Outlook And Strategy

We have already discussed Baker Hughes’s (BKR) Q1 2024 financial performance in our recent article. Here is an outline of its strategies and outlook. After Q1, Baker Hughes’s (BKR) management sees “declining activity in U.S. gas basins,” although activities will likely improve in 2H 2024. In international markets, it sees a transition of rigs from crude oil to natural gas in Saudi Arabia in 2024. Beyond 2024, we expect offshore market growth in Latin America, West Africa, and the Middle East. In the medium term, BKR will look to optimize production from existing assets following the launch of mature asset solutions.

Cost reductions and energy transitions are the keys to BKR’s growth path. Over the years, BKR has streamlined its organization to achieve a lower cost structure. Since 2017, these actions have helped lower costs by $150 million. It also invested in transforming the core business to drive higher profitability in the OFSE business. In 2024, it plans to increase its operating margin by 18%, or up more than 400 basis points from pre-COVID levels.

LNG Order Bookings

By 2040, BKR expects natural gas demand to grow by almost 20%, driven by higher energy demand and a net-zero energy ecosystem. The primary driver for natural gas’s demand surge is the coal-to-gas substitution, primarily in India and China and at a relatively slow rate in the rest of Asia. By the end of this decade, BKR expects demand for natural gas to increase by “mid-single digits.” It is expected to have a nameplate capacity of 800 MTPA by 2030, with further capacity additions beyond 800 MTPA by 2040. Natural gas prices, however, can remain volatile, leading to opportunities for accelerated demand creation.

LNG demand if typically higher when prices are low. The company estimates that year-to-date LNG demand was up by 4% after LNG prices nearly halved. Following the price fall, BKR expects to see LNG FIDs of about 100 MTPA by 2027. If this happens, installed capacity should increase by 70%, bringing significant opportunities for Baker Hughes. So, the company’s gas tech businesses will generate more profitability on the less cyclical aftermarket services.

New Energy Business Proliferation

Due to Higher demand from distributed power systems, BKR’s new energy orders would triple to $800 million-$1 billion By the end of 2024. BKR’s clean power solutions include the NovaLT fleet of turbines, which can run on natural gas and hydrogen. As the market scales up, the size of data centers will grow. It can also cause changes in the portfolio, as the focus is shifting towards emissions control. Due to the growth in demand and decarbonization efforts, the company expects to achieve $6 billion-$7 billion of new energy orders by 2030.

In Q1, BKR received two significant contract awards from Petrobras in OFSE. The company has long-standing relations with Petrobras, covering both OFSE and IET. Its previous orders include supplying electrical submersible pumps, variable-speed drives, and sand separation. In aggregate, BKR received orders totaling $6.5 billion, with $2.9 billion coming from the IET segment.

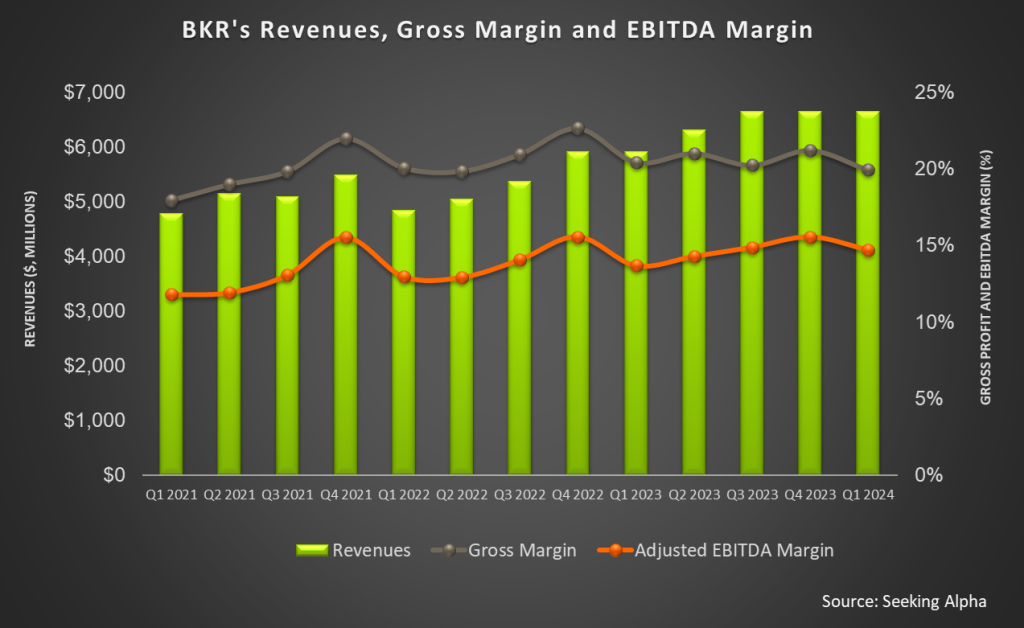

Margin Challenges

In the OFSE (Oilfield Services & Equipment) segment, the company’s operating margin improved by 80 basis points despite the lower offshore activity during the quarter. In the IET segment, the conversion of higher-margin equipment backlog, continued margin expansion, and cost optimization led to an 80 basis point improvement. During Q1, the company faced some delays in rigs due to maintenance in Mexico and the North Sea following tight supply chains and intense activities in shipyards. However, the OFSE segment outlook remains positive because the timing delays will disappear over time.

Q1 And FY2024 Forecast

In the Industrial & Energy Technology segment, revenues decreased by 8% quarter-over-quarter, while operating profit fell by 20%. The revenue visibility is not encouraging either, as order booking decreased by 4% in Q1. The financial results in the Oilfield Services & Equipment segment also weakened in Q1.

BKR expects Q2 2024 revenue in the IET segment to increase by 11% compared to Q1 2024, while revenues in the OFSE segment can grow by 6%. Flattish activity in North America, a healthy backlog for Gas Tech Equipment, and its conversion into industrial technology will likely drive the Q2 growth. In FY2024, the company expects continued strength in its international markets, partially offset by softness in North America onshore.

Cash Flows & Shareholder Returns

BKR’s cash flow from operations increased by 70% in Q1 2024 compared to a year ago. Its FCF increased by 2x during this period. Debt-to-equity (0.39x) remained unchanged compared to December 31, 2023 During Q1 2024, it returned $368 million to shareholders, including share repurchases and dividends. Its long-term objective is to return 60% to 80% of free cash flow to shareholders.

Relative Valuation

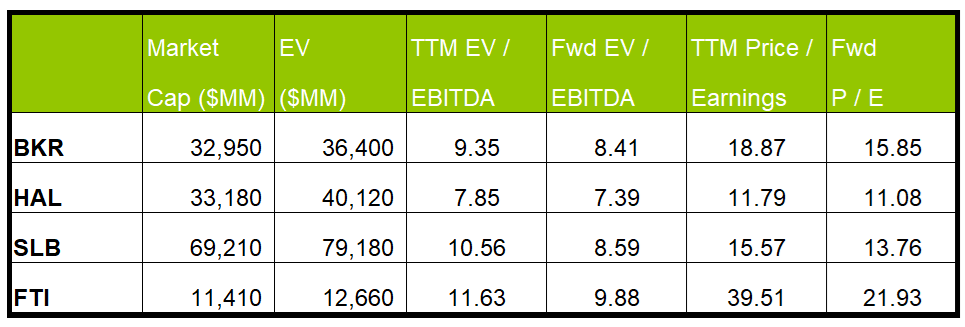

Baker Hughes is currently trading at an EV/EBITDA multiple of 9.4x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 8.4x. The current multiple is slightly lower than its past five-year average EV/EBITDA multiple of 10.3x.

BKR’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA is less steep than peers because the company’s EBITDA is expected to increase less sharply in the next four quarters. This typically results in a lower EV/EBITDA multiple than peers. The stock’s EV/EBITDA multiple is marginally lower than its peers’ (HAL, SLB, and FTI) average. So, the stock is reasonably valued versus its peers.

Final Commentary

After Q1, BKR’s management is relatively more optimistic about its international operations. The key trends that shape the international market environment are the transitioning of rigs from crude oil to natural gas, increasing demand for LNG, offshore market growth in various international geographies, and optimizing production from existing assets. On top of that, BKR has streamlined its organization to lower the cost structure. Going forward, it will transform the OFSE core business and focus on clean power solutions to drive higher profitability.

In the near term, however, it can witness declining activity in U.S. gas basins. Also, the company faced some delays in rigs due to maintenance work. Its cash flows improved substantially in Q1. Its long-term objective is to return 60%-80% of free cash flow to shareholders. The stock appears to be reasonably valued versus its peers.