Frac’ing And Drilling Outlook

We discussed our initial thoughts about Patterson-UTI Energy’s (PTEN) Q3 2023 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook. The slowdown of fracking activity has deferred some investments in new equipment, particularly in natural gas-powered pressure pumping fleets. In Q3, the company continued to witness plenty of white spaces in its fracking calendar as it exercises pricing discipline. The pricing restriction can also result in stacking some equipment. However, the company plans to use the downtime to maintain its equipment and prepare for increased activity in 2024. The company will remain invested in upgrading its pressure-pumping fleets. It plans to replace its entire diesel-powered fleet with natural gas at the end of its useful life.

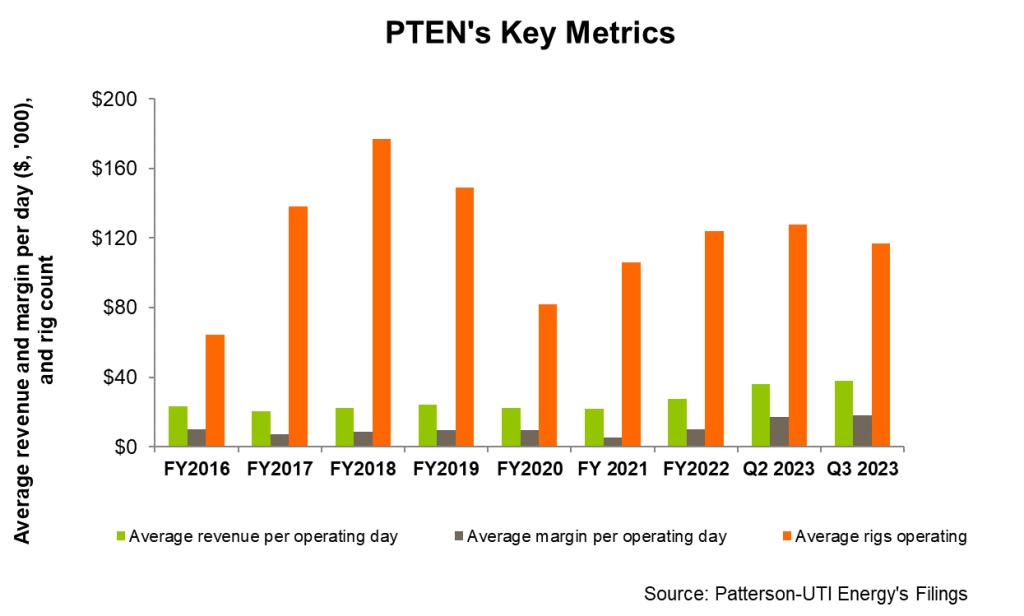

The company’s average rig count declined marginally to 117 in Q3 from 119 in Q2. It plans to exit Q4 with 120 rigs. Its revenue per day remains in the “mid- to low 30s” in Q3. Its super-spec rig utilization remained high as the demand for such advanced rigs outperformed the overall rig count. Given the momentum, the super-spec rig activity should recover faster than the idle lower-spec rigs. So, even if the US rig count does not recover in Q4, PTEN, with its advanced rig fleet, should benefit from the current scenario. Based on current contracts, PTEN will have an average of 74 rigs operating under term contracts in Q4. This will provide for ~$760 million of future dayrate drilling revenue.

Value Addition Through Mergers

Following the NEX merger, PTEN has strengthened its position as a key provider of drilling and completion services in the US. It has extended the NexTier power solutions natural gas fueling system to the legacy universal dual fuel fleet. It has also added NexTier’s wireline and last-mile logistics for improved wellsite efficiency and lower costs. The synergies from the acquisition will have ~$200 million in annualized synergies by Q1 2025.

During Q3, NEX acquired Ulterra, bringing revenue synergies between PTEN’s Drilling Services and Ulterra products. The secondary benefit from the mergers with NEX and Ulterra is reflected in enhanced market capitalization and market trading liquidity. The growth in size has also attracted new investors, leading to higher investments in PTEN.

Drilling Performance Analysis

In Q4, PTEN expects to exit the quarter with 120 rigs operating. The average revenue per operating day can decrease by 7%, while operating costs per day can decrease by 3%. As a result, its average margin per operating day can fall by 11% in Q4. After the addition of NexTier Oilfield Solutions to the legacy Pressure Pumping segment, the company’s revenues can nearly double In the Drilling Products segment in Q4. It will likely record an adjusted gross profit of $30 million in this segment. You may read more about the company in our article here.

Capex And Leverage

In Q4, PTEN expects capex to increase significantly to $190 million compared to Q3. Its cash flow from operations increased by 1.1x in 9M 2023 compared to a year ago, leading to a positive and healthy free cash flow from a negative FCF a year ago. The company’s capex strategy involves looking for ways to advance its core competencies. It focuses on short-term and long-term free cash flow generation to improve returns. It plans to return at least 50% of its free cash flow to shareholders annually. Over the past ten years, it has returned ~$1.2 billion to its shareholders. It targets a return of 50% of free cash flow to shareholders through dividends and share buybacks.

PTEN’s liquidity was $665 million as of September 30, 2023 (excluding working capital). Its debt-to-equity (0.25x) is much lower than that of its competitors (NBR, HP, and LBRT). As of September, $281 million remains under the share repurchase authorization.

Relative Valuation

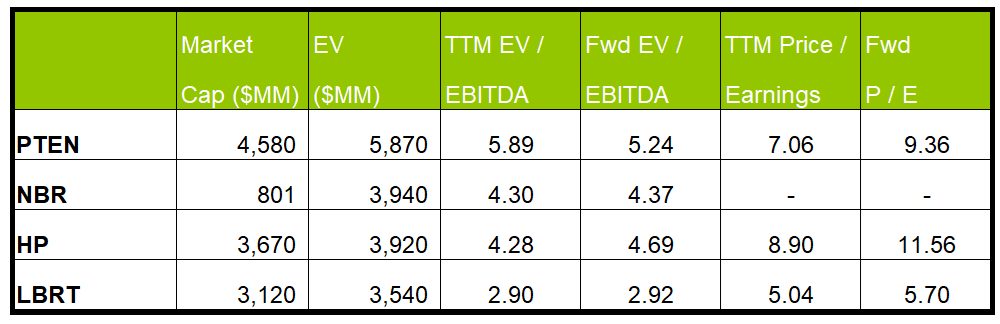

PTEN is currently trading at an EV/EBITDA multiple of 5.9x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 5.2x. The current multiple is lower than its past five-year average EV/EBITDA multiple of 8.6x.

PTEN’s forward EV/EBITDA multiple is expected to contract versus the current EV/EBITDA. This is in contrast to its peers because the company’s EBITDA is expected to increase as opposed to a fall in EBITDA for its peers in the next year. This typically results in a much higher EV/EBITDA multiple. The stock’s EV/EBITDA multiple is higher than its peers’ (NBR, HP, and LBRT) average. So, the stock is reasonably valued, with a positive bias, compared to its peers.

Final Commentary

In Q3, PTEN’s drilling and frac spread utilization fell. It witnessed plenty of white spaces in its fracking calendar as it exercises pricing. By 2024, the US rig and frac spread count will likely recover as energy operators increase drilling and completion activity. In this scenario, it continues to upgrade its drilling fleet. The demand for such advanced rigs will recover faster than the idle lower-spec rigs.

On top of that, the NEX merger helped extend the NexTier power solutions natural gas fueling system to the legacy universal dual fuel fleet. The annual synergies from the acquisition will yield ~$200 million by Q1 2025. Also, the Ulterra acquisition will bring revenue synergies between PTEN’s Drilling Services and Ulterra products. It focuses on short-term and long-term free cash flow generation to improve returns. Cash flow more than doubled in 9M 2023 compared to a year ago. It plans to return at least 50% of its free cash flow to shareholders annually. The stock is reasonably valued, with a positive bias, versus its peers.