The energy markets have remained volatile but within a fairly tight band over the last few weeks. Demand issues began to outweigh the geopolitical risks that have plagued the market since Oct 7th of last year. The broader range we’ve outlined is $82-$92, but we believe that May will see $83-$87 with Brent averaging around $84/$85. There has been some additional supply with Russia producing above their target, which we fully expected to happen. The demand side of the equation will be the biggest factor going forward as the global economy stays constrained. On the geopolitical front, Israel has already taken control of the Rafah border between Gaza and Egypt for the first time since 2005. This was quickly followed by dozens of sorties run by the Israelis in the region.

We expect to see an increase in rocket attacks from Lebanon and Yemen, but we don’t expect to see significant activity originating from Iran. The failure of the attack and the anger it created between Jordan/ Iran and KSA/ Iran will keep them on the sidelines. Jordan and KSA don’t want their airspace used for one-way suicide drones and ballistic missiles, which is another reason they helped Israel & Allies shoot down the incoming barrage. I would expect the ground offensive on Rafah to be imminent, which means it will likely happen over the next 10 days. The wording on the last cease-fire attempt solidified the resolve for Israel to attack. It implied that Hamas doesn’t even have 33 hostages left alive, which will result in the remaining offensive.

When we look at KSA and Israel relations, I’ve said from day one that it wouldn’t deter a normalization of diplomatic relations- just delay when it happens. I think this is a great summary of why KSA was always destined to create a lasting relationship with Israel:

“Vision 2030[1]

Increasingly, Saudi Arabia has shifted its focus towards economic and infrastructural development under the ambitious Vision 2030 plan. Consequently, internal considerations and a desire for regional stability have compelled the Kingdom to reassess its stance on Israel. Mohammed bin Salman, Crown Prince of Saudi Arabia, has a vision of leading the Kingdom away from fossil fuels and into business and tourism. He needs regional peace and prosperity to achieve his goals.

The shared pursuit of regional influence and access to advanced technologies has fostered a strategic convergence between Saudi Arabia and Israel. Bilateral agreements in cybersecurity, water management, renewable energy, and health care have established significant economic and technological exchanges, ultimately benefiting both nations. This evolving cooperation creates a foundation for further collaboration across numerous sectors and provides a platform for modified geopolitical alliances in the region.”

One of the key beliefs I’ve held since the beginning of this decade was that Iran was weakening rapidly. The regime is aging, and there is increasing resistance within the country to everything from the morality police to sponsorships of proxy groups. I believe the actions to date are from a country trying to show dominance but actually coming from a point of weakness. While the peace has held between Iran and KSA, it doesn’t mean that KSA will accept their airspace used as a battleground. There is also broader concern about Iran destabilizing the region, which is something the GCC wants to avoid.

I think Hamas will fall and Israel will work with the GCC to install a new government. This will be the “peace offering” that Israel will extend to the GCC in order to solidify normalized relations. Iran will be isolated further, and the regime will eventually fade into the background over the next 5/6 years.

This all leads to some near-term geopolitical risk in crude, but I don’t see long term issues impacting prices. The market has already absorbed (and normalized) the reroute of crude/products away from the Red Sea. In the meantime, supply increased in April above the OPEC+ target, but we should see that pull back.

RUSSIAN OIL:

- Russia Pumps Oil Above Target as New Voluntary Cuts Enter Force

- Output of 9.4 million b/d exceeded target of 9.1 million b/d

- Moscow pledged to deepen production cuts from April to June

The reduction won’t be driven by Russia being “good stewards of the OPEC+ deal”, instead it’s driven by refiners coming back from turnarounds. Russia needs an outlet for their crude, and when refiners are down for maintenance, we said Russia would direct as much crude as possible for export. As refiners come back from turnaround, this will pull crude off the water and back into processing. Ukraine has continued to attack Russian refiners and petrochemical facilities with another drone attack taking place just outside Moscow. So far, these drone strikes haven’t impacted refining operations on a permanent basis.

Russia pushing additional crude and now products into the market is going to keep a lid on crack spreads that have already struggled. The global markets are running long crude and products in storage, and we don’t see that changing as we head into peak demand. The market has been hoping for robust Chinese demand, but it has failed to appear. China’s state-owned refiners have started to reduce runs as their storage builds and export quotas are tapped out. Shandong refiners have maintained below seasonal normal averages as the internal market remains glutted and the export market oversupplied.

- China’s Oil Imports Slowed in April as Plants Shut For Repairs

- Crude oil imports fell 8.8% from March on seasonal maintenance

- Oil products exports fell 24% ahead of a new quota allocation

We’ve seen some small run cuts out of Asia because crack spreads (specifically distillate) doesn’t support the current run rates. So far, the run cuts have been small, but we don’t see any near-term improvement in the crack spreads. The global economy is languishing (opposed to what the equity market is showing), and it’s showing up in product builds and weakening crack spreads. When looking at Asia- even using Dubai crude as an input, Asian refining margins for the whole barrel are still below European margins and trending down. When you factor in netbacks, insurance, and other ancillary costs not covered- Asia is still trending negative. This will keep run rates muted, and I don’t see this improving in the near term.

We had builds this week across all regions:

- Inventories of diesel and heating oil in independent storage in ARA rose in the past week, remaining just higher than usual for the time of year, according to Insights Global.

- Singapore had a small drop, but still remain well above last year: Inventories of residual fuel at the Asian distribution hub of Singapore posted the largest weekly gain since February in the week through May 8, according to official data released Thursday. Stockpiles jumped by 2.9 million barrels to 20.8 million barrels. Middle-distillate and light-distillate fuel stockpiles declined by 4.5% and 2.5%, respectively.

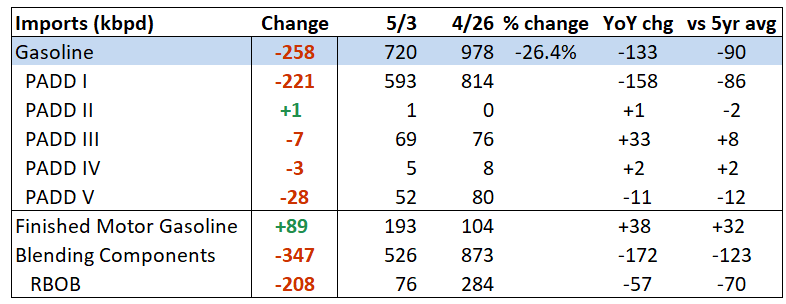

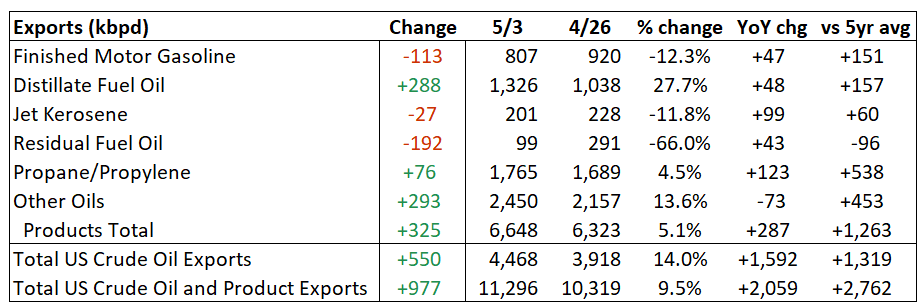

In the U.S, we had builds across key products even as imports dropped, and exports remained elevated.

We expected imports of gasoline to spike, which happened over the last few weeks. Our view was that imports would sit at around 850k barrels a day on average. So far- this has been exactly what happened as the arb opened up brining volume from Europe into PADD1.

Exports from the U.S. will weaken as refiners are already running a light slate and product builds shift flows. As Asia builds and Chinese flows stay elevated, Middle Eastern volumes will continue to flow into the Atlantic Basin/Africa. Middle Eastern volumes are the “swing” as they will flow to any region that has the highest margin. Asia being negative is pushing more ME volume into U.S. export markets.

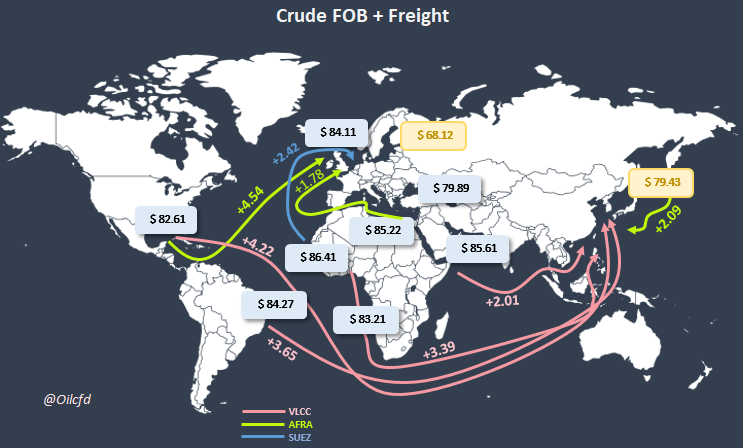

Here’s a great visual of what crude looks like across the board on flows. The futures market finally “converged” with the physical market, and I expect to see this settle close to $84/$85 based on the economics.

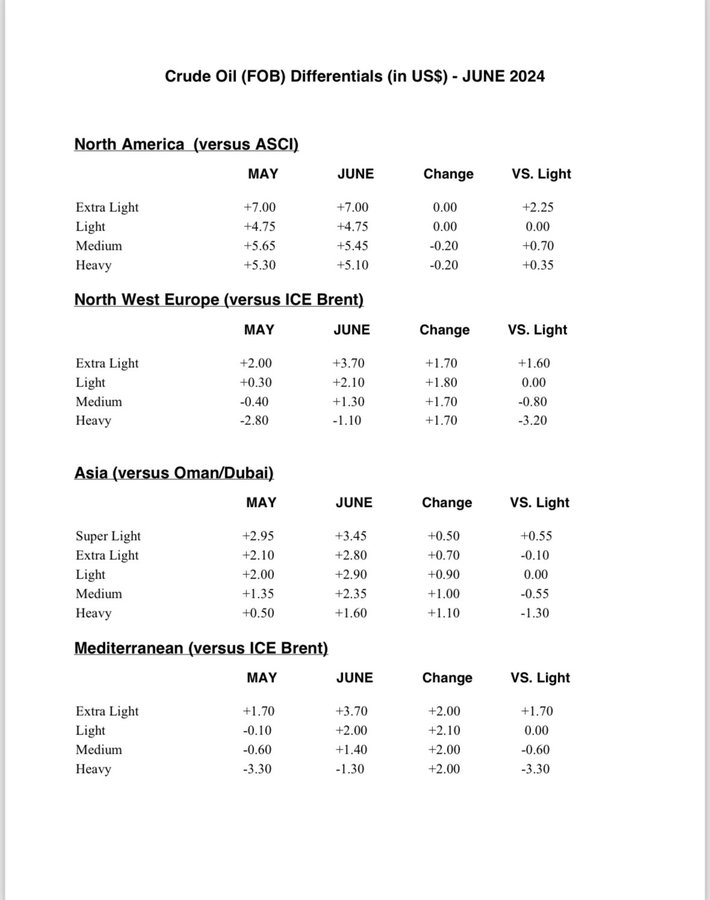

We had some updates on OSPs (official selling prices) from KSA. This should help support some flows from the U.S. into Europe as the change in differentials from KSA push more into the Asian markets. This will also cap U.S. flows into Asia. European/Med diffs have fallen back lately, which means KSA crude is expensive vs other crudes. The Atlantic Basin is very oversupplied at the moment with WTI Midland and Forties diffs falling strongly against dated Brent. So double whammy of KSA increasing OSPs to Europe, while dated falling against front month means KSA crudes are very expensive in Europe again.

- Saudi Aramco’s increases in its OSPs for Northwest Europe and the Mediterranean will tighten the European sour crude market, with other Middle East producers expected to raise their official prices too, according to traders

- Saudi term buyers are likely to nominate fewer barrels after the price gains, traders involved in the market said

- The impact on the broader market may be muted as the continent is still oversupplied with light sweet grades, especially WTI Midland from the US

The shift in OSPs won’t do anything to adjust the run cuts we talked about above: “Asia-Pacific refiners are contemplating and implementing slight run cuts because of lower refinery margins, as weakening transport fuel crack spreads weigh on profitability. South Korean refiner GS Caltex has cut runs marginally at its 800kb/d Yeosu refinery by about 15kb/d.”

We have seen some shifts in pricing with reductions in some areas:

- Socar offered 88k tons of CPC Blend for May 29-June 2 delivery at Dated -$3.75/bbl: trader monitoring Platts window

- Compares with -$3.45 for its previous offer on May 3

- Libya Keeps Es Sider Crude OSP Unchanged at 55c Discount for May

- Sonatrach Cuts May Saharan Blend OSP to Premium of 25c/Bbl

- Sonangol reduced its offer price to spot buyers on a June-loading shipment of Dalia crude for a second time, according to a list seen by Bloomberg News

- 950k bbl of Dalia for June 11-12 loading listed at Dated -60c/bbl

- The same cargo was last offered at Dated -10c on May 2, and +10c/bbl on April 24

NIGERIA OSPs:

- Nigeria has reduced its official selling price for Bonny Light crude to Dated +$2.34/bbl, the lowest since February

- Cut from +$3.28/bbl in April

- Qua Iboe OSP also reduced m/m to Dated +$2.95/bbl for May from +$3.97 in April

The cut by Nigeria isn’t surprising given how slow their crude has been selling- especially with maintenance in Europe: “Angola has sold almost half its crude for June loading, while Nigeria has yet to clear cargoes for this month, according to traders familiar with the matter. European refinery maintenance is limiting demand for Nigerian barrels, Kpler says.”

WAF SALES:

- For Angola, about 20 cargoes have yet to find buyers out of the 37 June consignments planned

- That equates to 54% that have yet to sell, with two full weeks left before July barrels open for deals

- China’s Unipec and Sinochem have been the main buyers so far, together with some Atlantic Basin customers, one of the traders said

- By contrast, very little Nigerian crude for June has sold this week, with an overhang of May crude still yet to clear, the traders said

- A total of 51 Nigerian cargoes were to load in May, plus at least 43 lots for June, according to data compiled by Bloomberg

- The unsold glut for May was pegged at 25-27 cargoes on April 22

- NOTE: European refinery maintenance is weighing on Nigerian crude valuations, Kpler said in a note, see story in News/Analysis section

- Five consignments of Republic of the Congo’s Djeno crude are still on offer, out of seven scheduled for June, the people said

- NOTE: The Angola trading cycle runs from the 16th of each month, when barrels for the month starting 6 weeks later are released; Nigerian schedules typically emerge a few days later; the Djeno cycle runs from around the 23rd-24th

There is still a glut of crude that has yet to sell in May- so it’s difficult to sell June when there is still such a big overhang from May. This is why I think Nigeria will get more aggressive on price cuts to move crude into the market.

OPEC+ has made a push to “make-up” for overproduction, but we know that it always falls flat. Supply from Russia and Iran will continue to flow, and volumes from Venezuela will pick-up into China. Iran can talk about increasing production, but there will be a limit to the buyers and ships able to move it to market. This will keep underlying flows at a minimum even as they talk about increasing production. Could they increase it- sure- but it doesn’t mean it can get to market. This would also just drive down the price of Russian/VZ crude as they all compete for a very finite amount of buyers.

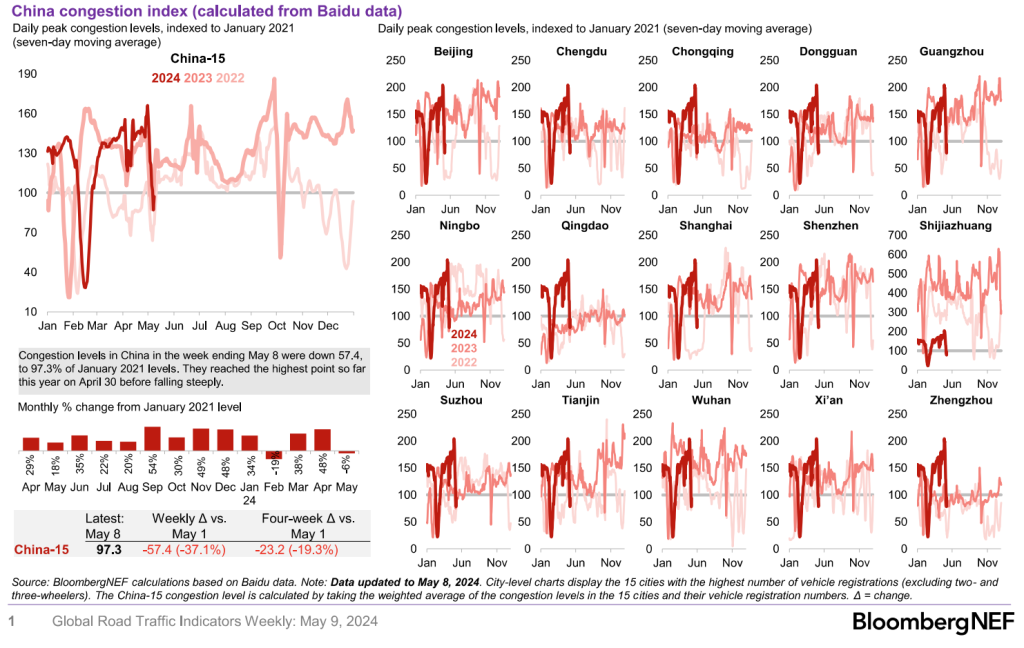

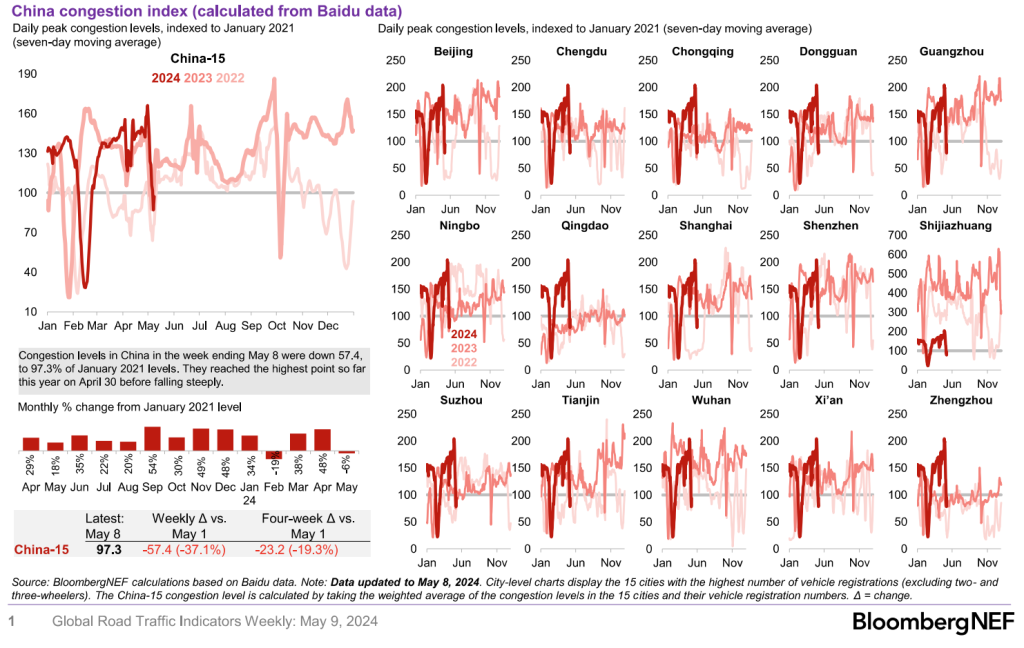

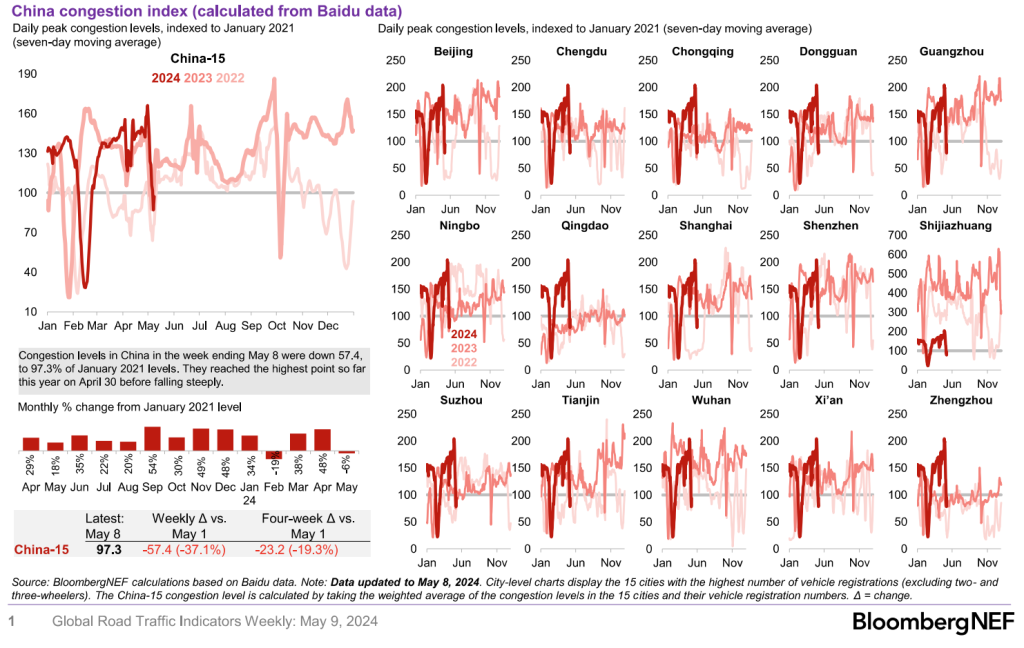

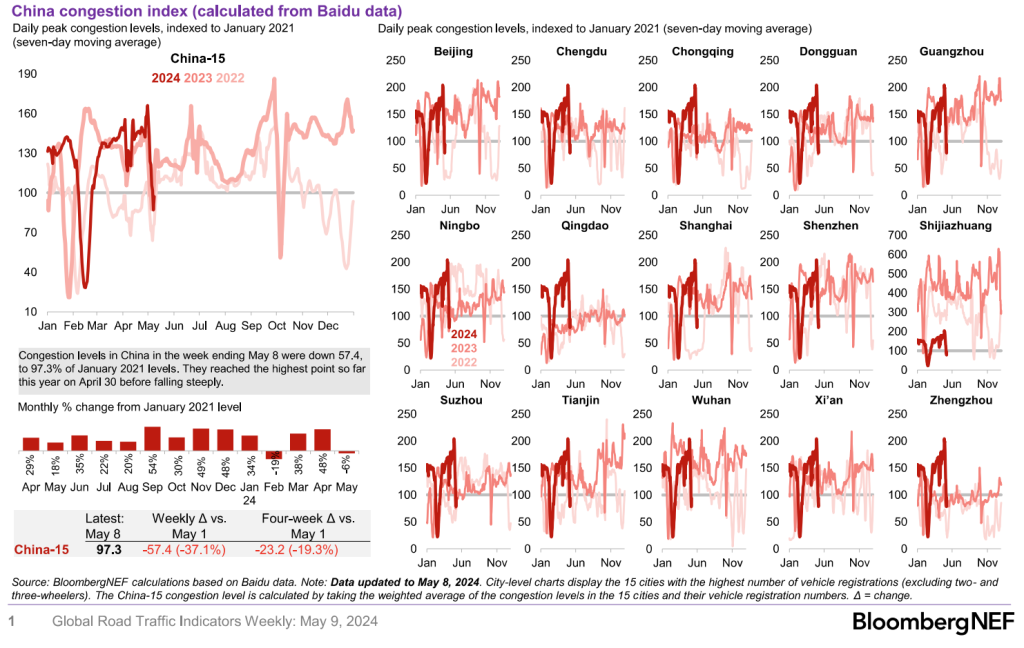

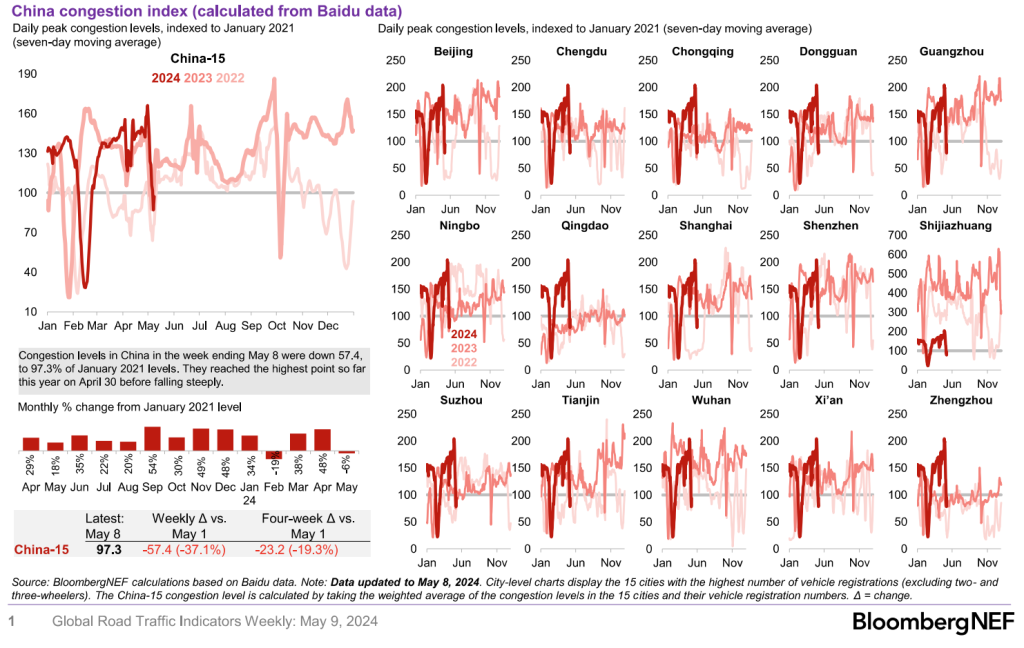

Chinese travel dropped along seasonal lines when you look at shifts for Labor Day. We expect to see a bounce back along 2023 lines. “Travelers made 28.2% more trips but spending only rose 13.5% from the 2019 break…figures add to evidence showing Chinese households remain cautious with consumption despite a recent rebound in economic growth driven by a pickup in industrial activity.”

The U.S. continues to fall flat as well across gasoline and distillate, which isn’t something we see adjusting any time soon.

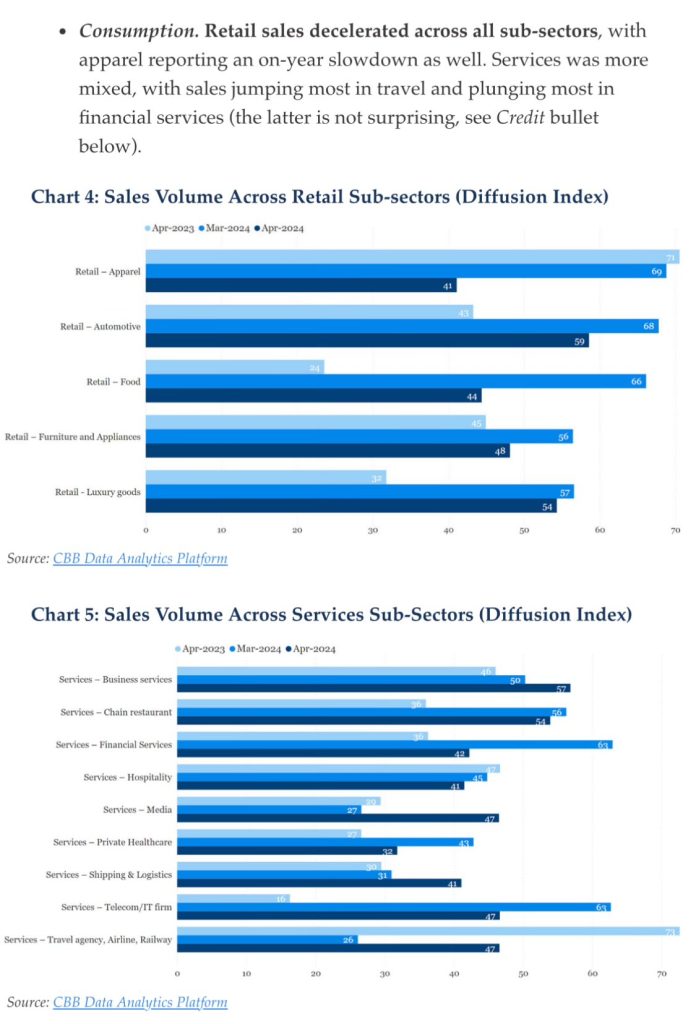

The bigger issue that continues to play out- especially in China- even though people may be willing to travel- they aren’t spending. April’s China Beige Book data showed that while consumers were willing to travel more, they were not ramping up spending on either goods or most other services/experiences. This has been a common theme across the globe, and given the pressure on consumers, this isn’t a trend we see shifting.

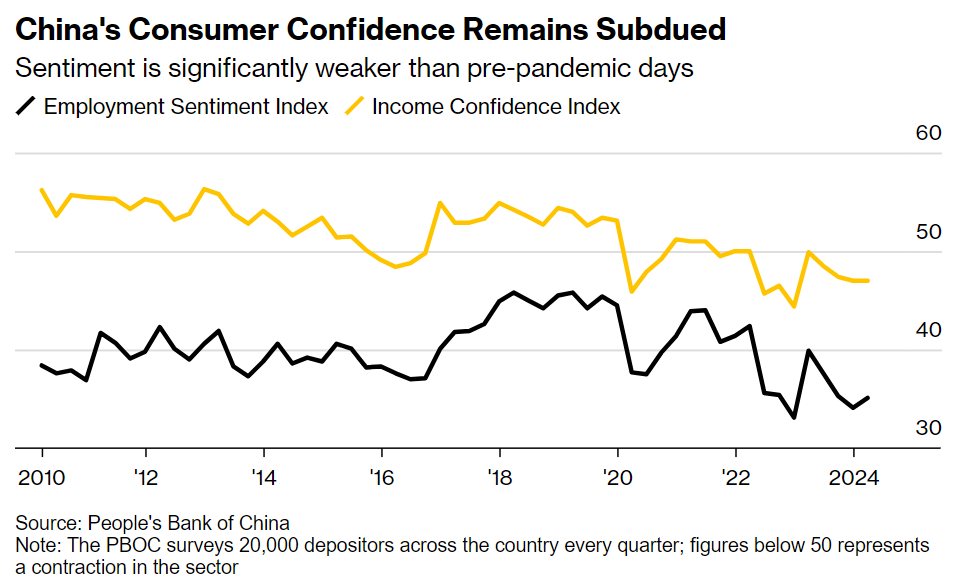

Consumer confidence across the globe is falling, and China is no different. “The figures add to evidence showing Chinese households remain cautious with consumption despite a recent rebound in economic growth driven by a pickup in industrial activity. Less than one in four residents wanted to spend more while an growing share of the urban population wanted to save in the first quarter, according to a survey by the People’s Bank of China. “Spending per head softened and was again below the pre-pandemic level, owing partly to more tourist flows towards lower-tier cities, and suggesting continued consumption downgrading,” said Goldman economists including Lisheng Wang in a note late Monday, adding that more policy support is needed to sustain the recovery of the services sector. The 2019 holiday was one day shorter.”[2]

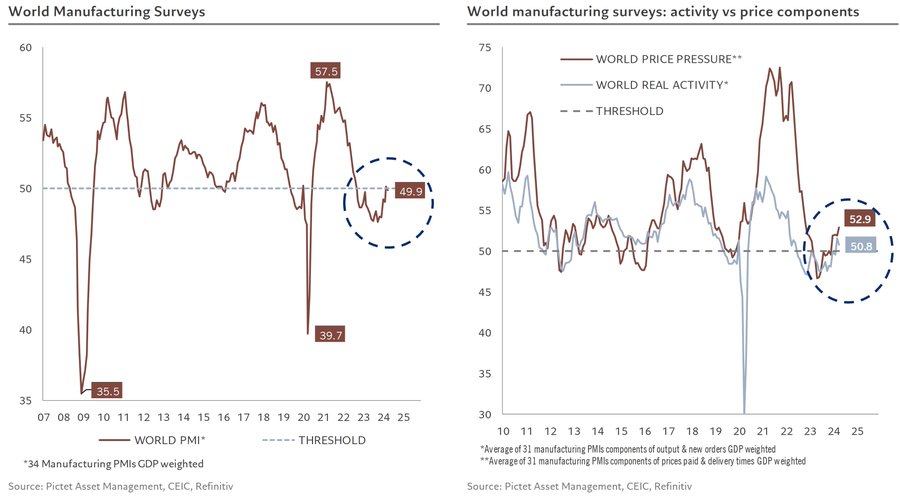

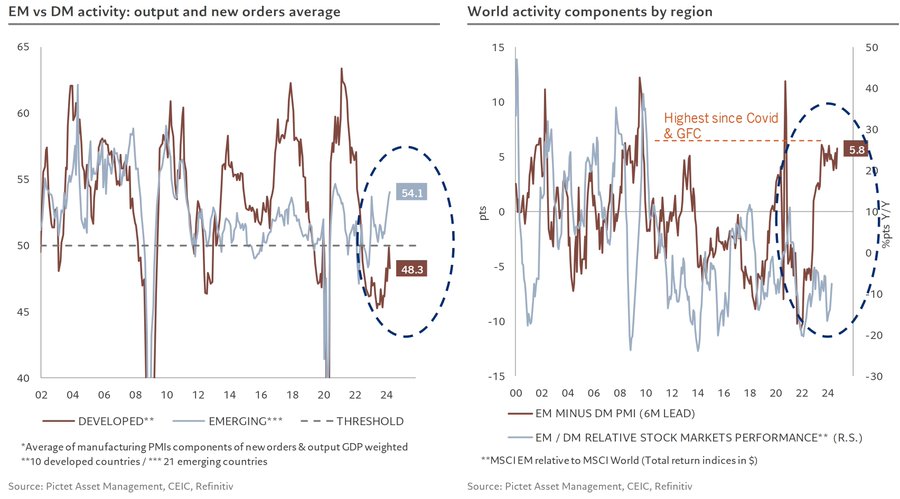

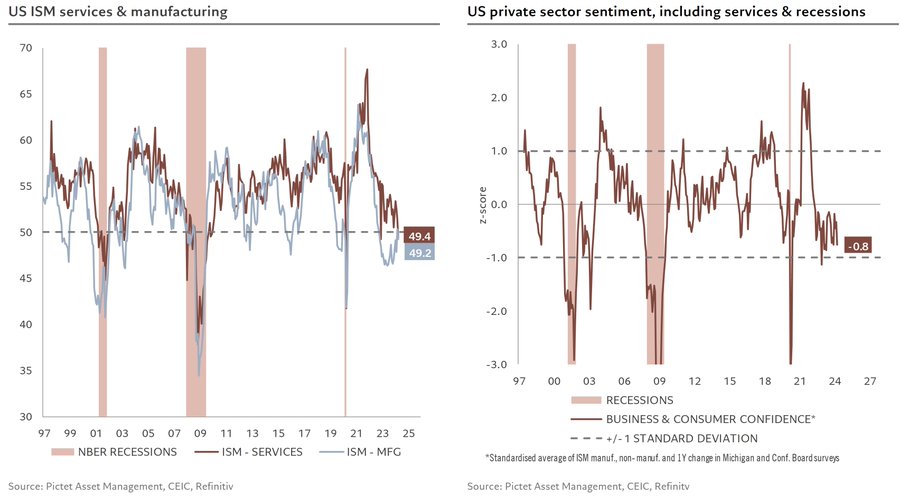

The U.S. is no different with another drop back below 50 on the PMI side. We’ve said from the VERY beginning that activity was going to settle just below 50. Many of the leading and current indicators support our view of another re-acceleration of inflation with a strong stagflationary backdrop holding for the long term. After briefly crossing the 50 threshold in March, the global manufacturing PMI fell back to 49.9 in April, with a marginal drop in activity components and a rise in short-term inflationary pressures.

The pressure in the DM areas haven’t fully transitioned to the EM world, which is something that is happening much slower than I expected. Rates and rolling EM debt will be biggest “wake-up call” for the market.

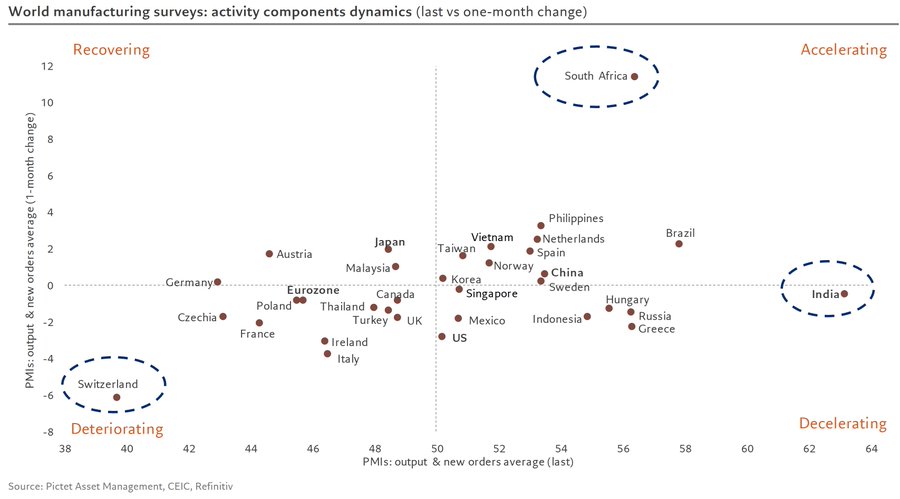

56% of countries stay in expansion (>50) of which 32% are accelerating. India remains with the highest activity index and S. Africa is accelerating the most. 12% are recovering. 32% deteriorating, Switzerland the most. I expect to see more pivot into the “deteriorating” as the slowdowns accelerate over the summer months. Consumer savings rates, spending, and confidence are showing how the cracks are increasing across the board.

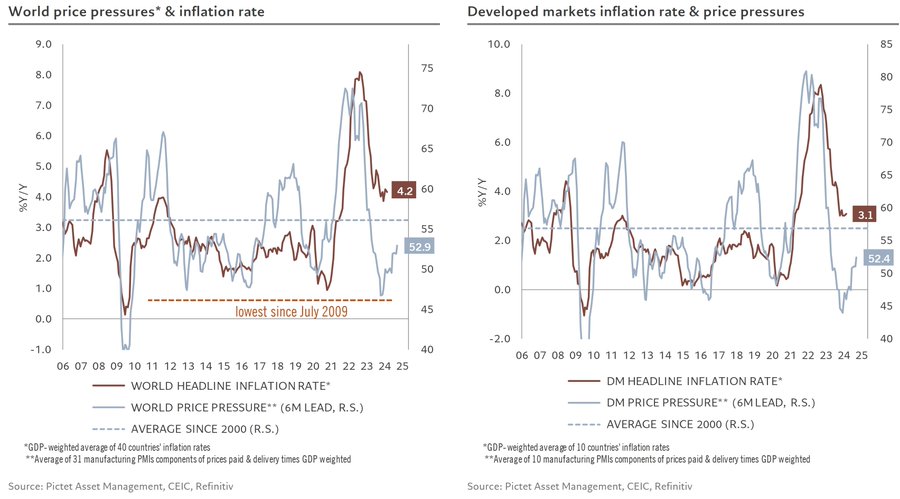

The pressure that is under appreciated is inflation. It isn’t just the U.S. that has seen a pick-up, and a strong USD/ inflation rate/ yields will be the undoing of many emerging markets. I thought this would have happened sooner at the EM level, but I think it will take EMs rolling debt at much higher interest rates to break investors out of their “slumber.”

The ISM service fell below the 50 threshold, joining the ISM manufacturing for the 1st time since Dec. 2022. The combination of these 2 surveys with consumer confidence avoids a recessionary signal (<1 st. dev.), still pointing to a soft landing. I still believe we will have a “soft landing” but it will just last MUCH longer than people expect. I don’t expect a “crash” but rather a long term stagflationary period with very little to no growth.

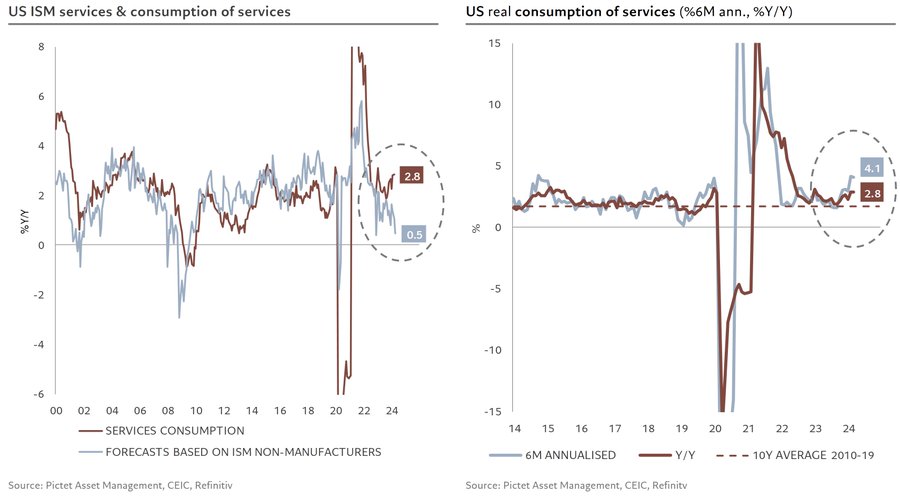

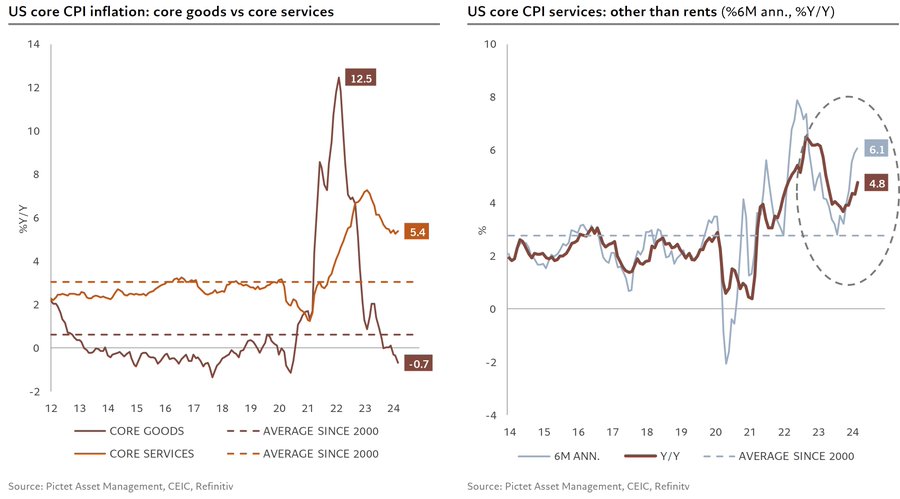

“This drop in the ISM services index points to a clear slowdown in services consumption, to 0.5% y/y since 2.8% and over 4% annualized over 6 months. This projected fall in services demand is rather good news for the Fed since it is certainly a major factor in the persistence of inflation in services, and in particular in the re-acceleration of inflation in services excluding rents.”

The problem with the belief that service demand will fall and drive down pricing is ignoring the amount of liquidity that is still pouring into the market through the fiscal side. We’ve had decades of liquidity pumped into the market, and labor costs continue to press higher. The demand slowdown could “cap” the rise but it won’t do much to push it lower- similar to what we saw in the 70’s.

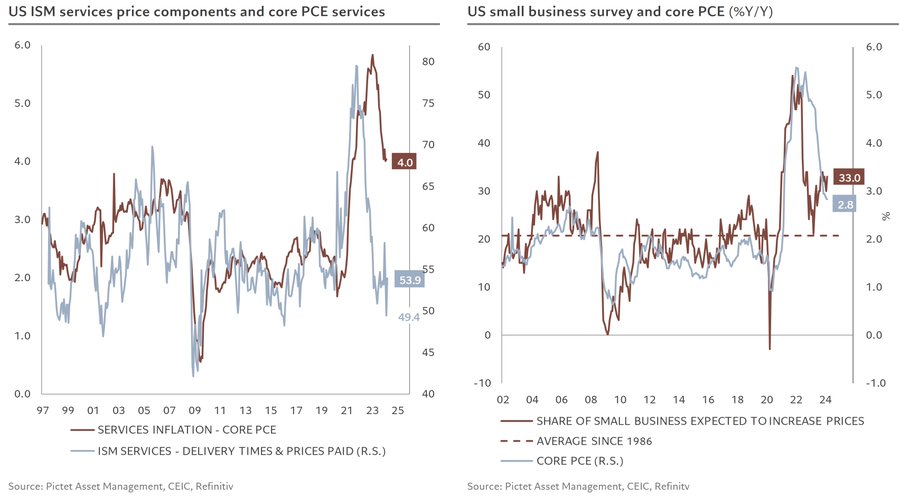

These issues are picked up more on the supply side: On the supply side, the signals are a little more mixed, with a rebound in the price components of the ISM services index, and a continued willingness on the part of companies to raise prices over the next 6 months and on the other hand, a lower rise in employment costs, down to 3.9% y/y and 3.6% over 3 months, but still well above the 2.5% to 3% margin that is historically consistent with inflation being close to its target.

Wage growth is a hindering factor- especially as the Fed moved a bit more “dovish” at their recent meeting. They are going to create even more problems if they “loosen” any further.

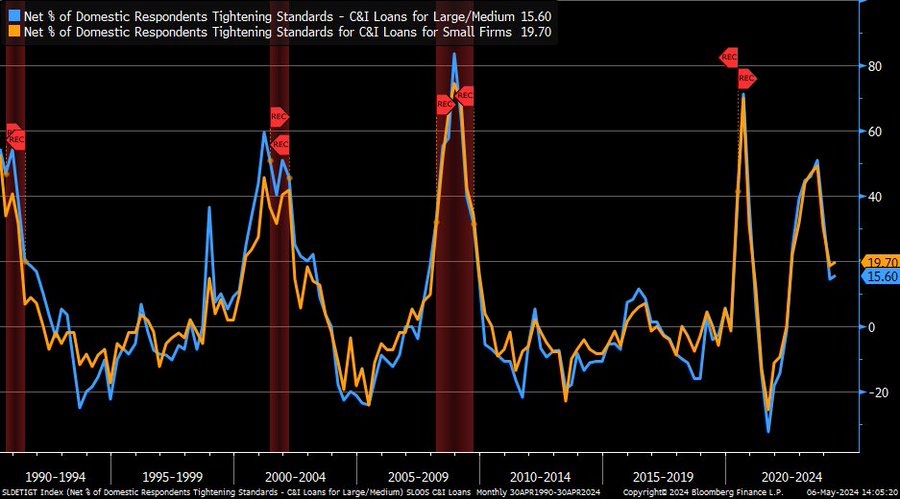

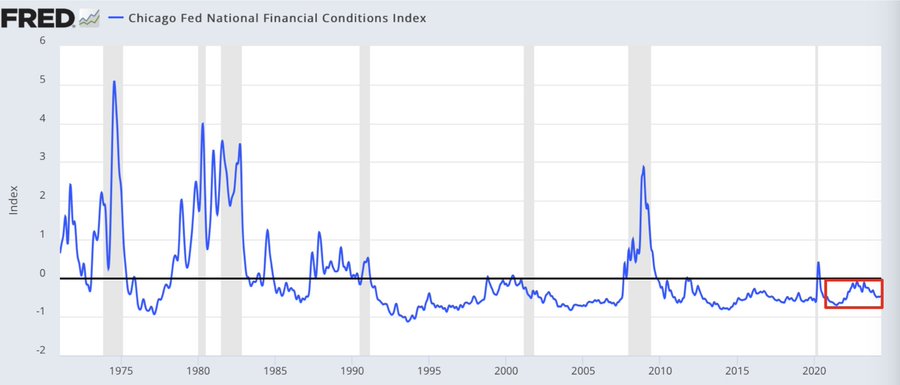

We still see fairly “lose” standards based on previous cycles where we SHOULD be tightening harder. I think we will see the Fed hold for much longer than what investors expect.

Here is another metric showing how lose policy remains:

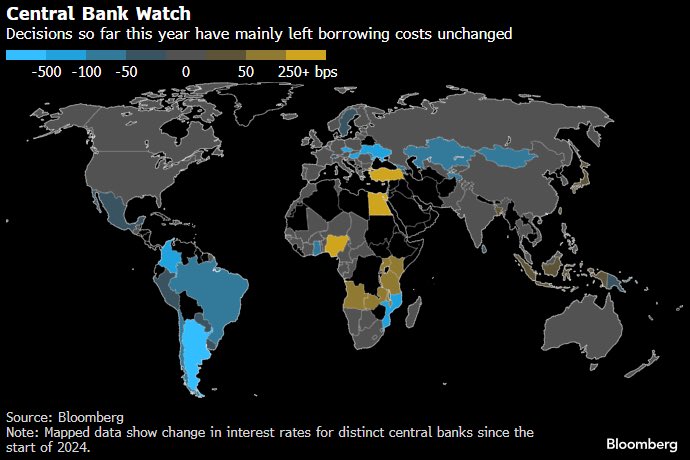

The current situation will keep central banks on the sidelines, and I don’t expect to see further easing.

The above chart is a great breakdown on where the decisions sit. I think we could see some small tightness happening again in emerging markets as developed markets keep things steady. It would be a HUGE mistake for anyone in the DM world to cut rates, but we have seen dumber things happen.

More on this next week!

- https://www.globalresearch.ca/saudi-israeli-normalization-post-gaza/5856848

- https://www.bloomberg.com/news/articles/2024-05-06/china-s-thrifty-travelers-show-consumer-confidence-remains-weak?sref=9yOLp5hz