First of all, I want to apologize for the delay in publishing the MST for this week as I am traveling to UAE speaking on a conference representing Primary Vision. I will do a detailed piece on some important points that were discussed during the conference.

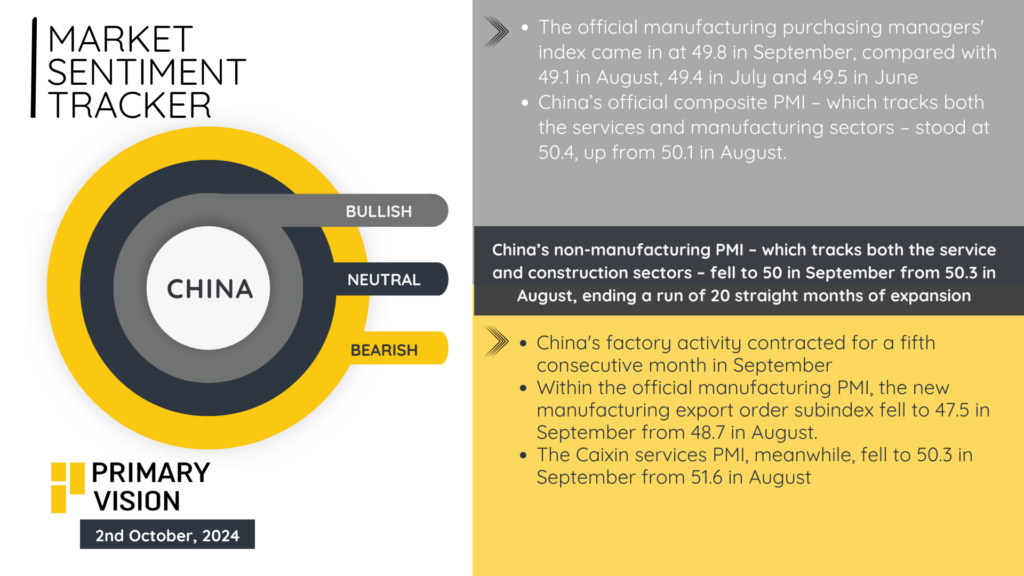

China’s latest economic indicators paint a mixed picture. The official manufacturing PMI edged up slightly to 49.8 in September from 49.7 in August, signaling continued contraction, though with a slower decline. It’s the fifth consecutive month of factory activity shrinking. Meanwhile, the non-manufacturing PMI dipped to 50 from 50.3, ending a 20-month expansion streak in the services and construction sectors. New export orders also dropped to 47.5, from 48.7 in August, reflecting weaker global demand. However, the official composite PMI remained in expansion territory at 50.4, up from 50.1, thanks to marginal growth in the services sector. The Caixin services PMI, which focuses more on smaller firms, also fell to 50.3 from 51.6, suggesting softening domestic demand. While some resilience remains in specific sectors, this combination of declining activity highlights the continued pressure on China’s economy, struggling to recover from ongoing challenges in domestic consumption and weak global demand.

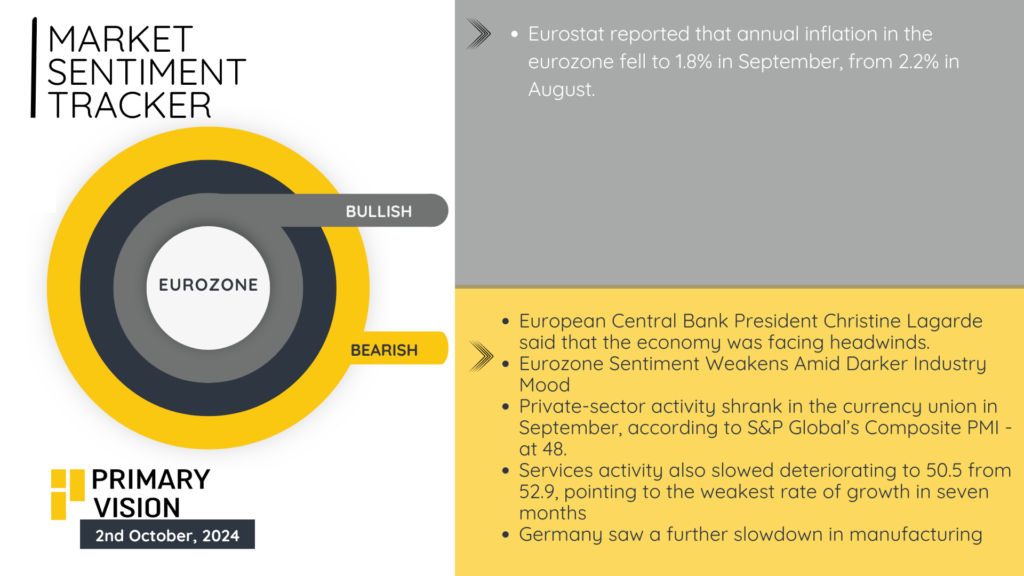

Eurozone economic sentiment continues to weaken as headwinds intensify. Private-sector activity contracted in September, with S&P Global’s Composite PMI slipping to 48. Services activity also deteriorated, dropping to 50.5 from 52.9, marking its slowest growth in seven months. In Germany, the manufacturing sector faced further slowdown, dragging down industrial momentum across the bloc. Inflation, however, eased to 1.8% in September from 2.2% in August, providing some respite, though European Central Bank President Christine Lagarde has highlighted ongoing challenges. Lagarde’s warnings underscore growing concerns about deeper economic stagnation in the months ahead. Consumer demand remains subdued, industrial production faltering, and the broader outlook clouded by weak sentiment and sluggish growth in key sectors, indicating further difficulties in sustaining recovery momentum.

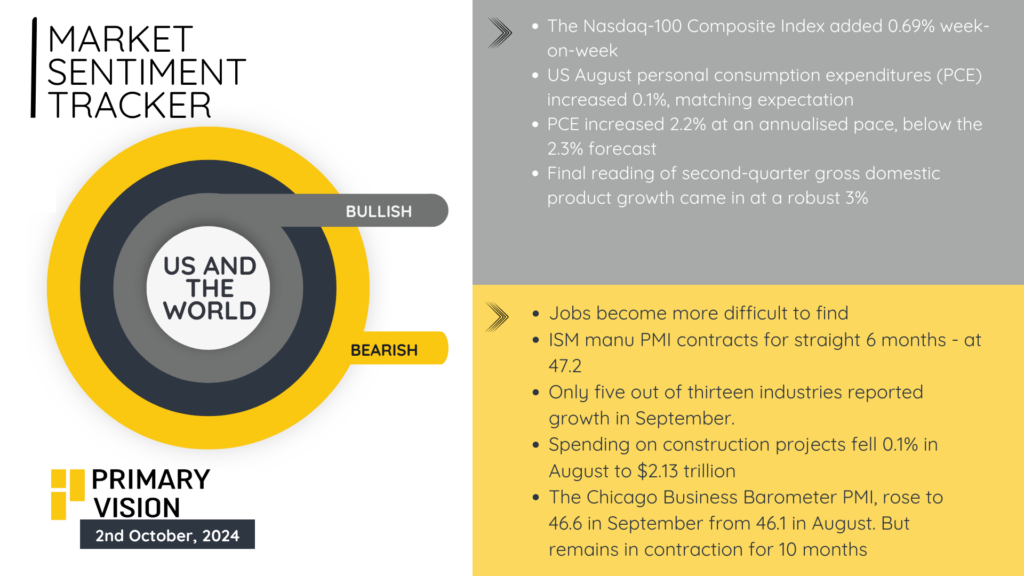

The U.S. economy continues to face mixed signals. While the Nasdaq-100 Composite Index added 0.69% last week, highlighting resilience in tech, other indicators show persistent weakness. Jobs are becoming harder to find as ISM manufacturing PMI contracts for the sixth consecutive month, now at 47.2. Only five out of thirteen industries saw growth in September, indicating broader economic struggles. Spending on construction projects fell by 0.1% in August, dipping to $2.13 trillion, while the Chicago Business Barometer rose slightly to 46.6 in September but remains in contraction for the tenth straight month. On the brighter side, personal consumption expenditures (PCE) increased by 0.1%, matching expectations, but the 2.2% annualized growth was below forecasts. Gross domestic product grew at a robust 3%, but the overall economic landscape remains choppy.