Trillions wiped away from global stock markets, Japanese central bank increasing their interest rates for the first time in 30 years, US job report disappointing the investors and triggering the Sahm’s Rule – a lot has happened in the past week. This update brings you the latest in that regard and also help to contextualize whether we have entered a recession or not.

1. MMV: What is Sahm’s Rule – PREMIUM

For this week’s Monday Macro View, we discuss what exactly is the Sahm’s rule that everyone is talking about and how does it relate to a recession? Please read the article to find out more.

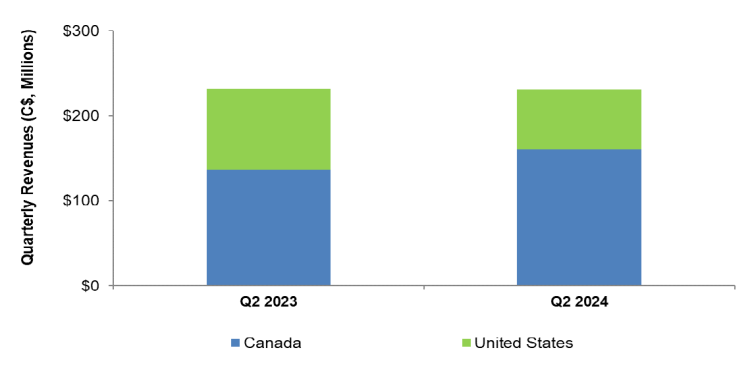

2. STEP Energy Services: Q2 Take Three – PREMIUM

In Q2 2024, STEP Energy Services (STEP) fracturing operating days kept increasing in Canada, but it fell in the USA compared to a year ago. Year-over-year, STEP’s revenues increased by 18% in Canada but took a steep downturn (27% down) in the US in Q2 2024. Delve deeper into the contours of the Shale industry by reading Avik’s brilliant article here.

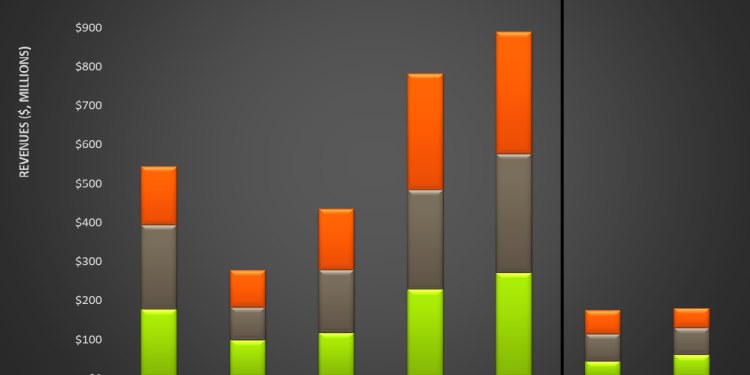

3. KLX Energy Services: Q2 Take Three – PREMIUM

In Q2, KLX Energy Services (KLXE) benefited from a shift in revenue mix towards the higher-margin Rockies segment. Quarter-over-quarter, KLXE’s revenues in the Rocky Mountains increased the most, by 35% in Q2, while its operating income turned significantly positive (profit of $10.5 million) compared to a loss a quarter earlier.

4. Market Sentiment Tracker: The Shadow of Recession is Upon Us – ENTERPRISE

We have been consistently writing, reminding, the readers that behind all the claims of a soft landing, the real economic data is still flashing red. Unfortunately, the recent events have shown this to be true and this week’s Market Sentiment Tracker gauges these indicators: The Eurozone economy grew by 0.3% in the second quarter, indicating resilience despite Germany’s 0.1% contraction. China’s official manufacturing PMI dipped slightly to 49.4 from 49.5, indicating a contraction for the third consecutive month. Bearish indicators include US jobs data falling short of expectations with 114,000 jobs added versus the expected 175,000, and the unemployment rate climbing to a three-year high of 4.3%.

*Premium Subscribers

**Enterprise Subscribers

Learn more about a subscription here or email us directly: info@primaryvision.co