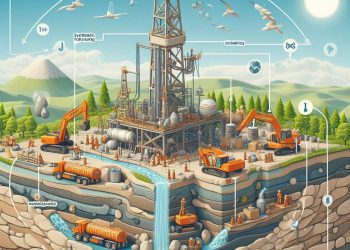

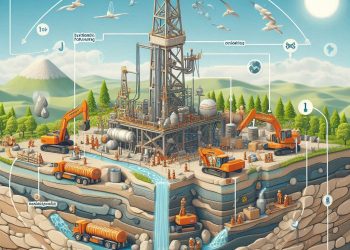

PTEN’s Rigs Weakened In Q3, But To Reverse In 2024: Patterson-UTI Energy’s (PTEN) averaged rig count dropped by 9% to 117 rigs in the US in Q3 2023 compared to a quarter earlier. Lower customer activity and slightly lower pricing adversely affected the company’s pressure pumping and the NexTier completion services businesses. In Q4, the average rig count will likely remain unchanged. PTEN’s management expects the US rig count to increase gradually in 2023, with “additional upside in 2024.” Completion activity should increase through 2024. Read more about this in our previous article here.

PTEN’s Acquisition Performance: PTEN closed its merger with NEX in September, while the integration of Ulterra was on course at the end of Q3. The annual synergies from the NEX acquisition would amount to $200 million by Q1 2025. Its Q3 revenues from the Completion Services segment increased significantly following the inclusion of NexTier Oilfield’s results (30 days of financial data) in Q3.

More On The Key Factors: Quarter-over-quarter, PTEN’s revenues (recast revenues) in the Drilling segment remained nearly unchanged in Q3 2023. However, average rig revenue and margin per operating day increased. Lower customer activity and lower pricing kept the Completion Services segment growth in check. Adjusted gross profit also increased significantly in this segment.

Thanks for reading the PTEN Take Three, designed to give you three critical takeaways from PTEN’s earnings report. Soon, we will present a second update on PTEN earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.