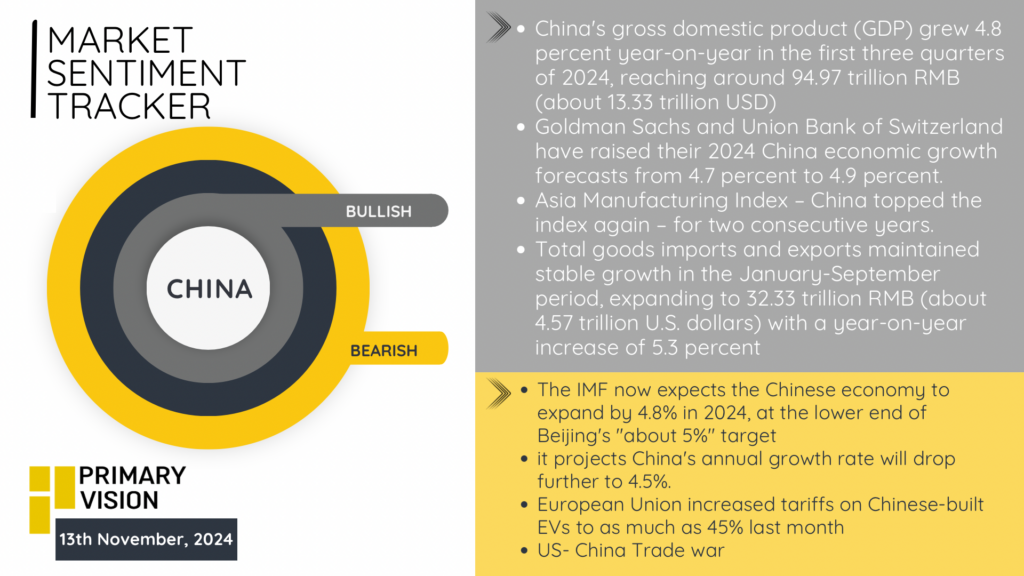

China

China’s economy showcased a resilient growth trajectory, with GDP expanding 4.8% year-on-year through the first three quarters of 2024, totaling approximately 94.97 trillion RMB ($13.33 trillion USD). Exports and imports remained robust, rising 5.3% to 32.33 trillion RMB ($4.57 trillion USD) from January to September.

The manufacturing sector maintained its dominance in Asia, topping the Asia Manufacturing Index for the second consecutive year, signifying its continued industrial strength. Optimism about the Chinese economy led Goldman Sachs and UBS to revise their growth forecasts upwards to 4.9% for 2024. However, challenges persist. The IMF projects growth to decelerate to 4.5% next year, reflecting ongoing structural issues. Additionally, rising tariffs from the European Union on Chinese EVs, reaching 45%, combined with lingering trade tensions with the US, temper long-term outlooks despite short-term momentum.

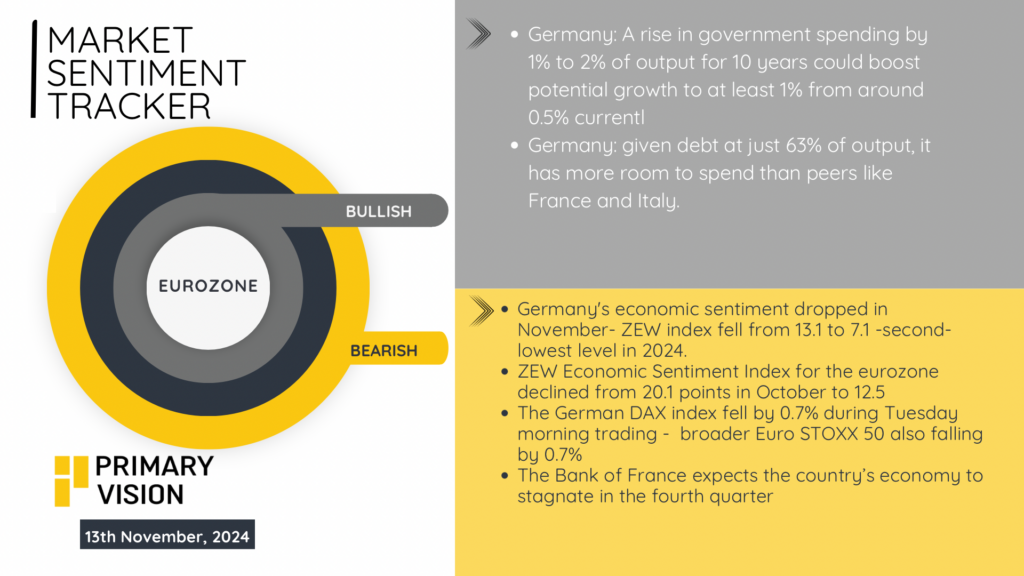

Eurozone

Economic sentiment across the Eurozone dampened in November, with the ZEW Index dropping from 20.1 in October to 12.5, signaling fading optimism. Germany, the bloc’s powerhouse, recorded its second-lowest ZEW sentiment of the year, plummeting from 13.1 to 7.1. Financial markets echoed these concerns, with the German DAX and Euro STOXX 50 each declining 0.7%. The Bank of France forecasts economic stagnation for Q4, amplifying fears of a broader regional slowdown. On the upside, Germany’s relatively low debt-to-GDP ratio (63%) provides fiscal room for government spending, which analysts suggest could raise long-term growth potential from 0.5% to 1%. Despite bearish short-term indicators, this fiscal flexibility hints at policy levers that could stabilize growth amid Eurozone volatility.

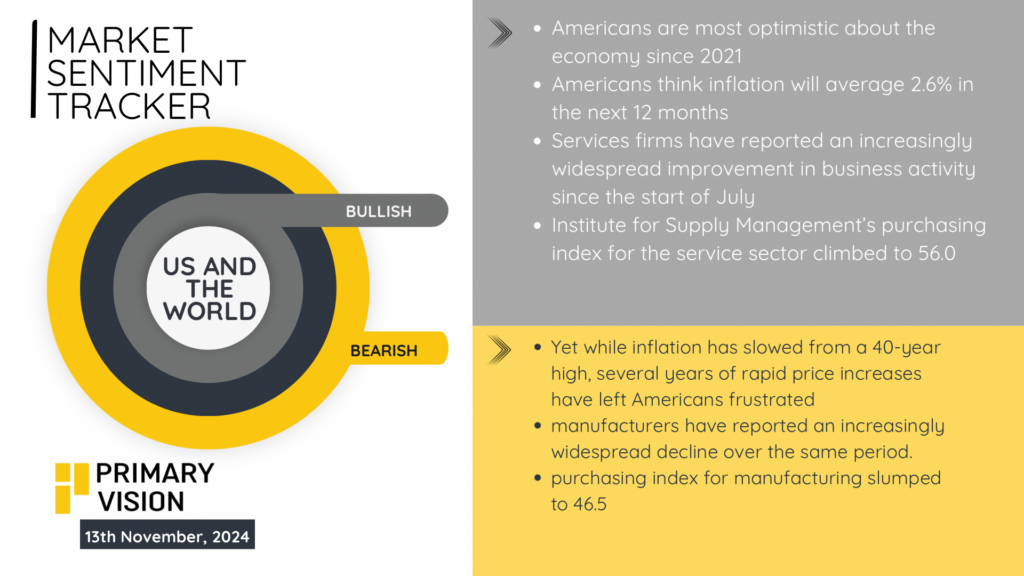

United States

Consumer optimism in the US reached its highest level since 2021, buoyed by expectations of 2.6% inflation over the next 12 months. Services, the backbone of the economy, surged as the ISM Purchasing Managers’ Index climbed to 56.0, signaling robust expansion. However, manufacturing tells a contrasting story, with the PMI slipping further into contraction at 46.5. Inflation, while slowing, has left a lasting mark on households, with years of rapid price hikes continuing to frustrate Americans. Meanwhile, improvements in the labor market and increased business activity in the service sector provide a mixed economic narrative. The divergence between a booming service industry and a struggling manufacturing sector encapsulates the complexities of the current US economic landscape.