The geopolitical risk was pushed higher over the last two days as Iran and Pakistan exchanged fire across the border. China and Saudi Arabia were said to attempt to broker a peaceful resolution, but it broke down resulting in Pakistan carrying out several sorties. There was another round of attacks launched from Pakistan into Southeast Iran this morning. Pakistan and Iran have been at odds for years when you look at cross-border tensions. Things had been trending “better,” but that quickly devolved: “Jaish al-Adl reportedly conducted a deadly attack in mid-December 2023 against a police station in southeastern Iran, and more broadly has been a key factor in the long-running Iran-Pakistan dispute over cross-border militancy. However, Iran-Pakistan relations had somewhat improved in recent months, with the two seeking to improve cross-border trade and security.” I’ve been working in the Middle East since 2010, where I had different roles across varying countries. I put together something on Iran in 2021, and I believe it continues to play out in real time: https://primaryvision.co/2023/10/10/how-big-of-a-threat-is-iran/. We are witnessing- not a rise to power- but rather the death throws of a regime.

The step-up in activity was driven by “Iran’s Islamic Revolutionary Guard Corps reported that Iran struck alleged bases in Pakistan linked to the Jaish al-Adl militant group, AP reported.” It’s important to note that Iran launched missiles into Pakistan’s Balochistan region. The below gives a general understanding of who the region that was struck. The Baloch tribe make up most of this region that spreads across the border into Pakistan, Iran, and Afghanistan. Iran claimed that there were attacks from the Baloch against IRGC assets within the country.

It’s estimated that in 2023, a total of 10 Pakistani soldiers and security personnel were killed in three separate attacks in Balochistan carried out by militants operating from the Iranian side. The Baloch tribe has always had issues with both sides of the border: “While the two countries have exchanged barbs and Iran has taken low-level retaliatory action to such attacks, Tehran’s decision to carry out full-blown airstrikes against Pakistan on Tuesday, targeting alleged Jaish al-Adl militant bases in Balochistan, marked an unprecedented escalation of tensions.”[1]

Pakistan launched airstrikes and rocket fire into Iran aiming for militant hideouts and killing a reported nine individuals.

China has been building out the Gwadar port for years now under the BRI (Belt and Road Initiative.) Pakistan is strategically important for China for several reasons:

- They have been constructing the Pakistan-China Economic Corridor for years.

- Pakistan is a huge buyer of Chinese military equipment

- China is looking to mine minerals throughout the region and filter that up through the corridor

- Gwadar enables China to move goods away from the Strait of Malacca

- China uses Pakistan to help counter-balance India in the region

This is a long way of saying that China would side with Pakistan in any conflict with Iran. I have several standing bets with friends that this is the flailing of a dying regime in Iran. I believe that by 2030 we will have a new government within Iran, and I will be doing business within Iran by 2035. For the last 4k+ years, Iran (Persia) has been a friend of the West- except for the small stint from 1979-today. I predicted (with the help of Generational Dynamics) that Iran would turn back to the West as a bigger confrontation expanded.

A deteriorating China-Iran relationship would also complicate the Iran-Russia setup. Iran is mishandling their position on the geopolitical stage. The U.K. and U.S. continue to hit strategic targets within Yemen to remove the capabilities of the Houthis to launch attacks into the Red Sea. It will take several weeks before many of the launching spots are neutralized, and the strikes are enough to reduce the number of weapons the Houthis have in storage. The Allies in the Red Sea have started boarding boats suspected of bringing military equipment from Iran to Yemen, which will also limit the Houthi’s ability to replenish lost assets.

There have been “discussions” that the border conflict can’t expand because of the weak economies of both countries- especially Pakistan. This is EXACTLY when things CAN escalate because people internally are angry and frustrated. They want to take this out on someone, and Politicians are HAPPY to give people an outlet that doesn’t involve them being blamed. With that being said, I don’t think we will see a bigger escalation. The Iran/Pakistan border has been an issue, and I don’t believe Iran can risk alienating China at this point in time.

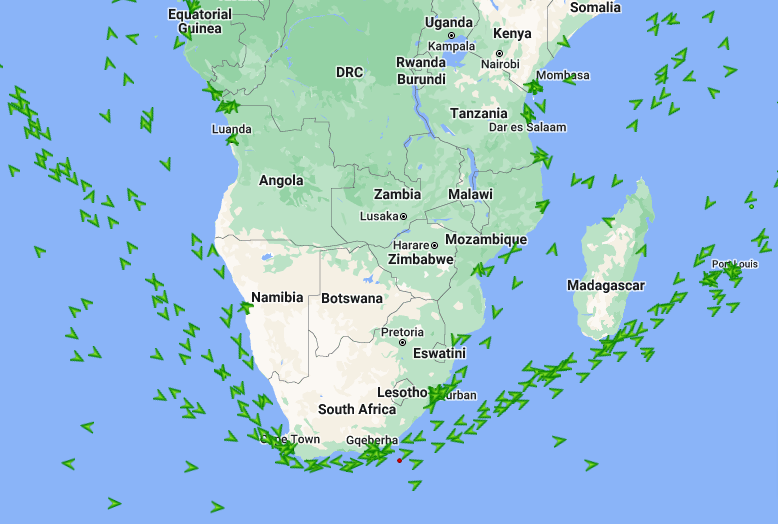

The Red Sea is going to be a “no go” zone for many shippers for at least the next several weeks. There is far too much risk to send anything through the region. This will push more cargoes around Africa, and we have already seen a surge with little to adjust the flows.

Here is another look at the amount of assets that are avoiding the Suez:

.

Geopolitical risk has pushed Brent back towards $80, but we should see that trend back towards $78 as we progress through the weekend. When you look at previous geopolitical events/ uncertainty, Fridays are a point when you get a lot of short covering because no one wants exposure going into the weekend. Brent pricing will fall back within the $72-$78 range with more downside risk in February as demand continues to slow into the end of Q1’24. The recent spike in pricing came from another missile fired at an American-owned commercial vessel yesterday (Thursday). As we highlighted above, it will take time to reduce the capabilities of the Houthi’s, but the game of attrition has begun and will accelerate. Iran has claimed to have show down a U.S. Reaper drone in Iraq, and we expect to have more back and forth while the strikes continue.

The geopolitical risk currently has about $6-$7 of value in the brent futures prices, but we see that bleeding out of the market- especially if nothing happens over the weekend. The U.S. already responded today to the additional launch, and I expect to see the allies get more aggressive in their deterrence.

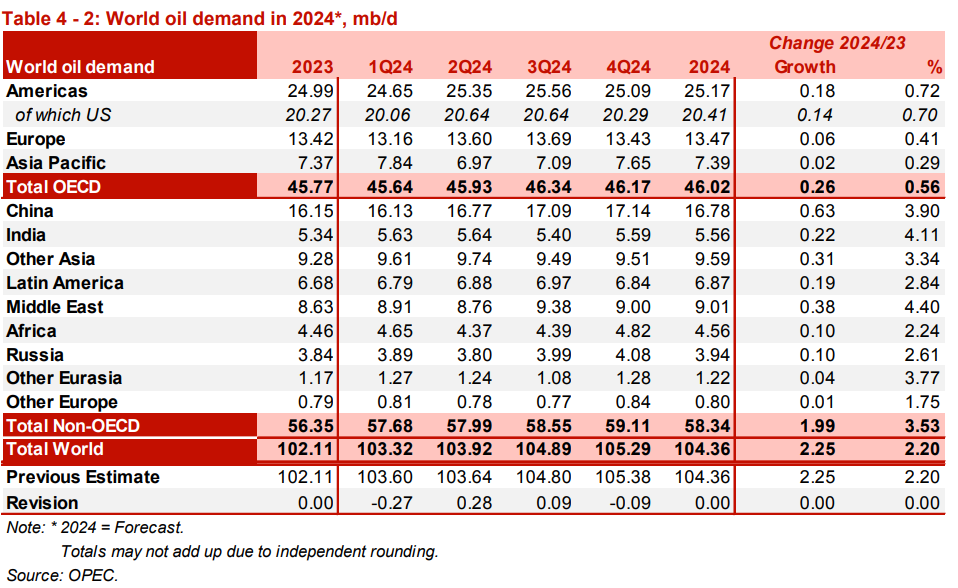

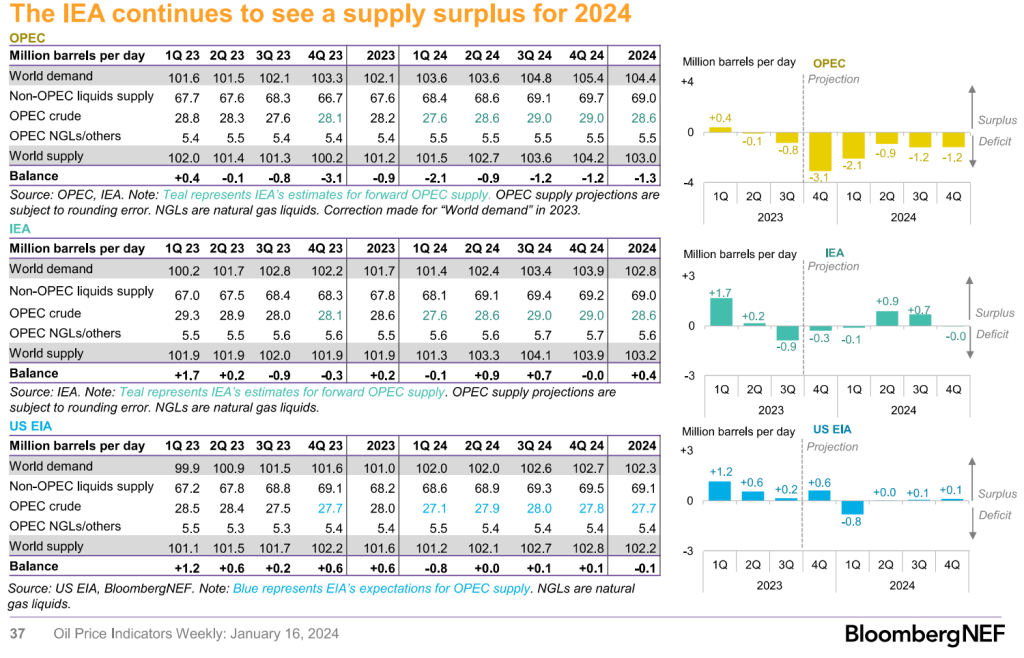

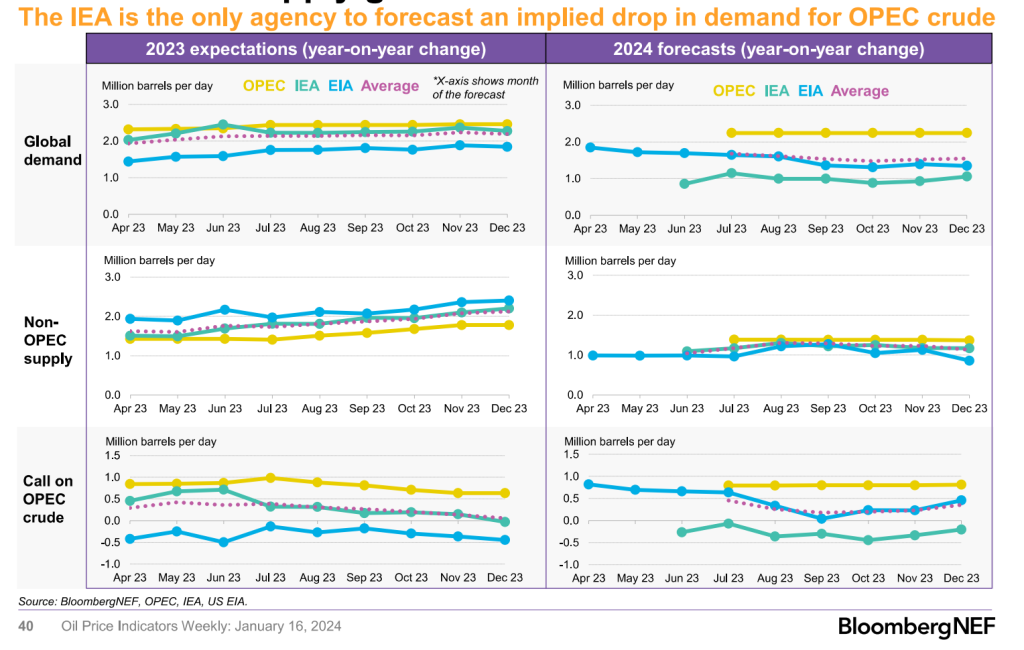

When we switch gears and turn to OPEC expectations of crude demand, there is still no fear of a global recession or even a slowdown. I still struggle to see how we get a sizeable bump in demand in Q2 given the “expected” bump already between 2023 and 2024 in Q1.

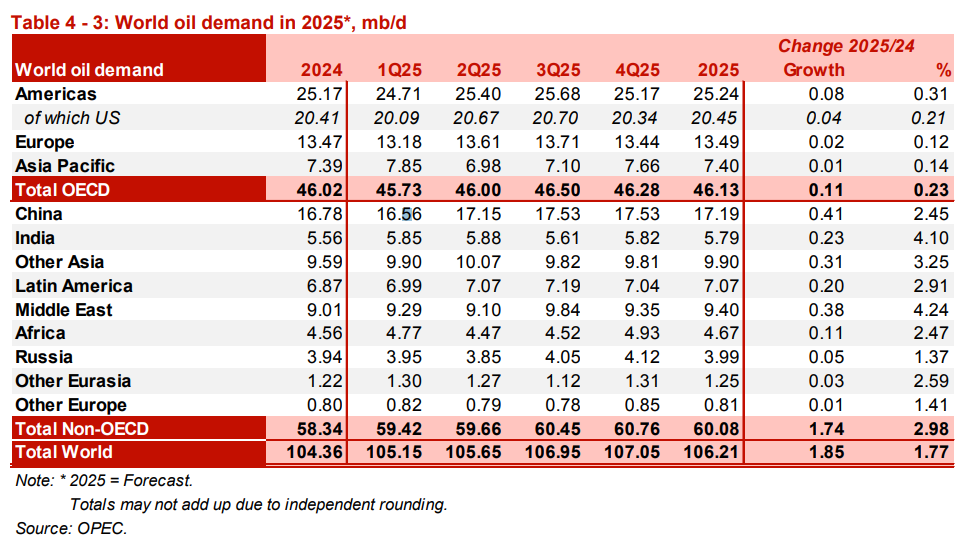

There is another expectation of a bump in 2025 that flies in the face of any potential global slowdown. When you factor in continued inflation and debt overhangs, it’s very difficult to see how we achieve robust economic growth around the world.

OPEC is factoring in additional liquids growth from key areas- specifically the U.S. and Latin America. On the liquids front, it’s very likely we will get some growth over the next several years. I do expect to see the U.S. growth slowdown over the next two years as we hit a “terminal velocity” level of growth. It will be tough to see how the U.S. crosses above 13.7M barrels a day with a “stall” point likely around 13.5M barrels per day.

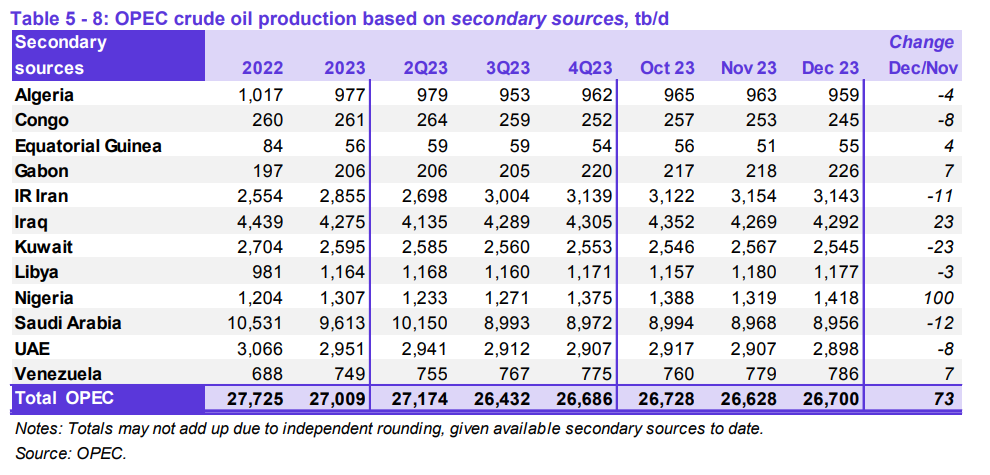

When we turn to OPEC production, you can see a meaningful drop in KSA production over the same period. The market is viewed as “balanced” or in slight builds- while KSA is currently producing about 9M barrels per day. This is about 1.5M barrels per day below 2022, which doesn’t include cuts that other countries have rolled out in the same time frame.

On a conservative basis, there is about 3M barrels a day in “voluntary” cuts that can come back to market. Using their estimates alone, it would take over two years to bring back these voluntary cuts to keep the market “balanced’ in their view. It means OPEC can return only 1.5mbpd over the next two years of their cuts, which is less than the Russian and Saudi voluntary cuts. The Saudi cut was meant to be for 1 month and could end up being for 2.5 years. This is EXACTLY what I said would happen if they went down this path. I just want to reiterate- this is assuming their own numbers:

OPEC January oil report oil demand growth

- 2023 unchanged at 2.46mbpd

- 2024 unchanged at 2.25mbpd

- 2025 at 1.85mbpd (first estimate)

Non-OPEC supply growth

- 2023 raised by 0.30 to 2.08mbpd

- 2024 raised by 0.05 to 1.34mbpd

- 2025 at 1.27mbpd (first estimate)

OPEC crude production up 73kbpd m/m to 26.700mbpd in December

If you consider these overhangs, it will be difficult to get crude to meaningfully push higher with this level of supply hanging over the market. I’ve highlighted the issues on demand countless times, which will make it difficult to bring this supply back without a bigger drop in pricing.

It’s also important to note that Iraq is still limited in their exports with the Ceyhan pipeline still not operational. This is keeping between 400k-450k a day out of the Mediterranean, which will support flows from CPC, U.S., and Libya. Even with the disruption in Libya, there wasn’t much of a bump in pricing.

As we look forward, there has been a bit of strength moving into the physical market as there is some “pre-buying” to account for the extended shipping times caused by the Red Sea debacle. This has helped tighten differentials and create some flat pricing in the market. While we have seen some strength, WAF still remains a bit weaker than expected. This is driven by slow European demand and Asia (mainly China) picking up discounted Russian cargoes. Russia is exporting crude + products at nine month highs. The below shows some strength in Nigeria cargoes, but physical movement slowdowns from Angola and Congo point to a slowdown in Asian buying from WAF. This will offer an opportunity for Europe/U.S. to pick up some preferential cargoes.

SPOT MARKET:

- For Angola, four to six February-loading shipments are still for sale out of 33 planned, according to traders familiar with the matter

- That’s little changed from 5-6 unsold in estimates from Jan. 12

- Republic of the Congo’s Djeno grade still has one or two February cargoes on offer from five scheduled, also little changed on the week, the people said

- Nigerian offer levels have added 20c-50c/bbl versus Dated Brent over the past week as buying activity increases and Libyan outages help lift prompt demand for replacement supplies, according to one trader

Here is just an example: “Colombia refiner Ecopetrol purchased Nigeria’s Agbami crude for the first time in at least six years. West African crudes strengthened last month due to increased demand from Asia coupled with Red Sea tensions, according to the IEA.”

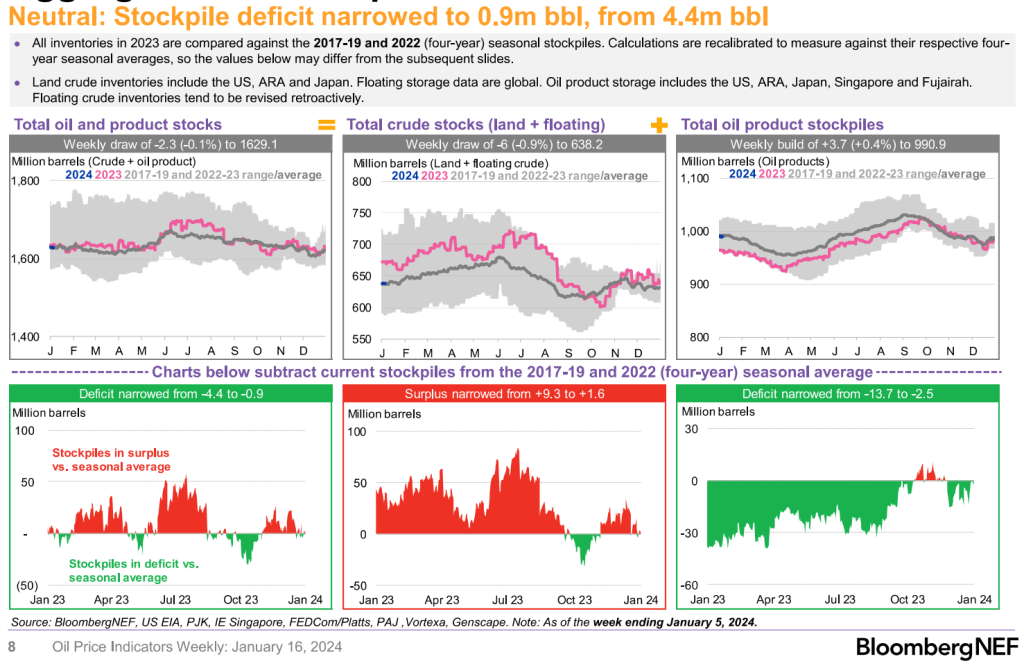

The underlying market still remains flush with product when you look at the balance across the board. The below data doesn’t capture the recent build this week in the U.S. that pushed the “deficit” into surplus.

When I look at the market, I start at the downstream storage- what are the products doing? If products are building or flat- what is the push for a refiner to run harder? When you look at the builds across the product market married with the global economic data- it’s difficult to see a meaningful push for refiners to run harder. We are still in a very “normal” level in comparison to history, which is a bit counter to the narrative in the market.

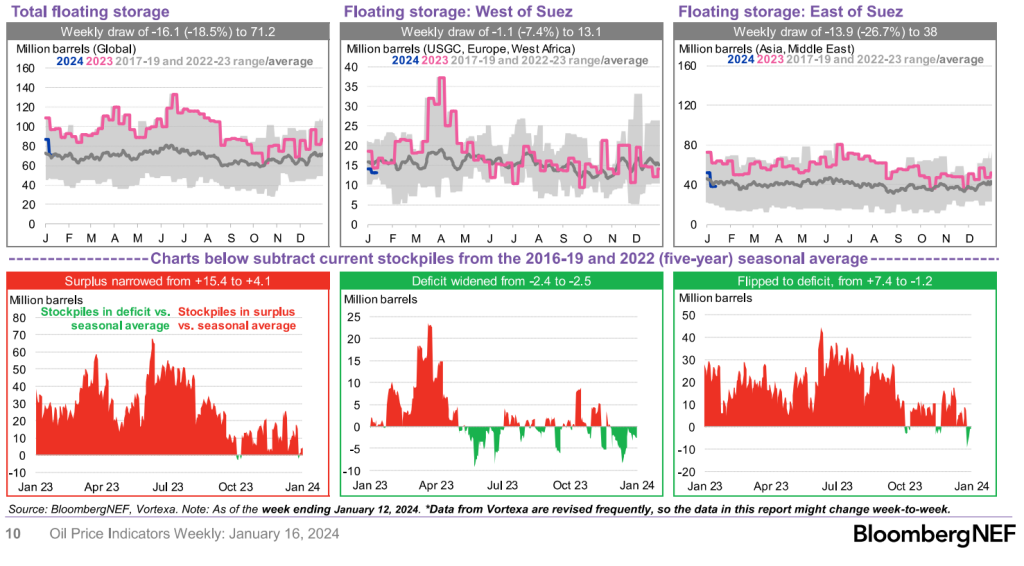

We have seen more crude get pushed into the water, but it’s getting harder to track through AIS transponders as the “shadow fleet” is at a record high following the push by Russia/ Iran to hide cargoes. Even with the shadow fleet growing, there is still a rising number of cargoes sitting on the water.

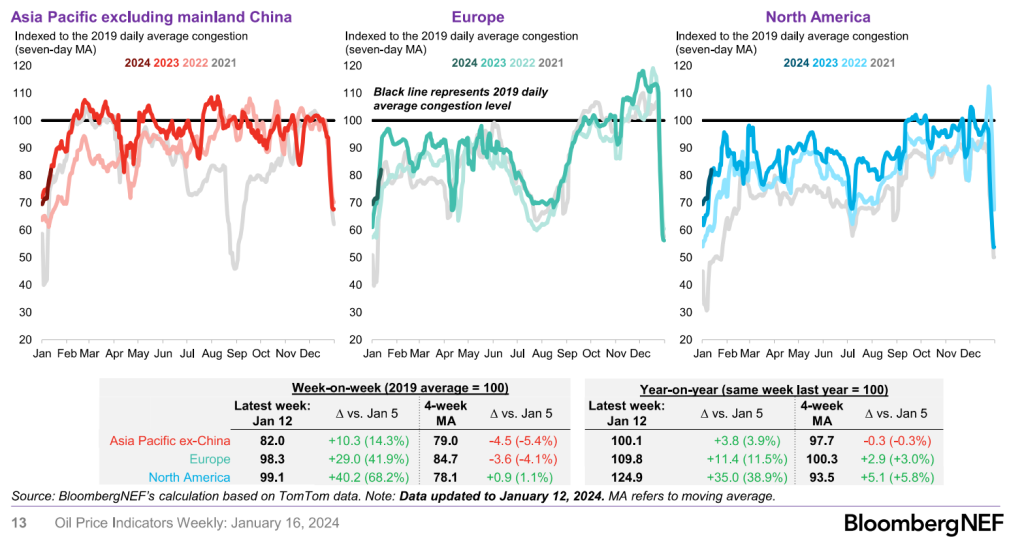

When we pivot to the demand equation, gasoline demand is still well below the 2019 seasonally adjusted average. It will likely look worse next week because weather impacted U.S. movements. It’s hard to find a place where there is a significant demand that will help push demand for crude higher, and support the data that OPEC is predicting this year and next.

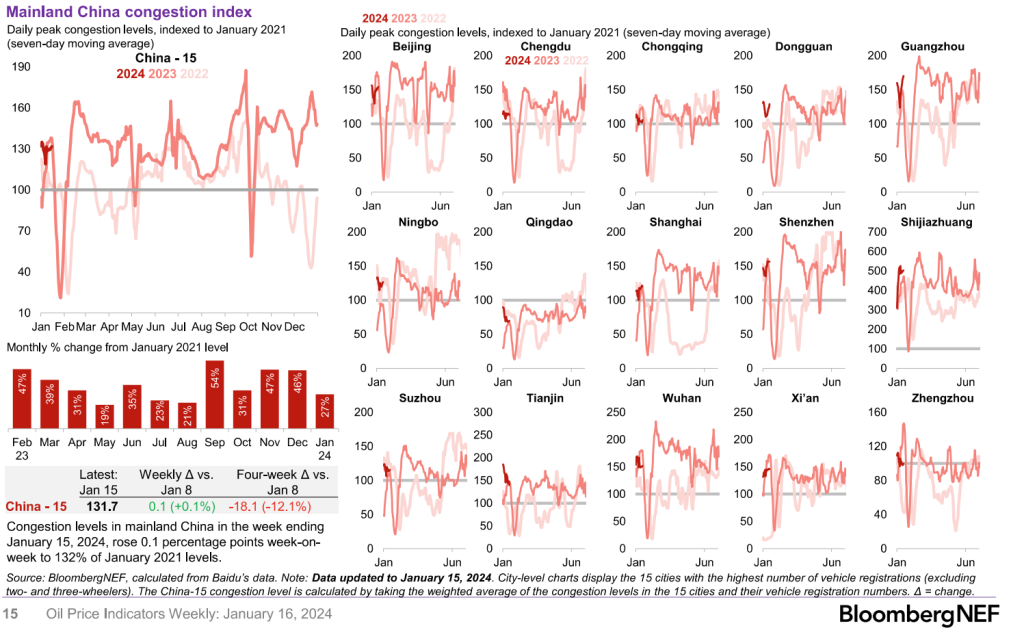

China is no different when you look at underlying activity in the region. It’s still “seasonably” normal when compared to periods that experienced lockdowns in 2022. We expect it to be better than that period, but we aren’t seeing a surge as the underlying consumer still struggles.

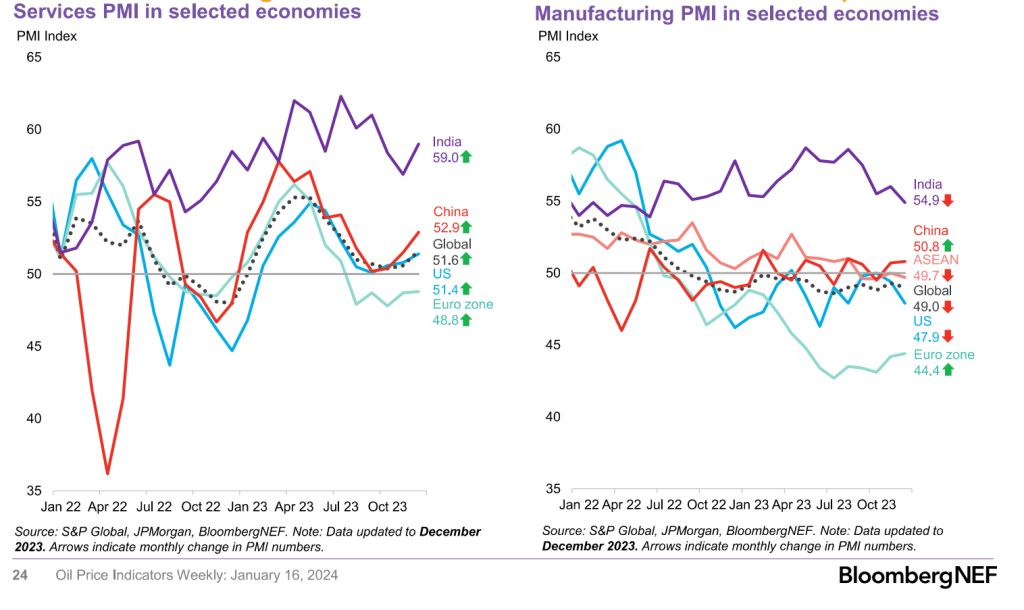

The average data and leading indicators point to another round of slowdowns going forward. Manufacturing moved lower again putting pressure on diesel, and with a drop in “new orders” and shift higher in “prices paid” will keep pressure in the market. This signifies stagflation, which is not supportive of economic activity/ growth.

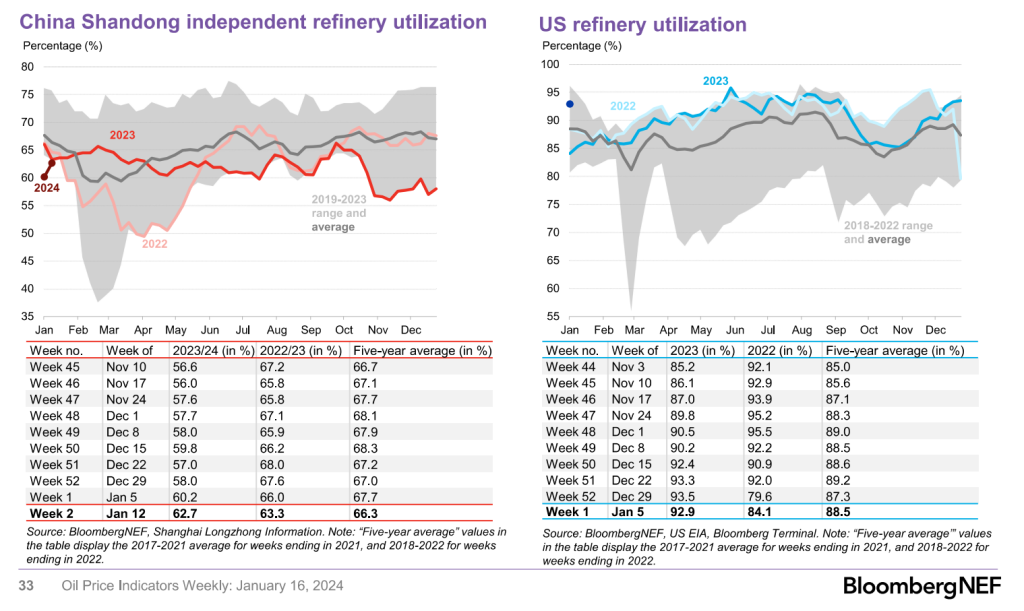

Total refinery utilization is consistent with steady growth, and we see this tracking with seasonal norms across China and the U.S.

This all supports a surplus in 2024 with one growing as demand wanes further as economic pressures mount.

I think other agencies are going to start factoring in a slowdown for OPEC crude- the IEA is just the first.

Here is a key chart that is important when you start looking at pressure in cash flows- there is a renewed push for stimulus in China, but it’s coming by way of Special Purpose Bonds. This is a meaningless exercise when you have a consumer and business environment that doesn’t want it and can’t tolerate additional leverage.

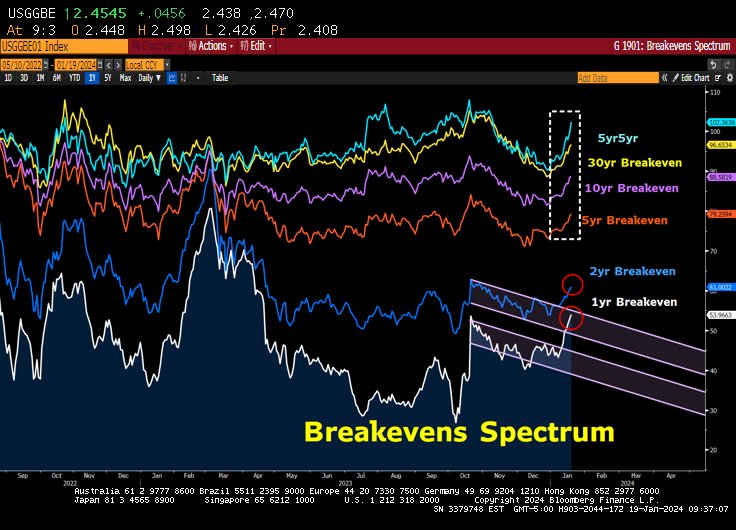

This is only made worse by a renewed push of inflation expectations and fears that are being reflected in the U.S. bond market.

The above chart puts into perspective the inflation fears, and I think captures the view that the Fed isn’t cutting rates in March. Given the current data backdrop, there is no way Powell can cut rates without driving inflation up faster and setting us up for a renewed 1970’s/1980’s level wage price spiral. This wouldn’t be contained to the U.S. but rather spread rapidly around the world as the amount of liquidity in the global market is still out of control.

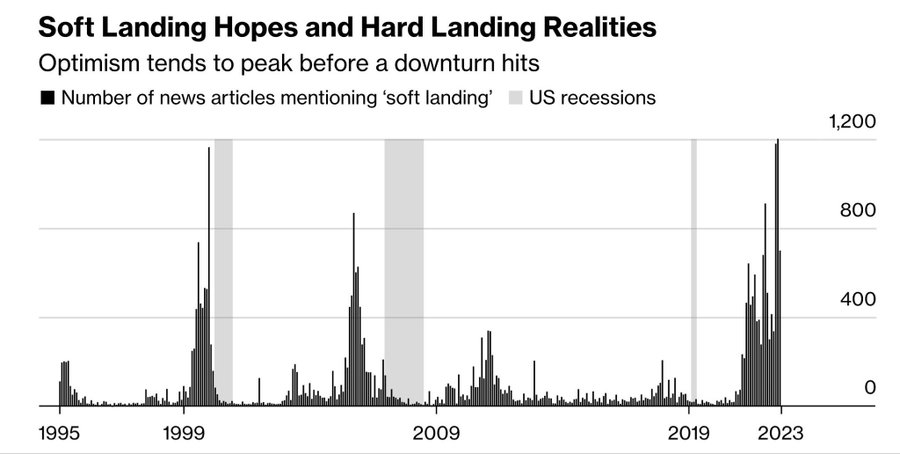

There is a view of a soft landing, which still may be the case- but I think the market is getting wrong the length of time of the landing. We are entering a period of no to slightly negative growth that will take years to work out of:

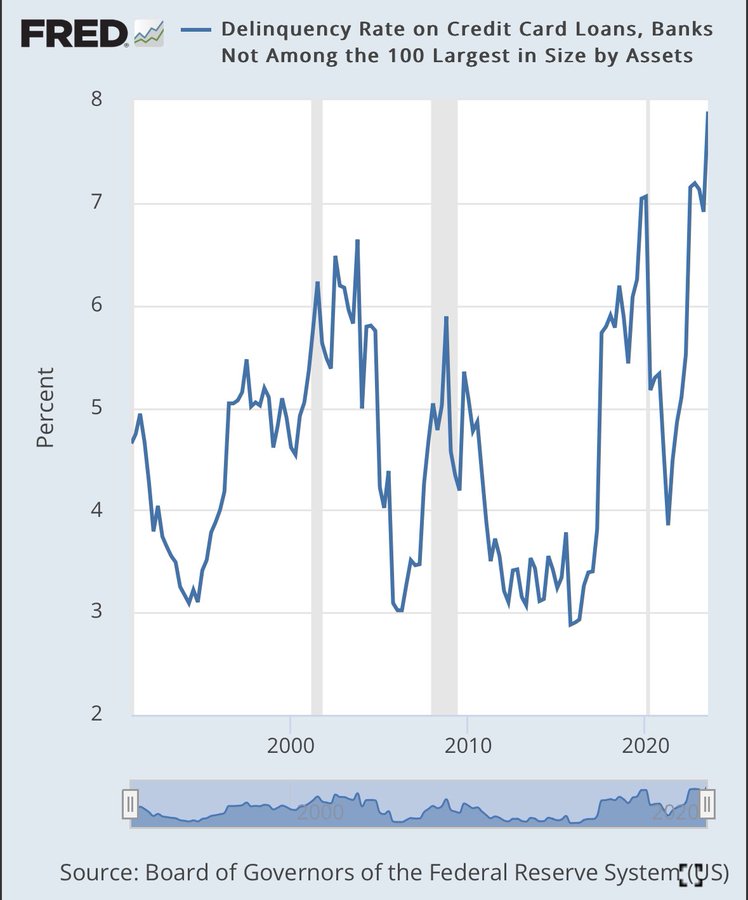

The U.S. consumer is seeing another round of CC loan delinquencies, and based on rates, this number is only going to move in one direction. It’s going to be even worse given the U.S. consumer utilized the “pay now pay later” option at a record level this past Christmas. Yes- it supported retail sales- but it also put the consumer in even more debt.

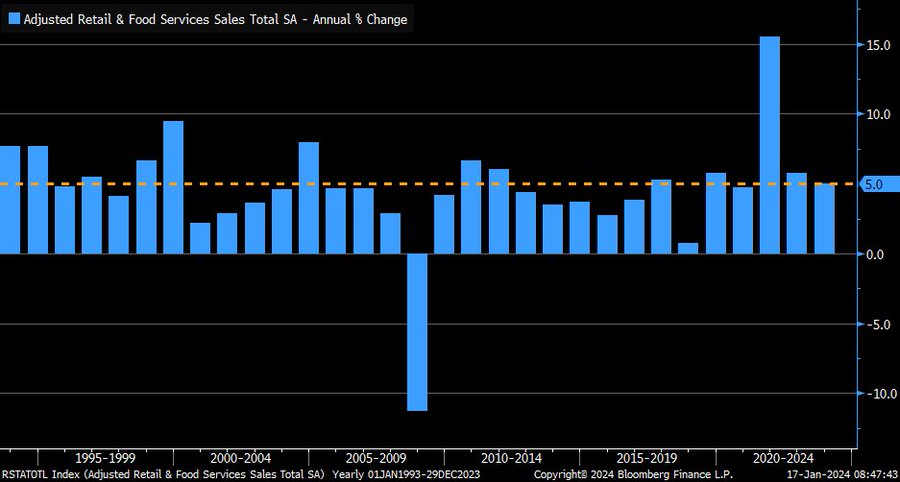

Here are the retail sales:

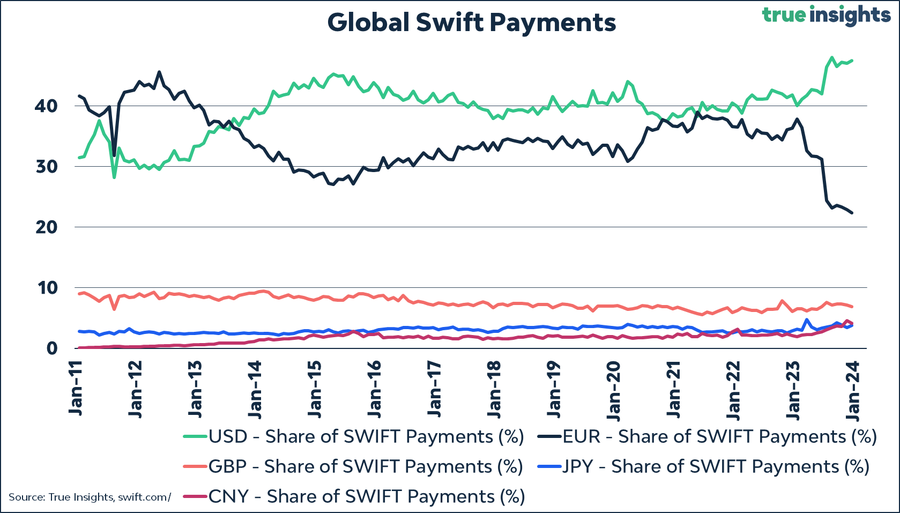

While all this pressure remains, I want to also reiterate the point that the dollar is still the preferred way to transact around the world. The below chart supports everything I have highlighted over the years given the steadfast comfort of USD. Given how embedded USD is in transactions, it’s unlikely this gets replaced- especially as other currencies degraded at a faster rate!

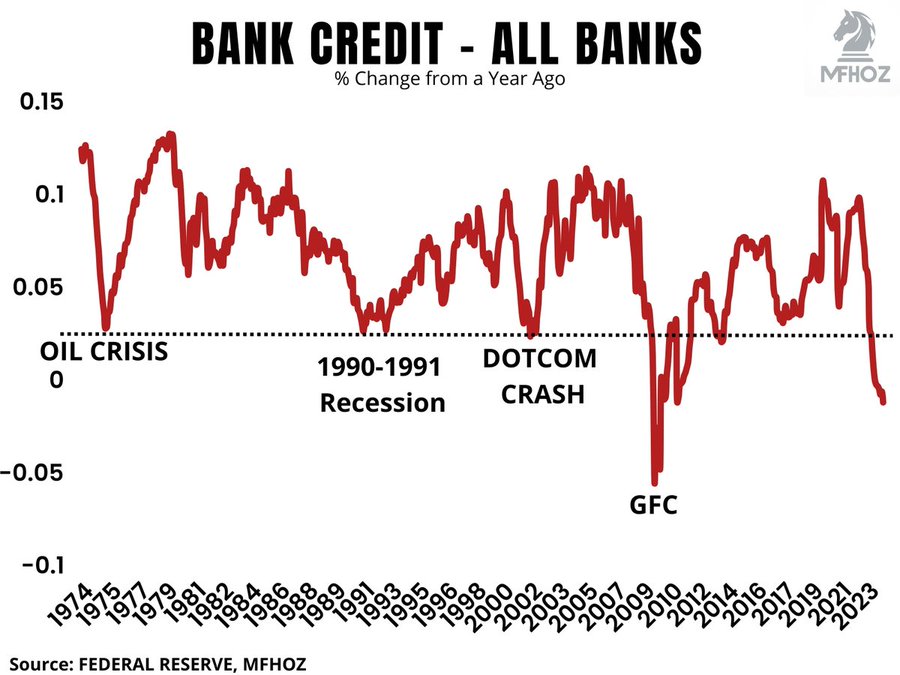

While I picked on Chinese credit, they aren’t the only ones that are seeing a contraction. Even as credit conditions loosened, we aren’t seeing growth in the U.S., and it’s unlikely we see anything in the near- medium term. The amount of leverage in the market is going to keep many entities (both consumer and corporate) on the sidelines.

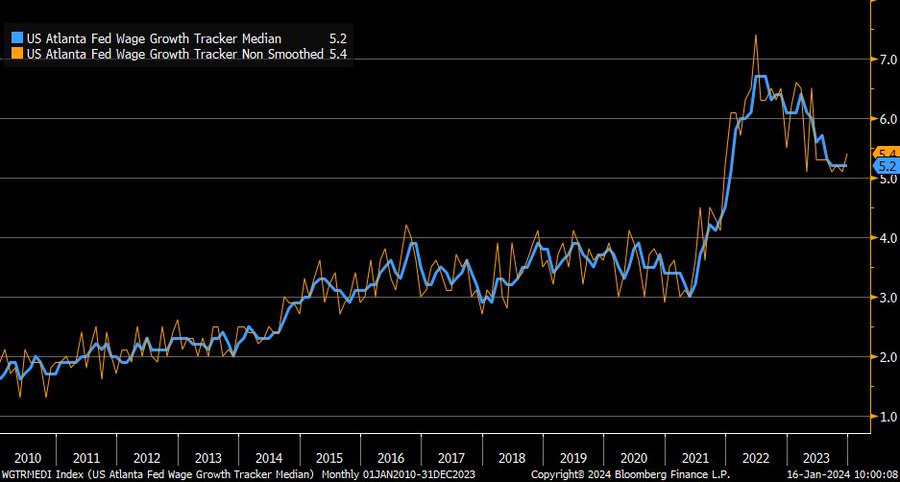

Even as bank credit faltered, the bigger issue for the Fed is the wage growth tracker and the leading indicators on prices paid. They ALL moved higher, and is supportive of prolonged inflation and the baseline for a wage price spiral.

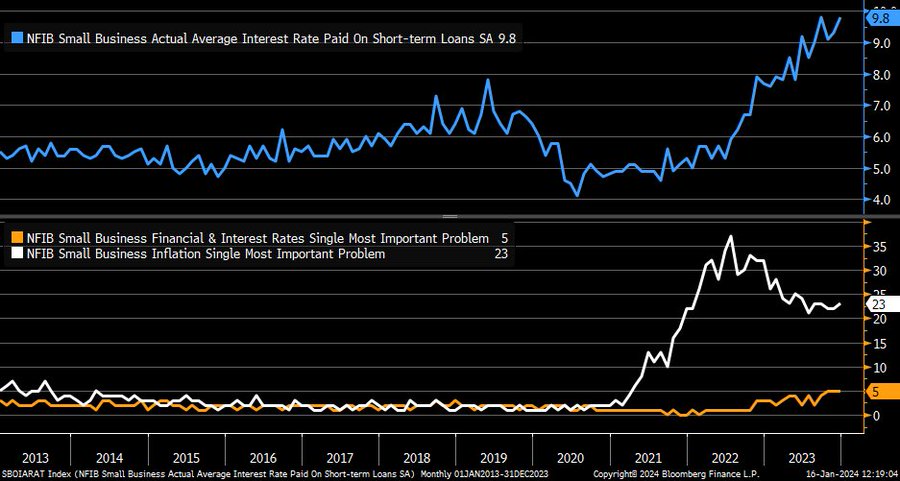

As small businesses face higher interest rates, it will keep them from borrowing and keep the prices they charge as high as the market will bear. “Small businesses, on average, facing higher interest rates on short-term loans (blue), but only 5% are saying financial/interest rates are their single most important problem (orange) … most important issue is still inflation (white)”

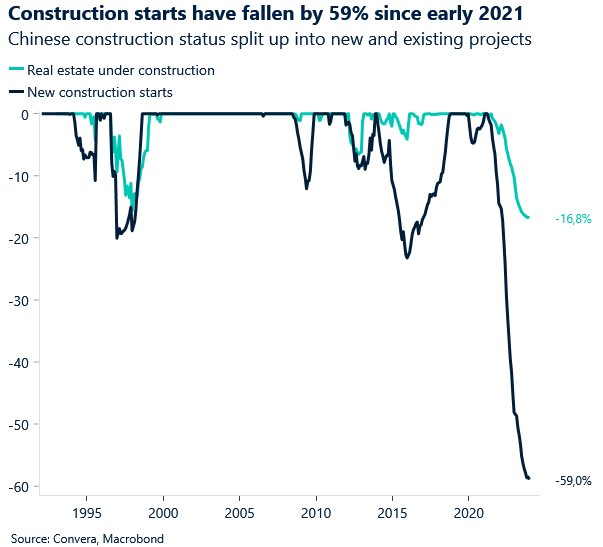

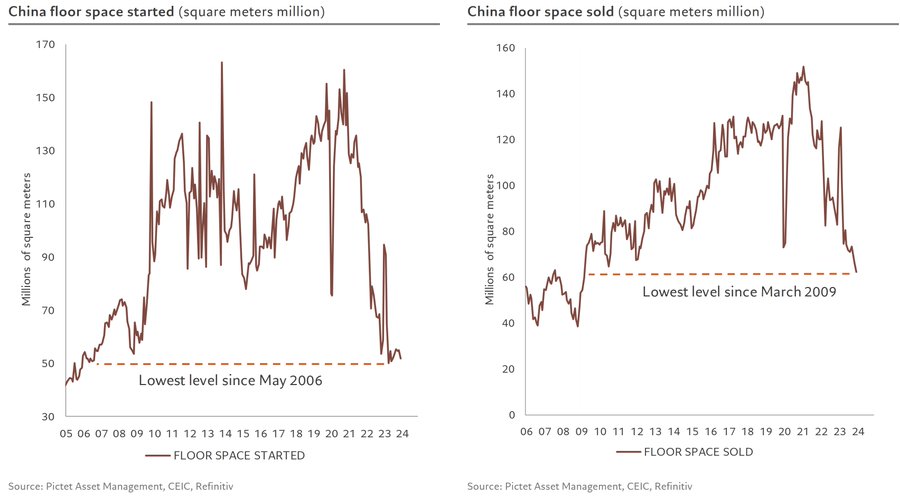

Just to close out on China- this helps put into perspective the struggle that exists in housing:

A significant amount of Chinese consumers have their savings and cash tied up in this broken projects. This is why I believe the “savings rate” or total value of savings is GROSSLY overstated. Many Chinese consumers are facing STEEP losses that aren’t truly appreciated. The property market still shows no signs of recovery on the supply side, and has deteriorated further on the demand side, which is now at its lowest level since mid-2009.

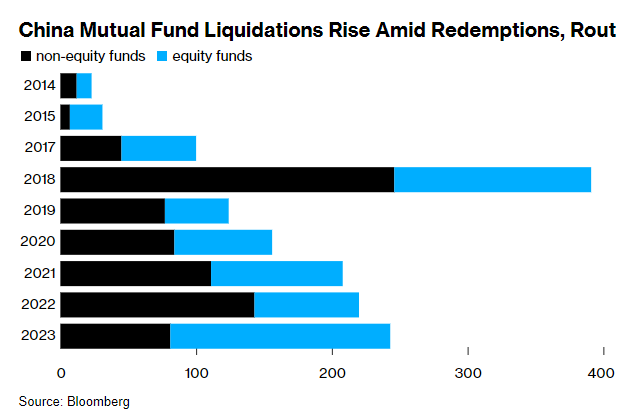

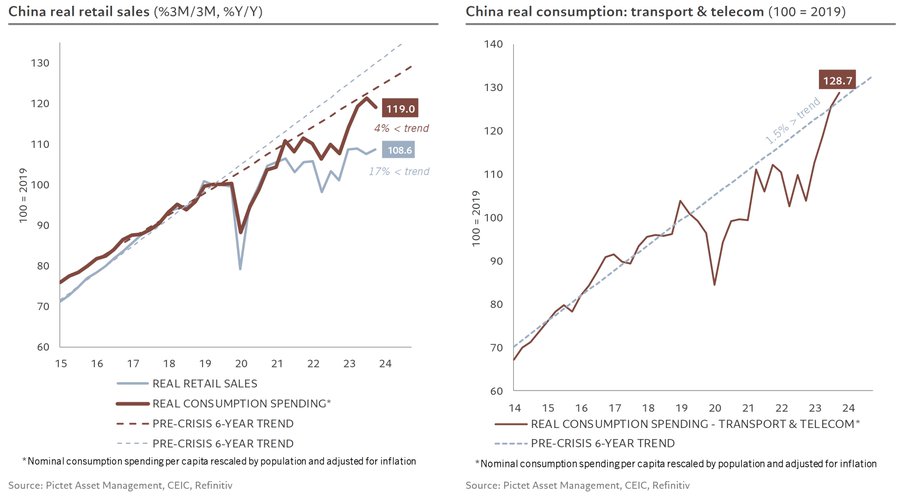

I think this is important to see how the Chinese consumer is buying, and It isn’t going to be very supportive of total economic growth.

I’ll provide more color in my next write up about how the global economy will fair throughout 2024. We closed out 2023 with a whimper, and with the renewed inflationary drivers and “easy” comps- the picture is going to get harder for the consumer.

- https://www.theguardian.com/world/2024/jan/18/where-balochistan-why-iran-pakistan-strikes