The Market Sentiment Tracker for the U.S. and World, dated May 15, 2024, reveals a complex economic landscape characterized by mixed signals. On the recession side, inflation remains a critical concern, with Fed officials still grappling with strategies to curb it. Neel Kashkari’s comments highlight the possibility of a sustained higher rate environment to achieve inflation targets. April retail sales slightly improved to $705.2 billion, but the National Association of Home Builders/Wells Fargo Housing Market Index dropped to 45 from 51 in April, reflecting ongoing weakness in the housing market.

E-commerce businesses experienced a decline, with nonstore retail sales falling by 1.2%. Trade tensions between the U.S. and China are raising concerns about a potential reversal in global economic progress. However, there are optimistic signals on the recovery side. Demand for mortgages has increased, driven by lower borrowing costs, which could support the housing market. Euromonitor International projects global GDP growth to reach 2.9% in 2024, indicating a stable economic outlook.

Despite these positive signs, there are significant risks, with predictions that a recession by early next year could potentially lead to a 30% drop in stock values. The overall outlook reflects a balance between cautious optimism and persistent economic challenges, with geopolitical tensions and market vulnerabilities continuing to pose substantial risks.

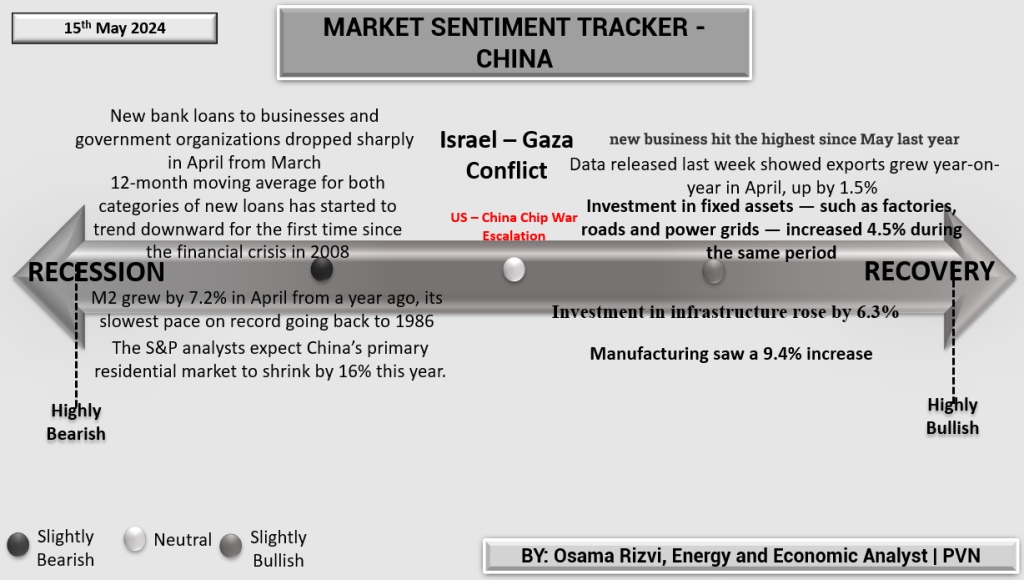

The Market Sentiment Tracker for China, dated May 15, 2024, presents a mixed picture of economic indicators. On the recession side, new bank loans to businesses and government organizations dropped sharply in April, marking a downward trend for the first time since the 2008 financial crisis. The 12-month moving average for new loans is declining, signaling potential tightening in credit conditions. M2 money supply grew by 7.2% in April, the slowest pace on record since 1986. Additionally, S&P analysts expect China’s primary residential market to shrink by 16% this year, reflecting significant stress in the real estate sector.

Conversely, positive indicators on the recovery side suggest some resilience in the economy. Data released last week showed exports grew year-on-year in April, up by 1.5%, highlighting continued external demand. Investment in fixed assets, including factories, roads, and power grids, increased by 4.5% during the same period. Infrastructure investment rose by 6.3%, indicating robust government spending to support economic growth. Manufacturing output saw a substantial increase of 9.4%, reflecting strong industrial activity. New business hits the highest since May of the previous year, suggesting a surge in economic activity.

Overall, while there are significant challenges such as declining credit growth and a struggling real estate market, China’s economy shows strength in industrial production, export growth, and infrastructure investment, indicating a balanced yet cautious recovery outlook.