Completion Operation Outlook

In our recent article, we have already discussed STEP Energy Services’ (STEP) Q4 2023 financial performance. Here is an outline of its strategies and outlook. STEP sees a mix of optimism and challenges in its outlook for 2024 and beyond. The long-term growth drivers in North America are the Trans Mountain expansion project, the LNG Canada facility, and numerous LNG projects in the US. The projects will encourage drilling and completion activities, although the challenges of energy price volatility remain.

STEP’s management continues investing in upgrading its diesel fuel frac spreads to Tier 4 dual fuel assets to reduce diesel consumption and improve technical capabilities. By 2024, it plans to convert 75% of its frac spreads to be dual fuel capable and 90% by 2025. Following the steep fall in natural gas prices and the resulting uncertainty over drilling and completions, the company estimates that the expenditure on Tier 4 dual fuel conversion will remain nearly unchanged in 2024 compared to 2023.

Canada and US Market Outlook

In Canada, STEP began with a busy schedule, particularly in its fracturing service line. While some works were deferred from Q4 2023 to Q1 2024, the typical cold weather in January had minimal impact. Following higher intensity in fracturing, the coiled tubing started warning up late.

In the US, STEP’s two frac spreads in the Permian saw steady activity levels as they secured long-term work. However, frac pricing and utilization in the US can face headwinds due to a near-term softness. However, its coiled tubing units should remain steady, with the prospect of one additional unit due to higher demand. Pricing should be resilient in Q1. As natural gas prices strengthen, the fracturing market pricing and utilization are expected to improve from Q3 through Q4. STEP’s management also seeks to enter new markets as it launches nitrogen industrial services. These services will cater to large-scale projects in the midstream and industrial facilities.

Current Challenges And Drivers

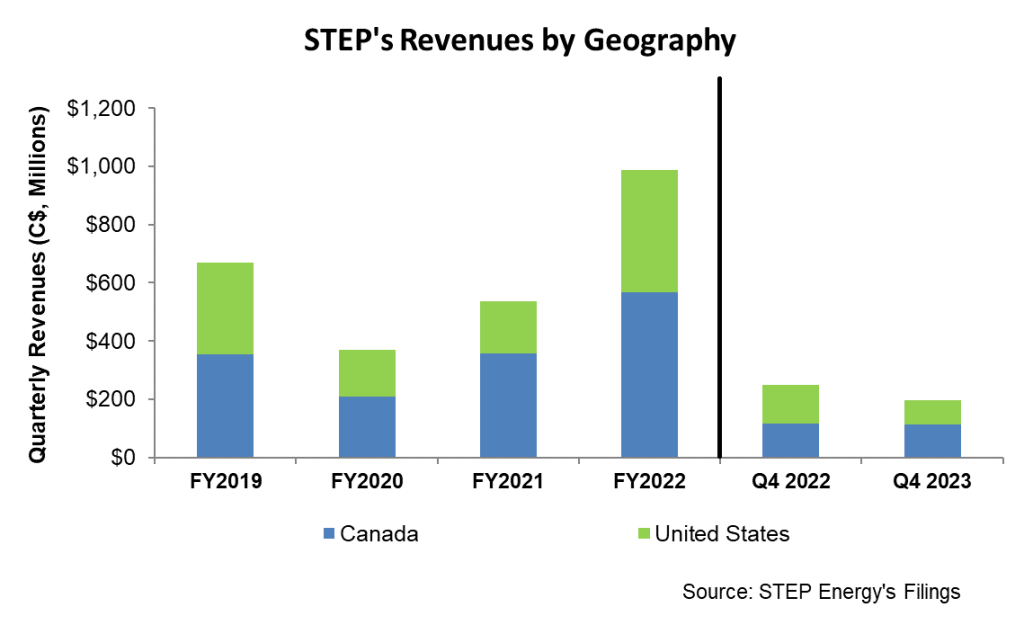

In Canada, the company deferred some jobs from Q4 and pushed them into 2024 following the weakness of natural gas prices. As a result, its utilization suffered, too. Although its topline declined, it led to higher profit intensity per well. Also, the company expects growing requirements for frac sand in the Montney and Duvernay wells. So, the company invested in its Canadian logistics team to address increased sand handling and hauling. With higher investment and efficiencies, the reliance on third-party hauling and non-productive time will be minimized.

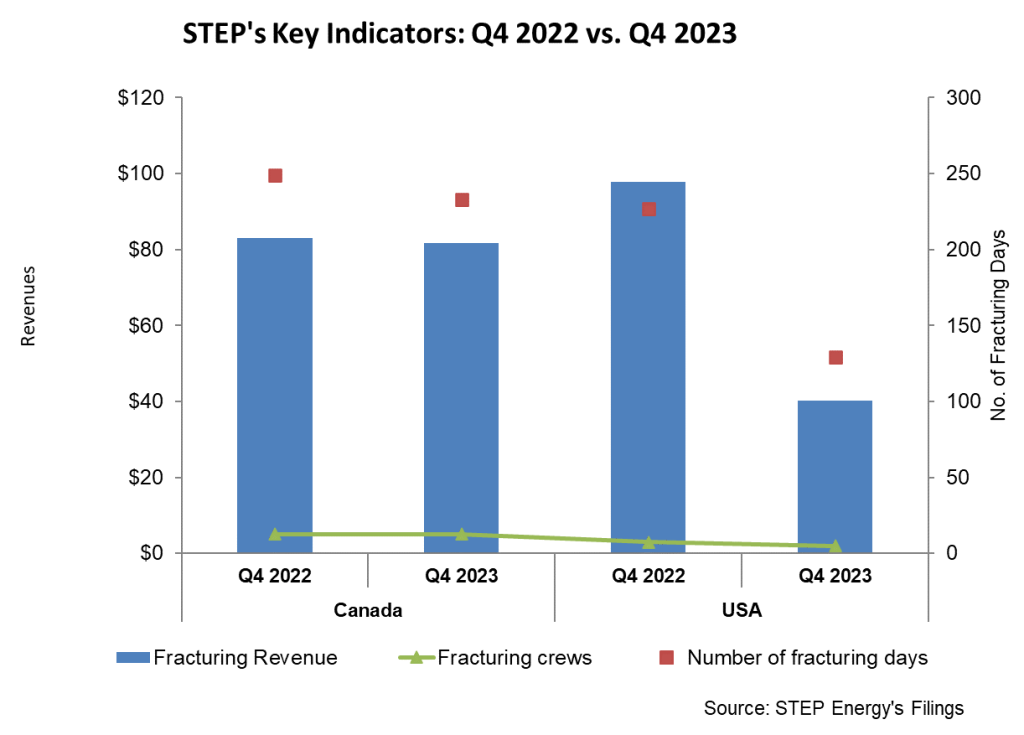

In the US, many operators reduced capex following weaker energy prices, which led to an oversupply in frac spread and equipment. Plus, M&As in the upstream space reduced demand for oilfield services. So, the US frac spread count declined by 9% in the past year. Given the sharp downturn in the US, STEP transferred some fracturing equipment back to Canada. In aggregate, it aimed to maintain six frac spreads. Our short article has already discussed the primary factors that drove its geographical operations in Q4.

Cash Flows And Debt

STEP’s cash flow from operations and FCF increased by 40% and 68% in FY2023 compared to a year ago. Its Q4 capex was the highest in the past four quarters due to the completion of various capital projects. Plus, it accelerated payments on large invoices by the end of 2023 to get the benefits of early payment and possession. This helped reduce its working capital requirements in Q4. However, in Q1, the company expects working capital to increase as the accounts receivable balance increases.

In FY2024, it plans to increase capex by 14% compared to FY2023. It reduced net debt by 38% by Q4 2023 compared to a year ago. As of December 31, 2023, STEP’s leverage (debt-to-equity) was 0.24x.

Relative Valuation

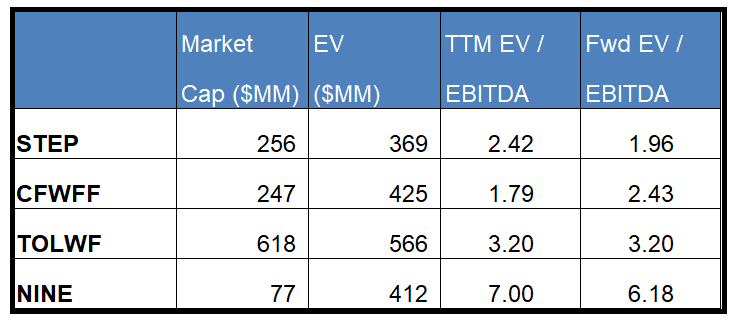

STEP is currently trading at an EV/EBITDA multiple of 2.4x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is lower, at 1.9x.

STEP’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA contrasts its peers because its EBITDA is expected to increase versus a slight fall in EBITDA for its peers in the next year. This typically results in a significant premium in the EV/EBITDA multiple compared to its peers. However, the stock’s EV/EBITDA multiple is lower than its peers’ (CFWFF, TOLWF, and NINE) average. So, the stock is undervalued versus its peers.

Final Commentary

With many energy development projects in Canada, STEP upgrades its diesel fuel frac spreads to Tier 4 dual fuel assets. It plans to upgrade 75% of its frac spreads to be dual-fuel capable by 2025. Because these are long-term projects, STEP’s management activity coiled tubing activity to improve in 2024. Its coiled tubing activities in the US remained busy, with the prospect of one additional unit in 2024. Plus, it has recently launched nitrogen industrial services, offering midstream and industrial facilities opportunities.

However, the company faces challenges from lower frac pricing and utilization. Following weaker energy prices, many operators reduced capex in the US. So, STEP transferred some fracturing equipment back to Canada. The near-term softness will continue, and the scenario can improve from Q3 through Q4 when natural gas prices improve. In FY2023, cash flows increased remarkably and reduced net debt, resulting in a favorable leverage ratio. The stock is relatively undervalued compared to its peers.