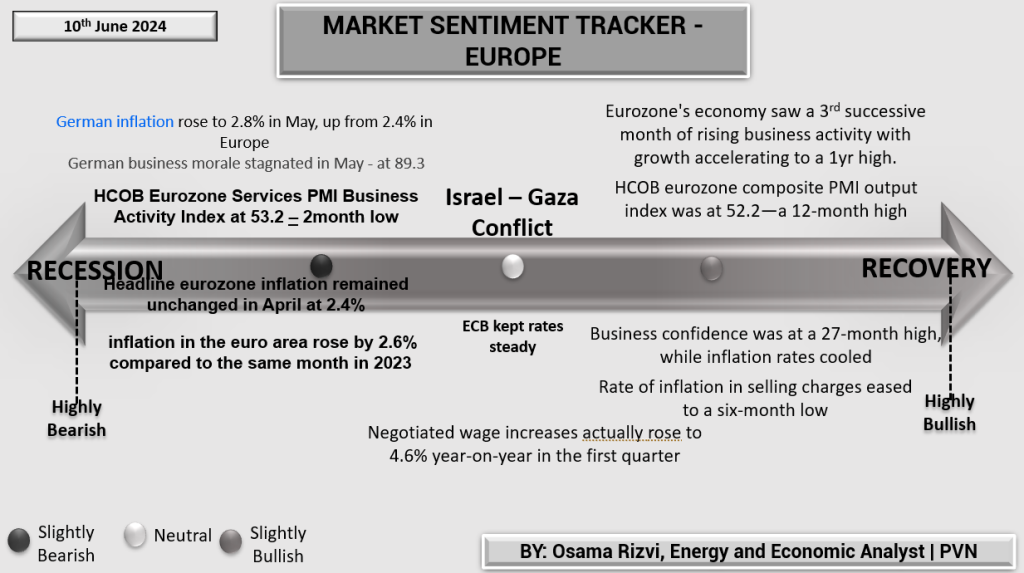

The Market Sentiment Tracker for the U.S. and World as of June 10th, 2024, provides a snapshot of the current economic climate. Gallup’s Economic Confidence Index registered -34 in May, indicating a significant deterioration in how Americans view the economy’s current state and future trajectory. Notably, 46% of Americans perceive the economy’s condition as “poor,” while only 22% describe it as “excellent” or “good.” This sentiment is echoed in a May 2024 survey, which finds that 70% of Americans believe the economy is “getting worse,” with only 26% feeling it is “getting better.”

Retail spending grew by just 1.3% in Q1 2024, down from 5% in Q3 2023, highlighting a slowdown in consumer activity. This decline in spending is further underscored by new manufacturing orders contracting in May, marking the 18th consecutive month of contraction in manufacturing activity. The Atlanta Fed economists have halved their expectations for second-quarter GDP growth from 3.4% to 1.8%, reflecting these challenging economic conditions. Additionally, the New York Fed predicts a 52% chance that the economy could slip into recession within the next 12 months.

Despite these bearish indicators, there are some positive signs. Unemployment claims fell for the second straight week, and business investment is on the rise. Wages are growing close to 4% annually, which is above the rate of inflation, suggesting some resilience in the labor market. Consumer spending was also up in March, offering a glimmer of hope amid broader economic concerns. While the U.S. economy faces significant headwinds, particularly in consumer confidence and manufacturing, there are areas of strength in the labor market and business investment that provide a more balanced outlook.

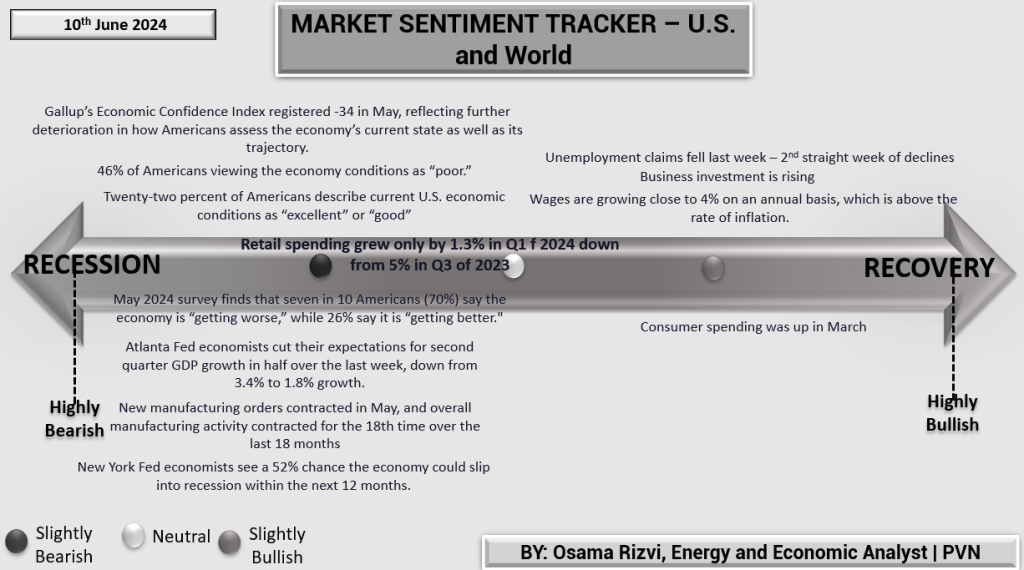

The Market Sentiment Tracker for China as of June 10th, 2024, presents a mixed economic outlook with significant indicators pointing towards both challenges and resilience. China’s PMI dropped to a three-year low of 49.5, indicating contraction. The new export order subindex fell sharply to 47.2 in May from 50.6 in April, reflecting weakening demand. Imports likely grew by 4.2% last month, which is slower compared to the 8.4% gain seen in April, highlighting a deceleration in domestic demand.

On the positive side, China’s exports grew for the second consecutive month, with outbound shipments increasing by 7.6% year-on-year in value in May, showing strength in the external sector. However, the growth in imports slowed to 1.8% from an 8.4% jump in the previous month, underscoring the fragility of domestic consumption. The official construction PMI also saw a significant fall from 56.3 to 54.4, pointing to a slowdown in the construction sector. The business activity and total new orders, however, continued to grow for the 17th month in a row, indicating ongoing strength in certain areas of the economy.

The geopolitical backdrop remains tense with the U.S.-China chip war escalation and new tariffs imposed by the Biden administration on Chinese electric vehicles, chips, and other goods, which could impact future trade dynamics. Overall, while China’s export sector shows robustness, internal economic indicators reflect significant headwinds, necessitating careful monitoring of both domestic and international developments. The mixed signals suggest that China’s economy is navigating through a period of uncertainty with both opportunities and risks ahead.

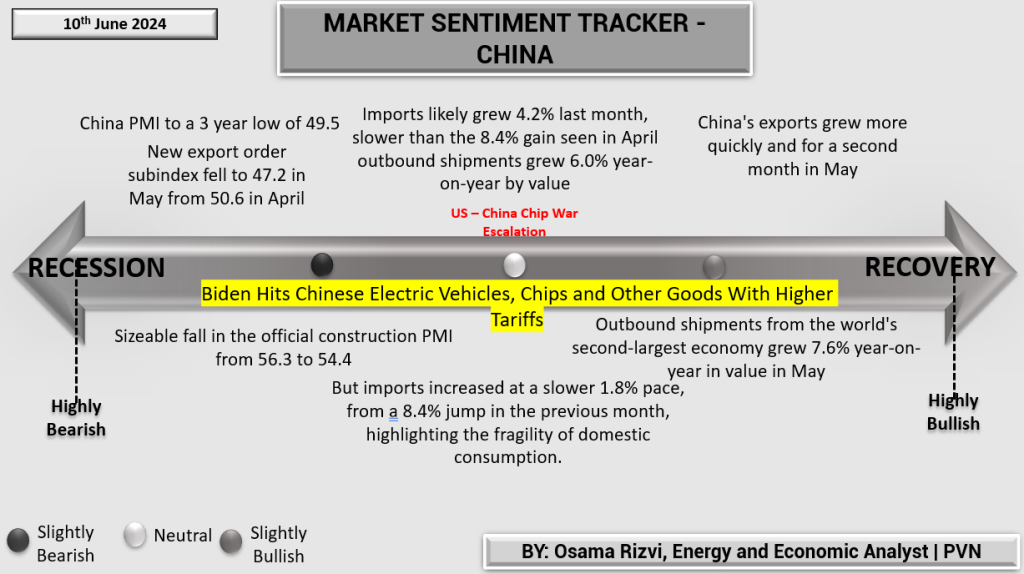

The Market Sentiment Tracker for Europe as of June 10th, 2024, indicates a complex economic landscape marked by both persistent inflation and rising business activity. German inflation rose to 2.8% in May from 2.4% in April, signaling ongoing price pressures. Despite this, the Eurozone economy recorded its third consecutive month of increased business activity, with growth reaching a one-year high. The HCOB Eurozone Composite PMI output index hit 52.2, marking a 12-month peak, although the Services PMI Business Activity Index dipped to a two-month low of 53.2.

Eurozone headline inflation remained unchanged at 2.4% in April, while inflation in the euro area increased by 2.6% compared to the same month in 2023. German business morale stagnated in May at 89.3, reflecting a cautious sentiment among businesses. The European Central Bank (ECB) kept rates steady, balancing between stimulating growth and containing inflation.

Business confidence reached a 27-month high, bolstered by the cooling inflation rates and the steady rise in business activities. The rate of inflation in selling charges eased to a six-month low, suggesting that price pressures may be stabilizing. Negotiated wage increases actually rose to 4.6% year-on-year in the first quarter, indicating a positive outlook for consumer spending power.

Overall, while inflation remains a challenge, the Eurozone’s economic activity and business confidence are showing signs of recovery. The mixed signals reflect a region cautiously navigating through inflationary pressures while capitalizing on rising business activity and improving consumer sentiment. This balanced approach highlights the Eurozone’s resilience and potential for gradual economic stabilization in the coming months.