average EV/EBITDA multiple of ~18x.

LBRT’s forward EV/EBITDA multiple versus the current EV/EBITDA is unchanged compared to rise in multiple for its peers because the company’s EBITDA is expected to remain unchanged versus a fall in EBITDA for its peers in the next four quarters. This typically results in a higher EV/EBITDA multiple than peers. The stock’s EV/EBITDA multiple is marginally lower than its peers’ (NINE, PUMP, and ACDC) average. So, the stock is relatively undervalued versus its peers.

Final Commentary

LBRT’s management believes that the current environment is conducive to supporting the long-term commodity price level and shale basins’ investments. It has set a strategy to withdraw underutilized frac spreads to maintain steady pricing. During Q3, it reduced its frac fleet count by one in response to softer market conditions. However, the company has steadily pushed out new and innovative products and services. Advancing its journey toward natural gas-powered frac fleets, its digiPrime units commenced operations in late September. The company plans to operate four digiFleets by 2023-end and six digiFleets by January 2024.

The company expects its EBITDA growth rate at 30%-40%. Its cash flows turned around in 9M 2023. Based on its ability to generate strong free cash flow through the cycles, it increased its quarterly dividend by 40% in Q3. The stock is slightly undervalued versus its peers at this level.