Oil prices have come under immense pressure as non-OPEC+ production continues to rise as highlighted in the latest oil market report by IEA. Demand concerns keep mounting. Chinese demand is now expected to grow 200,000 bpd in 2024 vs 380,000 bpd. Saudi Arabia needs oil above $90 for fiscal breakeven. Now how will all of this play out? Will the global demand surge to support prices? How long can OPEC+ afford to cut production.This update answers all these questions.

1. Monday Macro View: What will OPEC+ do next? – PREMIUM

The million-dollar question for OPEC right now revolves around what the organization will do next as they seem to be running out of options. Global oil prices have slumped dramatically, and as the charts you’ve uploaded indicate, OPEC members are now facing a stark disparity between their fiscal breakeven oil prices and the current market prices. This widening gap, combined with mounting economic pressures within member nations, raises the question of whether the existing production agreement can hold or if we could witness cheating or a potential collapse in the agreement. Read the article to find out more!

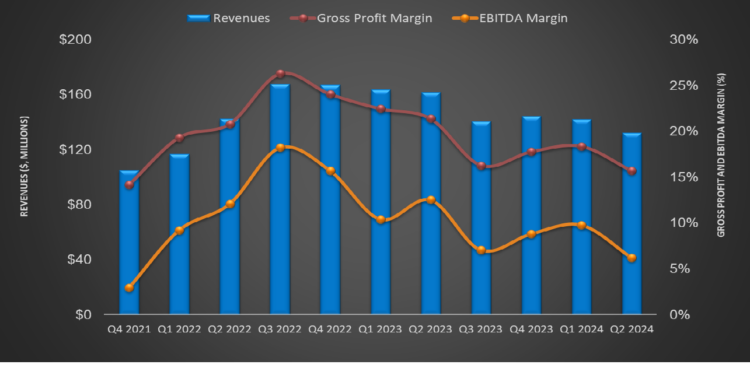

2. NINE Energy’s Perspectives in Q2: Key Takeaways – PREMIUM

NINE has refurbished its refrac business recently. It has already run over 300 refrac jobs for some top operators and currently leads the pack in refracking. NINE’s completion tools sales declined in Q2 as the frac count dropped. According to Primary Vision, the US frac count will remain nearly unchanged in 2024. Read this insightful anlaysis by Avik Chowdhury to find out more!

3. Primary Vision Insights – ENTERPRISE

Our senior analyst, Mark Rossano, brilliantly covers the global oil and economic markets in this latest update. It is a must read for anyone trying to grasp what is happening and more importantly what will happen moving forward especially in regards to the Fed’s interest rate cuts and overall health of the U.S. economy. Mark says in the article that “it looks as though we are heading directly into a situation of additional economic pressure around the world”. That’s something concerning.

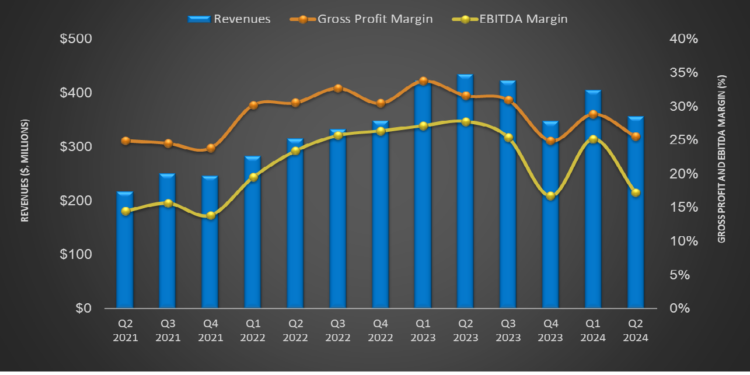

4. ProPetro’s Perspective in Q2: Key Takeaways – PREMIUM

This article does a deeper dive into the industry and its current outlook. In Q2, PUMP’s effective frac spread utilization was 15 compared to 12.9 in Q4 2023. The company will change the basis of frac utilization calculation. From reporting based on days worked, it will report the number of active frac fleets. During Q2, 14 hydraulic fracturing fleets were active, and the company expects to keep them unchanged at 14 in Q3. What lies ahead? Avik Chowdhury discusses it in detail here.

*Premium Subscribers

**Enterprise Subscribers

Learn more about a subscription here or email us directly: info@primaryvision.co