NINE’s Strategies

We discussed our initial thoughts about Nine Energy Service’s (NINE) Q2 2024 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook.

NINE has refurbished its refrac business recently. It has already run over 300 refrac jobs for some top operators and currently leads the pack in refracking. A refrac boosts total reserves recovery while allowing the operator to capture commodity prices without having to direct large amounts of capital to new drilling. Demand for its dissolvable and composite plugs has been strong in the refrac business.

As lateral lengths continue to extend, it expects to see dissolvable plugs. It is essential to understand the context of why refracking can become a helpful revenue generator. In refrac, the company offers the entire suite, which includes completion tools, cementing, wireline, and coiled tubing. Its partnership with NewGen should add value in the coming quarters because few service providers are in the refracking business, and NINE appears to wrestle a large chunk of the business.

Analyzing Current Trend

The current drilling and completion business displays signs of improvement. The US saw nearly 200 onshore rigs dropping out since 20222. NINE’s revenues and earnings correlate with the US rig count because rigs typically drive volume and pricing for its service lines.

Also, pricing in the cementing business suffered due to low utilization of its service lines. A decrease in activity and pricing, especially in the Haynesville and Eagle Ford basin, caused cementing revenue to decline in Q2. Interestingly, the cementing business appears to recover quickly and rapidly as and when the rig count bounces back.

NINE’s completion tools sales declined in Q2 as the frac count dropped. According to Primary Vision, the US frac count will remain nearly unchanged in 2024. So, its completion tool revenues were reduced following lower US onshore activity and decreased international sales. I do not see the international completion tool sales in Q3, although the company aims to accelerate the sales in the medium-to-long term.

NINE’s Outlook

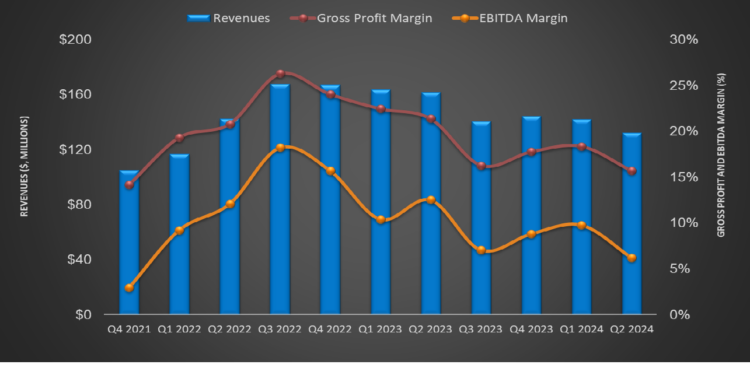

Because of low natural gas prices, completion delays, and low utilization, NINE expects Q3 rig count and pricing to stay relatively flat. Its projected revenue may range between $127 million and $137 million – nearly unchanged from Q2. Its adjusted EBITDA margin can be relatively flat. NINE derives 30%-35% of its revenues from natural gas. Despite the uncertainty over energy prices, its management is “positive on the medium- and long-term outlook.” This is because of the expected increase in power demand in the US. Some estimates show domestic power demand can grow by ~40% in the next two decades.

The months of June and July turned out to be strong, driven partly by higher refract demand. The cementing has also performed well in Q3 so far, which may improve coiled tubing utilization. It could shift some assets in West Texas, leading to better utilization.

Q2 Financials

Quarter-over-quarter, NINE’s revenues decreased by 6.8% in Q2, while its adjusted EBITDA margin contracted by 323 basis points. The company recorded a $0.4 net loss per share in Q2, and the magnitude of the loss steepened compared to a quarter earlier.

NINE’s cash flow from operations turned positive in Q2 2024 compared to a negative CFO a quarter ago. As a result, free cash flow also turned positive in Q2. Due to negative shareholders’ equity, its debt-to-equity remained negative as of June 30, 2024. Its liquidity was $51 million as of June 30. During Q2, the company sold 4.2 million shares for $6.8 million.

Relative Valuation

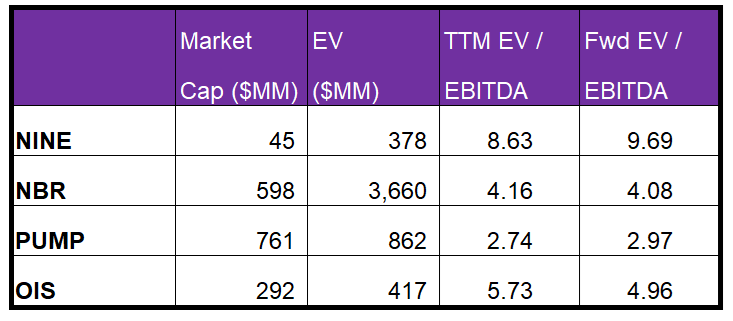

NINE is currently trading at an EV/EBITDA multiple of 8.6x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 9.7x.

NINE’s forward EV/EBITDA multiple compared to the current EV/EBITDA is expected to expand contract more sharply than its peers. This implies that its EBITDA is expected to decrease more steeply than its peers next year. This typically results in a lower EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is higher than peers’ (NBR, PUMP, and OIS) average. So, the stock is relatively overvalued versus its peers.

Final Commentary

Nine’s faced headwinds from a drilling and completion activity slowed down in Q2, primarily in the Haynesville and Eagle Ford basins. Low utilization in the company’s various service lines adversely affected the pricing in the cementing business. Despite the drawbacks, the company has reasonably medium- and long-term outlook. The cementing and coiled tubing business metrics will likely improve as the company shifts assets to West Texas. However, a lot will depend on natural gas price recovery timing.

We discussed earlier in our previous analysis that NINE has an asset-light business model, and diversity allows it to stabilize its top line. NINE’s cash flows improved in 1H 2024. However, the stock is financially risky due to negative shareholders’ equity. The stock is relatively overvalued compared to its peers.