In the latest edition of our Monday Macro View, we delve into the intricacies of the global economic landscape, emphasizing the pivotal developments in the global debt arena and providing an in-depth analysis of the current dynamics within the oil markets.

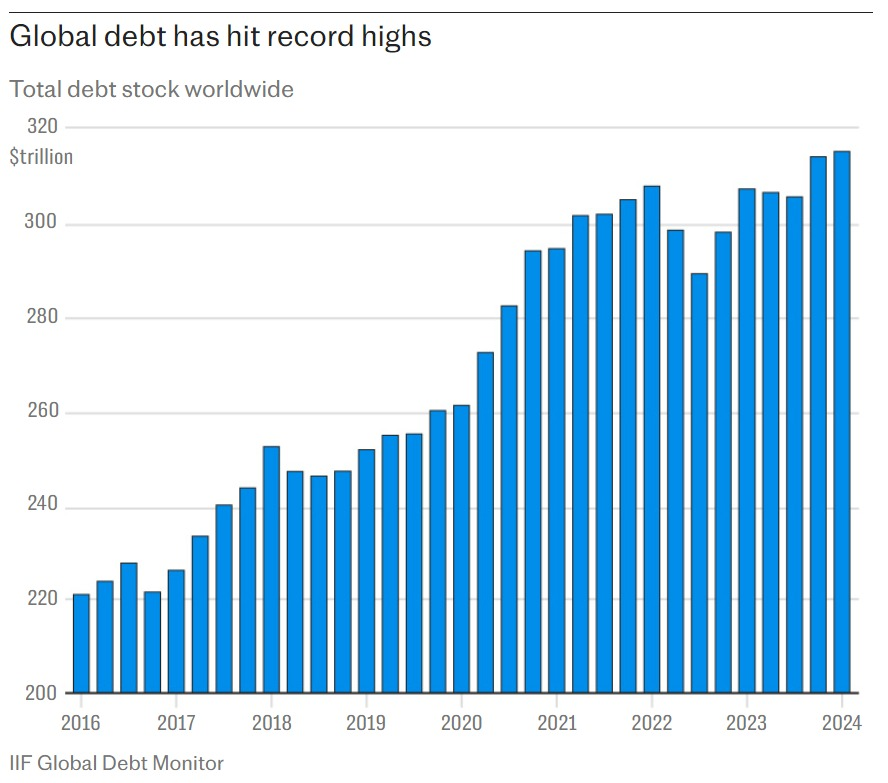

Global debt levels have reached a new zenith, escalating to $315 trillion, as noted by the Institute of International Finance (IIF). This substantial increase, predominantly fueled by major borrowing in emerging markets like China, India, and Mexico, marks a critical juncture. Notably, these countries have contributed to an unprecedented high of over $105 trillion in debt, a stark $55 trillion rise from a decade earlier. Amidst global uncertainties, these nations find themselves grappling with internal challenges such as China’s ongoing property sector woes and India’s financial exertions to manage recurrent natural disasters.

The surge in global debt is particularly concerning as it coincides with a period of heightened geopolitical tensions and a complex trade environment. The IIF’s report highlights that the rise in government debt in advanced economies during the first quarter of 2024 has been significant, with stubborn inflation in the U.S. posing additional challenges by potentially delaying expected Federal Reserve rate cuts. This scenario suggests a precarious future for global financial stability, particularly for developing countries with significant dollar-denominated debts.

Turning our focus to the oil markets, recent trends indicate a volatile yet contained trading range. The insights from Primary Vision suggest that despite geopolitical risks that have influenced the market since late last year, the price band has stabilized somewhat between $82 and $92 per barrel. However, the narrower expected range for May, between $83 and $87, with Brent averaging around $84/$85, reflects a market responding to nuanced shifts in supply and demand dynamics.

On the supply side, Russia has notably exceeded its oil production targets, pumping 9.4 million barrels per day against a target of 9.1 million barrels per day. This increase comes as Russian refiners return from maintenance, shifting more crude towards export markets. Such movements are critical as they influence global supply levels and can dampen price volatility. However, ongoing geopolitical tensions, including frequent drone attacks on Russian refining and petrochemical facilities, introduce an element of unpredictability that could impact refining operations and market perceptions.

Demand factors are equally pivotal in shaping the oil market landscape. The global economic slowdown has tempered demand growth, which, when combined with increased supply, particularly from Russia, places downward pressure on prices. Furthermore, crack spreads, especially for distillates, have been under pressure, leading to minor run cuts in Asia. These adjustments in refinery operations reflect a market attempting to recalibrate amidst fluctuating demand and supply levels.

Additionally, inventory levels provide further insights into market conditions. For instance, diesel and heating oil inventories in independent storage in the Amsterdam-Rotterdam-Antwerp (ARA) hub have risen, remaining slightly above typical levels for this time of year. In contrast, Singapore saw a small drop in inventories, though levels remain higher than last year, indicating a well-supplied market that could buffer against sudden price spikes.

The interplay between soaring global debt, persistent geopolitical tensions, and the nuanced dynamics within the oil markets will be crucial in shaping the global economic outlook. The ability of major economies and the oil sector to navigate these complex challenges will be key to maintaining economic stability and fostering sustainable growth in an increasingly interconnected world.