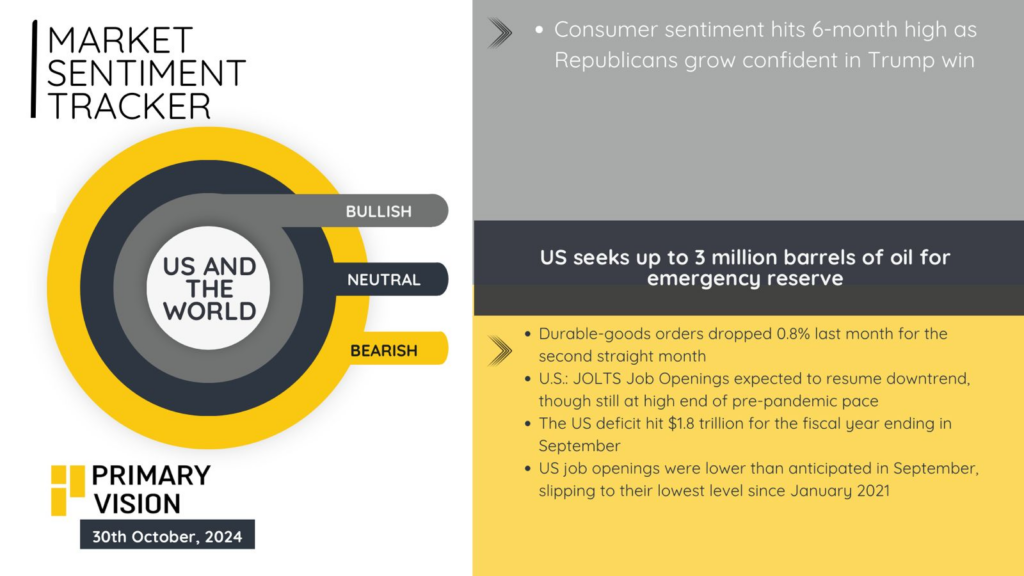

The latest U.S. economic indicators reflect a mixed landscape. Durable goods orders slipped by 0.8% in September, marking a second consecutive monthly decline, hinting at potential softening in capital investments. Job openings, as tracked by the JOLTS report, show a gradual descent, though they remain elevated by pre-pandemic standards. In fiscal terms, the deficit reached $1.8 trillion by September’s end—a stark increase, underscoring fiscal pressures despite consumer sentiment climbing to a six-month peak, bolstered by political optimism.

On energy, the U.S. is looking to bolster its Strategic Petroleum Reserve with up to 3 million barrels, a move reflecting cautious energy security planning amid uncertain global oil markets. Meanwhile, job openings fell more than expected in September, hitting levels unseen since January 2021. This could signal a cooling labor market ahead, adding further complexity to the economic outlook as consumer resilience faces off against macroeconomic headwinds.

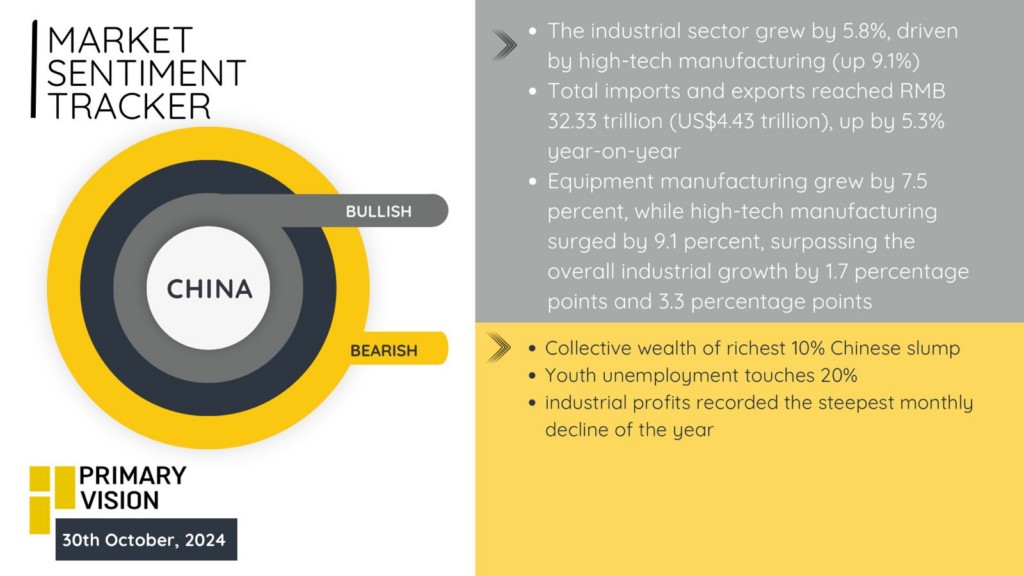

China’s industrial sector experienced a 5.8% growth, with high-tech manufacturing outperforming at 9.1%, reflecting an intensifying shift toward advanced industries. Equipment manufacturing rose by 7.5%, supporting the broader industrial base, while total trade volume—spanning imports and exports—hit RMB 32.33 trillion (US$4.43 trillion), marking a 5.3% increase year-over-year. However, the economic picture is clouded by domestic challenges. Youth unemployment reached a striking 20%, while the wealth of China’s wealthiest 10% saw a significant decline, suggesting economic strain among top earners. Additionally, industrial profits saw their sharpest monthly decline this year, underscoring underlying profitability issues within China’s manufacturing landscape despite production growth. This mixed data signals both resilience in China’s industrial transformation efforts and challenges in wealth distribution and job creation, painting a complex picture of the nation’s economic stability and growth potential.

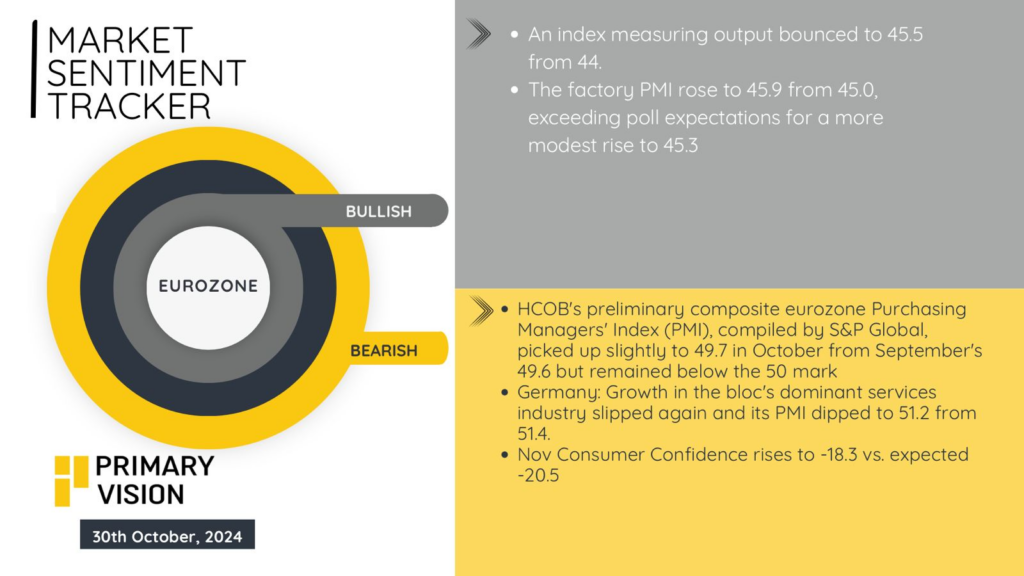

Eurozone indicators show a slight rebound but remain underwhelming. The factory PMI nudged up to 45.9 from 45.0, outpacing expectations but still deep in contraction territory. The composite PMI rose to 49.7 in October, just shy of the neutral 50 mark, hinting at persistent sluggishness. Germany’s service sector PMI slipped to 51.2 from 51.4, signaling stagnation in the bloc’s key industry. Meanwhile, Eurozone consumer confidence in November slightly improved to -18.3, beating forecasts yet still reflecting widespread caution. These incremental improvements are tempered by a broader trend of weak industrial output and low demand, underscoring the Eurozone’s ongoing economic struggles despite modest upticks in sentiment.