The Strategies Explained

We have already discussed SLB’s (SLB) Q2 2024 financial performance in our recent article. Here is an outline of its strategies. The company’s management plans to direct investments in key international markets like the Middle East and Asia while focusing on the global offshore market. The upcycle in natural gas and deepwater projects and production and recovery activity should benefit it. In the Middle East, using the company’s fit-for-basin technology and differentiated integration capability accelerated the scale of investments in gas development.

Offshore, through the OneSubsea joint venture, SLB has created value through high-value contracts and partnerships that unlocked reserves and reduced cycle times. The company’s subsea production processing technology offerings helped customers through the early engineering phases. Its pending acquisition of ChampionX should strengthen the portfolio. Another critical part of the strategy is digitization and AI. For OFS companies, upscaling the digital infrastructures is key, as it can create significant opportunities for high-margin growth.

Q3 and FY2024 Outlook

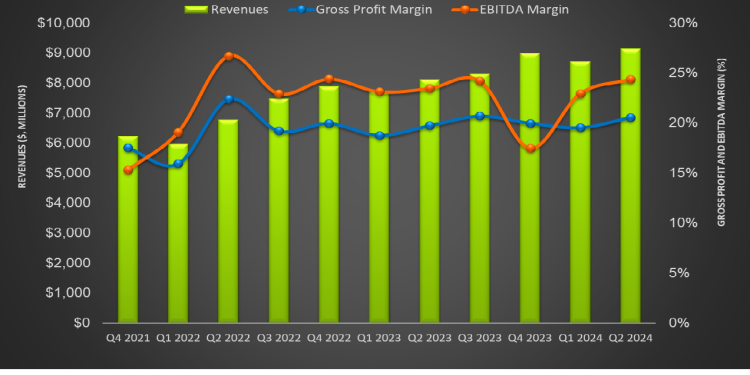

Based on the Q2 and 1H 2024 financial results, SLB expects its adjusted EBITDA to grow by 14%-15% in FY2024, while it expects the adjusted EBITDA margins to be at or above 25%. In Q3, it expects revenues to grow by “low single-digits” compared to Q2. The revenue and margin growth will likely accelerate by the end of the year due to higher top-line growth and margin expansion after a slow start in Q1 following the adverse effects of seasonality. The digital and product sets sales typically increase by Q4.

The company recognizes the resilience of oil capacity expansion and deepwater oil developments. It sees new offshore oil development projects emerging in Africa, Turkey, and Asia. Plus, oil capacity reinforcement in the Middle East increased its share of gas activity in the Middle East. In North America, high-intensity technology deployment will support sustained production growth.

SLB’s Q2 Performance

Our short article discussed SLB’s revenue drivers for the operating divisions and key geographic regions. We saw all four operating segments witnessed a quarter-over-quarter revenue rise in Q2. Geographically, the company’s International market growth was sharper than North America’s in Q2. Capacity expansions, natural gas development projects, and production recovery in international territories caused this growth.

Looking closely at the figures, we see quarter-over-quarter operating profit in the Digital & Integration division increased by 28% in Q2, followed by an 18% rise in the Production Systems division. The favorable conversion of backlog and the acceleration of production recovery investments, particularly in the Middle East, Asia, and Latin America, primarily contributed to the growth.

SLB’s cash flow from operations declined in 1H 2024 compared to a year ago. Due to the higher debt level, debt-to-equity increased (0.56x) compared to FY2023. During Q2, it repurchased shares worth $465 million. In 2H 2024, the management expects to generate higher EBITDA and strong cash flows following its commitment to continue returns to shareholders in 2025.

Relative Valuation

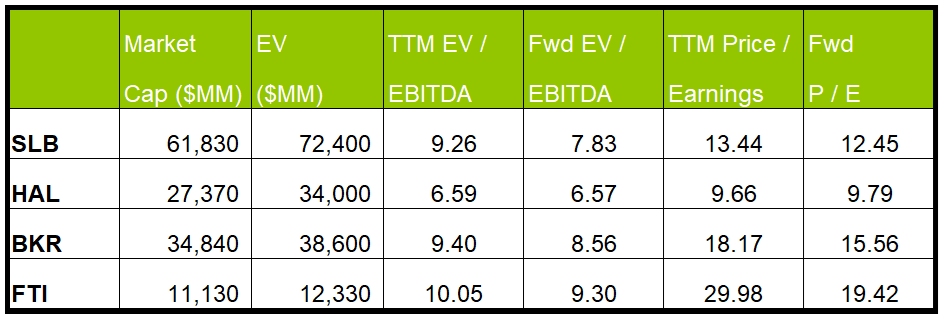

SLB is currently trading at an EV/EBITDA multiple of 9.3x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 7.8x. The current multiple falls short of its five-year average EV/EBITDA multiple of 11.8x.

SLB’s forward EV/EBITDA multiple contraction versus the adjusted current EV/EBITDA is steeper than its peers because the company’s EBITDA is expected to increase more steeply than its peers in the next four quarters. This typically results in a higher EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is slightly higher than its peers’ (HAL, BKR, and FTI) average. So, the stock is reasonably valued, with a positive bias, versus its peers.

Final Commentary

SLB continues to focus on the global offshore market in the Middle East and Asia. It has created value through high-value contracts and partnerships, including the pending acquisition of ChampionX. The company increased its share of gas activity in the Middle East, while offshore oil development projects in Africa, Turkey, and Asia regions will likely become the key growth factors. Another vital part of the strategy is digitization and AI. Integrating the strategies created significant opportunities for high-margin growth.

In 2H 2024, the management expects to generate higher EBITDA and strong cash flows. However, due to higher debt levels, leverage increased compared to FY2023. It continued to buy back shares in 1H 2024. Compared to its peers, the stock is reasonably valued, with a positive bias.