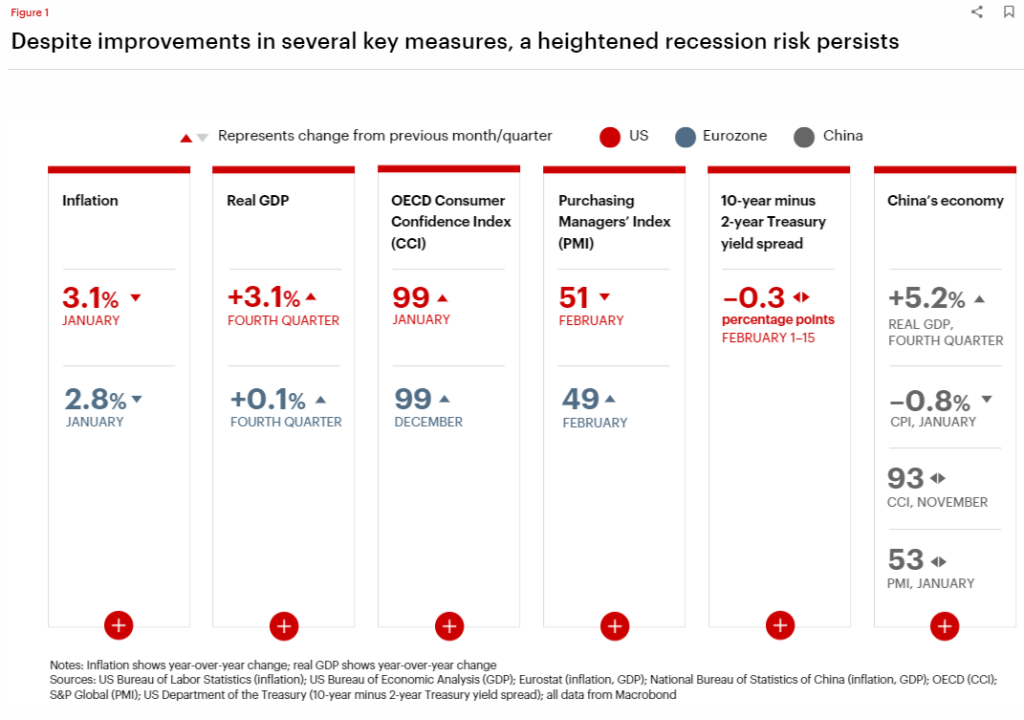

The global economy is currently at a crossroads with different regions showing varied signs of recovery and challenge. In the United States, there’s a cautiously optimistic view as the economy grew by 3.1% year over year in the last quarter, a sign that things might be moving in the right direction. However, a key indicator, the US 10-year minus 2-year Treasury yield spread, has been inverted since July 2022, hinting at a potential recession ahead. Inflation, though it has decreased from its peak of 9.1% in June 2022, still remains above the desired 2% target at 3.1% as of January.

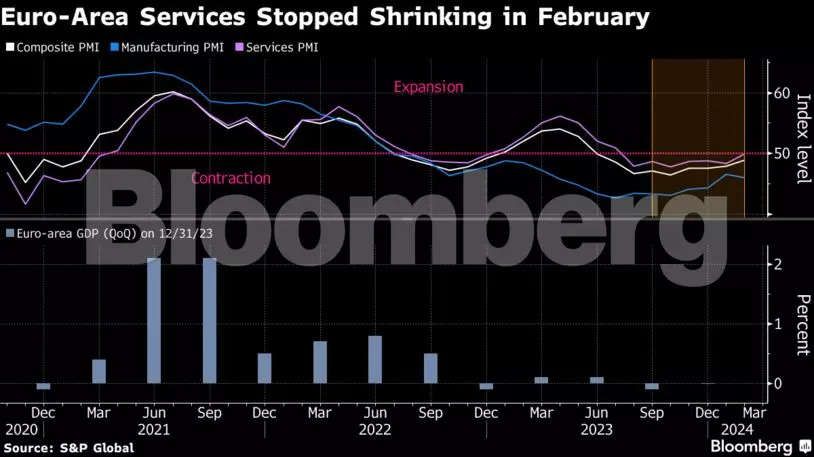

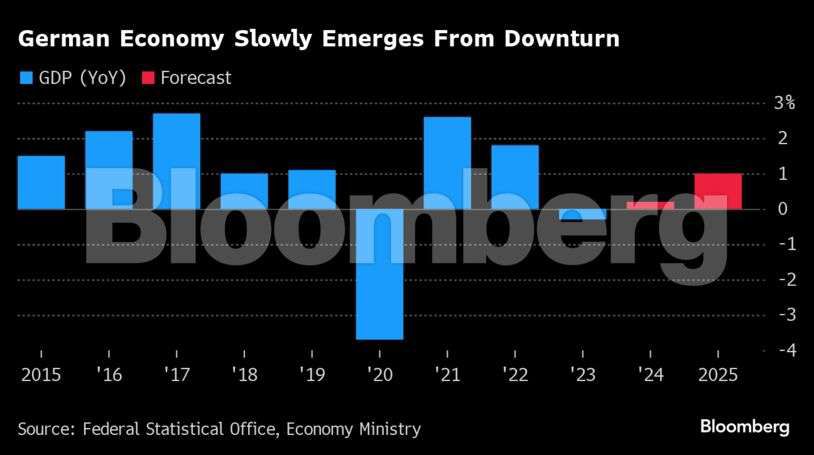

Europe is facing its own set of challenges, with structural issues like an aging population and high energy prices slowing down economic recovery. The Eurozone’s growth rate is barely hanging on, with a meager 0.1% year-over-year growth in the fourth quarter and virtually no growth since the third quarter of 2022. Inflation is also stubbornly high, slightly reducing from 2.9% in December to 2.8% in January, signaling a tough road ahead to reach the 2% target. The UK is also struggling to manage inflation, which has been stable at 4.2% for the past three months, and has officially entered a recession with a 0.3% GDP decline in the fourth quarter of 2023.

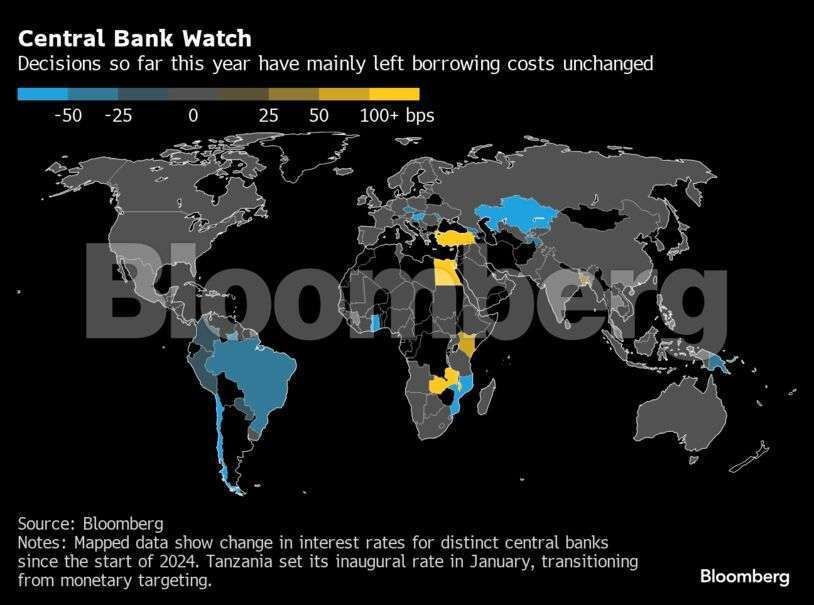

Central banks in the US, UK, and Eurozone have paused interest rate hikes, observing a slight decline in inflation from its peak in 2022. The US Federal Reserve has kept interest rates unchanged in its January meeting, signaling possible rate cuts but also not ruling out future increases. Similarly, the Bank of England and the European Central Bank have held rates steady, reflecting a cautious approach to navigating economic recovery.

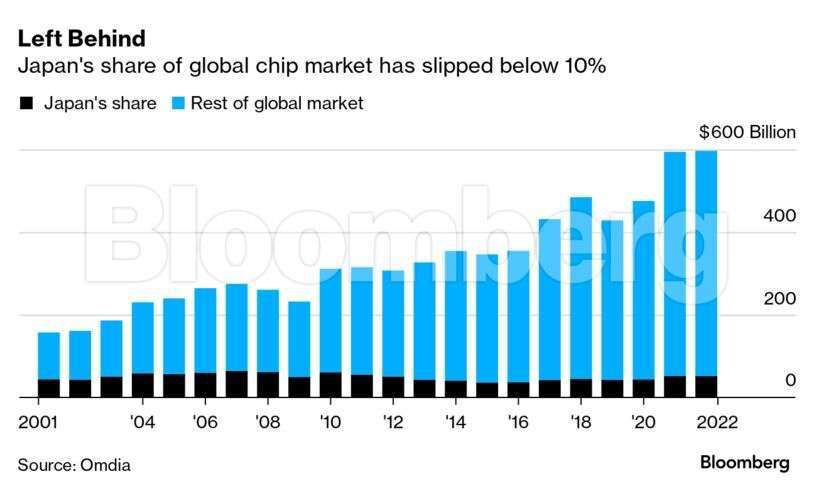

Asia presents a mixed picture, with China’s growth slowing down amidst deflation and Japan experiencing its highest inflation in four decades at 2.2% in January. India, however, is a bright spot, with a 7.6% GDP growth from July to September 2023, making it potentially the fastest-growing G20 country last year.

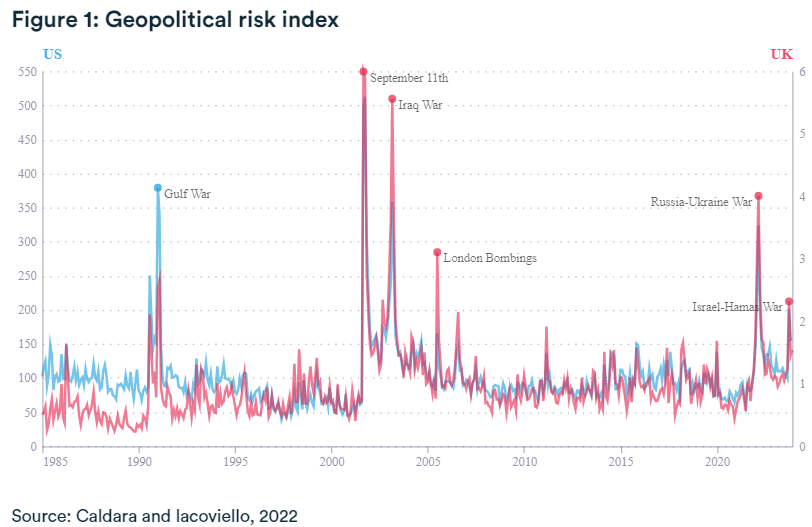

Geopolitical risks continue to loom large, with the ongoing war in Ukraine and potential conflicts in the Middle East threatening global trade and energy prices. The possibility of a larger Middle East conflict could disrupt shipping through the Suez Canal or cause oil prices to spike, adding more uncertainty to the global economic outlook.

Despite economic challenges, Germany’s DAX index has been reaching record highs, showing a disconnect between the stock market and the underlying economic performance. This could be due to the global nature of the companies in the DAX, whose revenues are largely generated outside Germany, indicating that the German economy’s performance might not directly impact these companies’ stock values.

In conclusion, while there are signs of recovery, especially in the US, the global economy remains fraught with challenges. High inflation, the risk of recession, and geopolitical tensions pose significant threats to economic stability. The cautious stance of central banks and the resilience of certain stock markets reflect the complex dynamics at play, emphasizing the need for vigilance and adaptability in the face of ongoing uncertainties.