In this week’s Market Sentiment Tracker, we have a big news to follow: Japan, third largest economy in the world, entered recession. This speaks about the ongoing confusion in the markets regarding the prospects of a soft-landing vs the chances of a global recession.

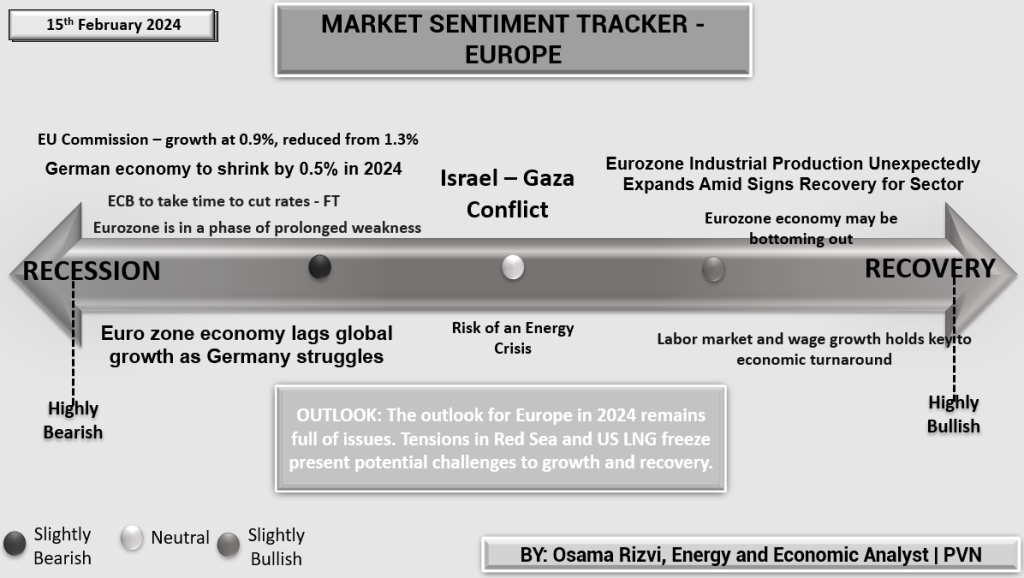

The European economic forecast as of February 15th, 2024, portrays a region grappling with slow growth and structural challenges:

The European Union faces a sobering revision of its growth outlook, downgraded to 0.9% by the EU Commission from an earlier more optimistic 1.3%. Germany, Europe’s largest economy, is anticipated to contract by 0.5% in 2024, underscoring the broader regional struggles. Despite the European Central Bank’s cautious approach to interest rates, the prolonged economic weakness suggests that quick fixes are not on the horizon.

However, it’s not all gloom. There are signs of resilience, as Eurozone industrial production has unexpectedly expanded, hinting that the sector might be on the mend. This positive note suggests that while the Eurozone economy may still be finding its footing, the labor market and wage growth could be the linchpin for an eventual turnaround.

In this climate of cautious optimism tempered by reality, Europe’s economic path in 2024 remains fraught with potential obstacles, including geopolitical frictions and energy supply concerns, which could influence the pace and sustainability of recovery.

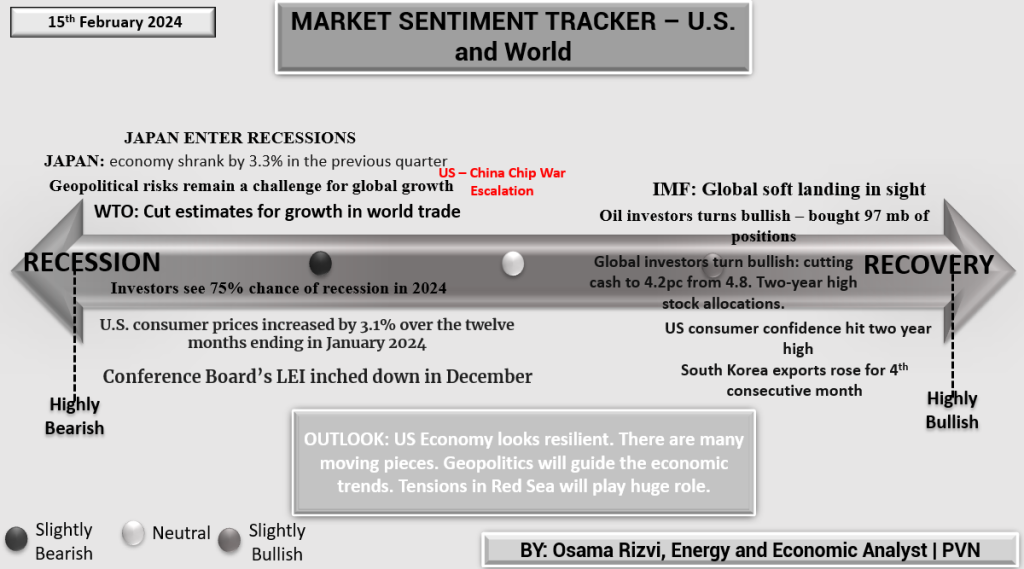

United States and World: The U.S. remains on alert with a persistent 75% chance of recession perceived by investors, despite signs of consumer optimism as confidence hits a two-year high. Geopolitical risks continue to exert pressure, with the U.S.-China chip war intensifying. However, there’s a silver lining as global investors shift towards a more bullish stance, reducing cash holdings for increased stock allocations, indicating a potential shift towards riskier assets.

Japan’s entry into recession, with a significant 3.3% contraction, is a stark reminder of the fragile nature of economic recovery. The WTO’s downward revision of growth in world trade adds to the global caution, reflecting concerns about the sustainability of the post-pandemic recovery.

Outlook: The U.S. economy’s resilience is being tested by a complex mix of domestic price pressures, as consumer prices have risen by 3.1%, and international headwinds. The Conference Board’s LEI’s slight drop is a subtle yet critical indicator of the economic trajectory. The IMF maintains a hopeful stance with the prospect of a global soft landing, suggesting that while growth is slowing, a drastic downturn might be avoidable.

This week’s Tracker underscores the nuanced reality of the current economic environment.