The Drilling Outlook

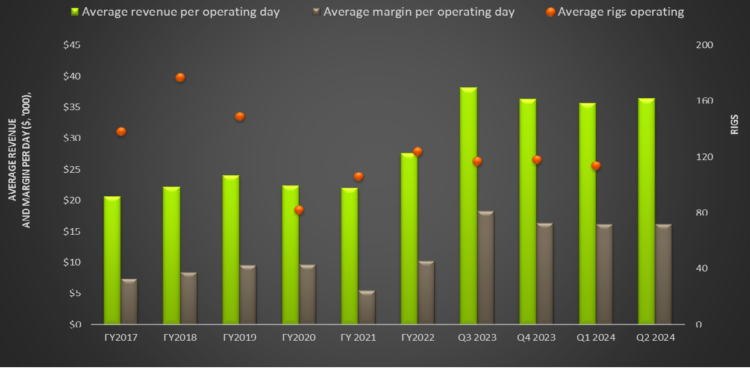

We discussed our initial thoughts about Patterson-UTI Energy’s (PTEN) Q1 2024 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook. PTEN’s management expects drilling and completion activity in natural gas basins to improve in 2025. In the near term, however, it faces constraints regarding natural gas takeaway capacity in West Texas and New Mexico and the market squeezing due to the operators’ M&A activities. By the end of July, PTEN’s rig count decreased to 107 from 111 recorded at the start of Q3. The management believes that the squeeze is now over, and it can grow from this level, particularly for high-grade equipment. The company expects an average of 63 rigs operating under term contracts in Q3.

In completions, energy operators’ budget constraints can diminish demand for PTEN’s services. In Q2, lower-than-expected natural gas activity affected its utilization. In the Drilling Products segment, revenue from Ulterra was resilient despite the US rig count fall in Q2. PTEN acquired Ulterra, a provider of drill bit solutions, in August 2023. The trend towards longer laterals benefits Ulterra, in which the revenue per industry rig improved in Q2. In Q3, the management expects international revenues to increase by “mid-teens percent” year-over-year, due primarily to higher sales in Saudi Arabia.

In Q3, activity in the Completion Services segment to improve marginally. The share of electric equipment in PTEN’s activity should also grow. In Q3, it expects to average 108 active rigs in U.S. contract drilling with adjusted gross profit per operating day of roughly $15,000. This would be lower than Q2 due to contract rollovers and a lower rig count, which can adversely affect fixed cost absorption in this business. Also, adjusted gross profit in other drilling services can decline in Q3. On June 30, PTEN’s term contracts for drilling rigs in the U.S. amounted to $433 million of future day rate drilling revenue.

Frac And Other Key Drivers

Approximately 80% of PTEN’s active fleets are natural gas capable. The company is in the process of rolling out its latest electric frac equipment. Each of the new electric fleets operated at least 500 hours per month. It offers next-generation frac solutions in a capital-efficient manner. The company operates through its natural gas fueling systems and is a CNG provider for multiple third-party frac fleets. Outside of traditional drilling and completion activities, it seeks a potential market in power services as the E&P customers electrify their growing production facilities.

The fastest growing area in this business is the new data centers. Today’s data centers require significantly more power than their previous generation. Here, PTEN offers energy solutions, including medium and high-voltage electrical controls, electrical engineering, control automation, and microgrids. The company’s management expects this market to grow because local utilities fall short of supplying all of the power demand. It has recently supplied microgrid components to a data center operator with further possible delivery.

PTEN believes that its integrated natural gas fueling business has reached critical mass in providing CNG and field gas for ~2 MM HHP of natural gas-powered equipment. In June, it delivered 100 million diesel gallons equivalent of natural gas and expects volumes to increase by 25% in 2024. It has the capacity to generate more than 1 gigawatt-hour of electricity, the majority of which will be powered by natural gas-powered fleets. In international markets, it sees opportunities in the Middle East and deepwater markets in the North Sea, Guyana, and the Gulf of Mexico.

Capex And Leverage

Quarter-over-quarter, PTEN’s revenues in the Drilling Services segment decreased by 4% in Q2 2024. Revenues from the Completion Services segment declined by 15%, while revenues from the Drilling Products segment decreased by 4%. PTEN’s cash flow from operations increased by 42% in 1H 2024. It used FCF to repurchase 28 million shares for $309 million in the past three quarters until Q2.

The company expects to convert ~40% of its adjusted EBITDA to free cash flow in 2024. PTEN has planned to return $400 million annually. PTEN’s liquidity was $688 million as of June 30, 2024 (excluding working capital). Its debt-to-equity (0.26x) is much lower than that of its competitors (NBR, HP, and LBRT).

Relative Valuation

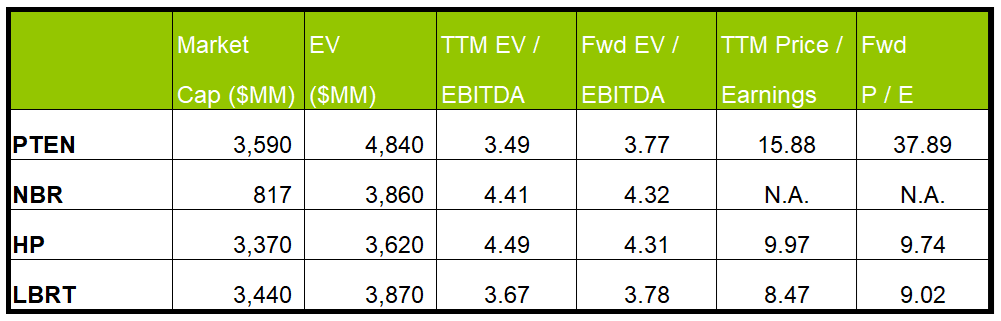

PTEN is currently trading at an EV/EBITDA multiple of 3.5x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 3.8x. The current multiple is lower than its past five-year average EV/EBITDA multiple of 8.6x.

PTEN’s forward EV/EBITDA multiple is expected to expand versus the current EV/EBITDA. This contrasts the fall in the multiple for its peers because the company’s EBITDA is expected to decrease compared to a rise in EBITDA for its peers in the next year. This typically results in a much lower EV/EBITDA multiple. The stock’s EV/EBITDA multiple is lower than its peers’ (NBR, HP, and LBRT) average. So, the stock is reasonably valued, with a negative bias, versus its peers.

Final Commentary

PTEN has a few speedbumps ahead. The energy operators’ budget constraints, low natural gas takeaway capacity in a few US Basins, and declining rig count in recent times can impair it growth potential in the short term. Its adjusted gross profit per operating day can decrease in Q3 due to lower fixed cost absorption. However, revenue per industry rig improved in Q2. The primary driver outside of its traditional energy business can emanate from the demand for electrification from natural gas data centers. PTEN provides electrical controls, electrical engineering, and microgrid solutions for the growing need for power from such data centers.

The company’s natural gas fueling business is believed to have reached critical mass in providing CNG and field gas. Its cash flow generation in 1H 2024 allowed share repurchases and increased shareholder returns. Compared to its peers, the stock is reasonably valued, with a negative bias.